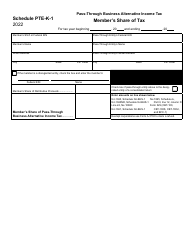

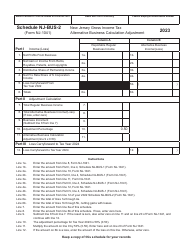

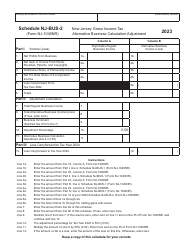

Form PTE-150 Instructions for Pass-Through Business Alternative Income Tax Statement of Estimated Tax - New Jersey

What Is Form PTE-150?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTE-150?

A: Form PTE-150 is the Pass-Through Business Alternative Income Tax Statement of Estimated Tax in New Jersey.

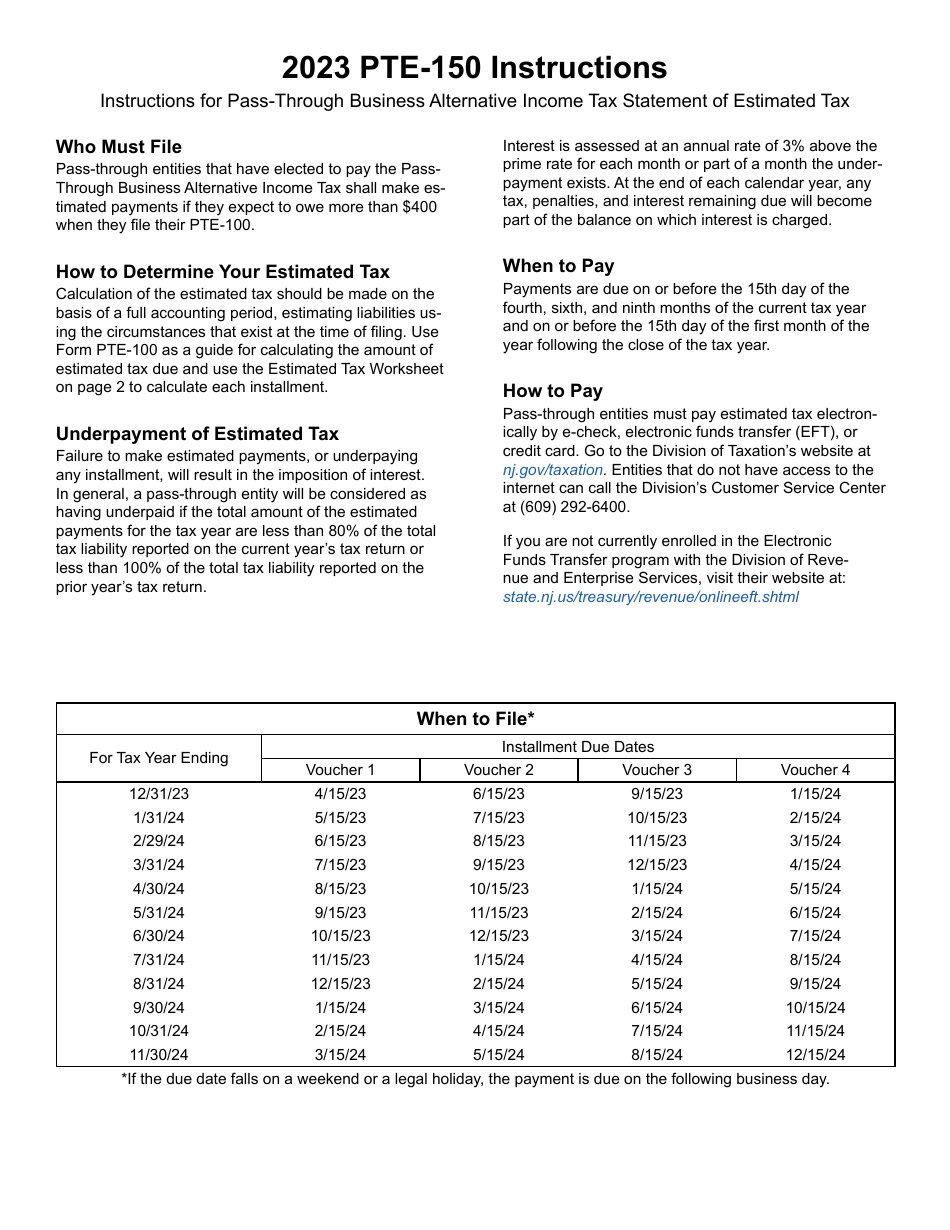

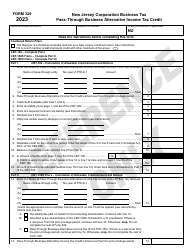

Q: What is the purpose of Form PTE-150?

A: Form PTE-150 is used to report estimated tax payments for pass-through businesses in New Jersey.

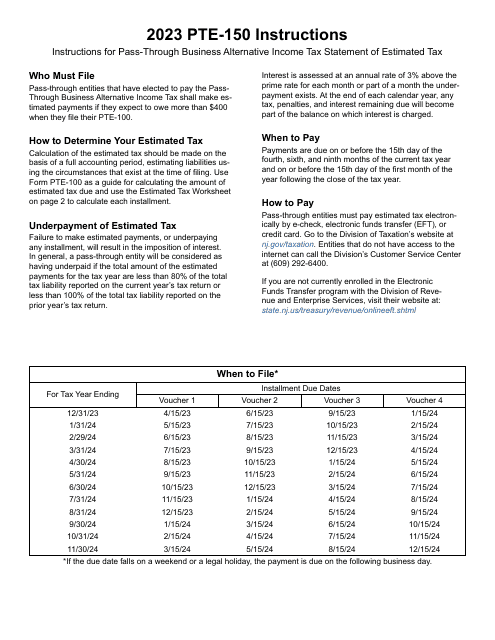

Q: Who needs to file Form PTE-150?

A: Pass-through businesses in New Jersey need to file Form PTE-150.

Q: When is Form PTE-150 due?

A: Form PTE-150 is due on or before the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing of Form PTE-150?

A: Yes, there are penalties for late filing or underpayment of estimated tax. It is important to file and pay on time to avoid penalties.

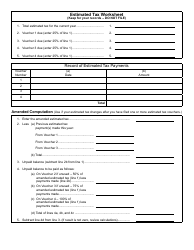

Q: What information is required to complete Form PTE-150?

A: The form requires information such as the taxpayer's name, address, federal identification number, estimated tax amount, and taxable year.

Q: Is Form PTE-150 only for New Jersey residents?

A: No, Form PTE-150 is for pass-through businesses operating in New Jersey, regardless of the residency of the business owners.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-150 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.