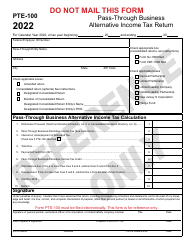

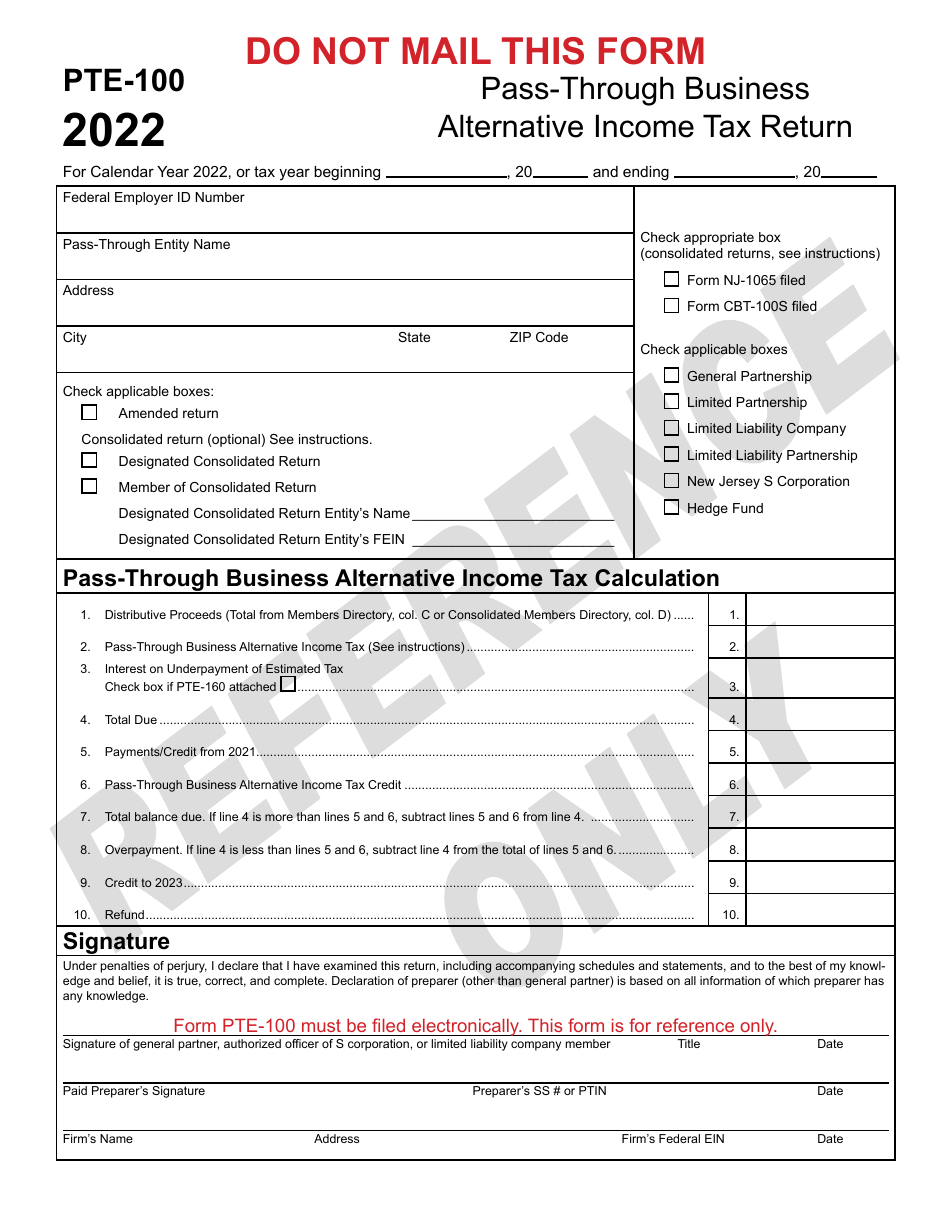

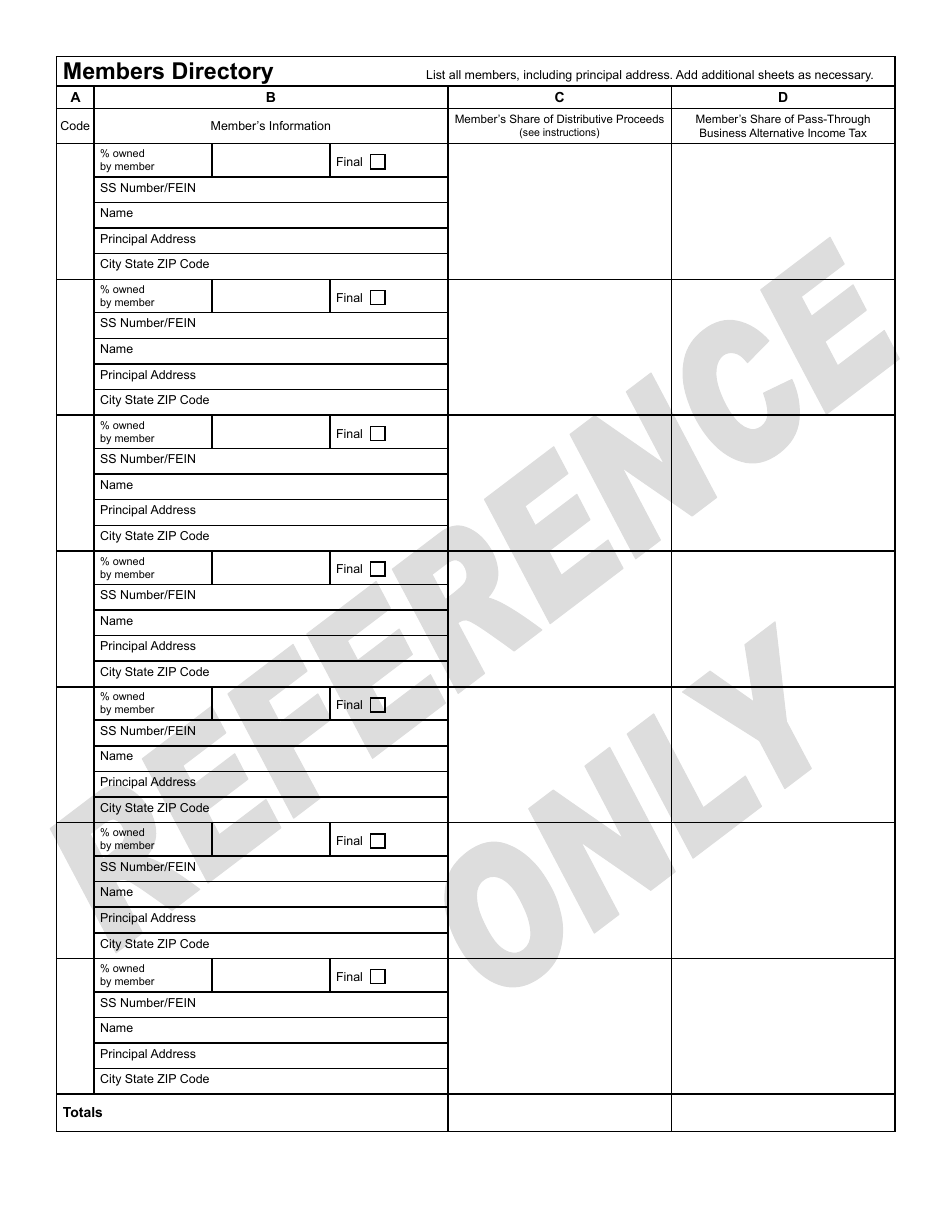

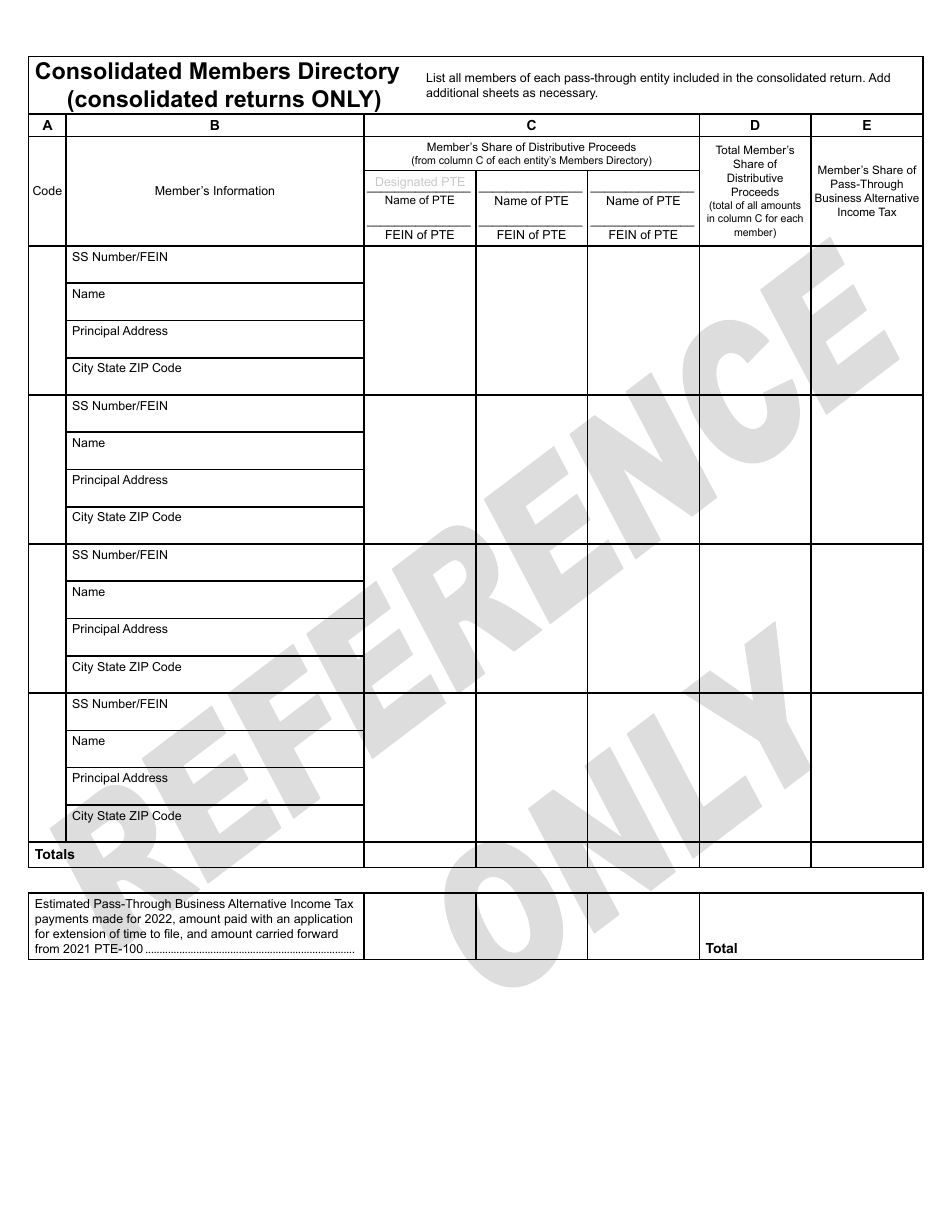

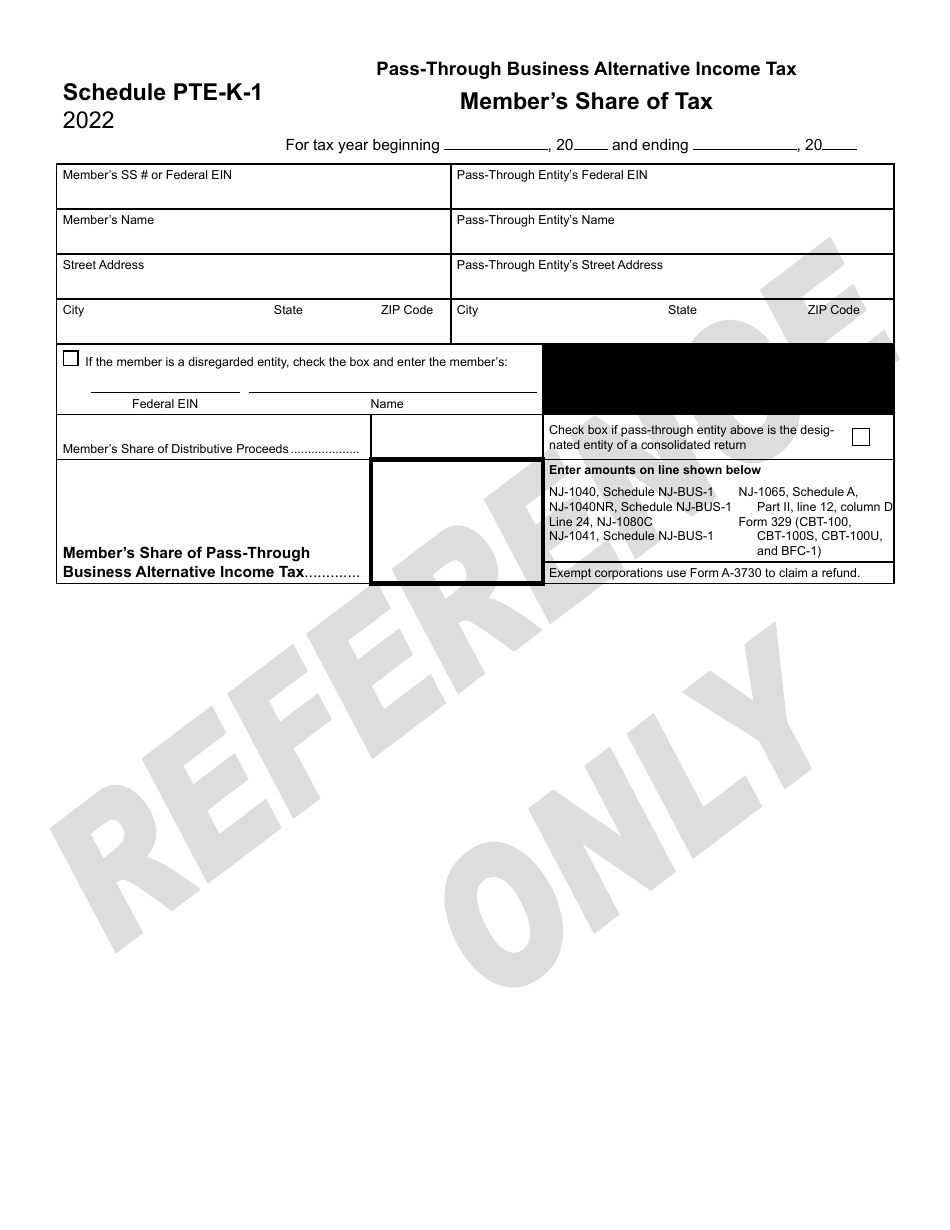

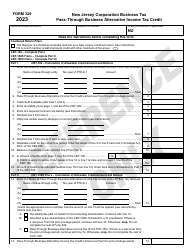

Form PTE-100 Pass-Through Business Alternative Income Tax Return - New Jersey

What Is Form PTE-100?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is PTE-100?

A: PTE-100 is the Pass-Through Business Alternative Income Tax Return form.

Q: What is the purpose of PTE-100?

A: The purpose of PTE-100 is to report the pass-through business alternative income tax in New Jersey.

Q: Who needs to file PTE-100?

A: Pass-through businesses in New Jersey need to file PTE-100.

Q: What is a pass-through business?

A: A pass-through business is a business entity where the income passes through to the owner's personal income tax return.

Q: What is the alternative income tax?

A: The alternative income tax is an alternative tax calculation for pass-through businesses in New Jersey.

Q: Is PTE-100 the only tax return that pass-through businesses need to file?

A: No, pass-through businesses also need to file federal and state income tax returns.

Q: Are there any penalties for not filing PTE-100?

A: Yes, there are penalties for late or non-filing of PTE-100. It is important to file the form by the due date.

Q: When is the deadline to file PTE-100?

A: The deadline to file PTE-100 is on or before the 15th day of the fourth month following the close of the tax year.

Q: Can I file PTE-100 electronically?

A: Yes, you can file PTE-100 electronically using the New Jersey E-File system.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.