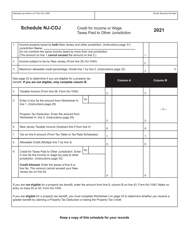

This version of the form is not currently in use and is provided for reference only. Download this version of

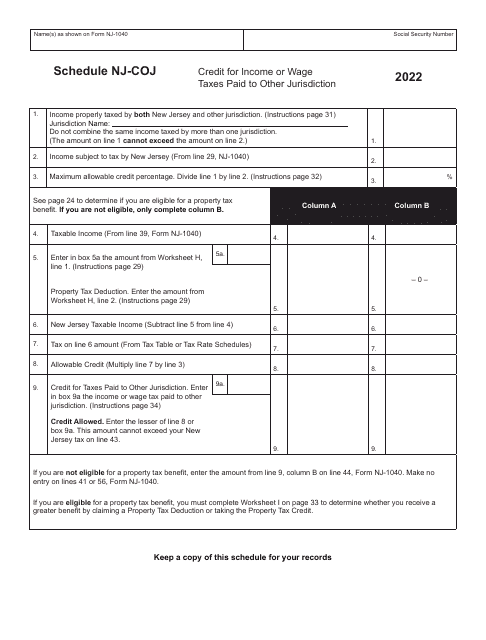

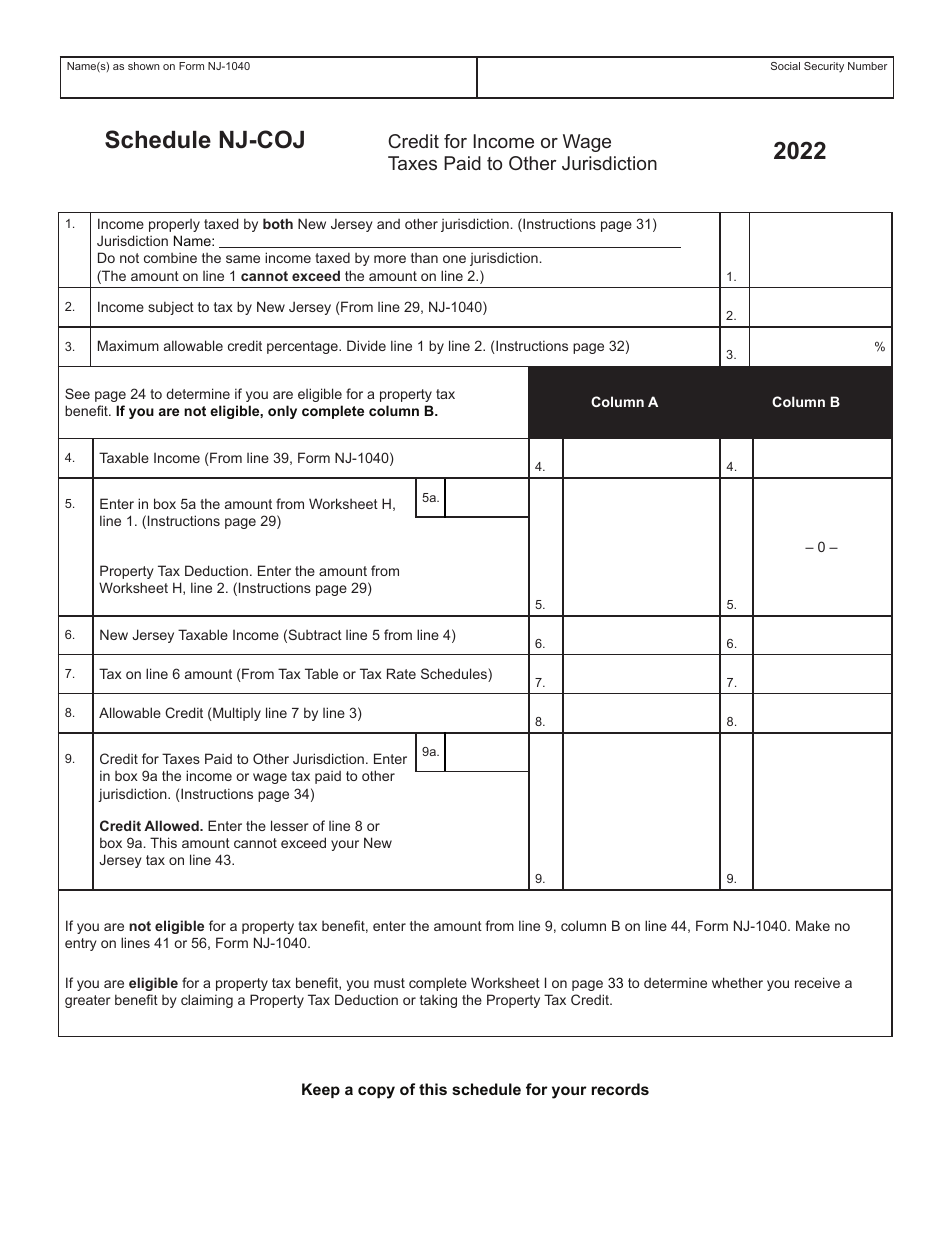

Schedule NJ-COJ

for the current year.

Schedule NJ-COJ Credit for Income or Wage Taxes Paid to Other Jurisdiction - New Jersey

What Is Schedule NJ-COJ?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NJ-COJ Credit?

A: The NJ-COJ Credit is a credit that allows New Jersey residents to reduce their state income tax liability by the amount of income or wage taxes they paid to another jurisdiction.

Q: Who is eligible for the NJ-COJ Credit?

A: New Jersey residents who paid taxes to another jurisdiction on income or wages earned outside of New Jersey are eligible for the NJ-COJ Credit.

Q: How does the NJ-COJ Credit work?

A: The NJ-COJ Credit allows you to claim a credit on your New Jersey state income tax return for the taxes you paid to another jurisdiction. This reduces your overall tax liability.

Q: What taxes qualify for the NJ-COJ Credit?

A: The NJ-COJ Credit can be claimed for income or wage taxes paid to another jurisdiction, such as another state or a foreign country.

Q: How do I claim the NJ-COJ Credit?

A: You can claim the NJ-COJ Credit by completing the Schedule NJ-COJ and attaching it to your New Jersey state income tax return.

Q: What documentation do I need to support my NJ-COJ Credit claim?

A: You will need to provide documentation such as copies of your income tax returns filed with the other jurisdiction and any forms or documentation that show the amount of taxes paid.

Q: Is there a limit to the NJ-COJ Credit?

A: Yes, the NJ-COJ Credit is limited to the amount of tax that would have been due to New Jersey on the income or wages earned outside of New Jersey.

Q: Can I claim the NJ-COJ Credit for taxes paid to any jurisdiction?

A: Generally, you can claim the NJ-COJ Credit for income or wage taxes paid to another state or a foreign country. However, there may be certain limitations or restrictions depending on the specific jurisdiction and tax laws.

Q: Are there any exceptions to the NJ-COJ Credit?

A: There may be certain exceptions or special rules that apply depending on your individual circumstances or the specific tax laws of the other jurisdiction. It is important to review the instructions for Schedule NJ-COJ and consult with a tax professional if you have any questions.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule NJ-COJ by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.