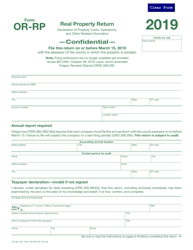

This version of the form is not currently in use and is provided for reference only. Download this version of

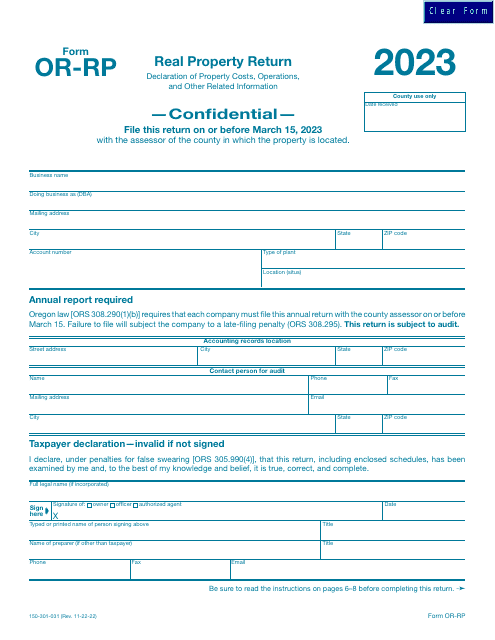

Form OR-RP (150-301-031)

for the current year.

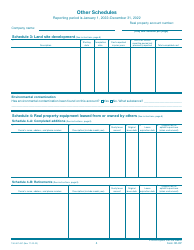

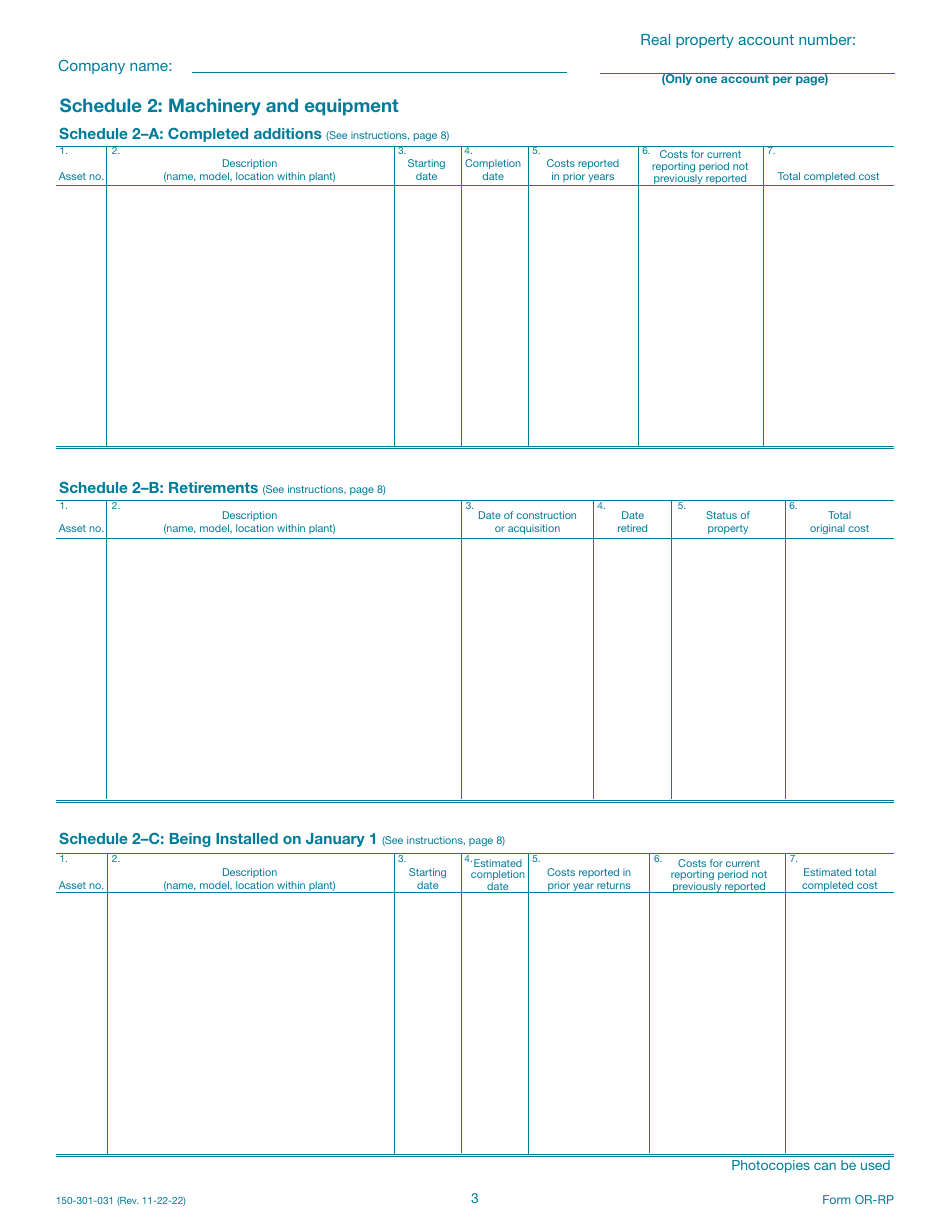

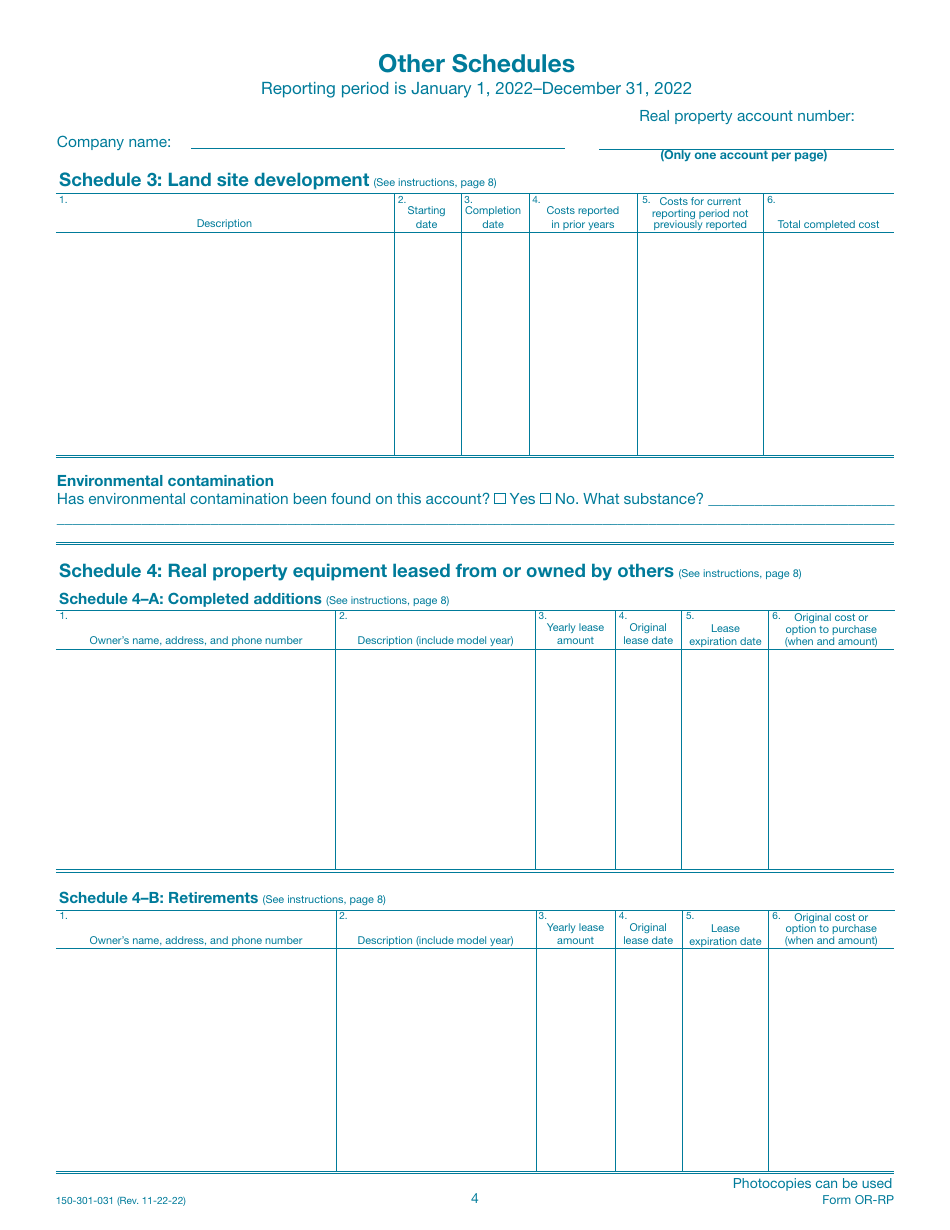

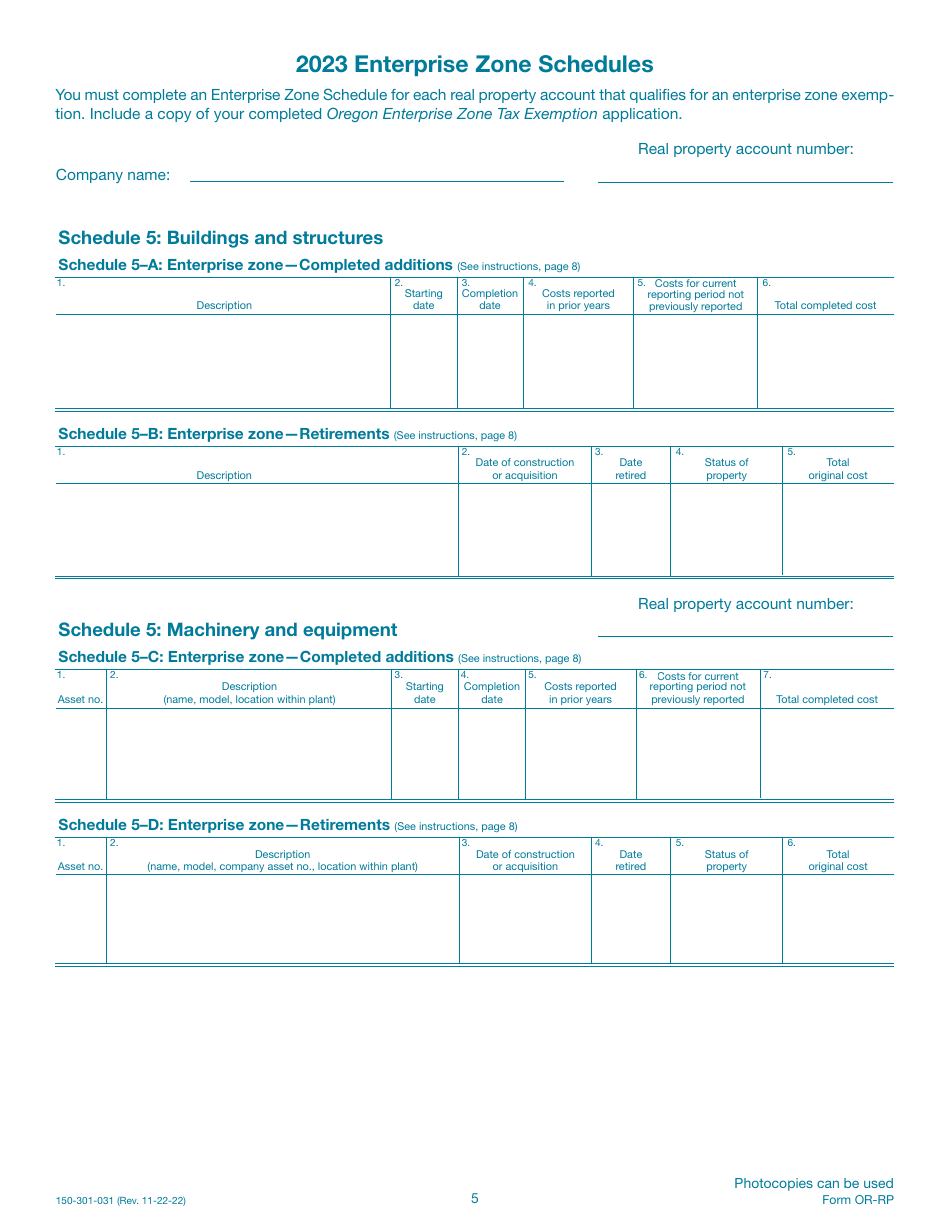

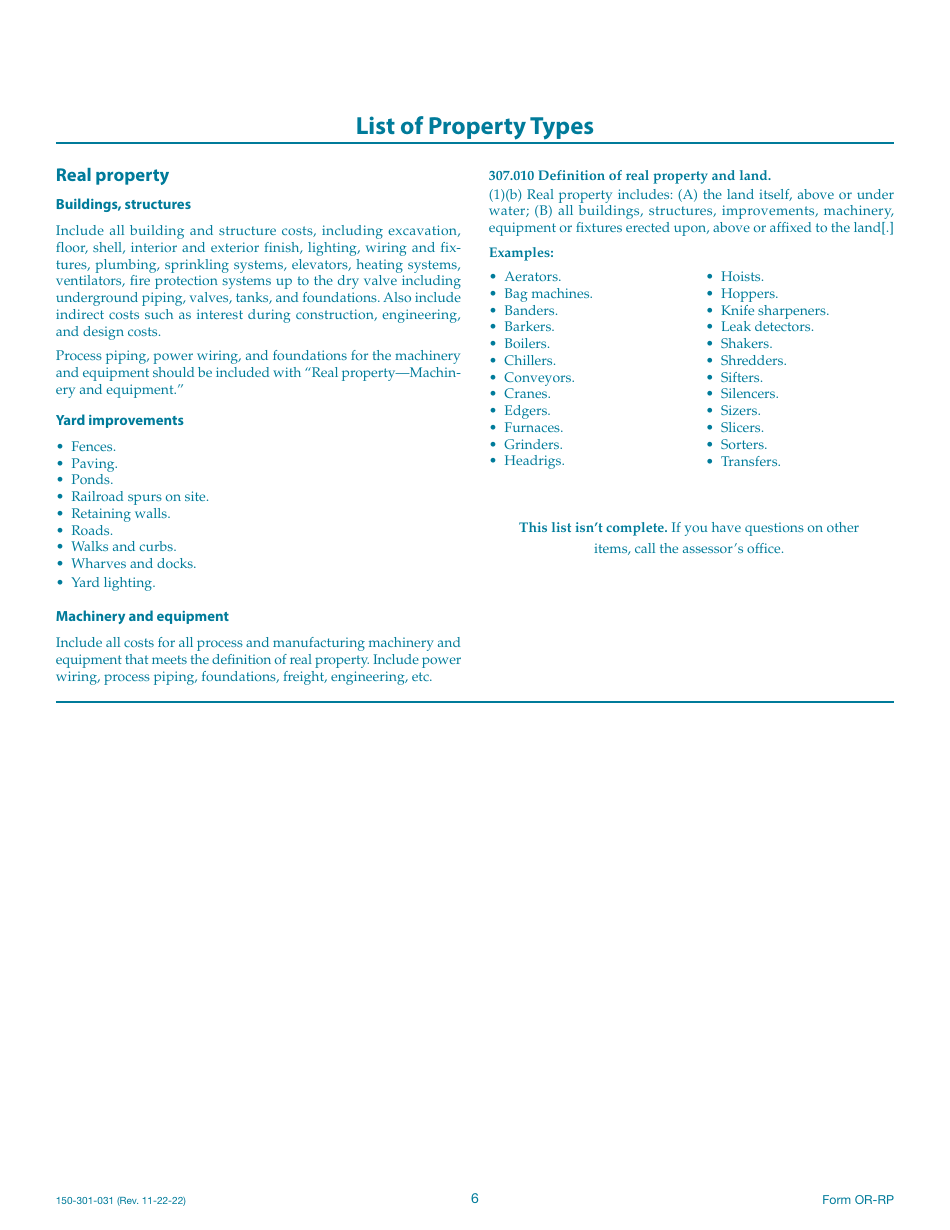

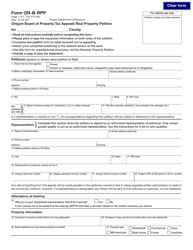

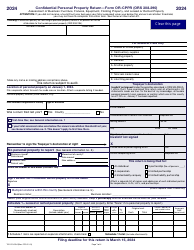

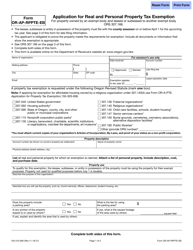

Form OR-RP (150-301-031) Real Property Return - Oregon

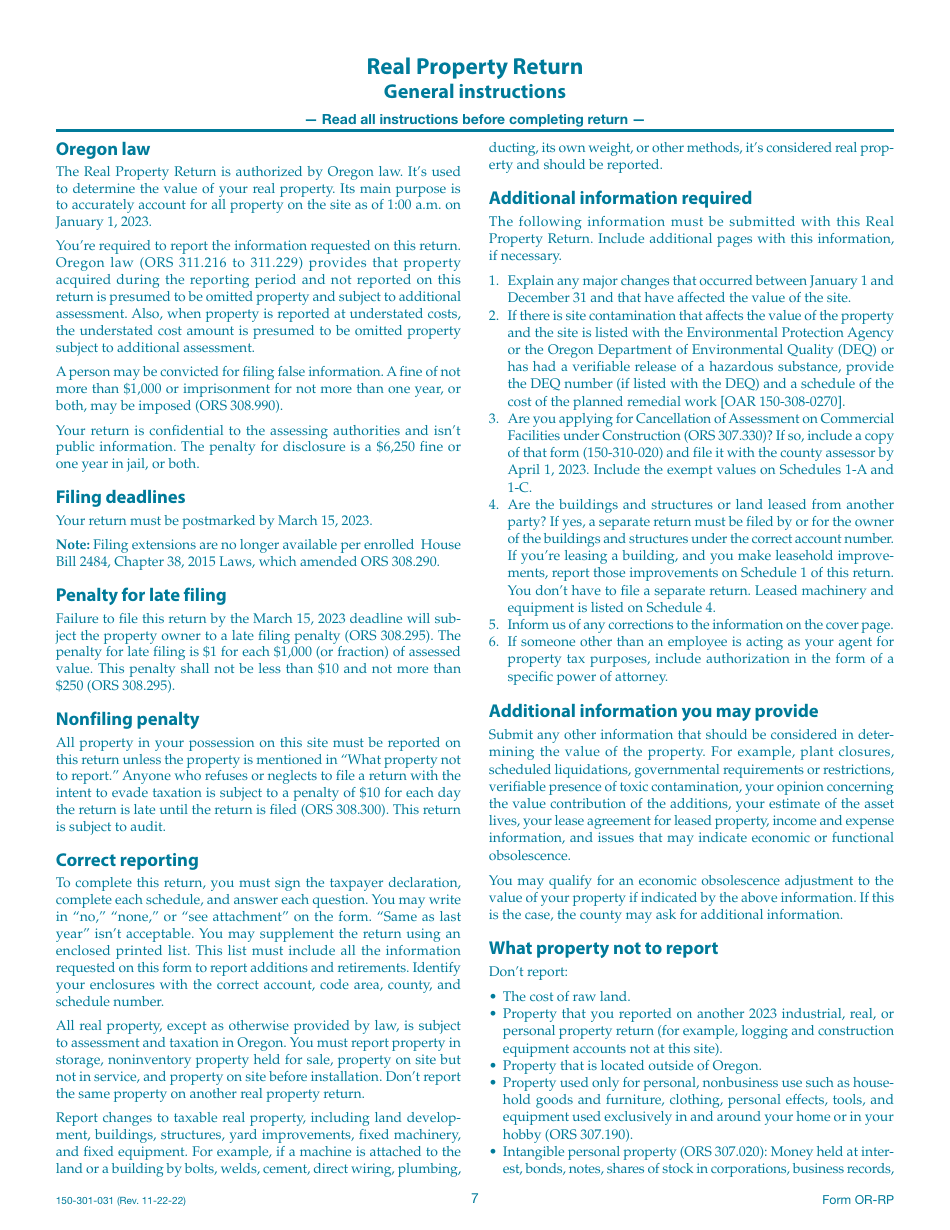

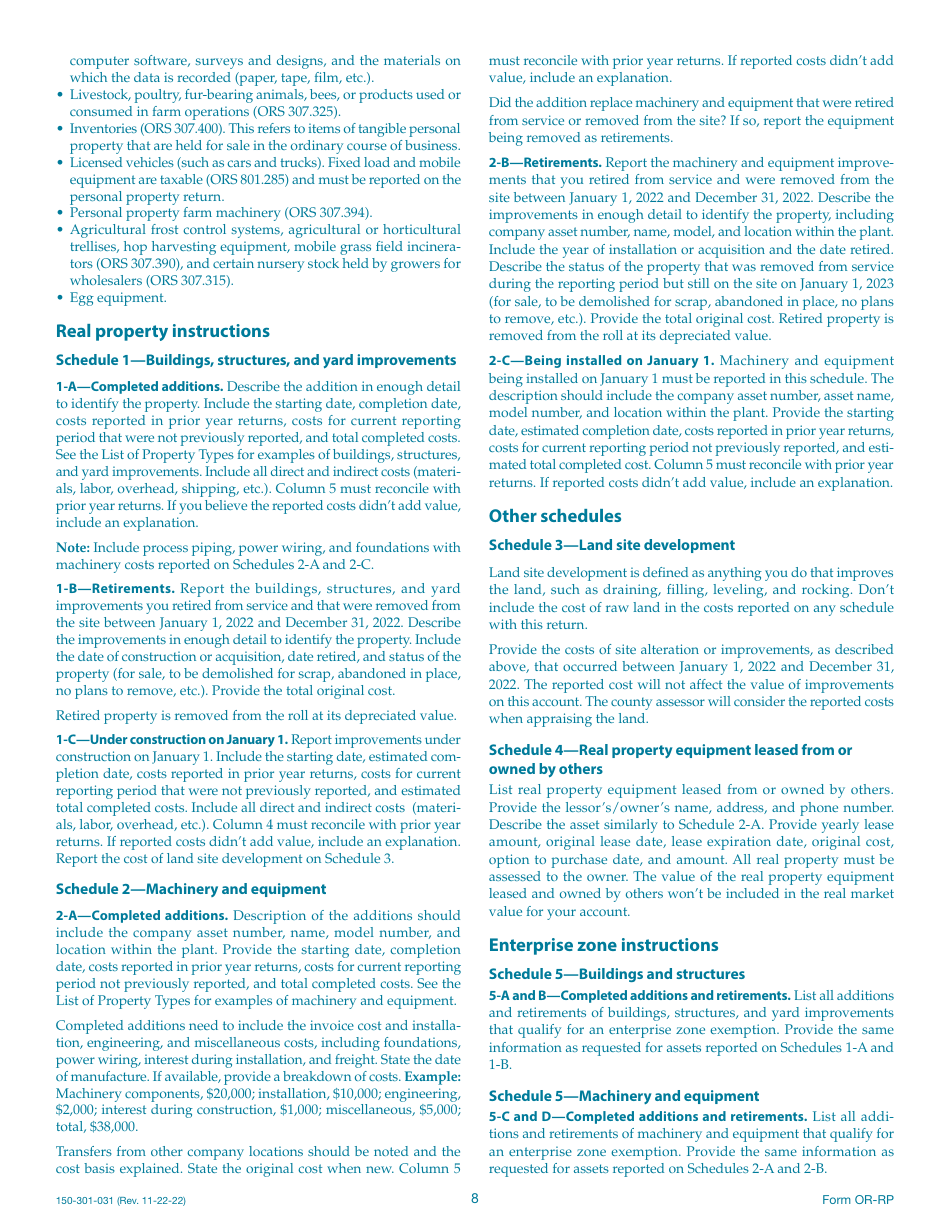

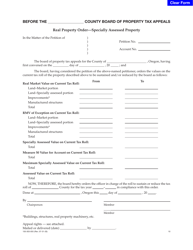

What Is Form OR-RP (150-301-031)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

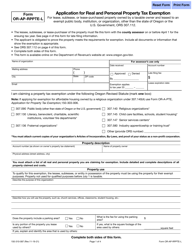

Q: What is Form OR-RP?

A: Form OR-RP is the Real Property Return form in Oregon.

Q: What is the purpose of Form OR-RP?

A: The purpose of Form OR-RP is to report information about real property owned in Oregon.

Q: Who needs to file Form OR-RP?

A: Any person or entity that owns or holds a legal interest in real property in Oregon needs to file Form OR-RP.

Q: When is Form OR-RP due?

A: Form OR-RP is due by March 15th of each year.

Q: What information is required on Form OR-RP?

A: Form OR-RP requires information such as property description, ownership details, and property use.

Q: Are there any penalties for not filing Form OR-RP?

A: Yes, there are penalties for not filing Form OR-RP, including a 5% penalty on the assessed value of the property.

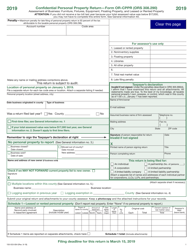

Form Details:

- Released on November 22, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-RP (150-301-031) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.