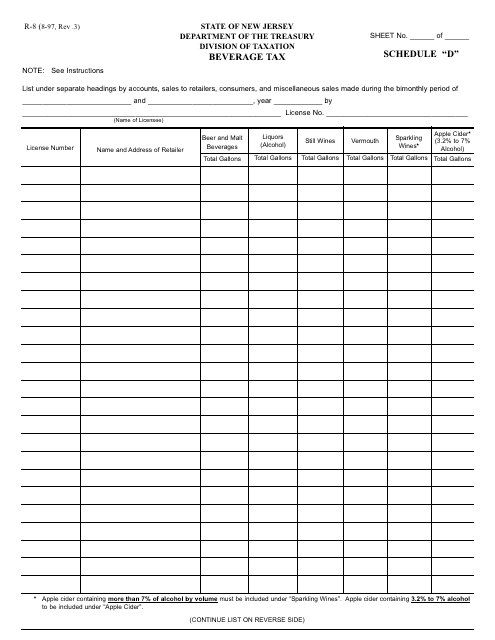

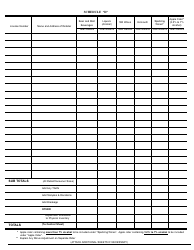

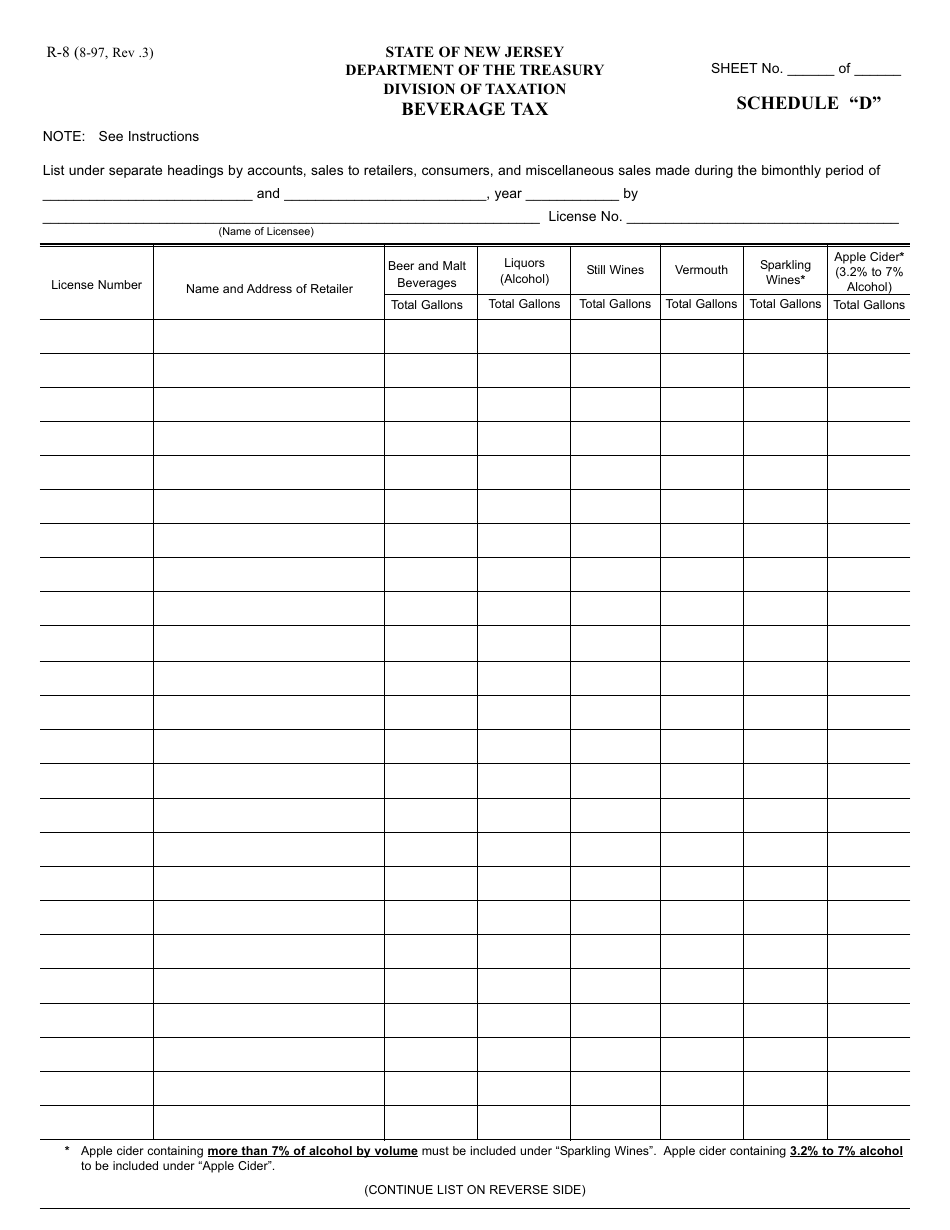

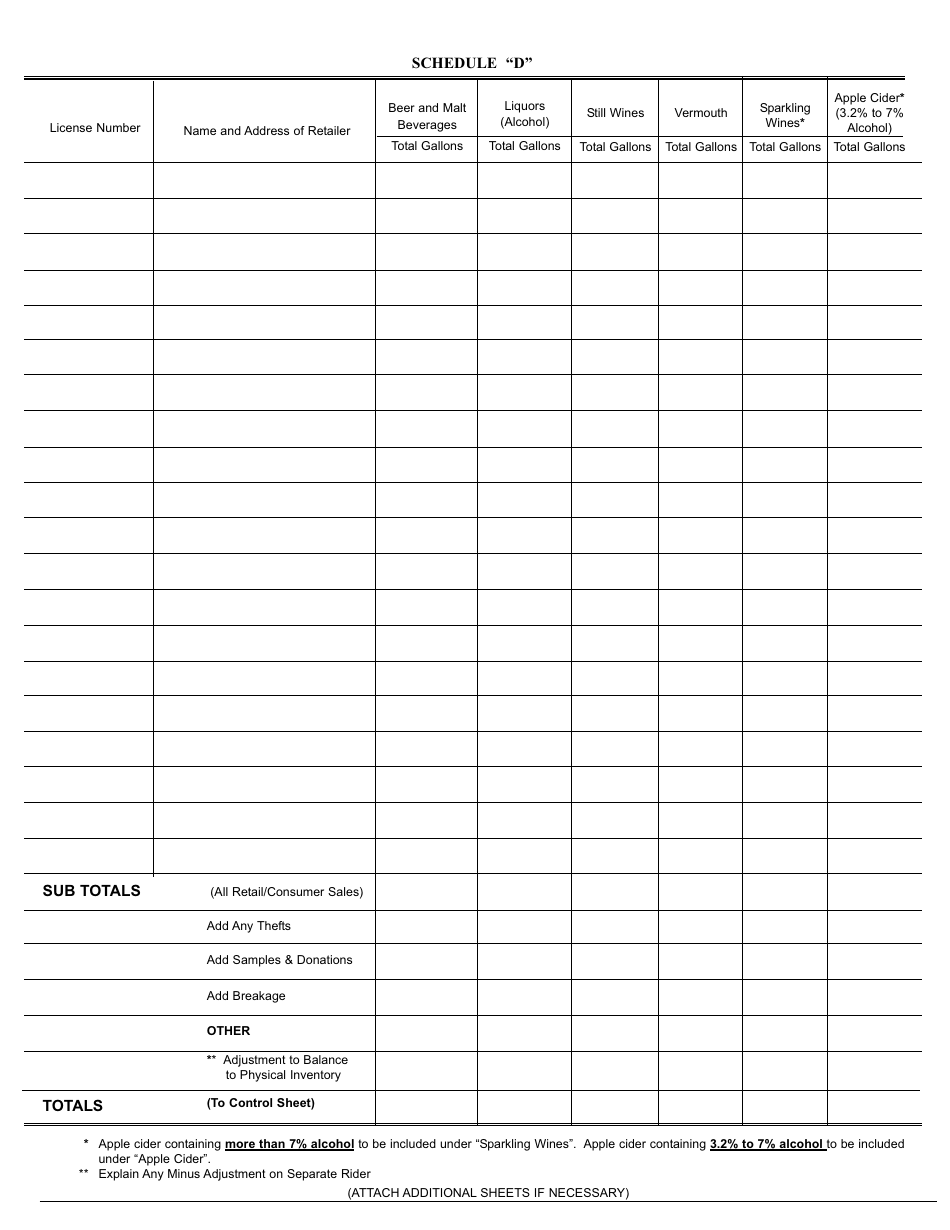

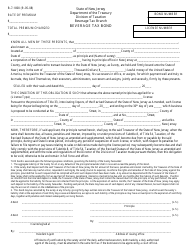

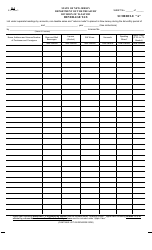

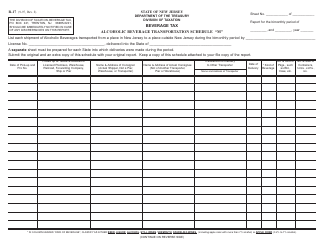

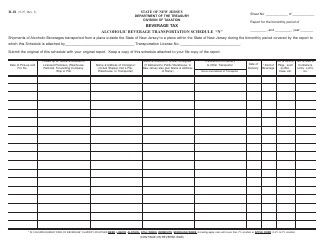

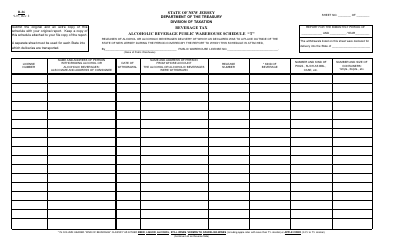

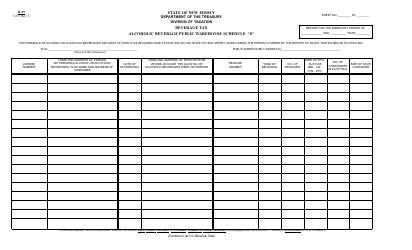

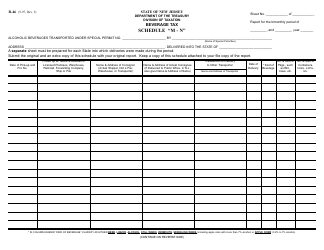

Form R-8 Schedule D Beverage Tax - New Jersey

What Is Form R-8 Schedule D?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-8 Schedule D Beverage Tax?

A: Form R-8 Schedule D Beverage Tax is a tax form used in the state of New Jersey to report and remit taxes on the sale of beverages.

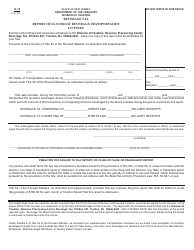

Q: Who needs to file Form R-8 Schedule D Beverage Tax?

A: Businesses that sell beverages in New Jersey are required to file Form R-8 Schedule D Beverage Tax.

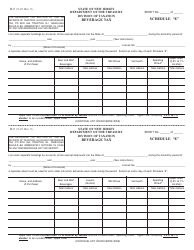

Q: What beverages are subject to this tax?

A: The tax applies to alcoholic and non-alcoholic beverages sold in New Jersey, including beer, wine, liquor, soda, and other beverages.

Q: How often do I need to file Form R-8 Schedule D Beverage Tax?

A: Form R-8 Schedule D Beverage Tax must be filed monthly by the 10th day of the following month.

Q: Is there a penalty for late or non-filing of Form R-8 Schedule D Beverage Tax?

A: Yes, there are penalties for late or non-filing of Form R-8 Schedule D Beverage Tax, including interest charges and possible license suspension.

Q: Are there any exemptions to this tax?

A: Some beverages are exempt from this tax, such as milk, 100% fruit juice, and certain medical beverages. However, specific criteria must be met for these exemptions.

Form Details:

- Released on August 1, 1997;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-8 Schedule D by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.