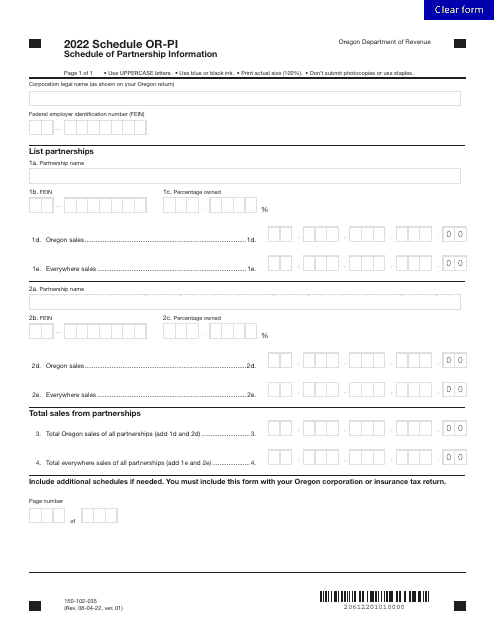

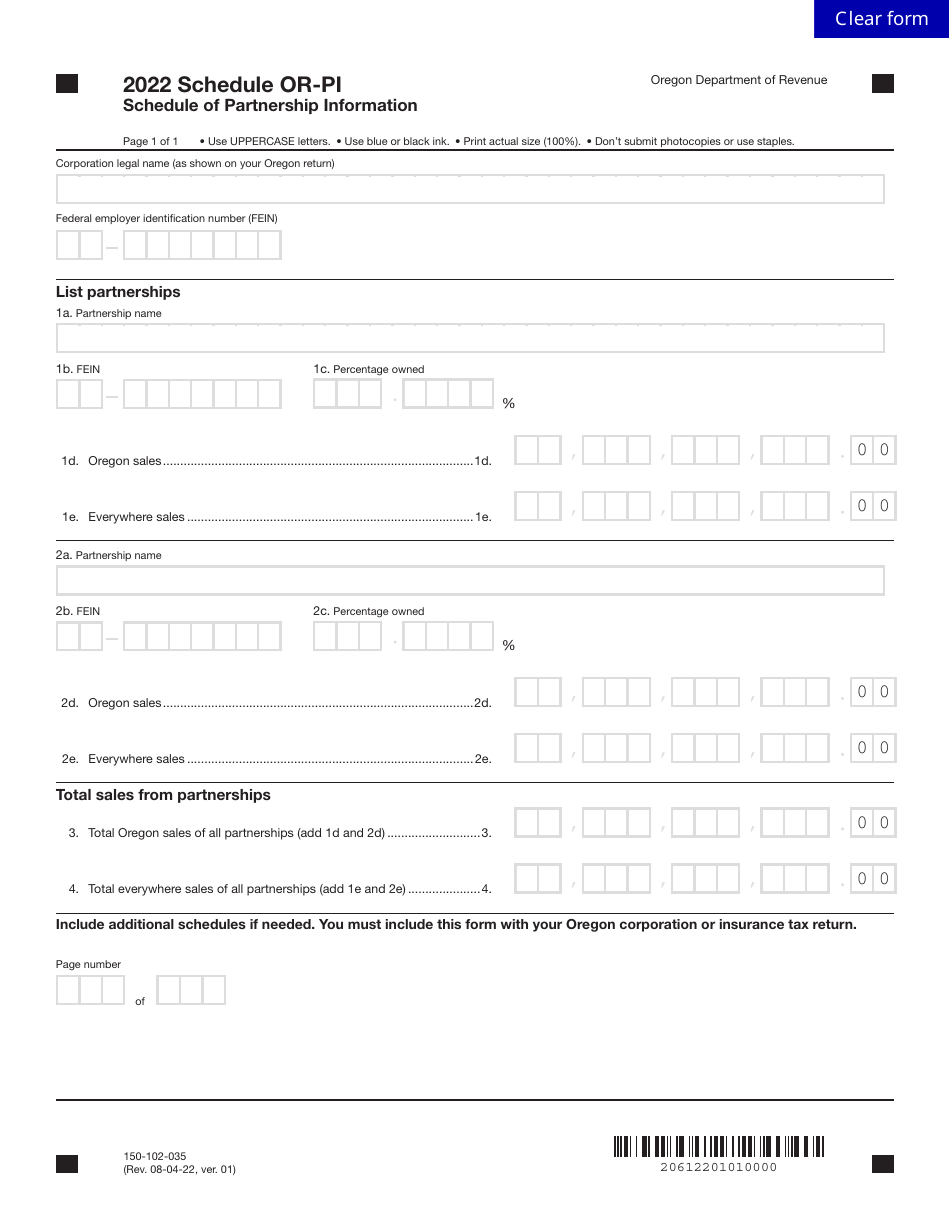

This version of the form is not currently in use and is provided for reference only. Download this version of

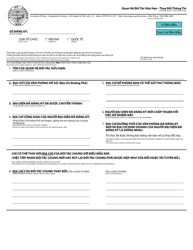

Form 150-102-035 Schedule OR-PI

for the current year.

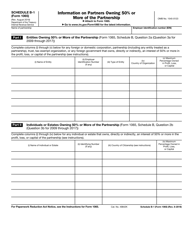

Form 150-102-035 Schedule OR-PI Schedule of Partnership Information - Oregon

What Is Form 150-102-035 Schedule OR-PI?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-102-035?

A: Form 150-102-035 is the Schedule OR-PI, which is the Schedule of Partnership Information for the state of Oregon.

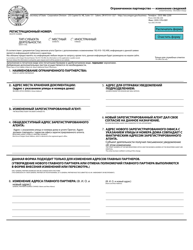

Q: What is the purpose of Schedule OR-PI?

A: The purpose of Schedule OR-PI is to provide information about partnerships for tax purposes in Oregon.

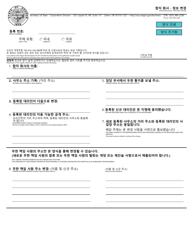

Q: Who needs to file Schedule OR-PI?

A: Partnerships that operate in Oregon need to file Schedule OR-PI.

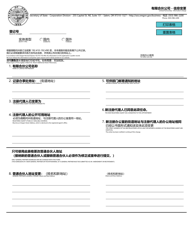

Q: What information is required on Schedule OR-PI?

A: Schedule OR-PI requires information about the partnership, its partners, and the income and deductions allocated to each partner.

Q: When is the deadline to file Schedule OR-PI?

A: The deadline to file Schedule OR-PI is generally the same as the deadline to file the partnership's tax return in Oregon, which is typically April 15th.

Q: Are there any penalties for not filing Schedule OR-PI?

A: Yes, there can be penalties for failing to file Schedule OR-PI or for filing it late. It is important to comply with the filing requirements to avoid penalties.

Form Details:

- Released on August 4, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-035 Schedule OR-PI by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.