This version of the form is not currently in use and is provided for reference only. Download this version of

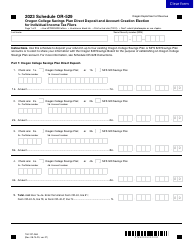

Form 150-101-051 Schedule OR-SCH-P

for the current year.

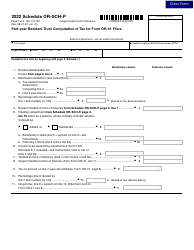

Form 150-101-051 Schedule OR-SCH-P Part-Year Resident Trust Computation of Tax for Form or-41 Filers - Oregon

What Is Form 150-101-051 Schedule OR-SCH-P?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-051?

A: Form 150-101-051 is a schedule used for the computation of tax for Oregon Form OR-41 filers who are part-year resident trusts.

Q: What is OR-SCH-P?

A: OR-SCH-P refers to Schedule OR-SCH-P, which is the specific schedule used for the computation of tax for Form OR-41 filers.

Q: Who should use this schedule?

A: This schedule should be used by part-year resident trusts that are filing Oregon Form OR-41.

Q: What is the purpose of this schedule?

A: The purpose of this schedule is to calculate the tax owed by part-year resident trusts in Oregon.

Q: What does this schedule involve?

A: This schedule involves the computation of tax for part-year resident trusts based on their income and deductions in Oregon.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-051 Schedule OR-SCH-P by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.