This version of the form is not currently in use and is provided for reference only. Download this version of

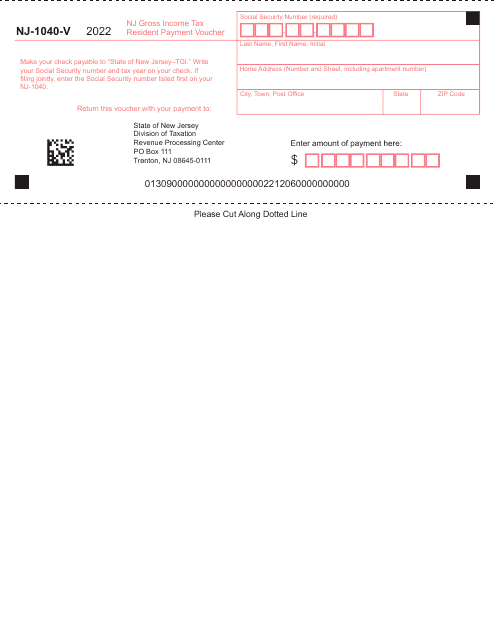

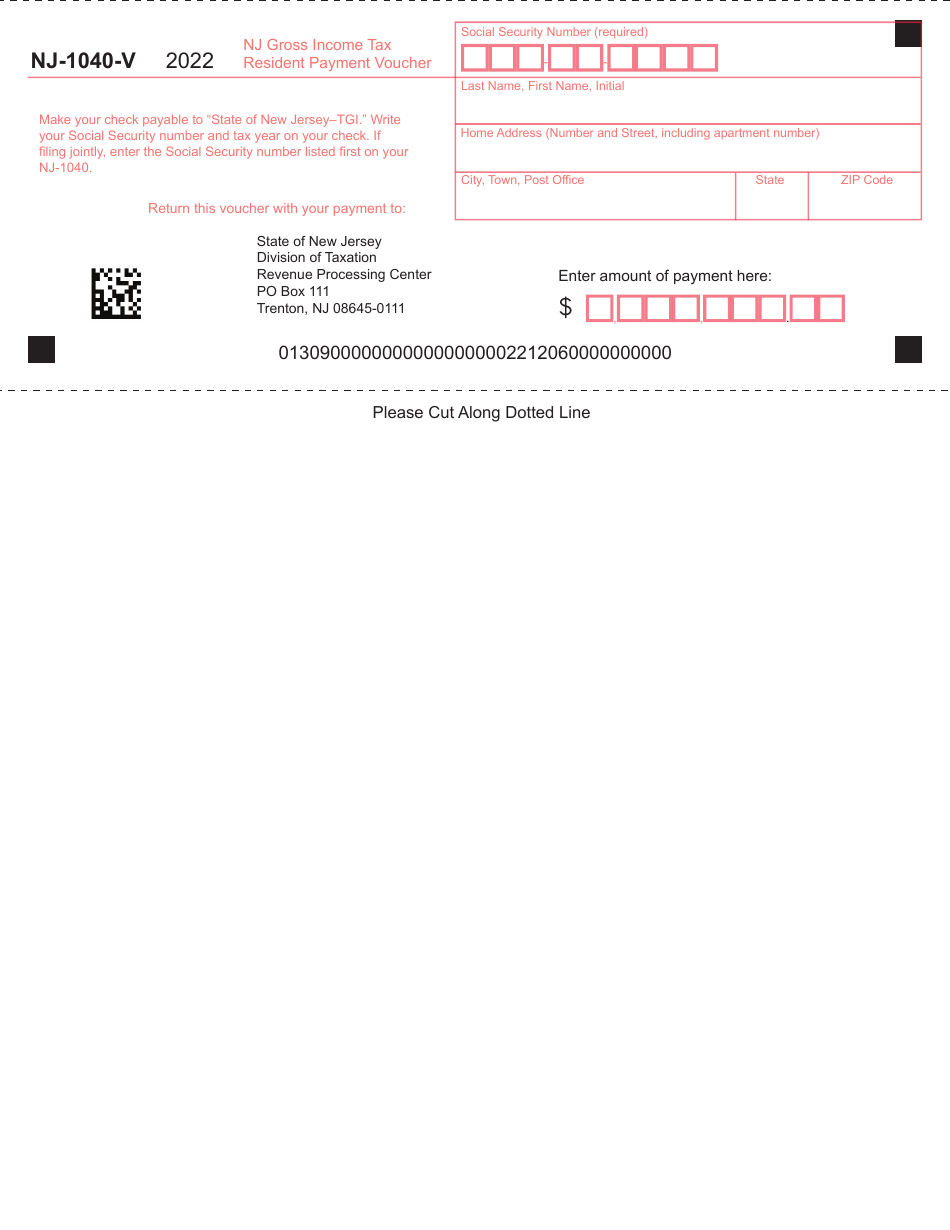

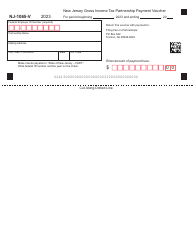

Form NJ-1040-V

for the current year.

Form NJ-1040-V Resident Income Tax Return Payment Voucher - New Jersey

What Is Form NJ-1040-V?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1040-V?

A: Form NJ-1040-V is a voucher used for residents of New Jersey to make a payment towards their income tax return.

Q: Who needs to use Form NJ-1040-V?

A: Residents of New Jersey who are making a payment towards their income tax return need to use Form NJ-1040-V.

Q: What is the purpose of Form NJ-1040-V?

A: The purpose of Form NJ-1040-V is to provide a voucher for taxpayers to remit their payment towards their income tax return.

Q: How do I fill out Form NJ-1040-V?

A: To fill out Form NJ-1040-V, you will need to enter your personal information, the amount you are paying, and your signature.

Q: Can I file my income tax return electronically with Form NJ-1040-V?

A: No, Form NJ-1040-V is only used for making a payment towards your income tax return. Your tax return should be filed separately.

Q: What if I am unable to pay the full amount owed with Form NJ-1040-V?

A: If you are unable to pay the full amount owed, you should still submit Form NJ-1040-V with the partial payment you can make. Contact the New Jersey Division of Taxation for more information on payment options.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040-V by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.