This version of the form is not currently in use and is provided for reference only. Download this version of

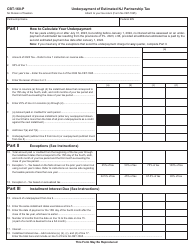

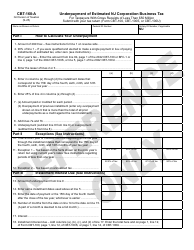

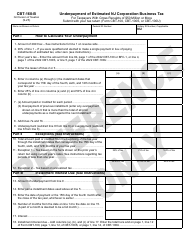

Form NJ-2210

for the current year.

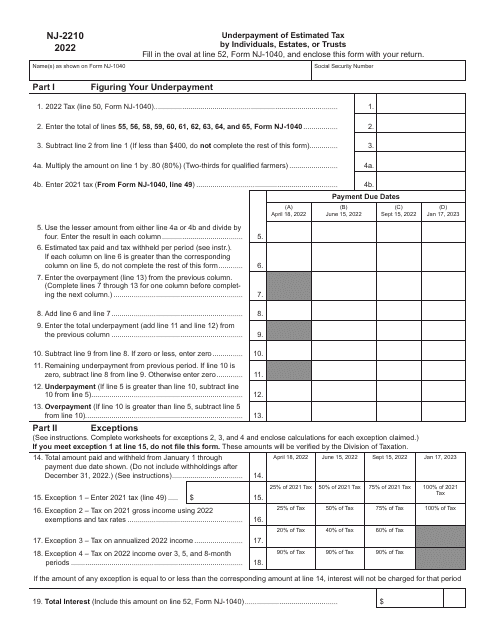

Form NJ-2210 Underpayment of Estimated Tax by Individuals, Estates, or Trusts - New Jersey

What Is Form NJ-2210?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-2210?

A: Form NJ-2210 is used to calculate the underpayment of estimated tax by individuals, estates, or trusts in the state of New Jersey.

Q: Who needs to file Form NJ-2210?

A: Individuals, estates, or trusts who have underpaid their estimated tax in New Jersey may need to file Form NJ-2210.

Q: Why would someone need to file Form NJ-2210?

A: Form NJ-2210 is required if you did not pay enough in estimated taxes throughout the year and owe additional tax at the time of filing your New Jersey tax return.

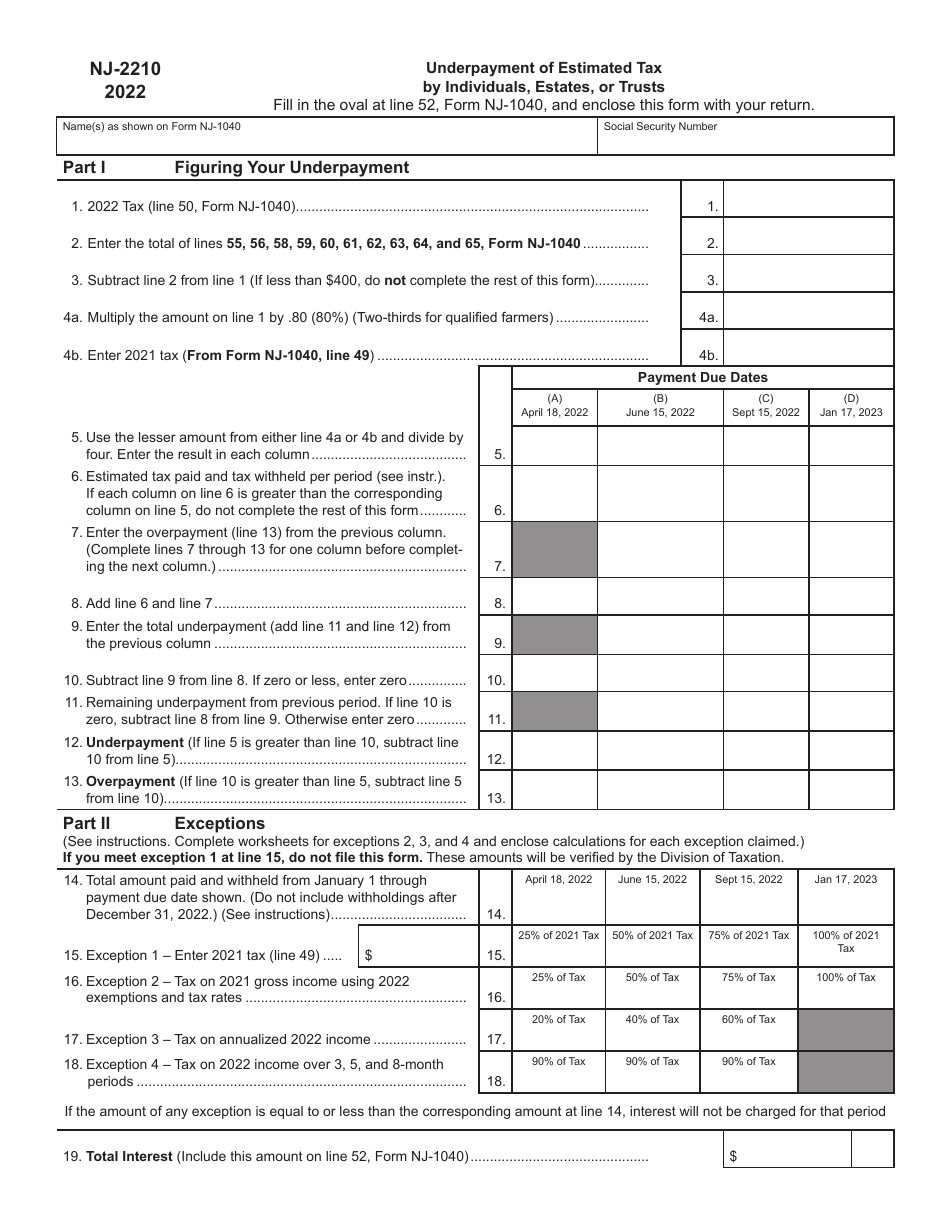

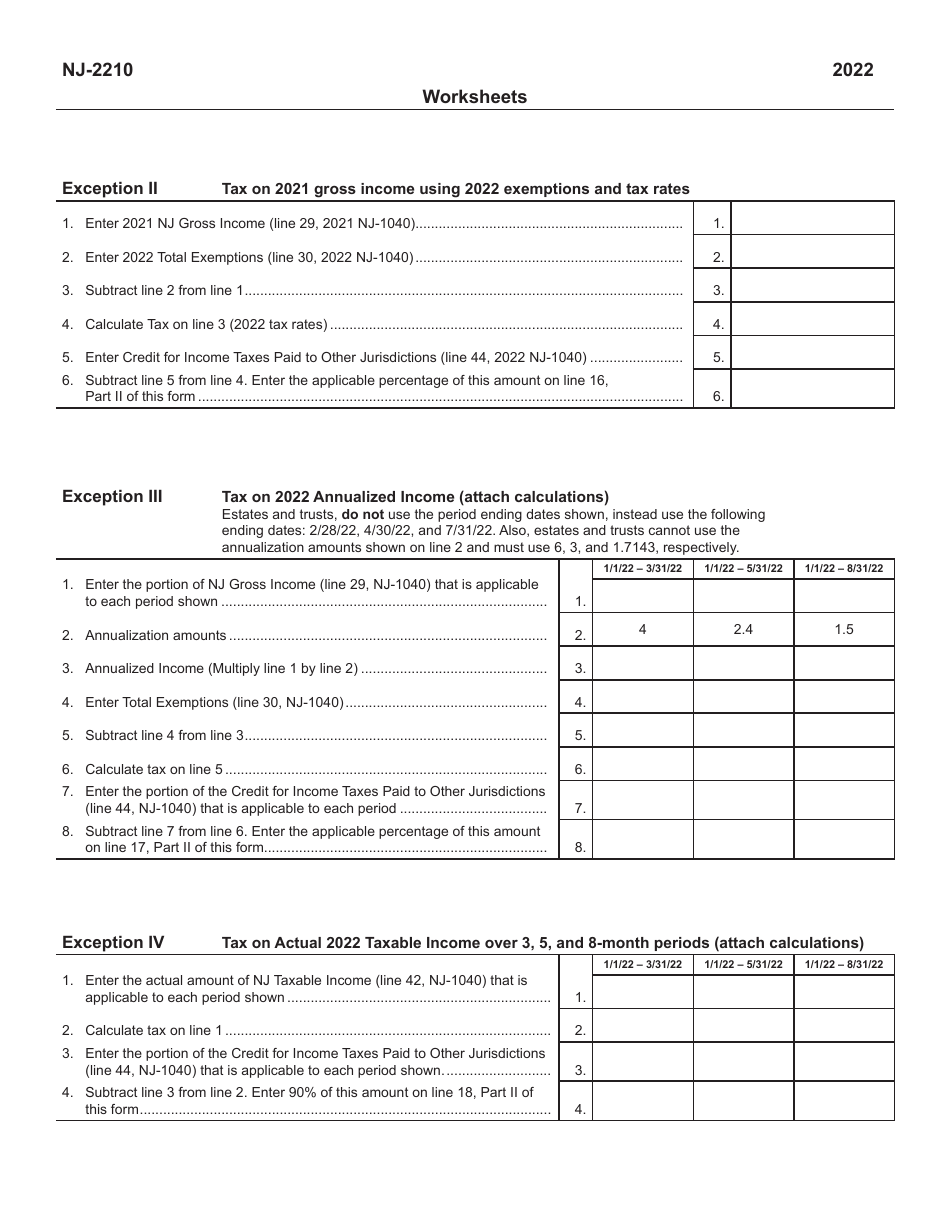

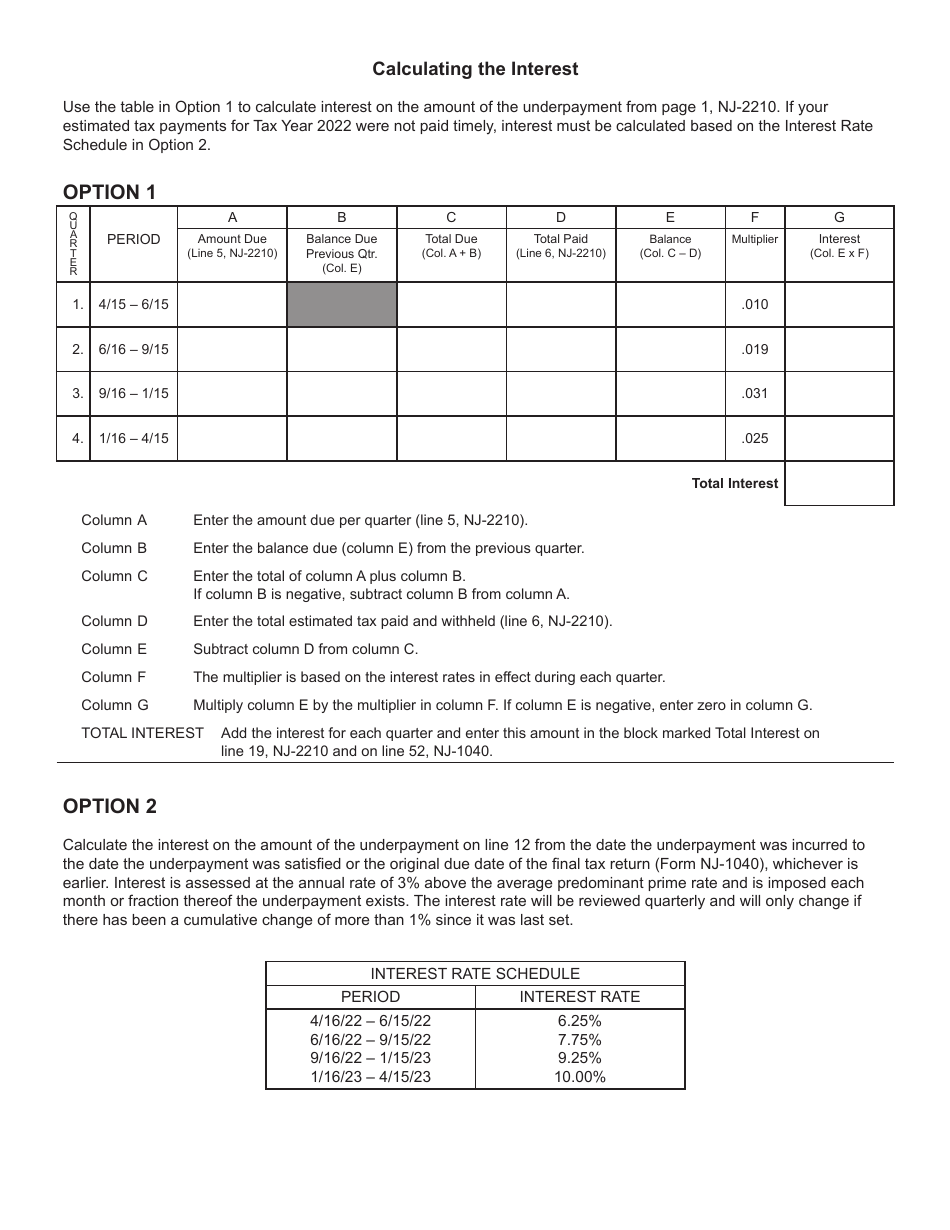

Q: What information is needed to complete Form NJ-2210?

A: To complete Form NJ-2210, you will need information about your estimated tax payments, tax withheld, and any penalty or interest payments.

Q: When is the deadline for filing Form NJ-2210?

A: Form NJ-2210 should be filed along with your New Jersey tax return by the original due date of the return, which is typically April 15th.

Q: Are there any penalties for not filing Form NJ-2210 if I underpaid my estimated tax?

A: If you underpaid your estimated tax in New Jersey, you may be subject to penalties and interest. Therefore, it is important to file Form NJ-2210 to calculate and possibly minimize those penalties.

Q: Can I file Form NJ-2210 electronically?

A: Yes, you can file Form NJ-2210 electronically if you are e-filing your New Jersey tax return.

Q: Is Form NJ-2210 only for individuals?

A: No, Form NJ-2210 can also be used by estates or trusts that have underpaid their estimated tax in New Jersey.

Q: Do I need to attach supporting documents with Form NJ-2210?

A: You generally do not need to attach supporting documents when filing Form NJ-2210. However, it is important to keep all relevant records and documents for your own records in case of an audit.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-2210 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.