This version of the form is not currently in use and is provided for reference only. Download this version of

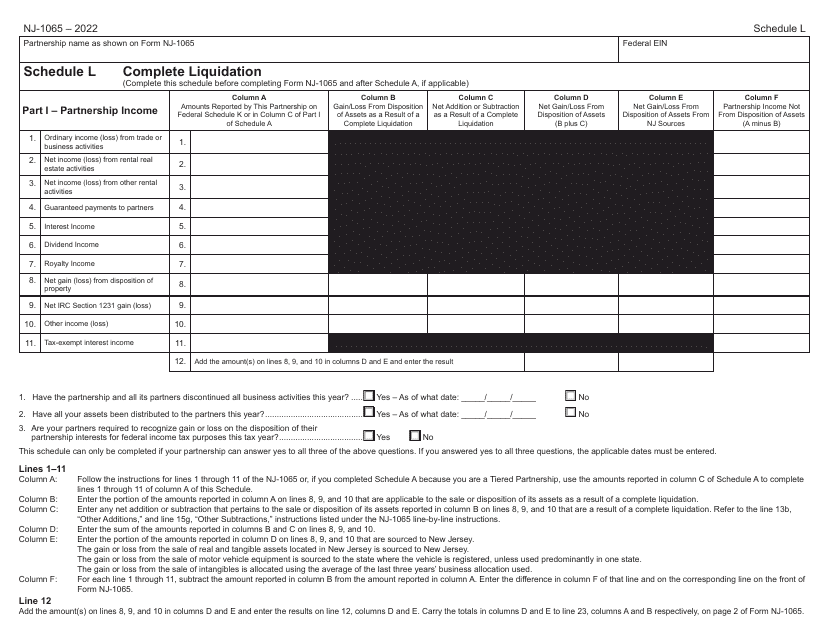

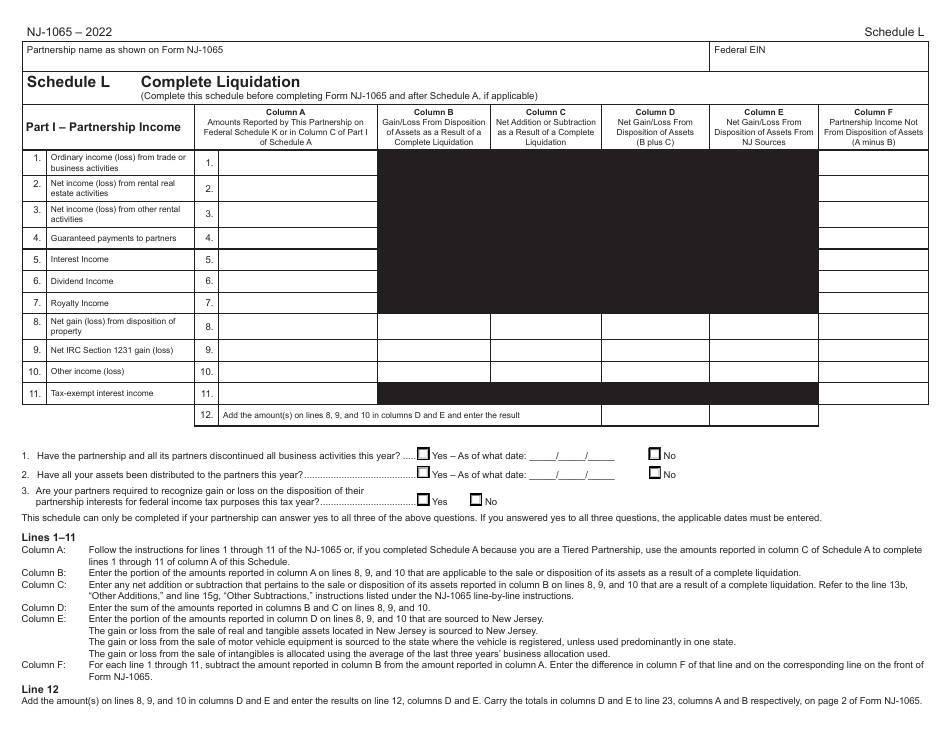

Form NJ-1065 Schedule L

for the current year.

Form NJ-1065 Schedule L Complete Liquidation - New Jersey

What Is Form NJ-1065 Schedule L?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1065 Schedule L?

A: Form NJ-1065 Schedule L is a tax form used by partnerships in New Jersey to report the complete liquidation of the partnership.

Q: Who needs to file Form NJ-1065 Schedule L?

A: Partnerships in New Jersey that have undergone a complete liquidation need to file Form NJ-1065 Schedule L.

Q: What is the purpose of Form NJ-1065 Schedule L?

A: The purpose of Form NJ-1065 Schedule L is to report the details of the complete liquidation of a partnership, including the transfer of assets and allocation of gains or losses.

Q: When is the deadline to file Form NJ-1065 Schedule L?

A: The deadline to file Form NJ-1065 Schedule L is typically the same as the deadline to file the partnership tax return, which is the 15th day of the fourth month following the close of the tax year.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1065 Schedule L by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.