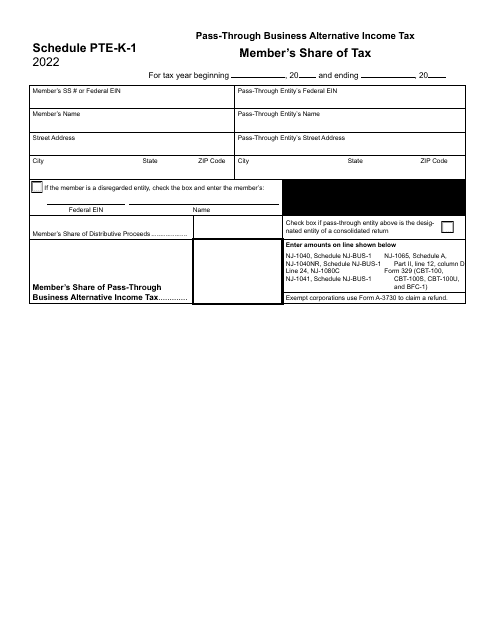

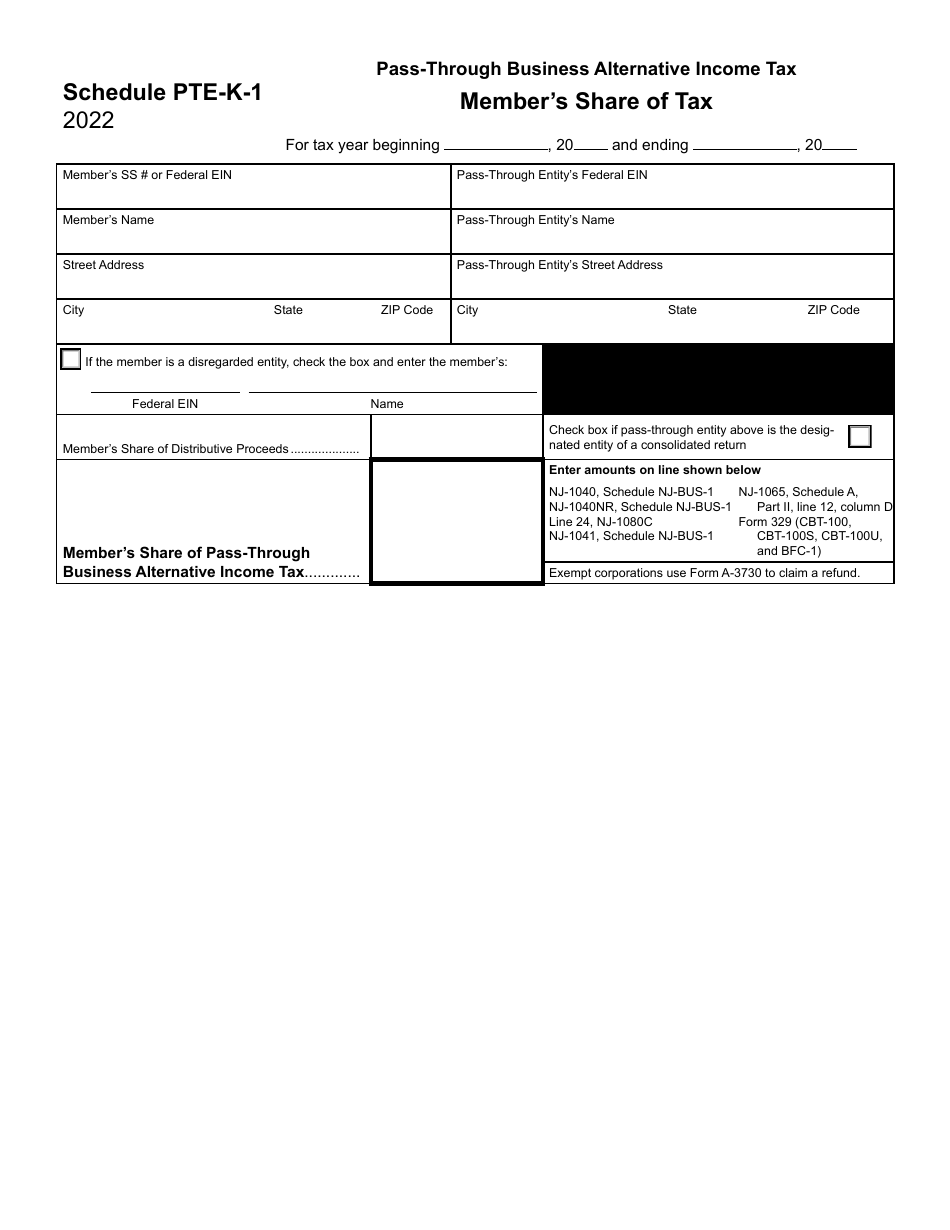

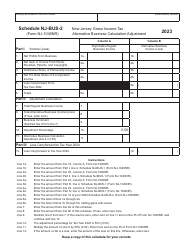

Schedule PTE-K-1 Member's Share of Tax - Pass-Through Business Alternative Income Tax - New Jersey

What Is Schedule PTE-K-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule PTE-K-1?

A: Schedule PTE-K-1 is a form used by members of pass-through businesses in New Jersey to report their share of the Alternative Income Tax.

Q: Who needs to file Schedule PTE-K-1?

A: Members of pass-through businesses in New Jersey need to file Schedule PTE-K-1 to report their share of the Alternative Income Tax.

Q: What is the Alternative Income Tax?

A: The Alternative Income Tax is a tax imposed on certain taxpayers, including members of pass-through businesses, in New Jersey.

Q: What is a pass-through business?

A: A pass-through business is a business entity that does not pay taxes itself, but passes its income, losses, deductions, and credits to its owners or members who report them on their individual tax returns.

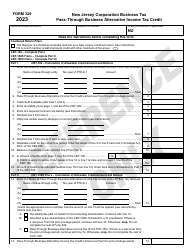

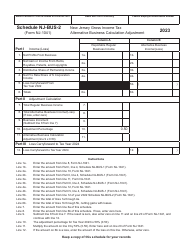

Q: How do I calculate my share of the Alternative Income Tax?

A: Your share of the Alternative Income Tax is typically calculated based on your ownership percentage in the pass-through business.

Q: When is the deadline to file Schedule PTE-K-1?

A: The deadline to file Schedule PTE-K-1 is generally the same as the deadline to file your personal income tax return in New Jersey.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule PTE-K-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.