This version of the form is not currently in use and is provided for reference only. Download this version of

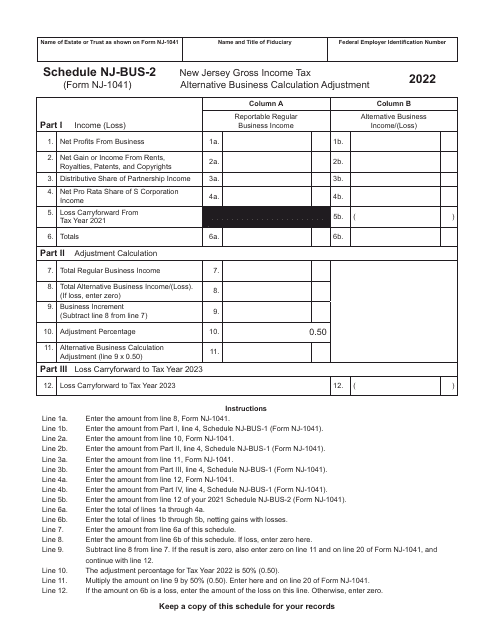

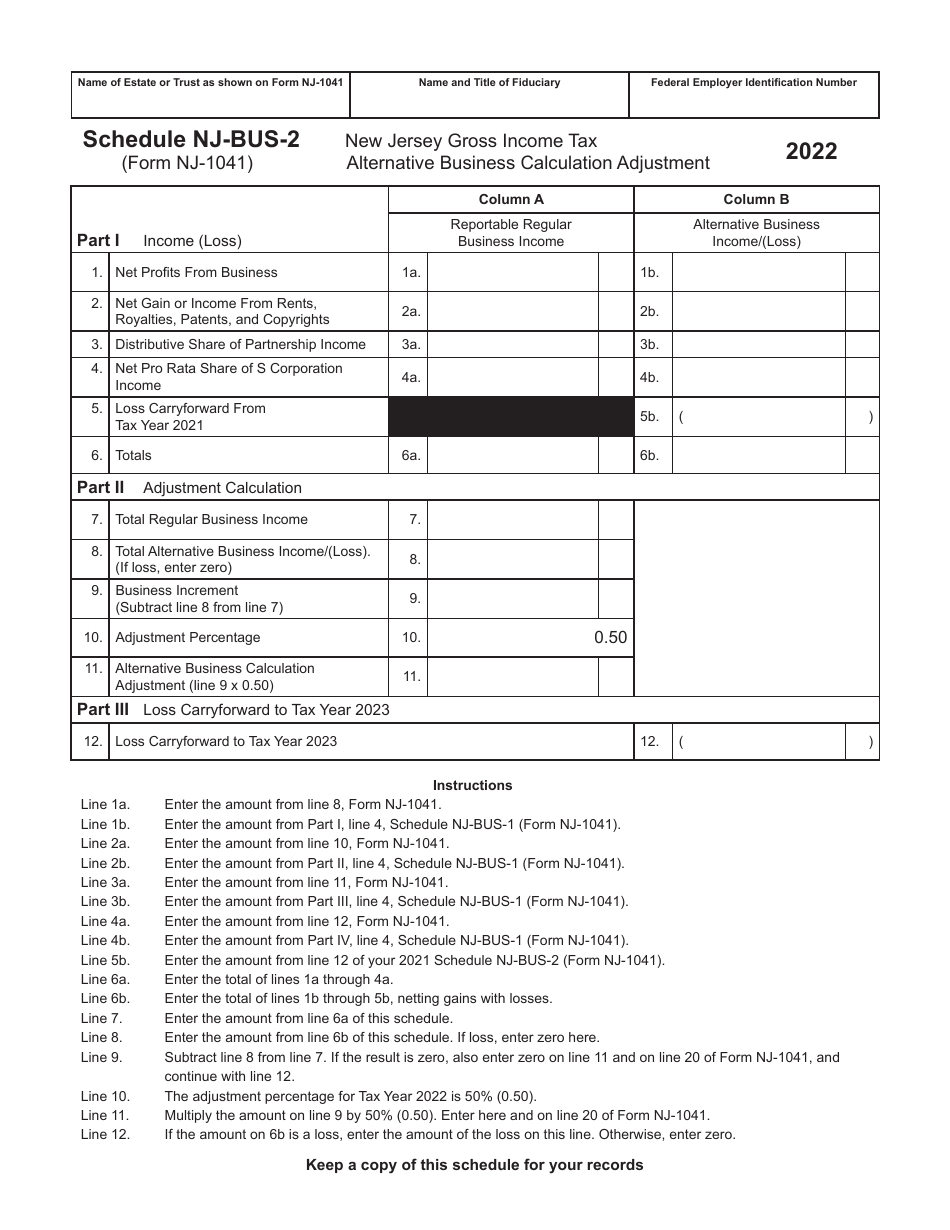

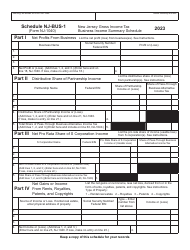

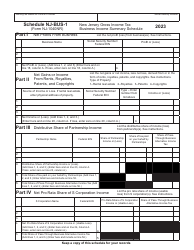

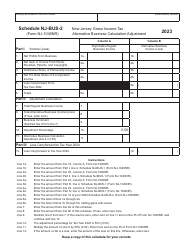

Form NJ-1041 Schedule NJ-BUS-2

for the current year.

Form NJ-1041 Schedule NJ-BUS-2 New Jersey Gross Income Tax Alternative Business Calculation Adjustment - New Jersey

What Is Form NJ-1041 Schedule NJ-BUS-2?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1041 Schedule NJ-BUS-2?

A: Form NJ-1041 Schedule NJ-BUS-2 is a New Jersey tax form used to calculate the Alternative Business Calculation Adjustment for New Jersey Gross Income Tax.

Q: What is the Alternative Business Calculation Adjustment?

A: The Alternative Business Calculation Adjustment is a calculation made on Form NJ-1041 Schedule NJ-BUS-2 that adjusts the gross income tax owed by a business in New Jersey.

Q: Who needs to file Form NJ-1041 Schedule NJ-BUS-2?

A: Businesses in New Jersey that need to make the Alternative Business Calculation Adjustment for their gross incometax obligation must file Form NJ-1041 Schedule NJ-BUS-2.

Q: What is the purpose of the Alternative Business Calculation Adjustment?

A: The purpose of the Alternative Business Calculation Adjustment is to provide businesses in New Jersey with an alternative method for calculating their gross income tax obligation.

Q: Are there any instructions available for Form NJ-1041 Schedule NJ-BUS-2?

A: Yes, the New Jersey Division of Taxation provides detailed instructions for completing Form NJ-1041 Schedule NJ-BUS-2.

Q: What information is required to complete Form NJ-1041 Schedule NJ-BUS-2?

A: To complete Form NJ-1041 Schedule NJ-BUS-2, you will need information about your business's income and expenses, as well as any additional adjustments or deductions applicable.

Q: When is the deadline for filing Form NJ-1041 Schedule NJ-BUS-2?

A: The deadline for filing Form NJ-1041 Schedule NJ-BUS-2 is the same as the deadline for filing the New Jersey Gross Income Tax return, which is typically on or around April 15th of each year.

Q: What happens if I do not file Form NJ-1041 Schedule NJ-BUS-2?

A: If you are required to file Form NJ-1041 Schedule NJ-BUS-2 and fail to do so, you may be subject to penalties and interest on any unpaid taxes owed.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1041 Schedule NJ-BUS-2 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.