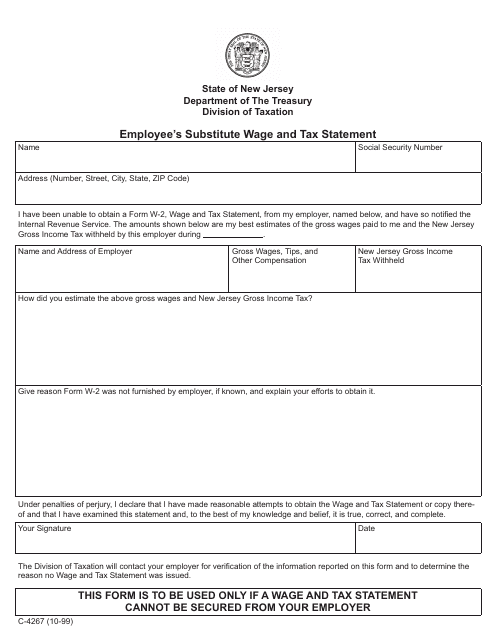

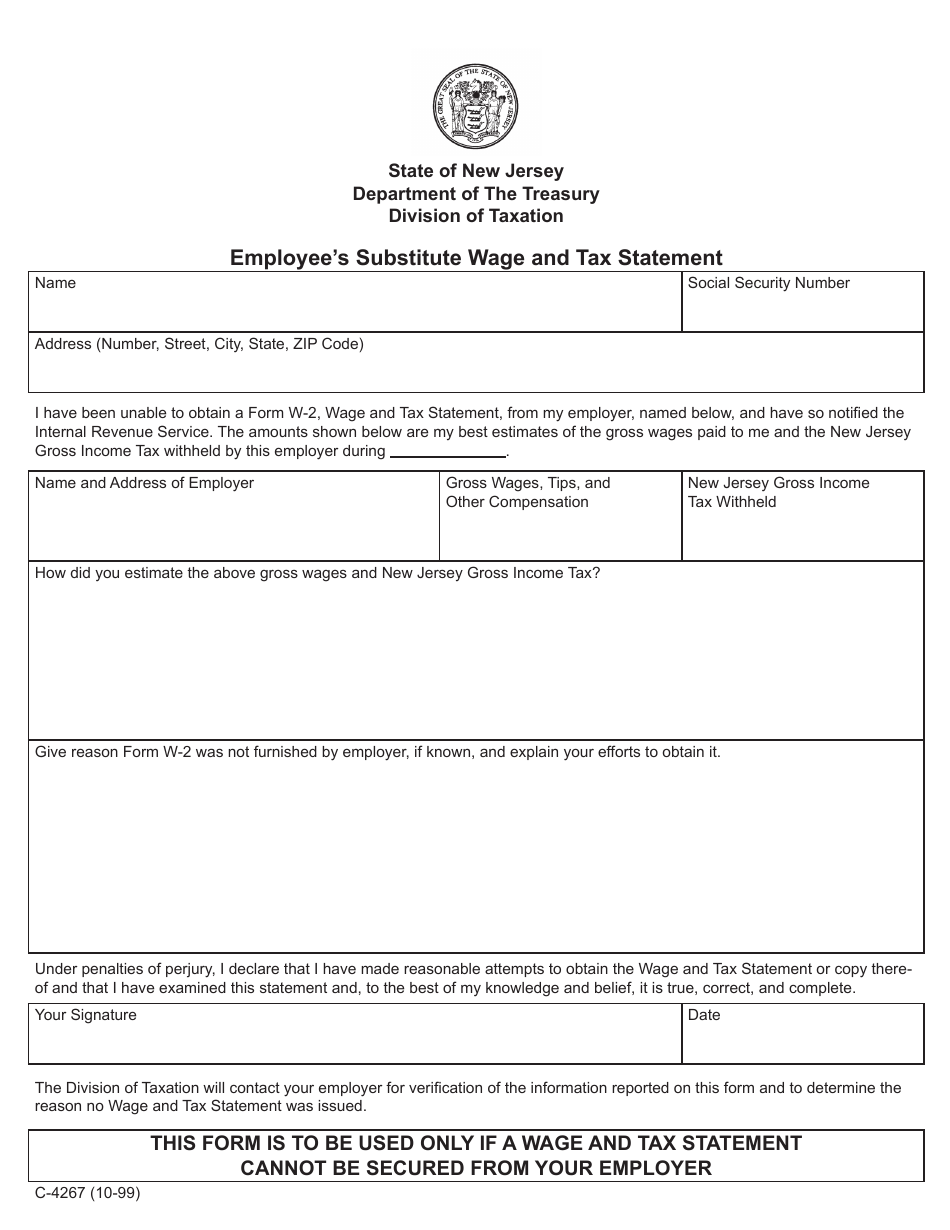

Form C-4267 Employee's Substitute Wage and Tax Statement - New Jersey

What Is Form C-4267?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-4267?

A: Form C-4267 is an Employee's Substitute Wage and Tax Statement used in New Jersey.

Q: Who uses Form C-4267?

A: Employees in New Jersey use Form C-4267.

Q: What is the purpose of Form C-4267?

A: Form C-4267 is used to report employee wages and taxes to the state of New Jersey.

Q: Do I need to fill out Form C-4267?

A: You need to fill out Form C-4267 if you are an employee in New Jersey and your employer is not providing you with a Form W-2.

Q: What information do I need to provide on Form C-4267?

A: You will need to provide information such as your name, address, Social Security number, wages, and taxes withheld.

Q: When is Form C-4267 due?

A: Form C-4267 is due by January 31st of the following year.

Form Details:

- Released on October 1, 1999;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-4267 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.