This version of the form is not currently in use and is provided for reference only. Download this version of

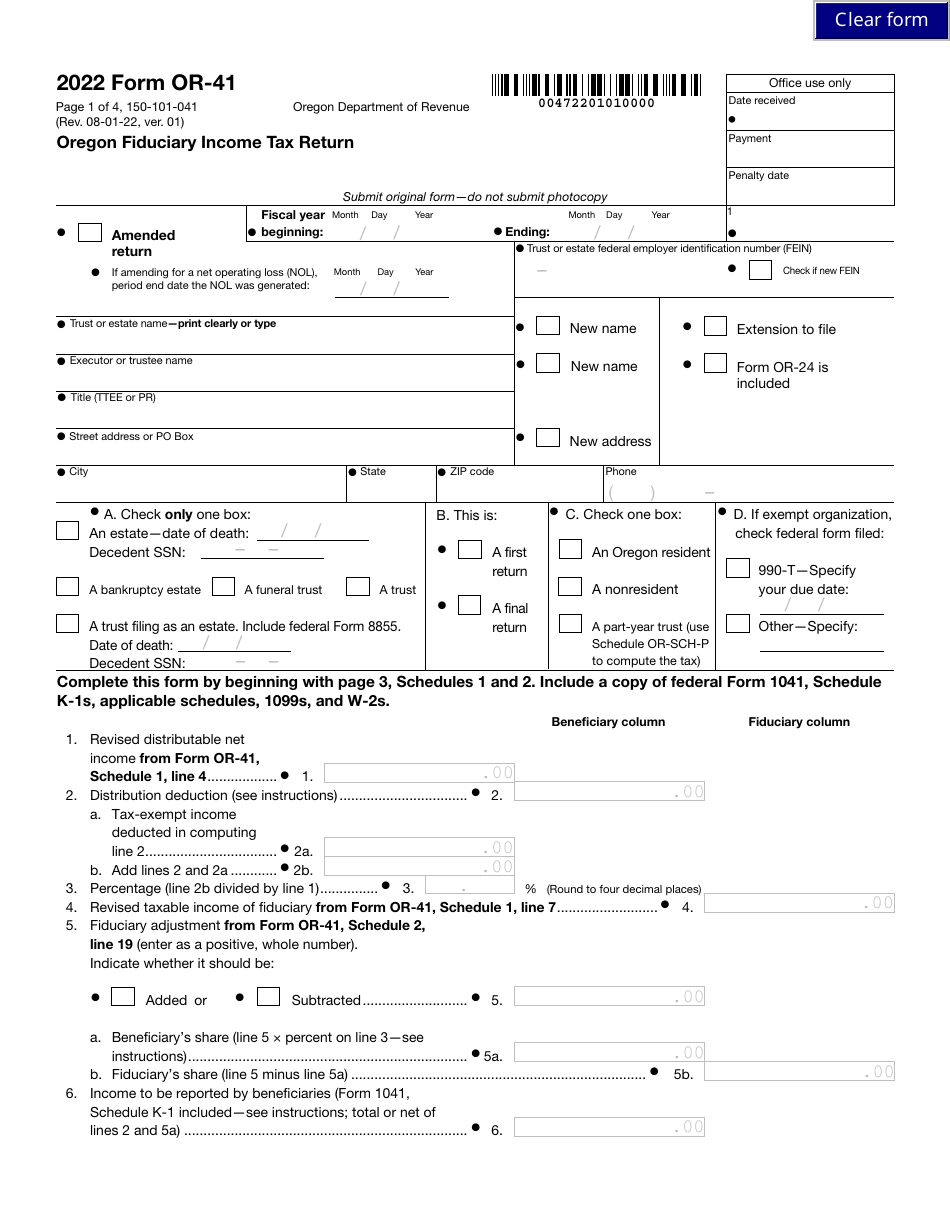

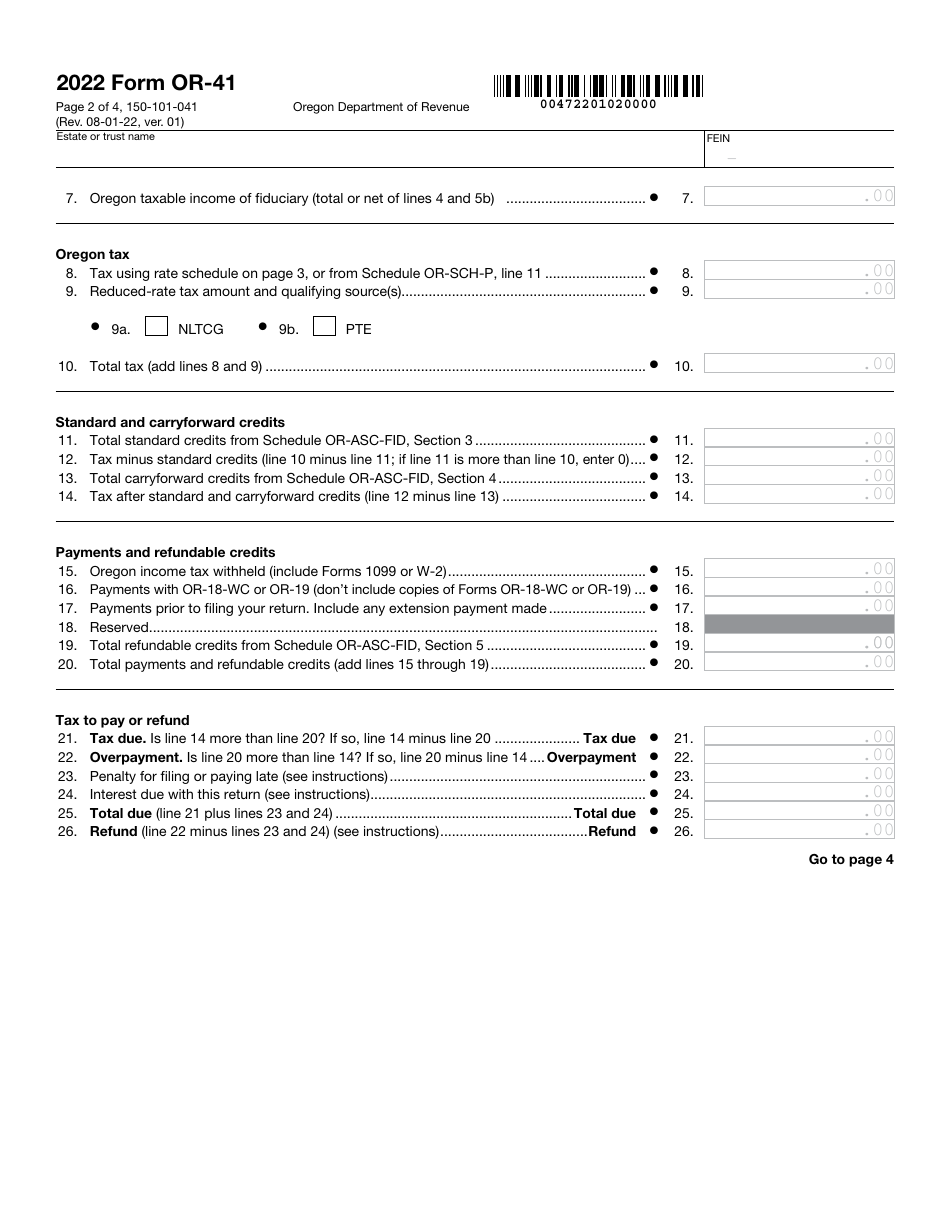

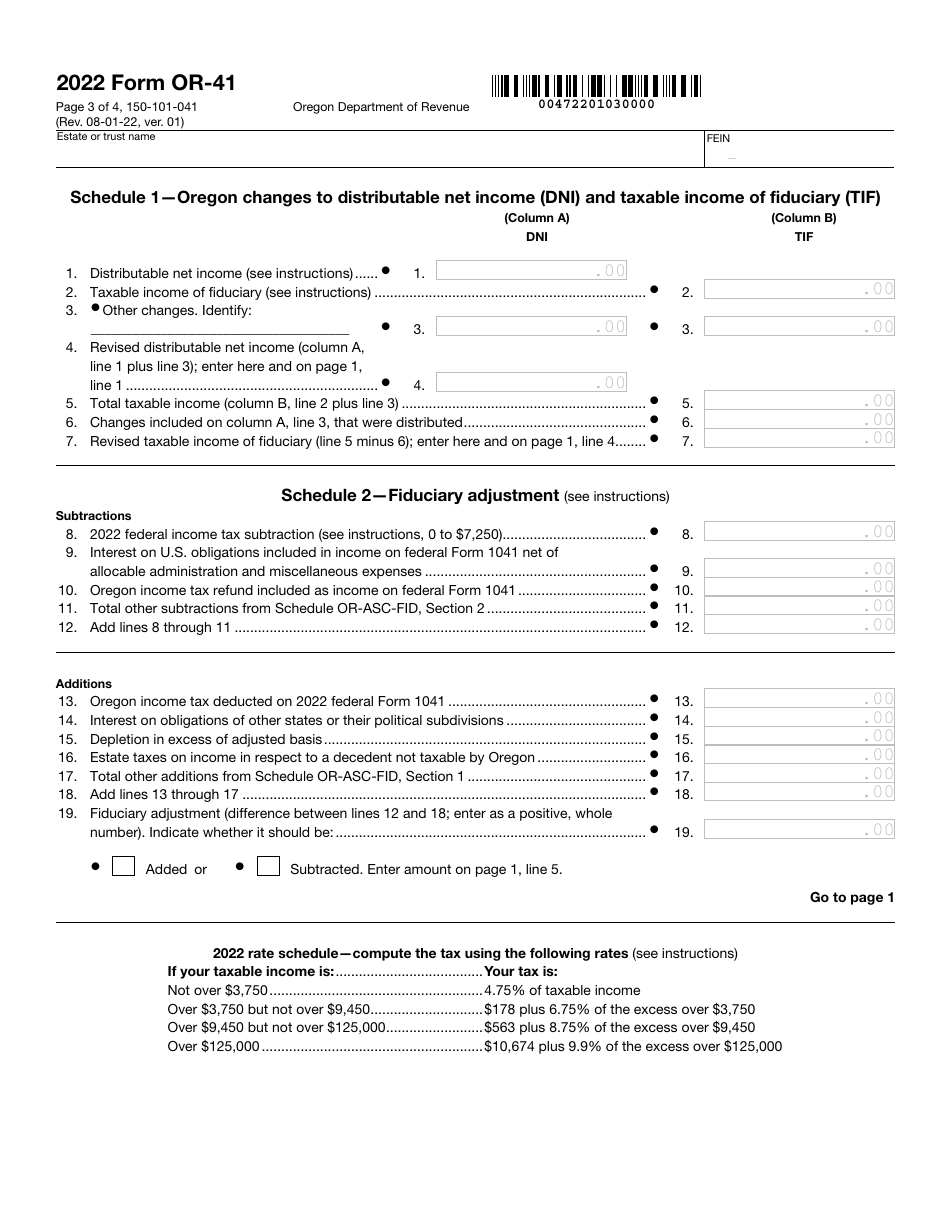

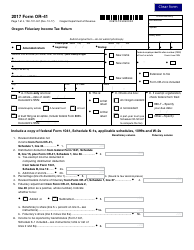

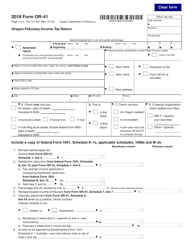

Form OR-41 (150-101-041)

for the current year.

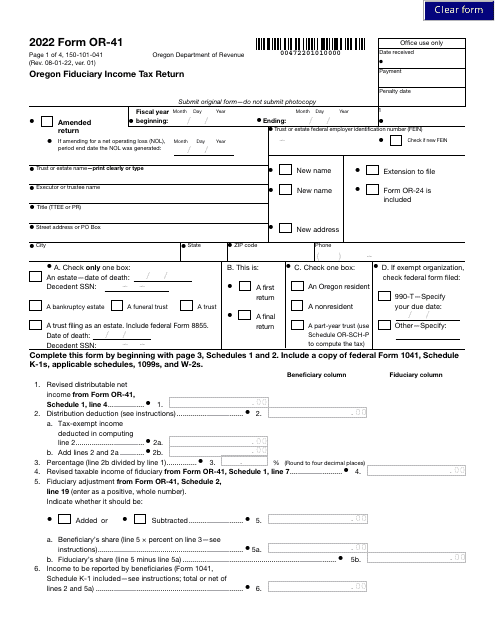

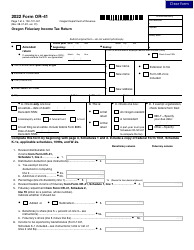

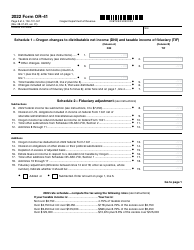

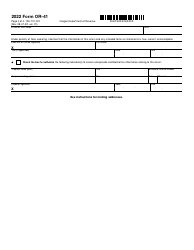

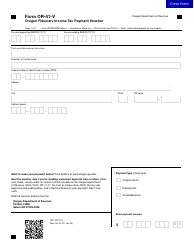

Form OR-41 (150-101-041) Oregon Fiduciary Income Tax Return - Oregon

What Is Form OR-41 (150-101-041)?

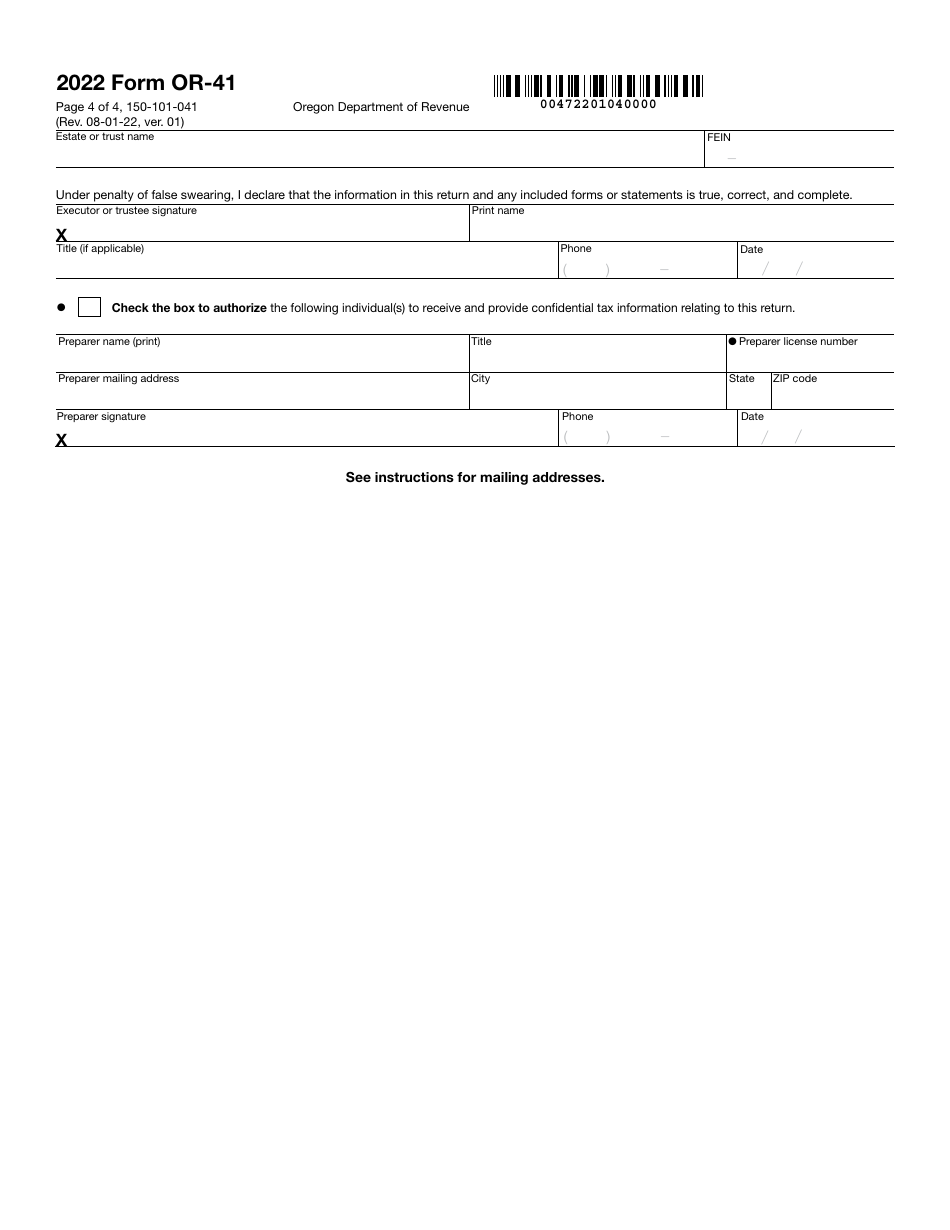

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-41?

A: Form OR-41 is the Oregon Fiduciary Income Tax Return.

Q: Who needs to file Form OR-41?

A: Any fiduciary, such as an executor or administrator of an estate, trustee of a trust, or receiver, who has income from sources in Oregon needs to file Form OR-41.

Q: What is the purpose of Form OR-41?

A: The purpose of Form OR-41 is to report and pay Oregon income tax for fiduciaries.

Q: What information do I need to complete Form OR-41?

A: To complete Form OR-41, you will need information about the income, deductions, and credits related to the fiduciary's activities in Oregon.

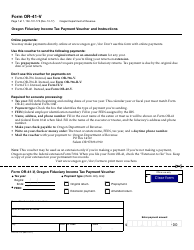

Q: When is the deadline to file Form OR-41?

A: The deadline to file Form OR-41 is the same as the federal income tax deadline, which is usually April 15th.

Q: Are there any extensions available for filing Form OR-41?

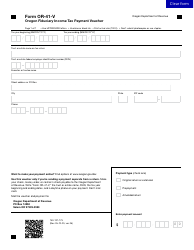

A: Yes, you can request an extension to file Form OR-41 by filing Form OR-40-V.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-41 (150-101-041) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.