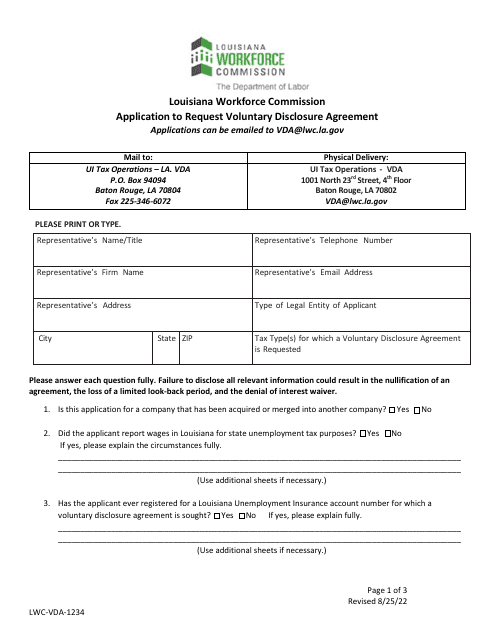

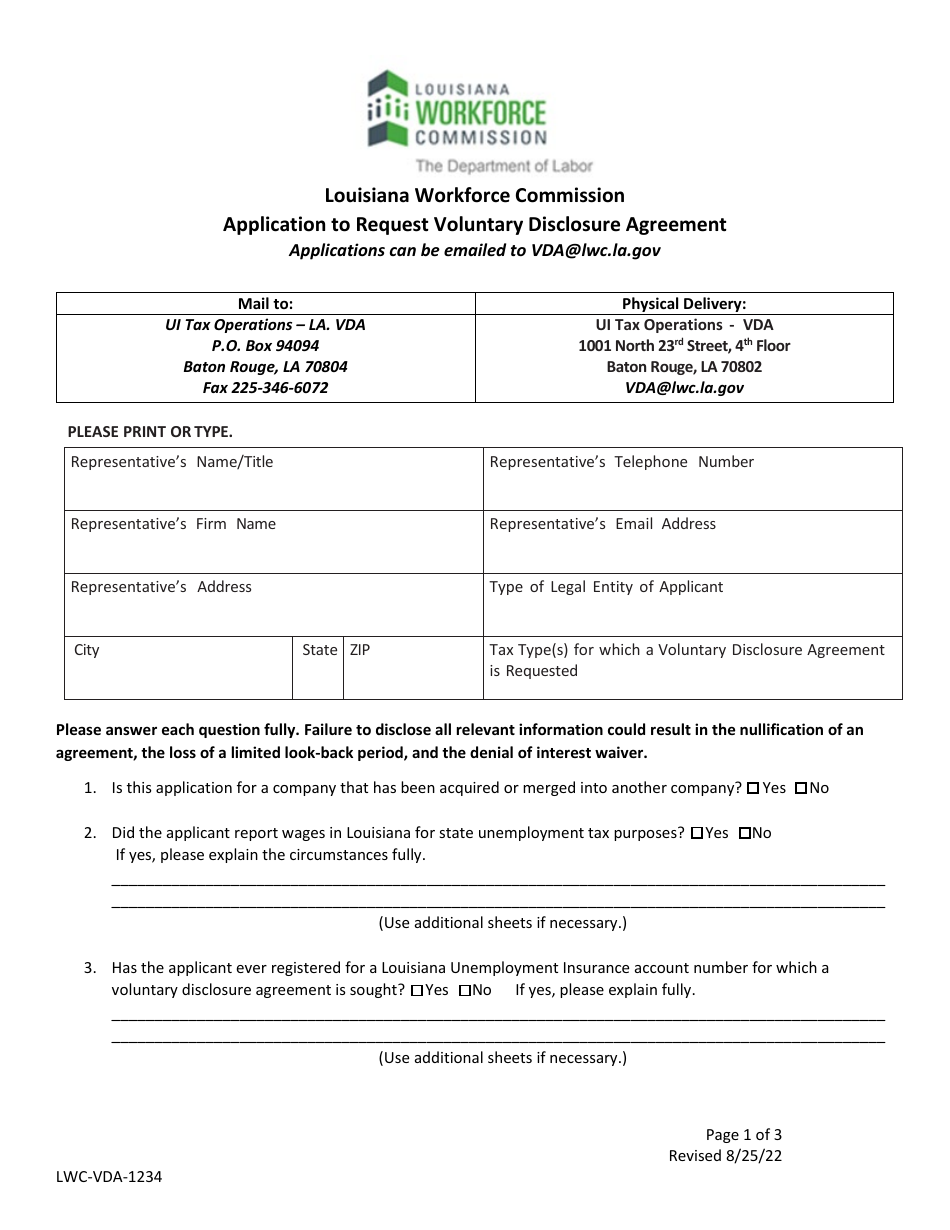

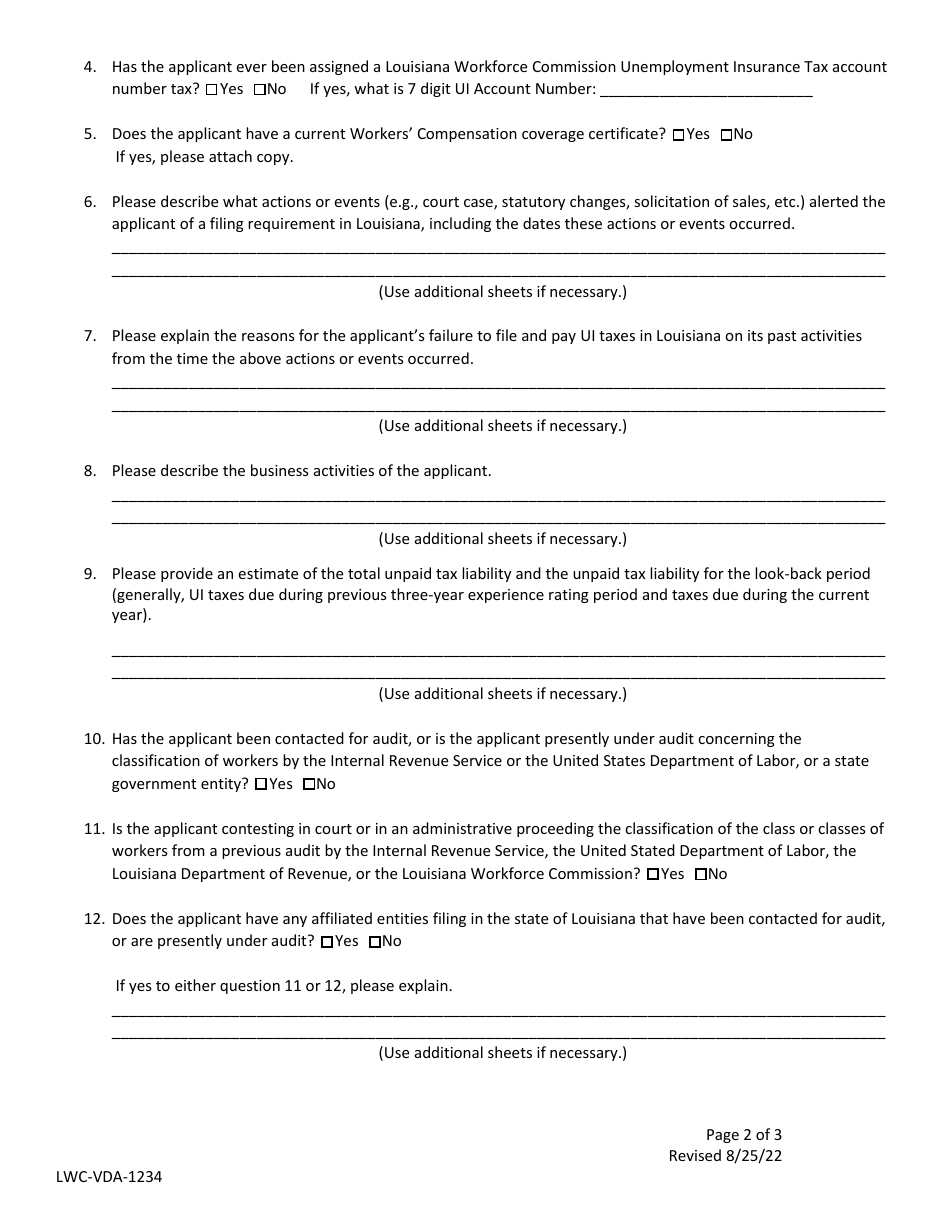

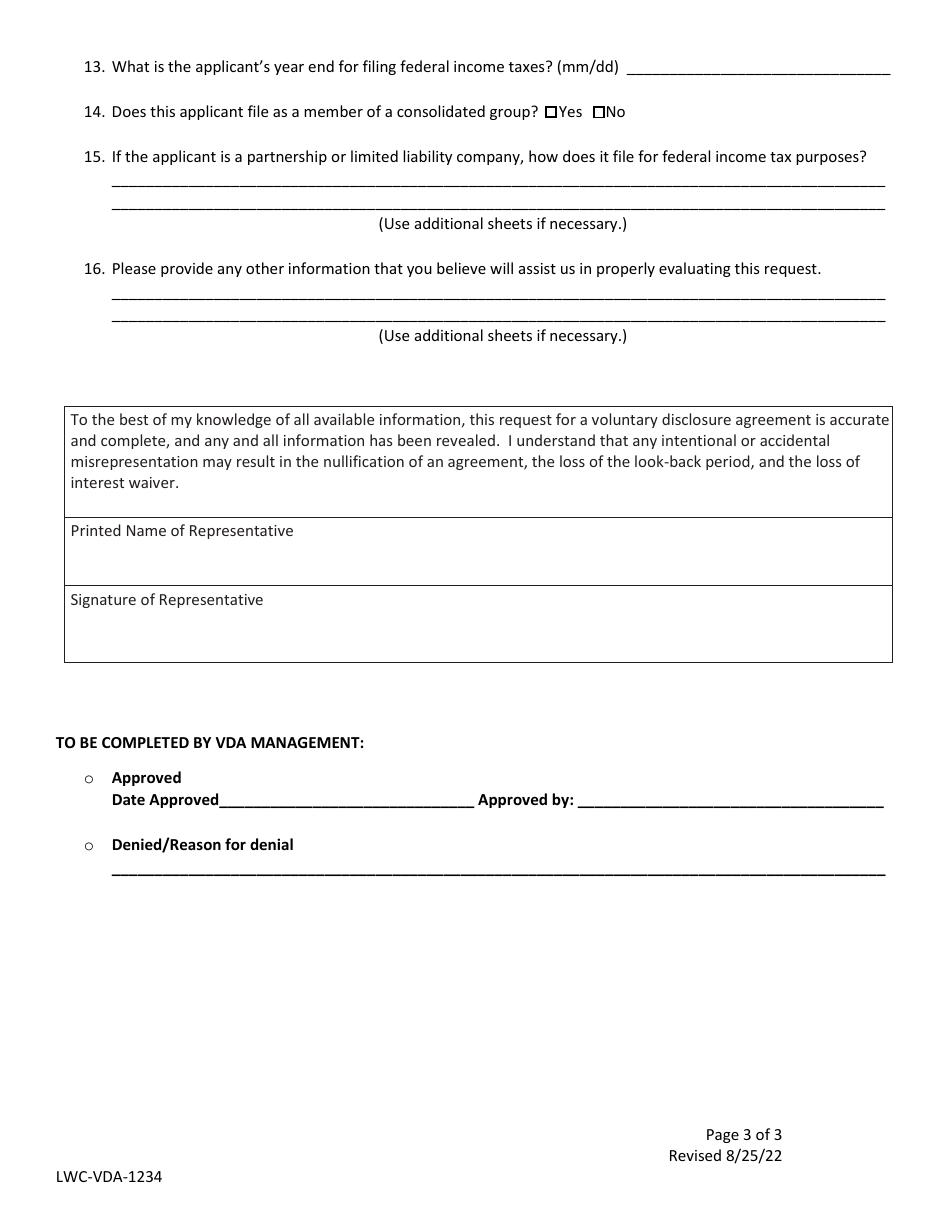

Form LWC-VDA-1234 Application to Request Voluntary Disclosure Agreement - Louisiana

What Is Form LWC-VDA-1234?

This is a legal form that was released by the Louisiana Workforce Commission - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is LWC-VDA-1234?

A: LWC-VDA-1234 is the application form used to request a Voluntary Disclosure Agreement in Louisiana.

Q: What is a Voluntary Disclosure Agreement?

A: A Voluntary Disclosure Agreement is a program offered by the Louisiana Workforce Commission (LWC) that allows taxpayers to come forward voluntarily and report any unreported or underreported tax liabilities.

Q: Who can use the LWC-VDA-1234 form?

A: Any taxpayer who wants to disclose unreported or underreported tax liabilities to the LWC can use the LWC-VDA-1234 form.

Q: What is the purpose of the LWC-VDA-1234 form?

A: The purpose of the LWC-VDA-1234 form is to initiate the process of requesting a Voluntary Disclosure Agreement with the LWC.

Q: Are there any fees associated with the Voluntary Disclosure Agreement?

A: Yes, there are fees associated with the Voluntary Disclosure Agreement. The specific fees will be determined based on the taxpayer's situation and the amount of the tax liabilities being disclosed.

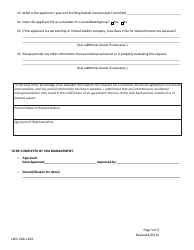

Q: What happens after I submit the LWC-VDA-1234 form?

A: After submitting the LWC-VDA-1234 form, the LWC will review the application and contact the taxpayer to discuss the next steps in the process.

Q: Can I request a Voluntary Disclosure Agreement for other types of taxes?

A: No, the Voluntary Disclosure Agreement program offered by the LWC is specific to tax liabilities governed by the Louisiana Workforce Commission.

Q: Is participation in the Voluntary Disclosure Agreement program confidential?

A: Yes, participation in the Voluntary Disclosure Agreement program is confidential, meaning the information disclosed by the taxpayer will not be made public.

Q: What are the benefits of participating in the Voluntary Disclosure Agreement program?

A: The benefits of participating in the Voluntary Disclosure Agreement program include potential reduction in penalties and interest, avoidance of legal actions, and resolution of outstanding tax liabilities.

Form Details:

- Released on August 25, 2022;

- The latest edition provided by the Louisiana Workforce Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LWC-VDA-1234 by clicking the link below or browse more documents and templates provided by the Louisiana Workforce Commission.