This version of the form is not currently in use and is provided for reference only. Download this version of

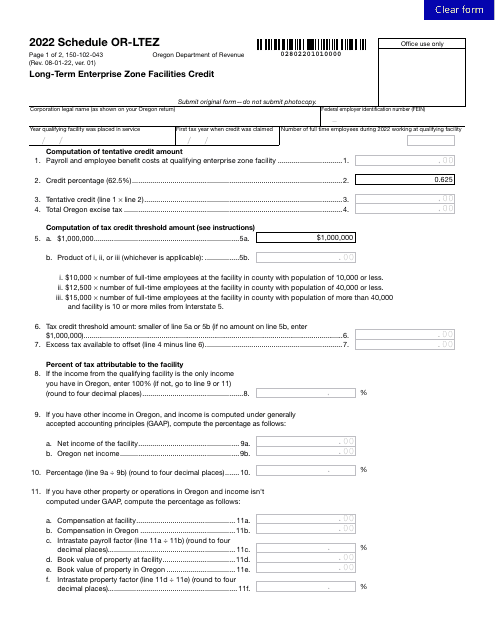

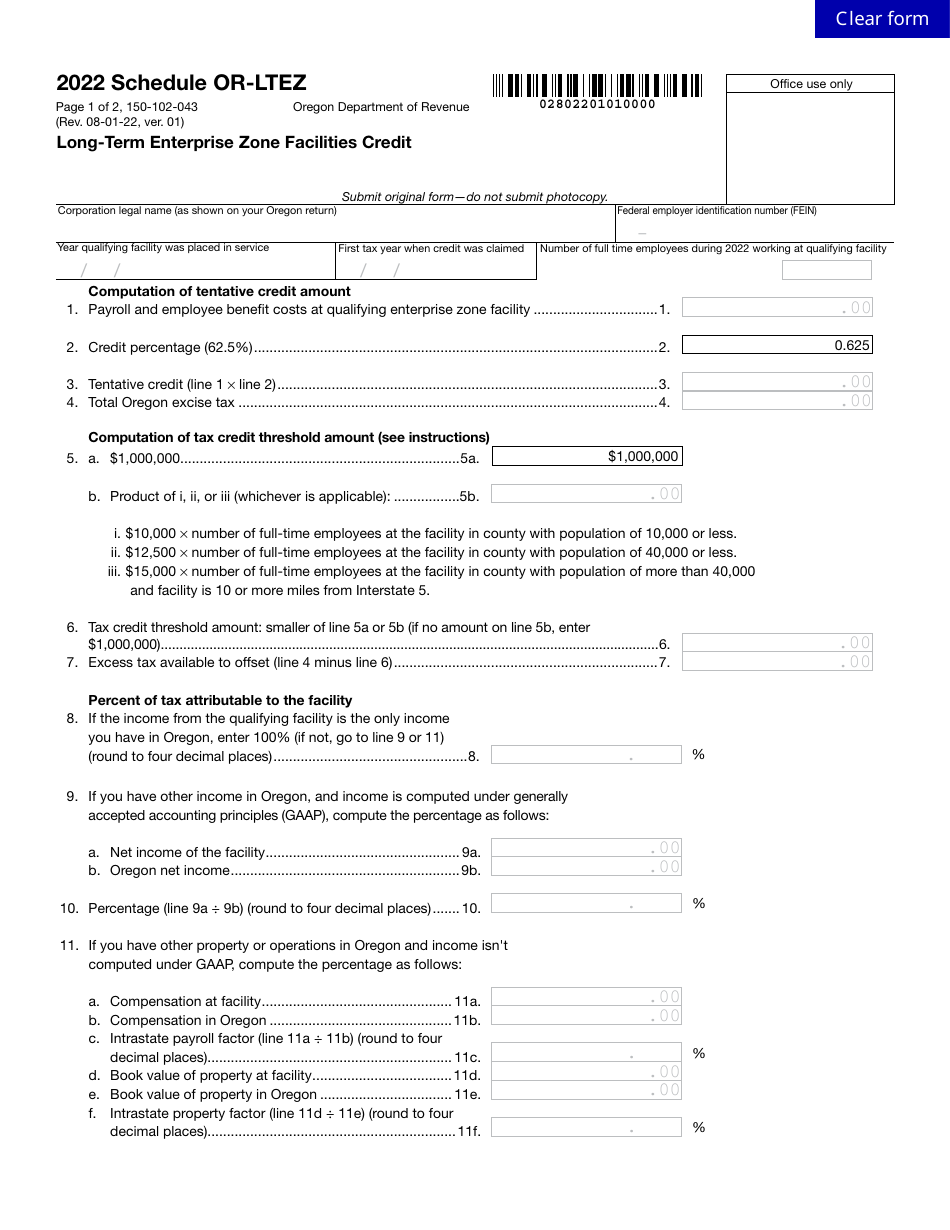

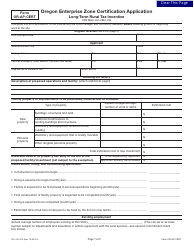

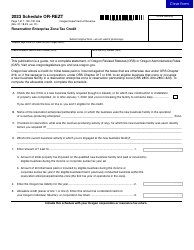

Form 150-102-043 Schedule OR-LTEZ

for the current year.

Form 150-102-043 Schedule OR-LTEZ Long-Term Enterprise Zone Facilities Credit - Oregon

What Is Form 150-102-043 Schedule OR-LTEZ?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-102-043?

A: Form 150-102-043 is the schedule for claiming the Long-Term Enterprise Zone Facilities Credit in Oregon.

Q: What is the Long-Term Enterprise Zone Facilities Credit?

A: The Long-Term Enterprise Zone Facilities Credit is a tax credit in Oregon for qualifying businesses that invest in eligible long-term enterprise zones.

Q: Who can claim the Long-Term Enterprise Zone Facilities Credit?

A: Qualifying businesses that have made eligible investments in long-term enterprise zones in Oregon can claim the credit.

Q: What is the purpose of the Long-Term Enterprise Zone Facilities Credit?

A: The purpose of the credit is to encourage businesses to invest in long-term enterprise zones, thereby promoting economic development and job creation.

Q: Are there any deadlines for filing Form 150-102-043?

A: Yes, the form must be filed by the due date of the tax return for the tax year in which the investments were made.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-043 Schedule OR-LTEZ by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.