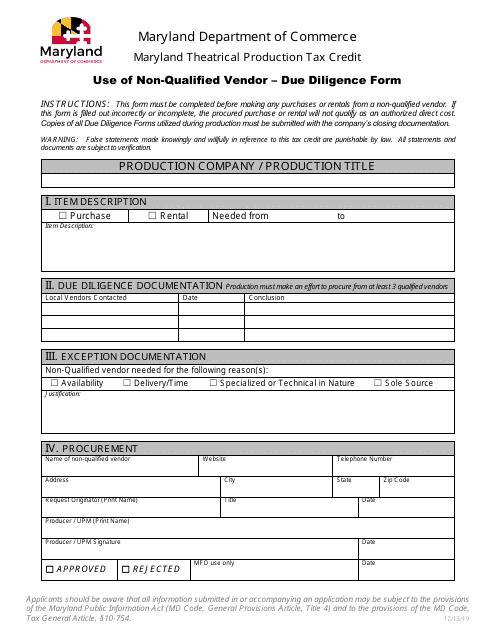

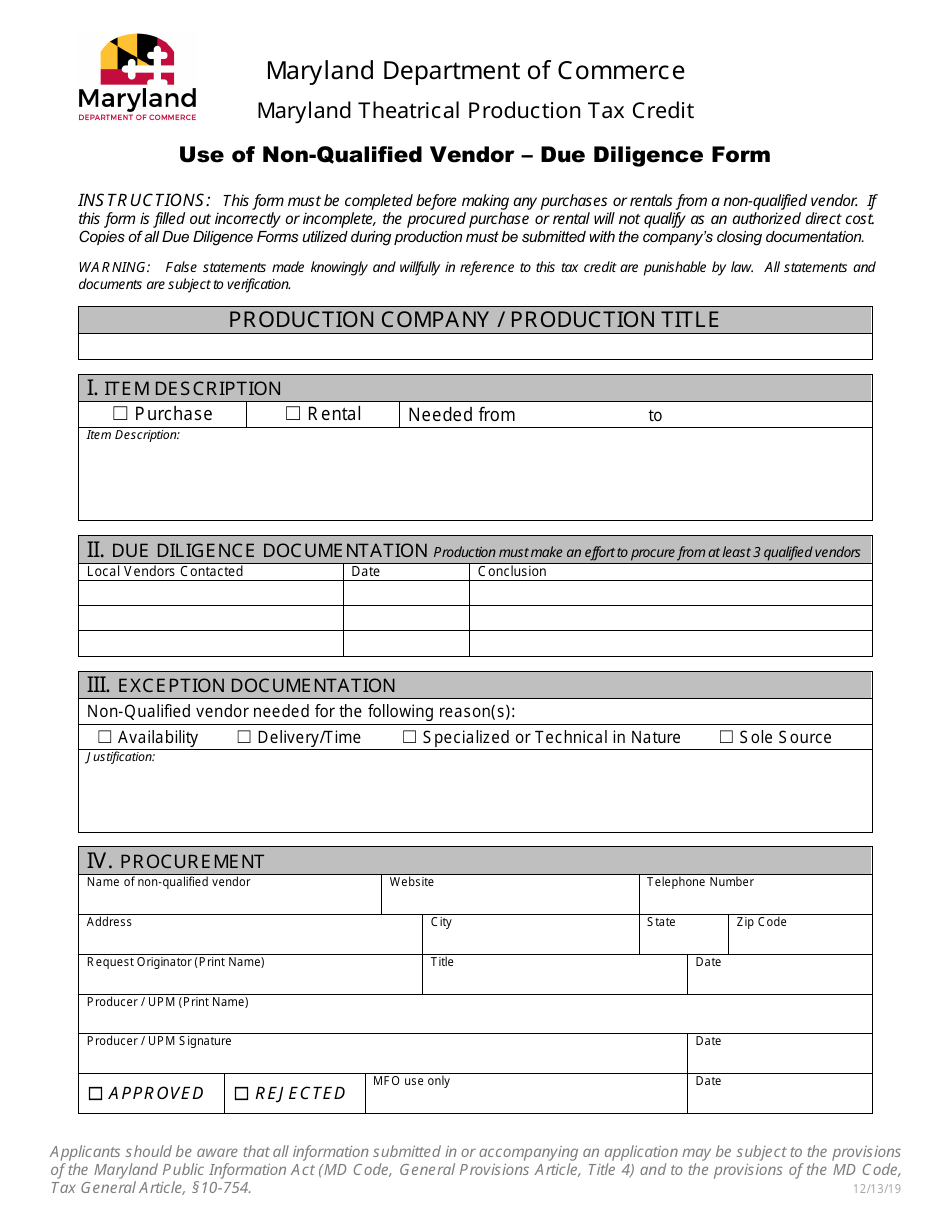

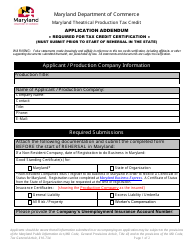

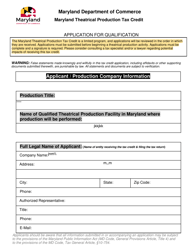

Use of Non-qualified Vendor - Due Diligence Form - Maryland Theatrical Production Tax Credit - Maryland

Use of Non-qualified Vendor - Due Diligence Form - Maryland Theatrical Production Tax Credit is a legal document that was released by the Maryland Department of Commerce - a government authority operating within Maryland.

FAQ

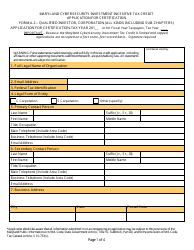

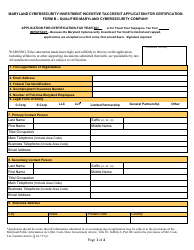

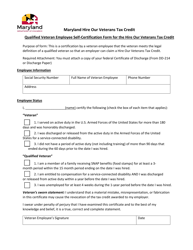

Q: What is the Non-qualified Vendor - Due Diligence Form for the Maryland Theatrical Production Tax Credit?

A: The Non-qualified Vendor - Due Diligence Form is a form that needs to be filled out as part of the Maryland Theatrical Production Tax Credit application process.

Q: What is the purpose of the Non-qualified Vendor - Due Diligence Form?

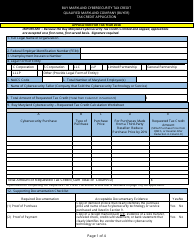

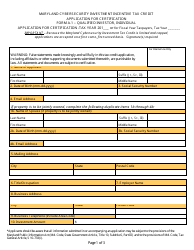

A: The purpose of the form is to verify that vendors used in the production meet certain parameters as outlined by the Maryland Theatrical Production Tax Credit program.

Q: Who needs to fill out the Non-qualified Vendor - Due Diligence Form?

A: The form needs to be filled out by the production company applying for the Maryland Theatrical Production Tax Credit.

Q: What information is required on the Non-qualified Vendor - Due Diligence Form?

A: The form requires information about vendors used in the production including their name, address, services provided, and the amount paid to them.

Q: Is the Non-qualified Vendor - Due Diligence Form mandatory for all Maryland Theatrical Production Tax Credit applicants?

A: Yes, the form is mandatory for all applicants and must be submitted along with the application.

Form Details:

- Released on December 13, 2019;

- The latest edition currently provided by the Maryland Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Commerce.