This version of the form is not currently in use and is provided for reference only. Download this version of

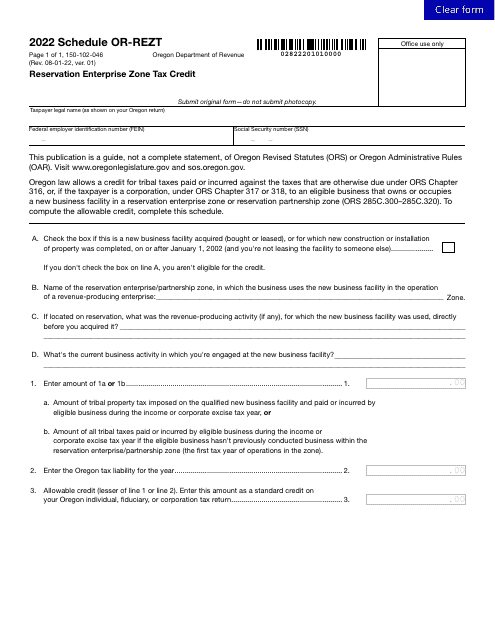

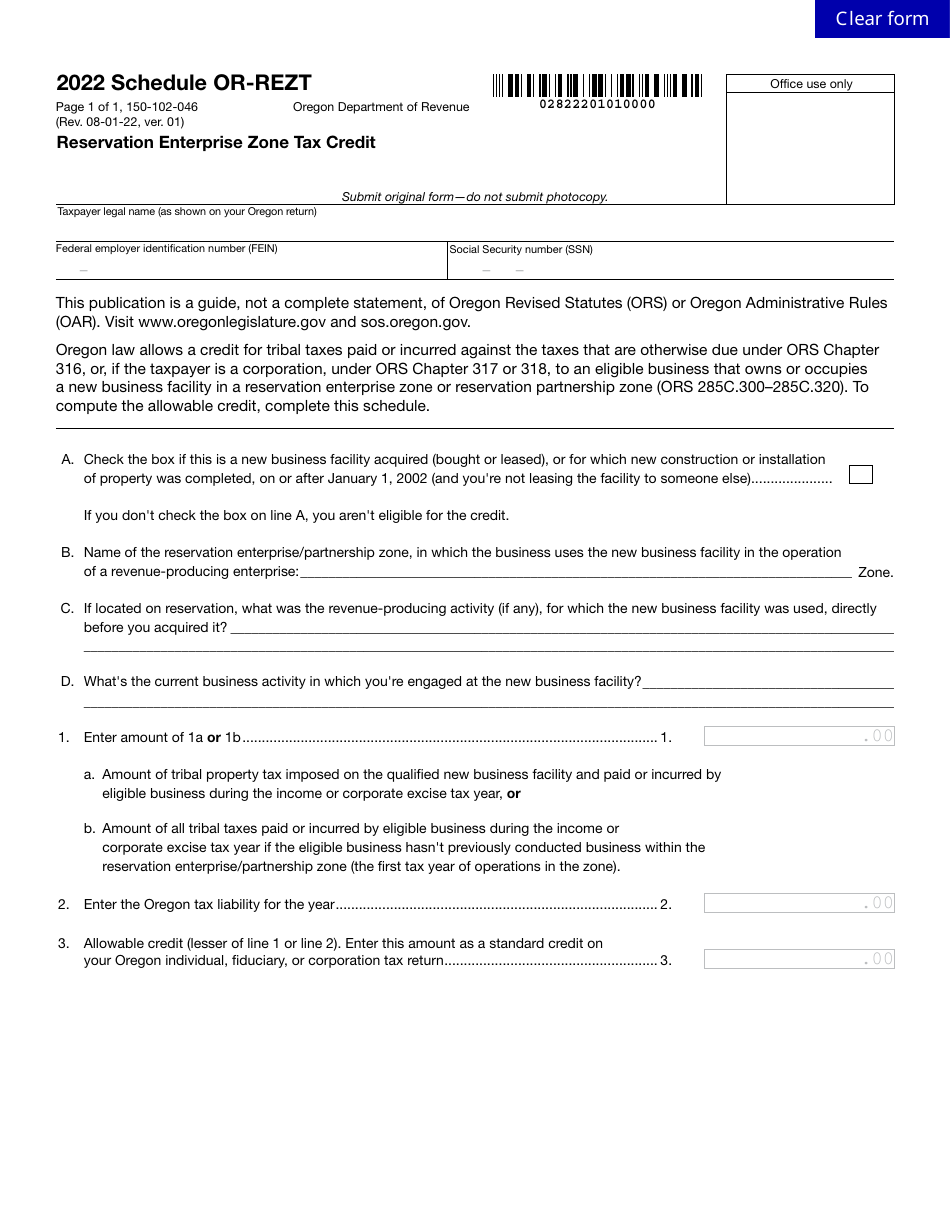

Form 150-102-046 Schedule OR-REZT

for the current year.

Form 150-102-046 Schedule OR-REZT Reservation Enterprise Zone Tax Credit - Oregon

What Is Form 150-102-046 Schedule OR-REZT?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-102-046?

A: Form 150-102-046 is a tax form in Oregon.

Q: What is Schedule OR-REZT?

A: Schedule OR-REZT is a part of Form 150-102-046.

Q: What is the Reservation Enterprise Zone Tax Credit?

A: The Reservation Enterprise Zone Tax Credit is a tax credit available in Oregon.

Q: Who can claim the Reservation Enterprise Zone Tax Credit?

A: Businesses operating within a designated reservation enterprise zone in Oregon can claim this tax credit.

Q: What is the purpose of Schedule OR-REZT?

A: Schedule OR-REZT is used to calculate and claim the Reservation Enterprise Zone Tax Credit.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-046 Schedule OR-REZT by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.