This version of the form is not currently in use and is provided for reference only. Download this version of

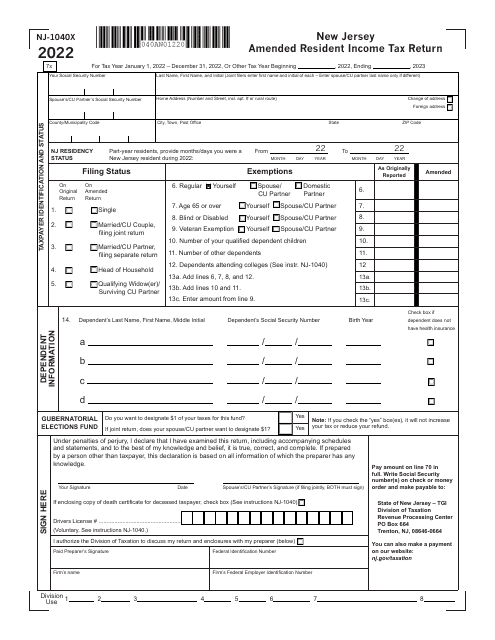

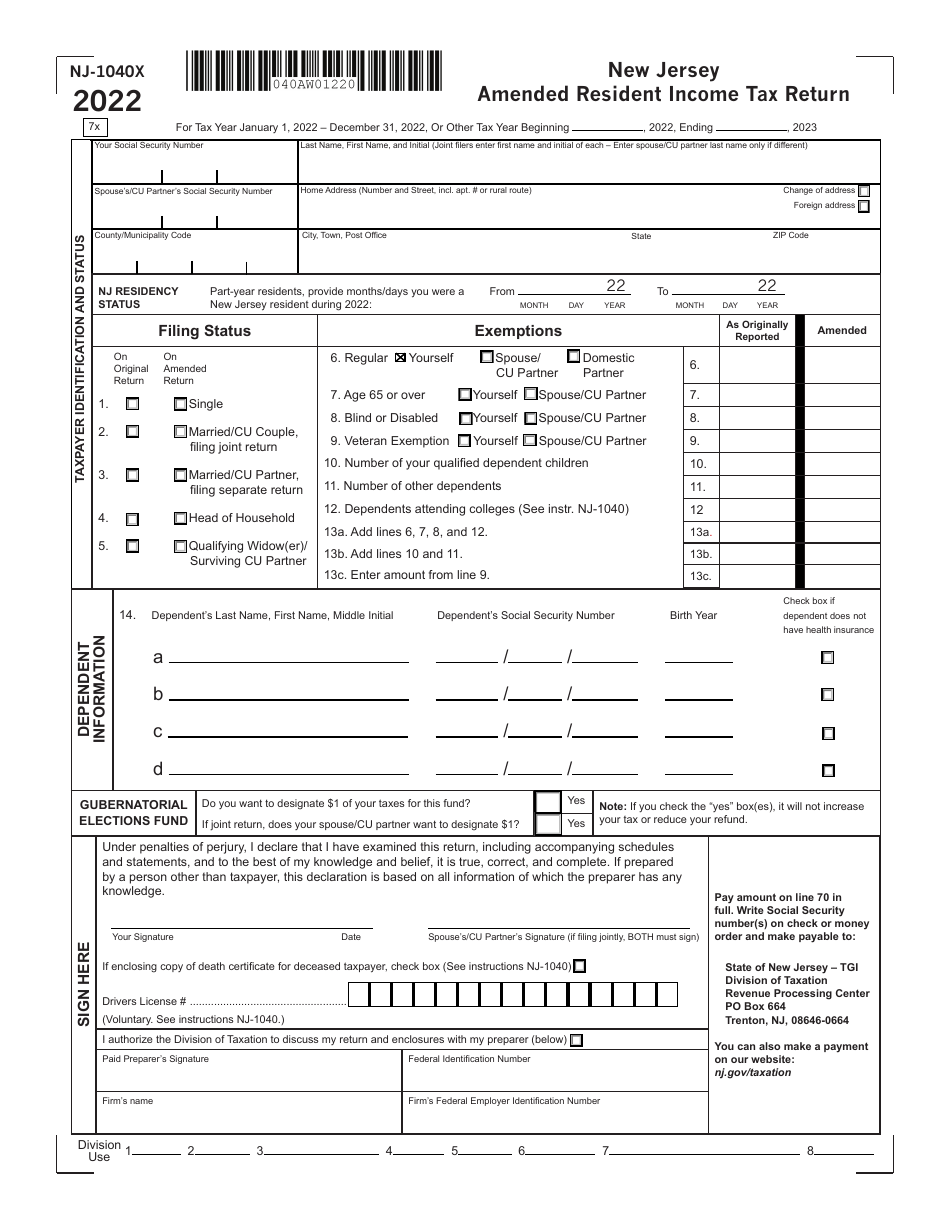

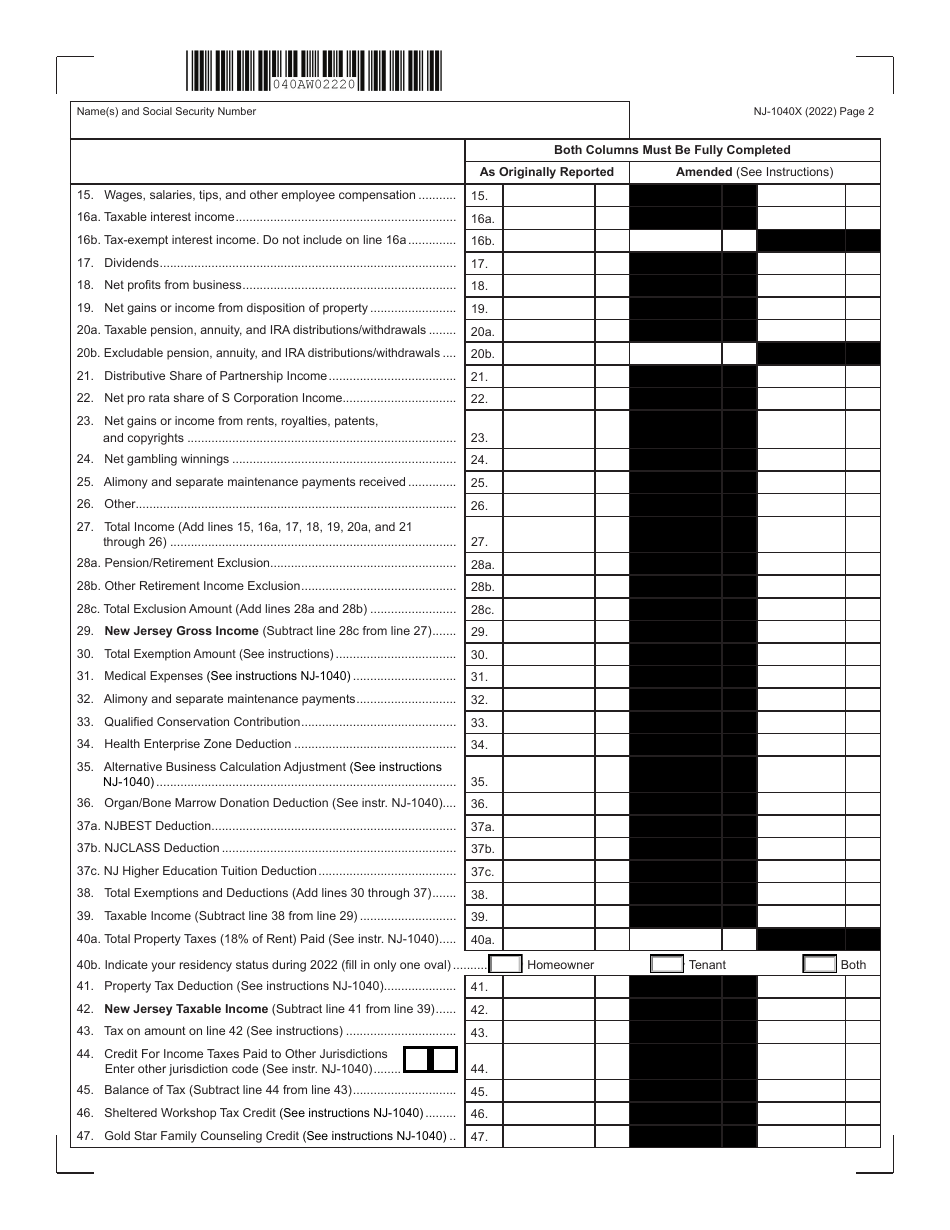

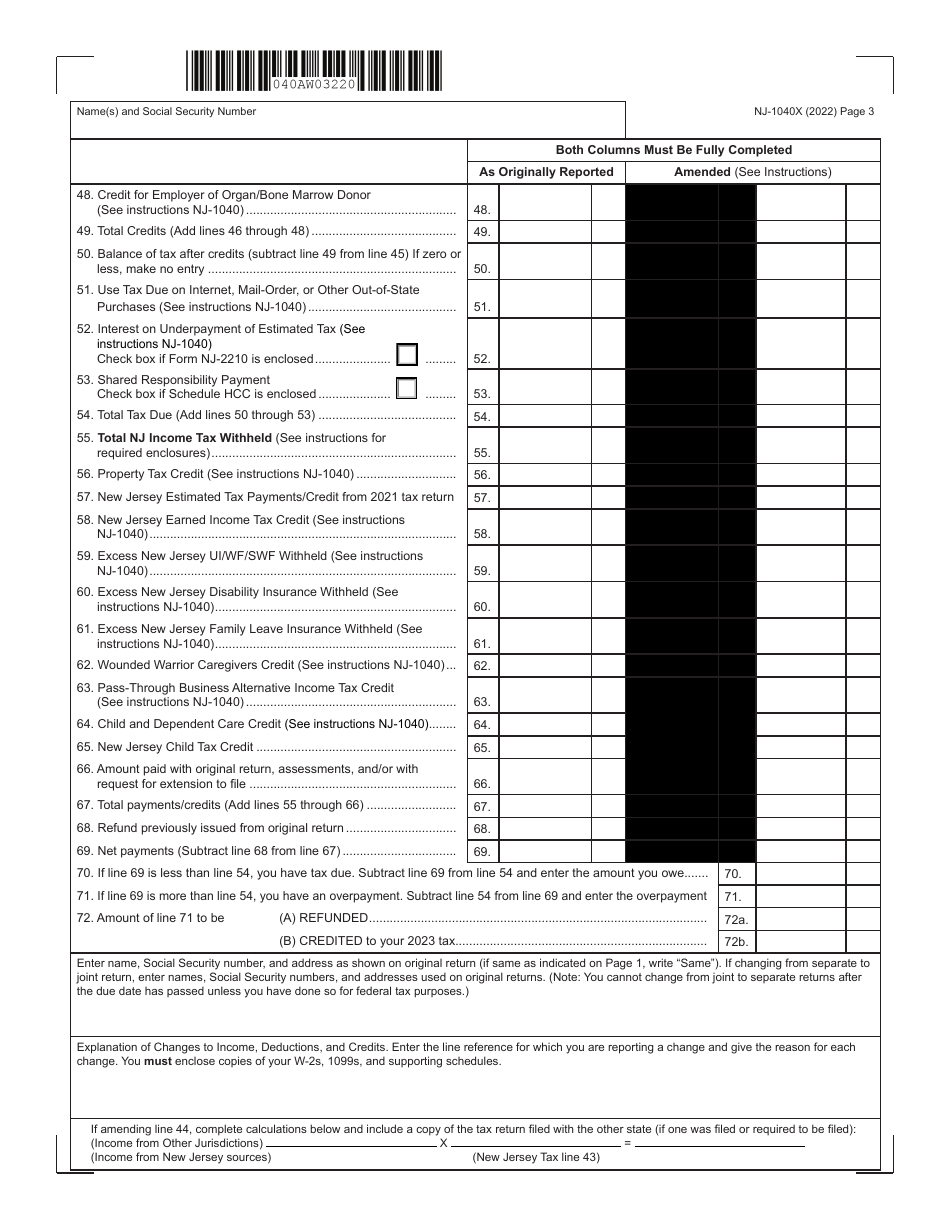

Form NJ-1040X

for the current year.

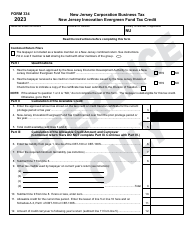

Form NJ-1040X New Jersey Amended Resident Income Tax Return - New Jersey

What Is Form NJ-1040X?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NJ-1040X?

A: Form NJ-1040X is the New Jersey Amended Resident Income Tax Return.

Q: Who should file Form NJ-1040X?

A: Residents of New Jersey who need to make changes or corrections to their original New Jersey income tax return should file Form NJ-1040X.

Q: When should I file Form NJ-1040X?

A: You should file Form NJ-1040X as soon as you discover an error or omission on your original New Jersey tax return.

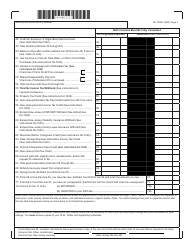

Q: What information is required to complete Form NJ-1040X?

A: You will need to provide information about your original New Jersey tax return, as well as the changes or corrections you are making.

Q: Are there any fees to file Form NJ-1040X?

A: No, there are no fees to file Form NJ-1040X.

Q: Can I e-file Form NJ-1040X?

A: No, Form NJ-1040X cannot be e-filed. It must be filed by mail.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040X by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.