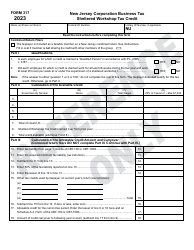

This version of the form is not currently in use and is provided for reference only. Download this version of

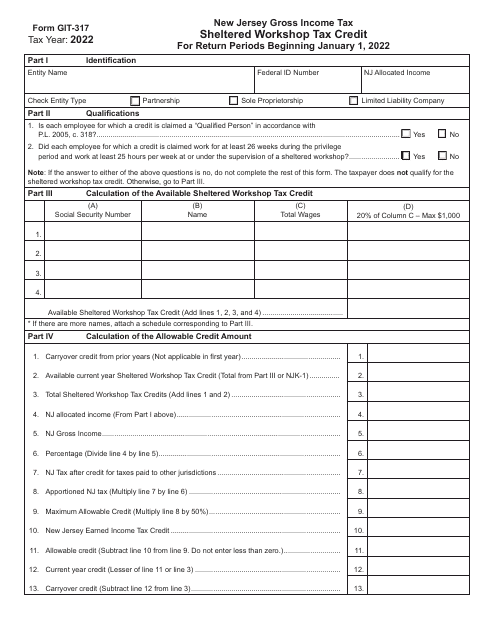

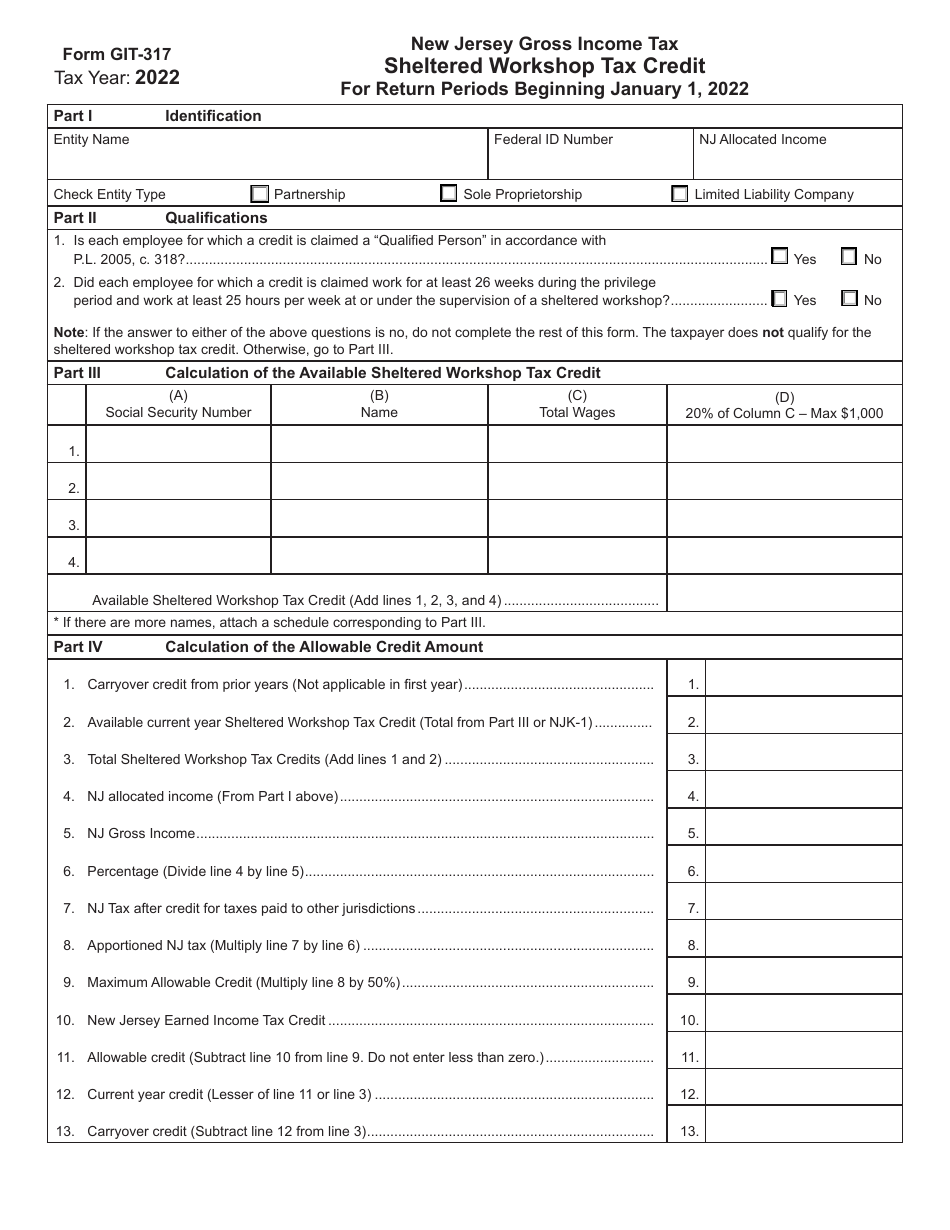

Form GIT-317

for the current year.

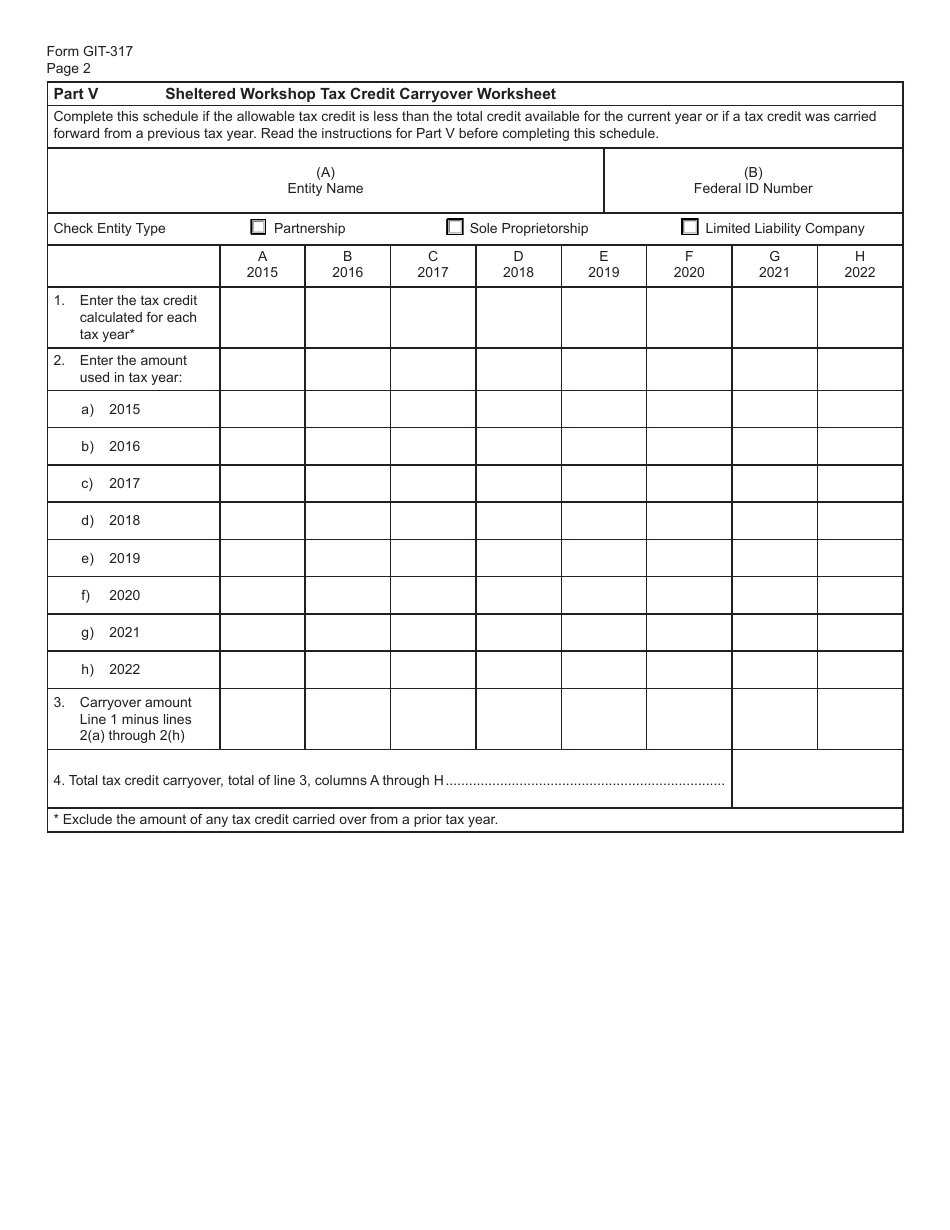

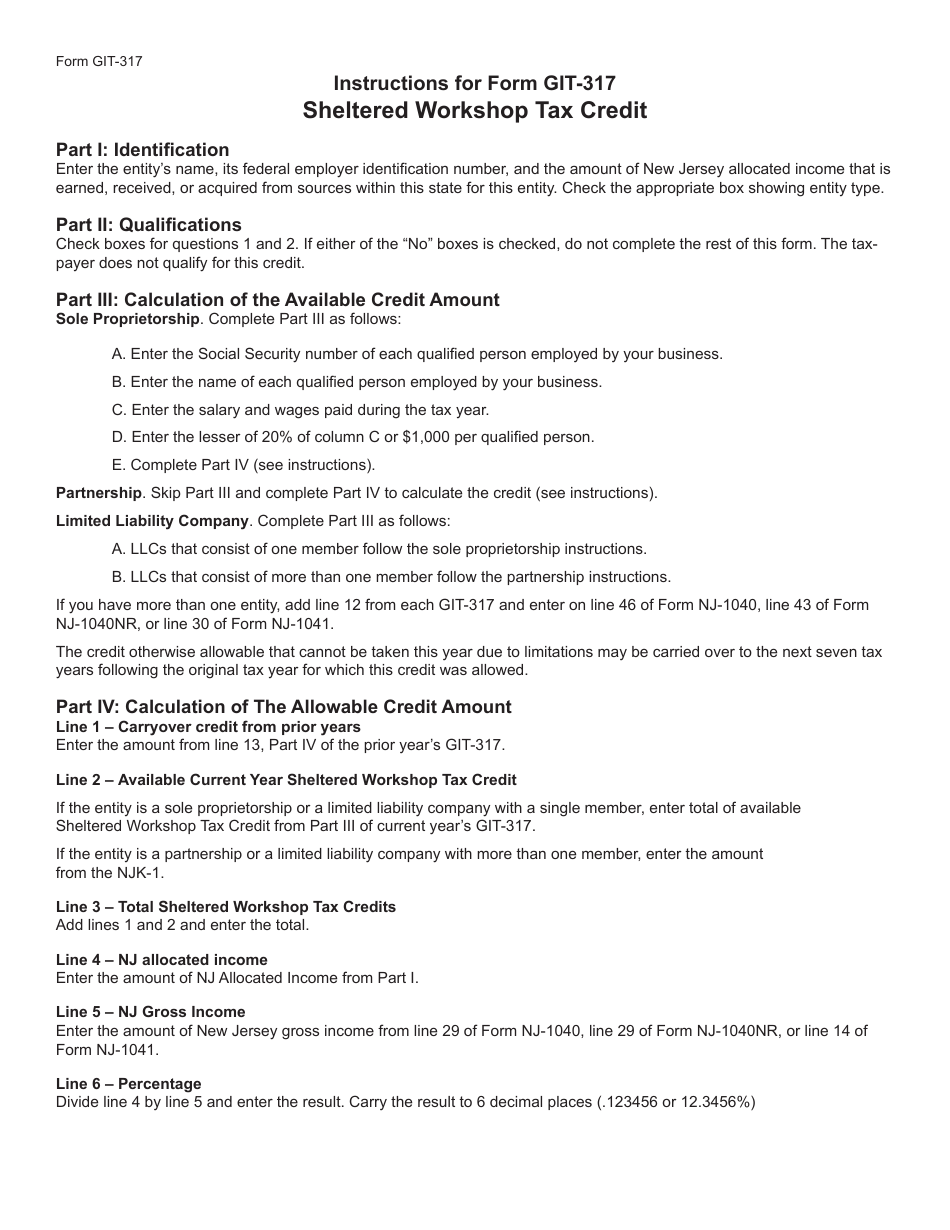

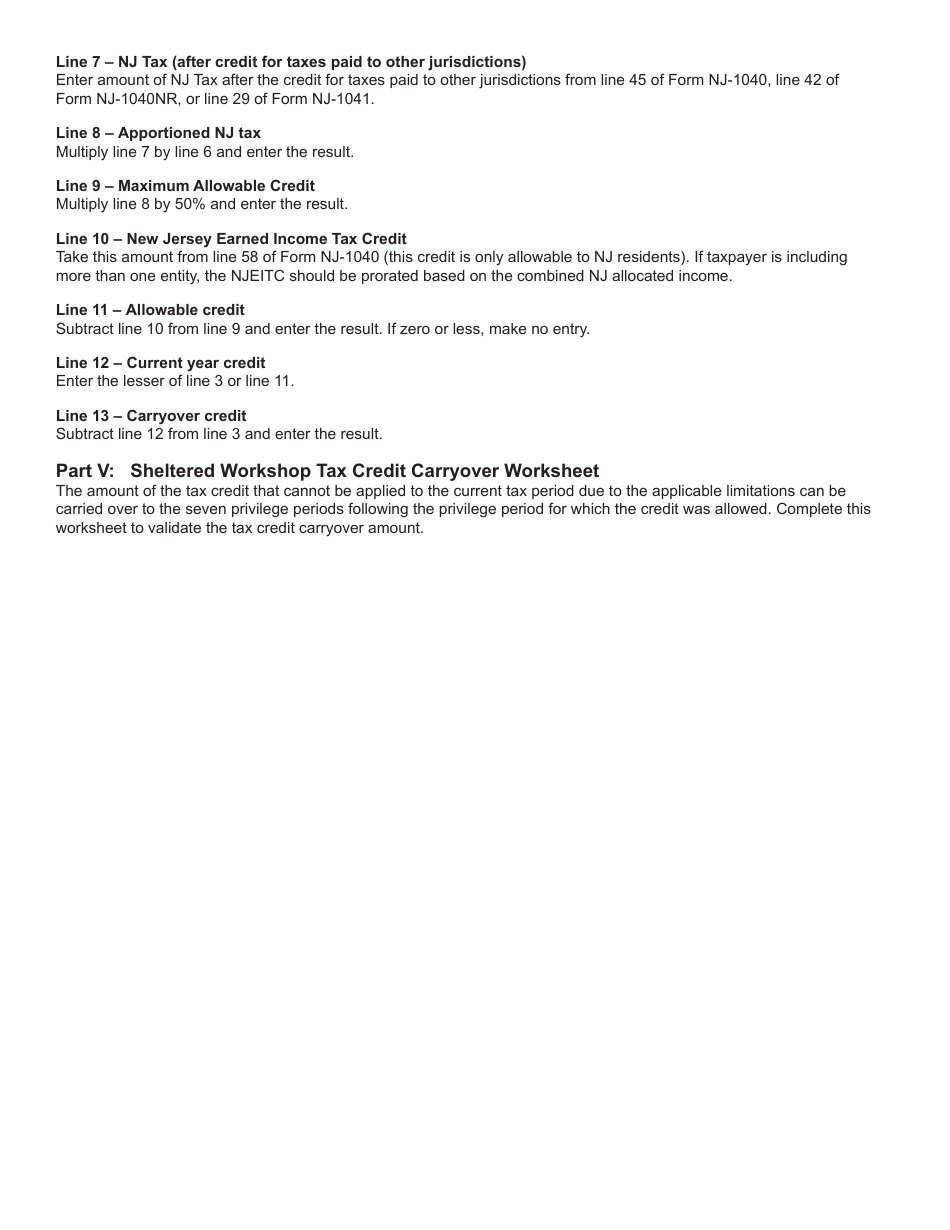

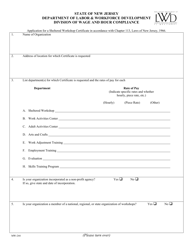

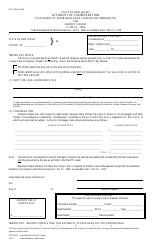

Form GIT-317 Sheltered Workshop Tax Credit - New Jersey

What Is Form GIT-317?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the GIT-317 Sheltered Workshop Tax Credit?

A: The GIT-317 Sheltered Workshop Tax Credit is a tax credit offered in the state of New Jersey.

Q: Who is eligible for the GIT-317 Sheltered Workshop Tax Credit?

A: Employers who hire individuals with disabilities in sheltered workshops are eligible for this tax credit.

Q: What is a sheltered workshop?

A: A sheltered workshop is a vocational training program that provides employment opportunities for individuals with disabilities.

Q: How much is the tax credit?

A: The tax credit is equal to 50% of the wages paid to eligible employees in the sheltered workshop.

Q: How do I claim the GIT-317 Sheltered Workshop Tax Credit?

A: To claim the tax credit, you need to complete and file the GIT-317 form with the New Jersey Division of Taxation.

Q: Is there a maximum limit on the tax credit?

A: Yes, the maximum tax credit that can be claimed in a year is $1,500 per eligible employee.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT-317 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.