This version of the form is not currently in use and is provided for reference only. Download this version of

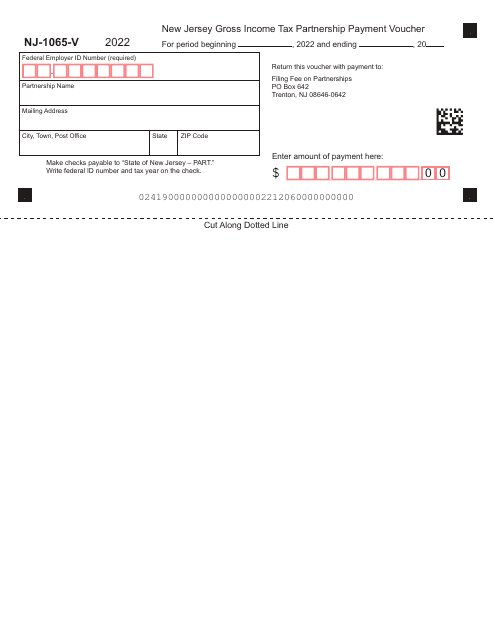

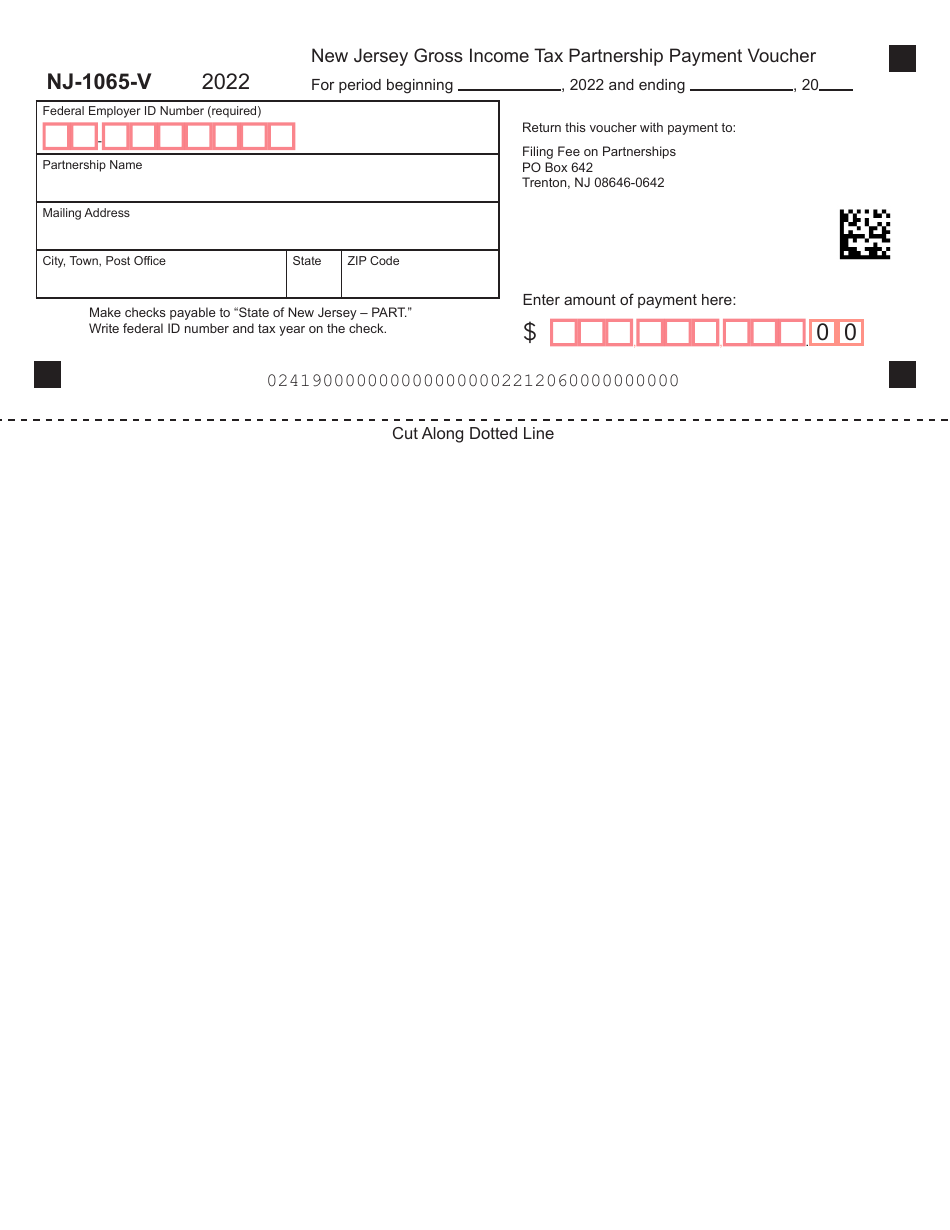

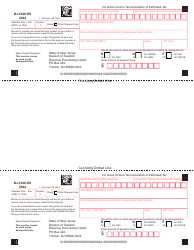

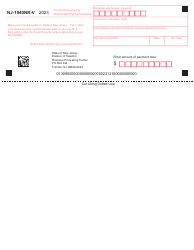

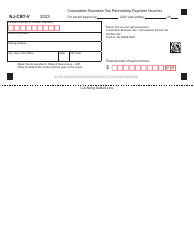

Form NJ-1065-V

for the current year.

Form NJ-1065-V New Jersey Gross Income Tax Partnership Payment Voucher - New Jersey

What Is Form NJ-1065-V?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1065-V?

A: Form NJ-1065-V is a payment voucher for the New Jersey Gross Income Tax Partnership.

Q: What is the purpose of Form NJ-1065-V?

A: The purpose of Form NJ-1065-V is to make payments for the New Jersey Gross Income Tax Partnership.

Q: Who needs to use Form NJ-1065-V?

A: Partnerships in New Jersey that need to make payments for the Gross Income Tax must use Form NJ-1065-V.

Q: Do I need to file Form NJ-1065-V if I don't have any tax due?

A: No, if you don't have any tax due, you don't need to file Form NJ-1065-V.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1065-V by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.