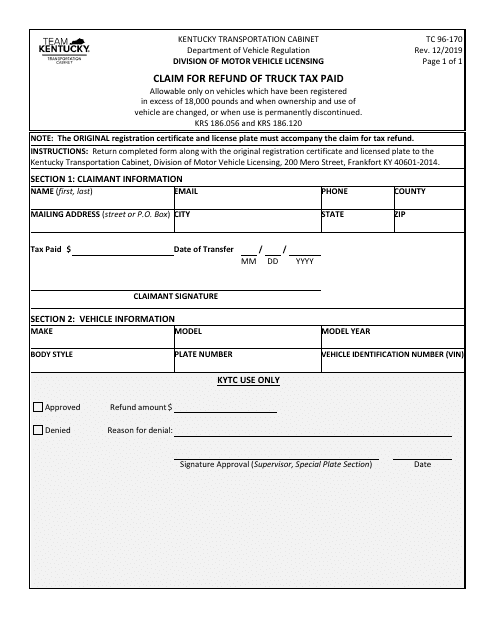

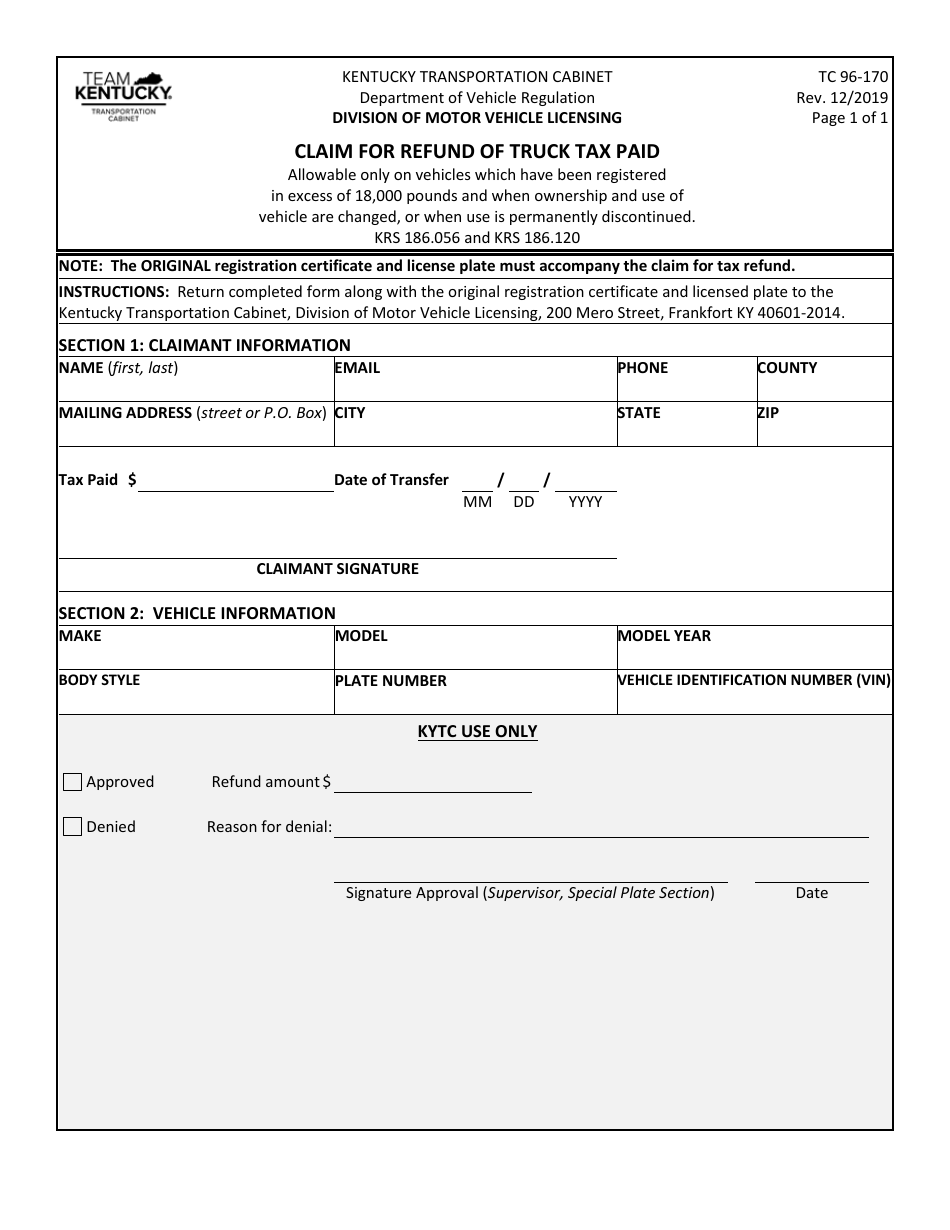

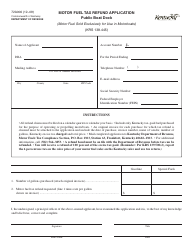

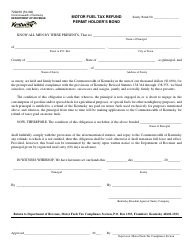

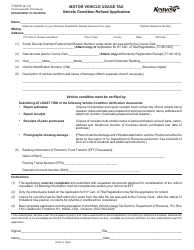

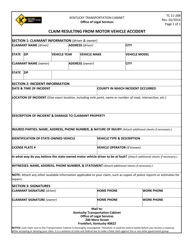

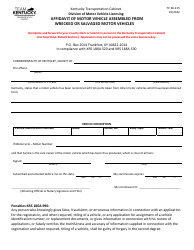

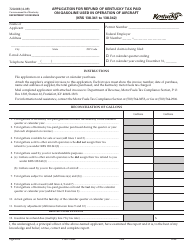

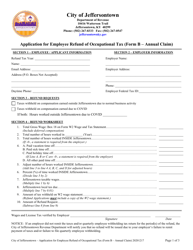

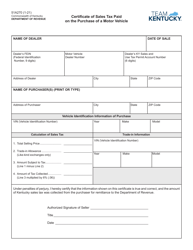

Form TC96-170 Claim for Refund of Truck Tax Paid - Kentucky

What Is Form TC96-170?

This is a legal form that was released by the Kentucky Transportation Cabinet - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC96-170?

A: Form TC96-170 is a claim for refund of truck tax paid in the state of Kentucky.

Q: Who can file Form TC96-170?

A: Anyone who has paid truck tax in Kentucky and wants to claim a refund can file Form TC96-170.

Q: What information is required on Form TC96-170?

A: Form TC96-170 requires information such as the taxpayer's name, address, and tax account number, as well as details about the truck for which the tax was paid and the amount of tax paid.

Q: What is the deadline to file Form TC96-170?

A: The deadline to file Form TC96-170 is 6 months from the date of tax payment.

Q: What happens after I file Form TC96-170?

A: After you file Form TC96-170, the Kentucky Transportation Cabinet will review your claim and determine if you are eligible for a refund. If approved, you will receive a refund check in the mail.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Kentucky Transportation Cabinet;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TC96-170 by clicking the link below or browse more documents and templates provided by the Kentucky Transportation Cabinet.