This version of the form is not currently in use and is provided for reference only. Download this version of

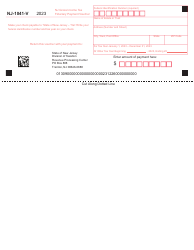

Form NJ-1080E

for the current year.

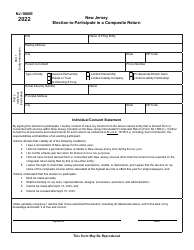

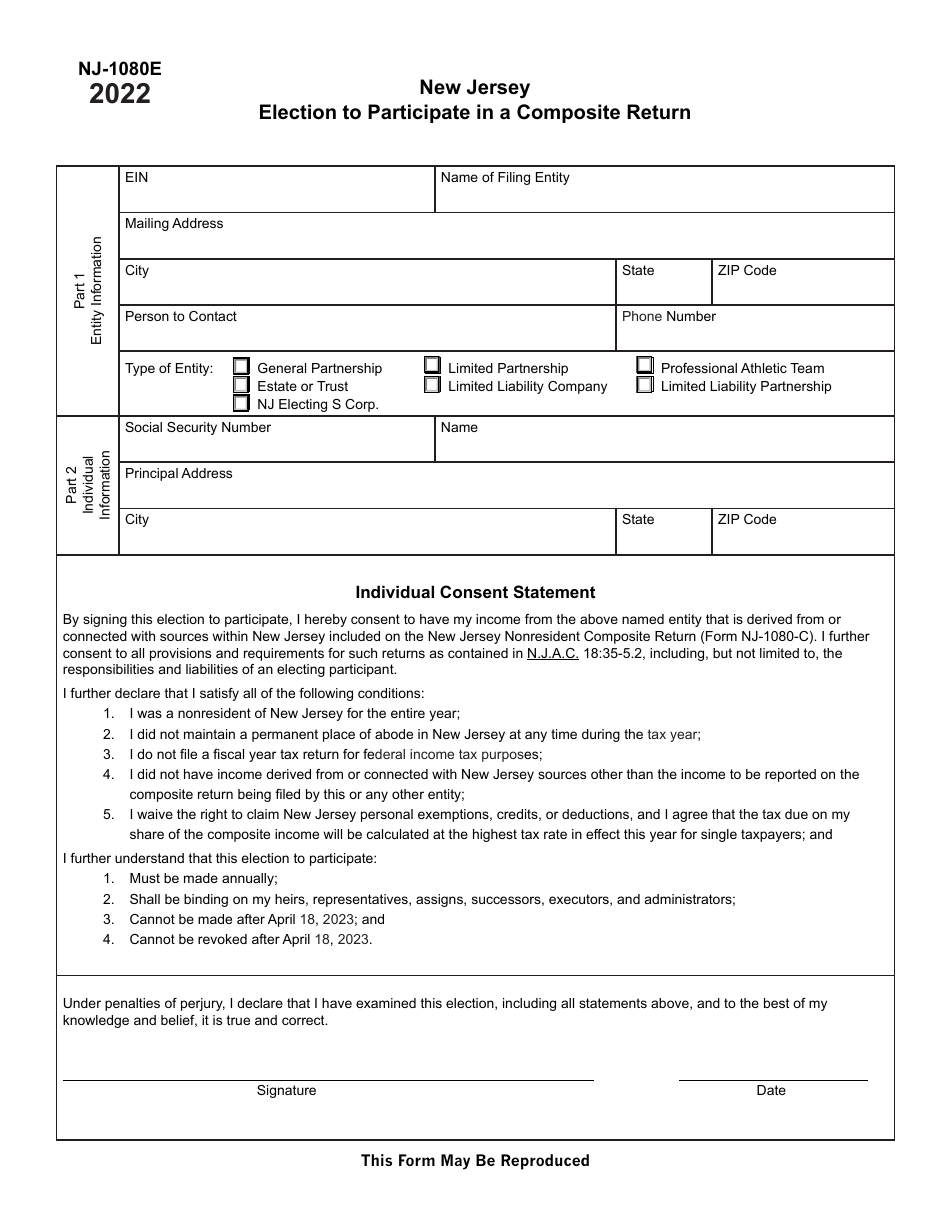

Form NJ-1080E New Jersey Election to Participate in a Composite Return - New Jersey

What Is Form NJ-1080E?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NJ-1080E?

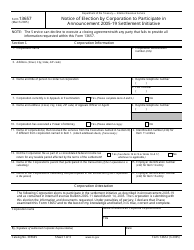

A: Form NJ-1080E is the New Jersey Election to Participate in a Composite Return.

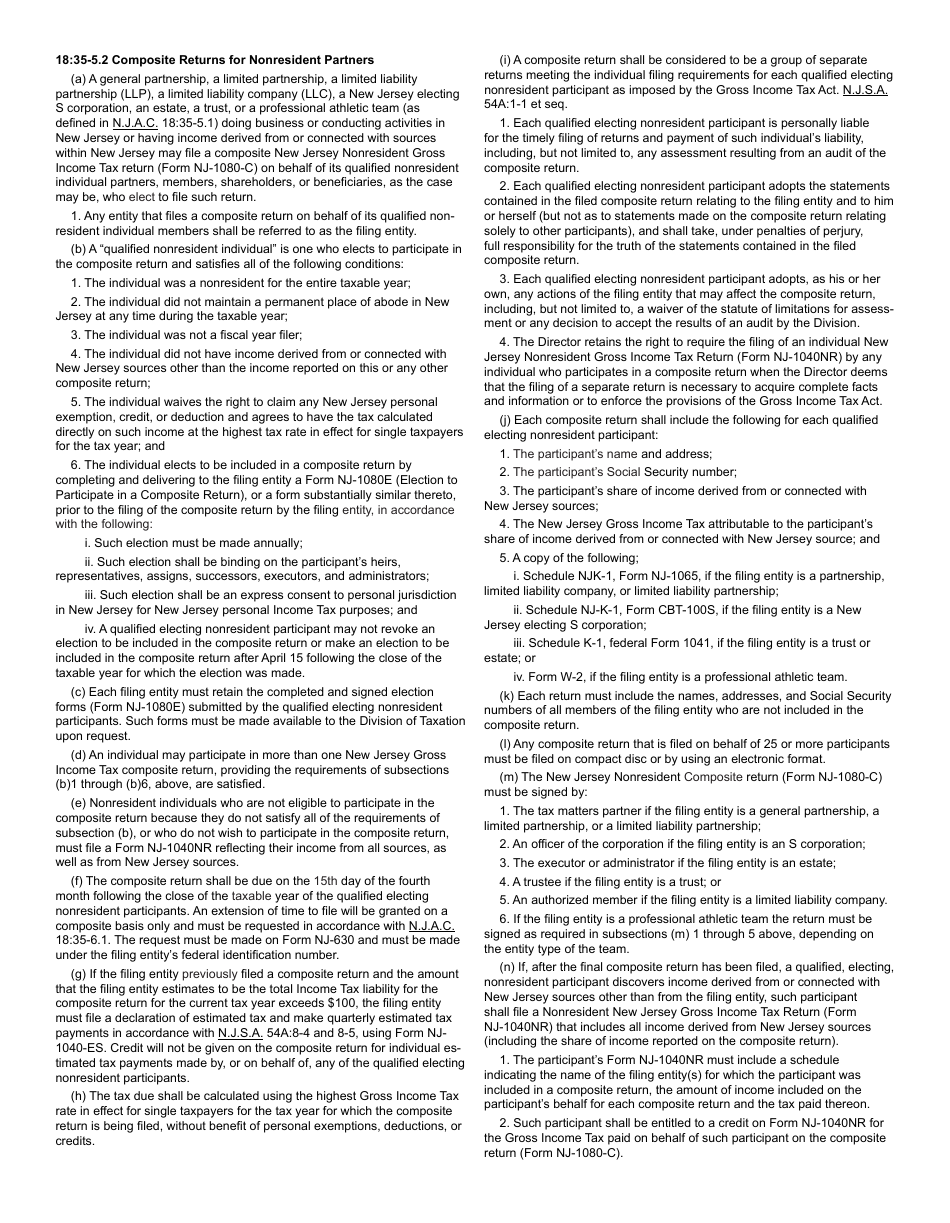

Q: What is a composite return?

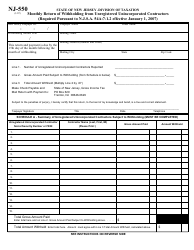

A: A composite return is a single tax return filed on behalf of nonresident members of a partnership or LLC.

Q: Who should file Form NJ-1080E?

A: Nonresident individual partners or members of an electing partnership or LLC should file Form NJ-1080E.

Q: What is the purpose of filing Form NJ-1080E?

A: The purpose of filing Form NJ-1080E is to elect to file a composite return on behalf of nonresident partners or members.

Q: When is the deadline to file Form NJ-1080E?

A: The deadline to file Form NJ-1080E is the same as the deadline to file the partnership or LLC's return, which is generally April 15th.

Q: Are there any penalties for not filing Form NJ-1080E?

A: Yes, there can be penalties for not filing Form NJ-1080E, so it is important to file the form on time.

Q: Can I file Form NJ-1080E electronically?

A: No, Form NJ-1080E cannot be filed electronically and must be filed by mail.

Q: What information do I need to complete Form NJ-1080E?

A: To complete Form NJ-1080E, you will need the nonresident partners' or members' information, such as their names, addresses, and distributive shares of income.

Q: Can I make changes to Form NJ-1080E after filing it?

A: No, you cannot make changes to Form NJ-1080E after filing it, so it is important to review the form carefully before submitting it.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1080E by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.