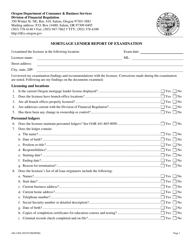

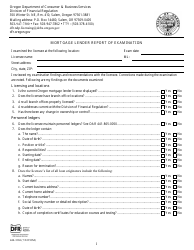

This version of the form is not currently in use and is provided for reference only. Download this version of

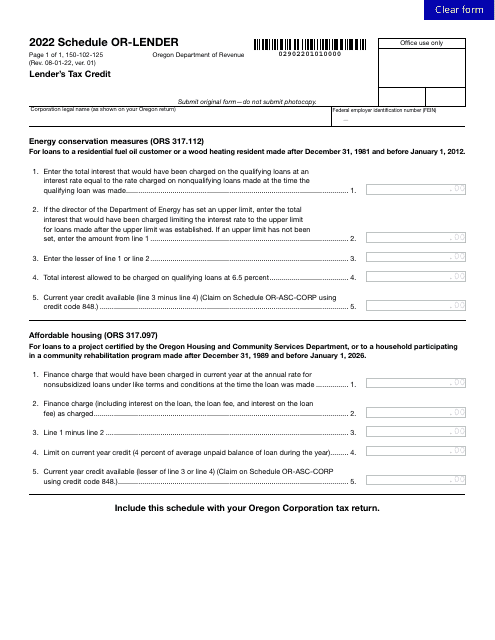

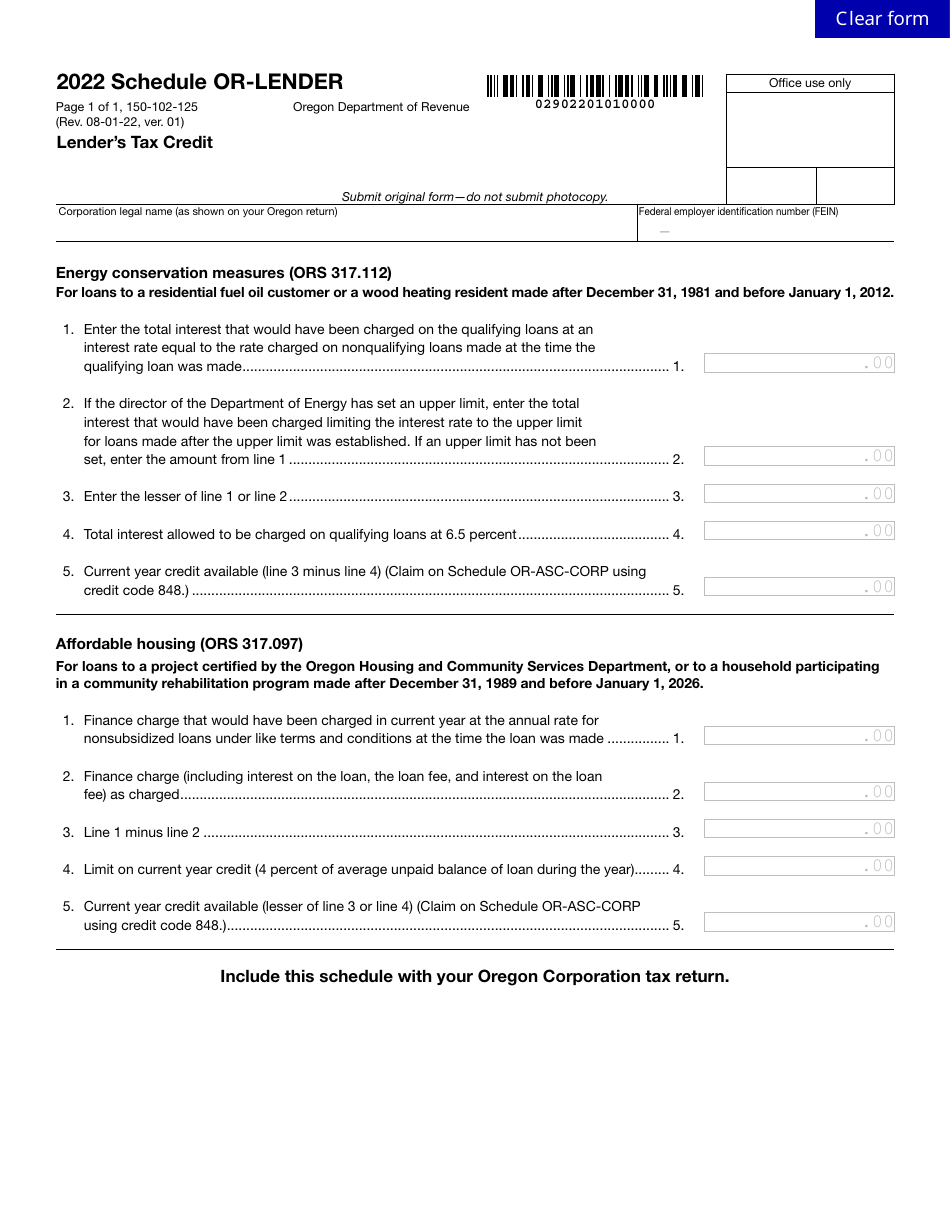

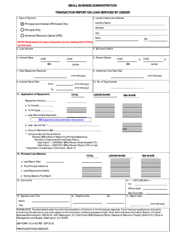

Form 150-102-125 Schedule OR-LENDER

for the current year.

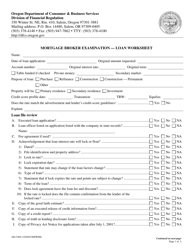

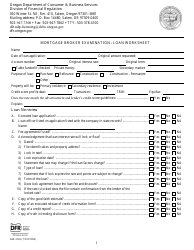

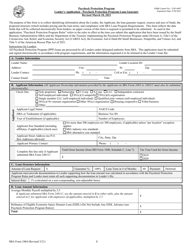

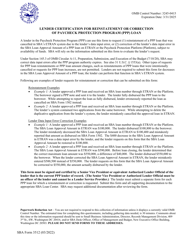

Form 150-102-125 Schedule OR-LENDER Lender's Tax Credit - Oregon

What Is Form 150-102-125 Schedule OR-LENDER?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

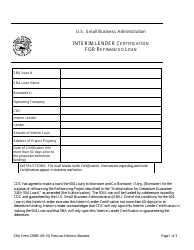

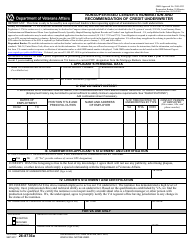

Q: What is Form 150-102-125?

A: Form 150-102-125 is a schedule used for claiming the Lender's Tax Credit in Oregon.

Q: What is the Lender's Tax Credit in Oregon?

A: The Lender's Tax Credit is a tax credit available in Oregon for lenders who provide loans for certain affordable housing projects.

Q: Who is eligible to claim the Lender's Tax Credit in Oregon?

A: Lenders who provide loans for certain affordable housing projects in Oregon are eligible to claim the Lender's Tax Credit.

Q: What is the purpose of Form 150-102-125?

A: The purpose of Form 150-102-125 is to calculate and claim the Lender's Tax Credit in Oregon.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-125 Schedule OR-LENDER by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.