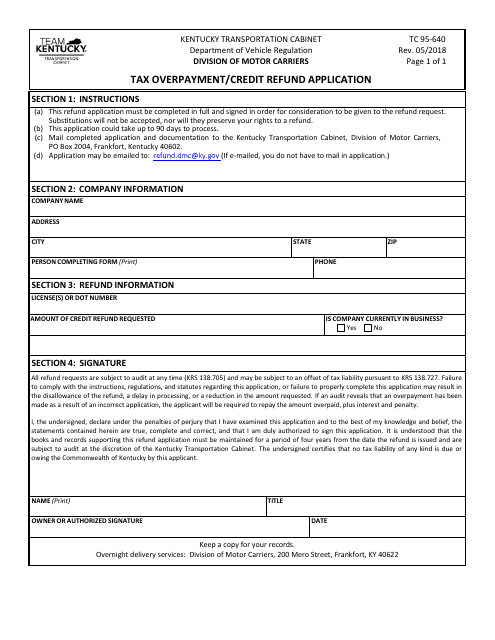

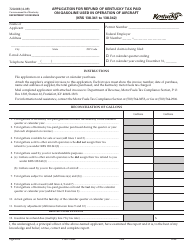

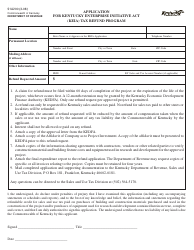

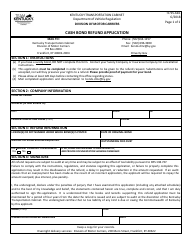

Form TC95-640 Tax Overpayment / Credit Refund Application - Kentucky

What Is Form TC95-640?

This is a legal form that was released by the Kentucky Transportation Cabinet - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form TC95-640?

A: Form TC95-640 is the Tax Overpayment/Credit Refund Application in Kentucky.

Q: What is the purpose of form TC95-640?

A: The purpose of form TC95-640 is to request a refund of tax overpayment or credit in Kentucky.

Q: Who can use form TC95-640?

A: Form TC95-640 can be used by individuals and businesses who have overpaid their taxes or have tax credits.

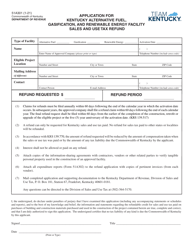

Q: What information is required on form TC95-640?

A: Form TC95-640 requires information such as taxpayer identification number, tax year, amount of overpayment or credit, and bank account information for direct deposit.

Q: Is there a deadline for filing form TC95-640?

A: Yes, form TC95-640 must be filed within three years from the date the tax was paid or due, whichever is later.

Q: How long does it take to receive a refund after filing form TC95-640?

A: It typically takes six to eight weeks to receive a refund after filing form TC95-640.

Q: Are there any fees for filing form TC95-640?

A: No, there are no fees for filing form TC95-640.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Kentucky Transportation Cabinet;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TC95-640 by clicking the link below or browse more documents and templates provided by the Kentucky Transportation Cabinet.