This version of the form is not currently in use and is provided for reference only. Download this version of

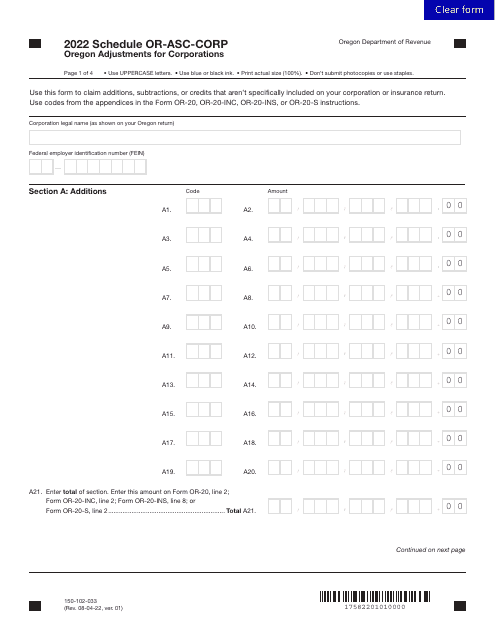

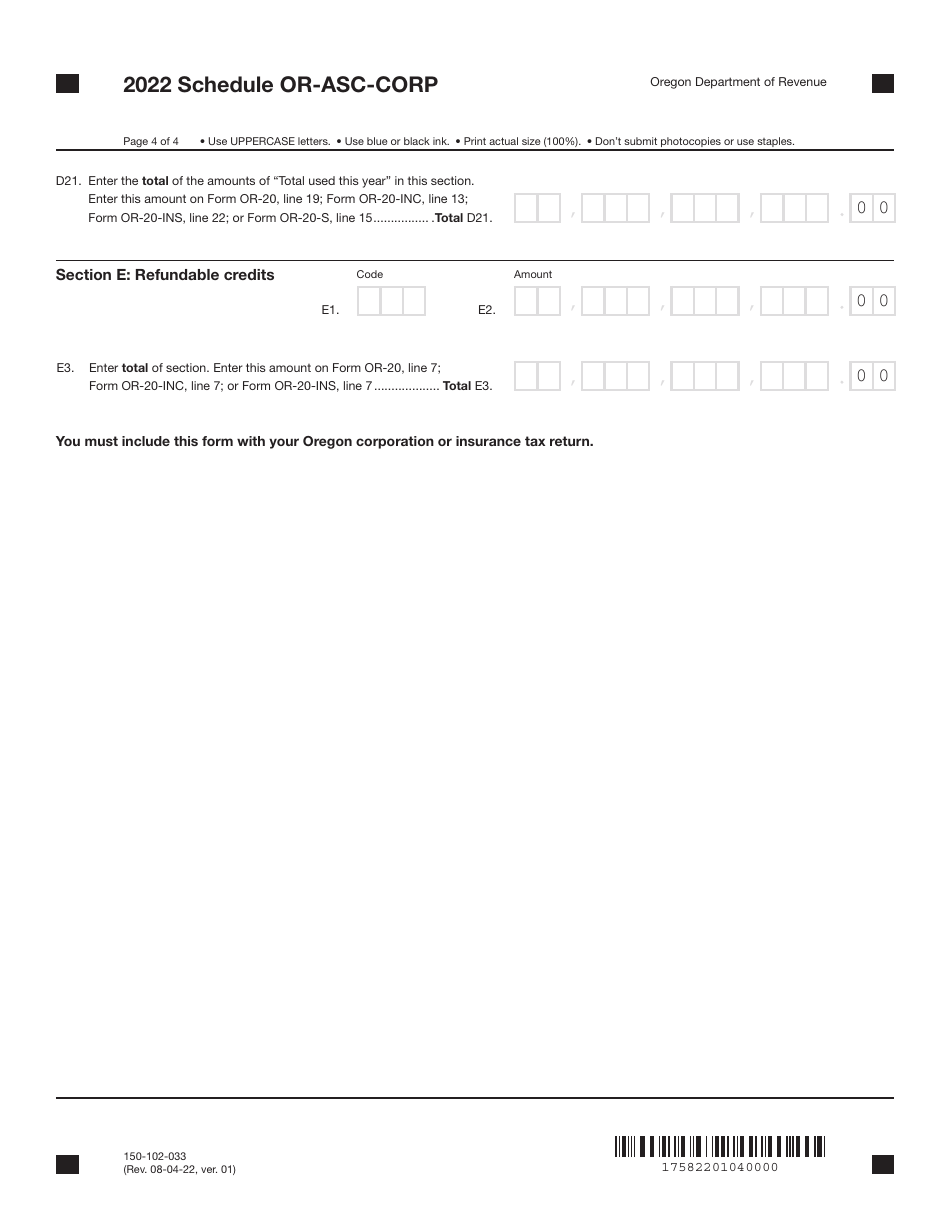

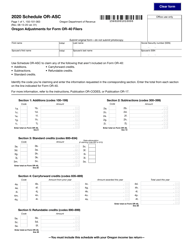

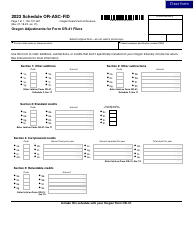

Form 150-102-033 Schedule OR-ASC-CORP

for the current year.

Form 150-102-033 Schedule OR-ASC-CORP Oregon Adjustments for Corporations - Oregon

What Is Form 150-102-033 Schedule OR-ASC-CORP?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-102-033?

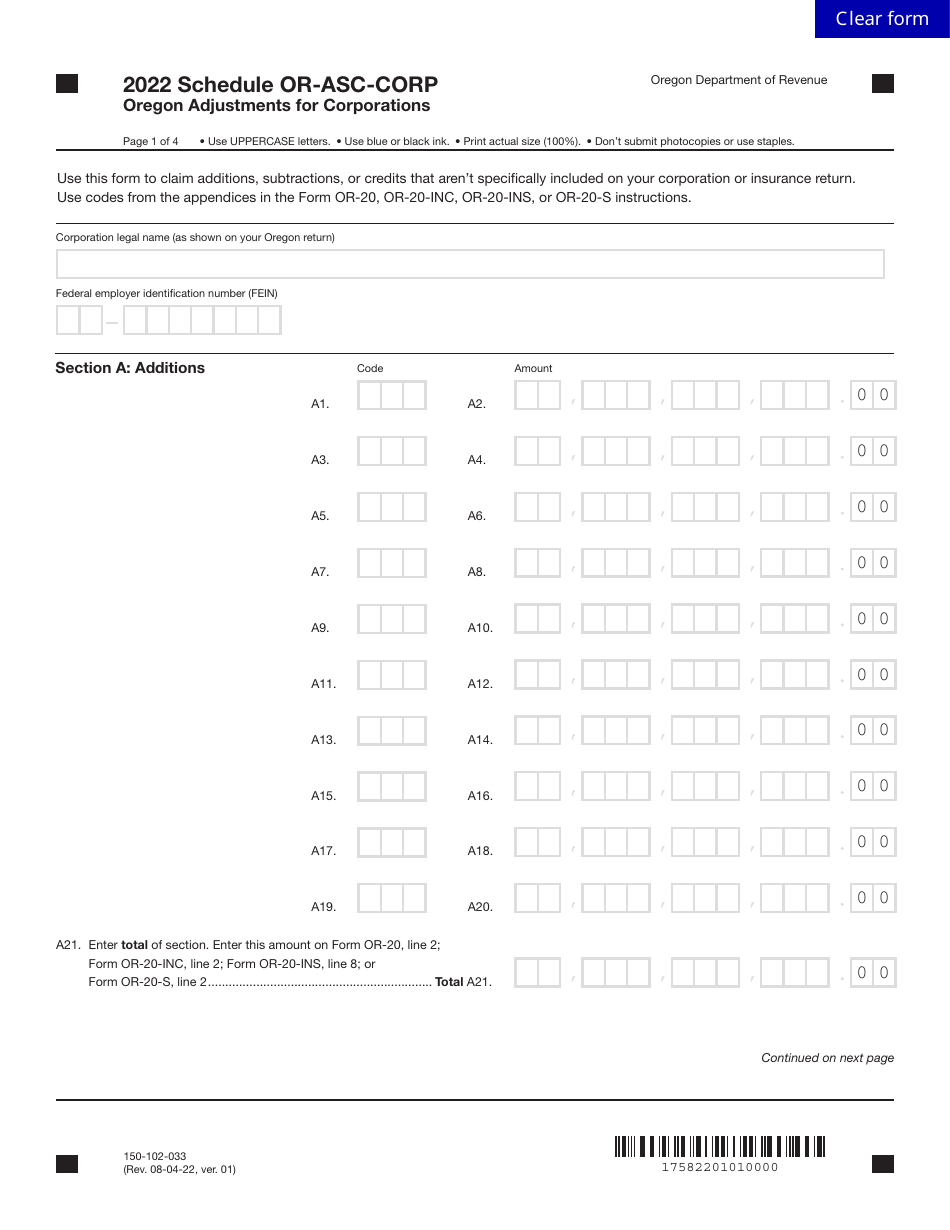

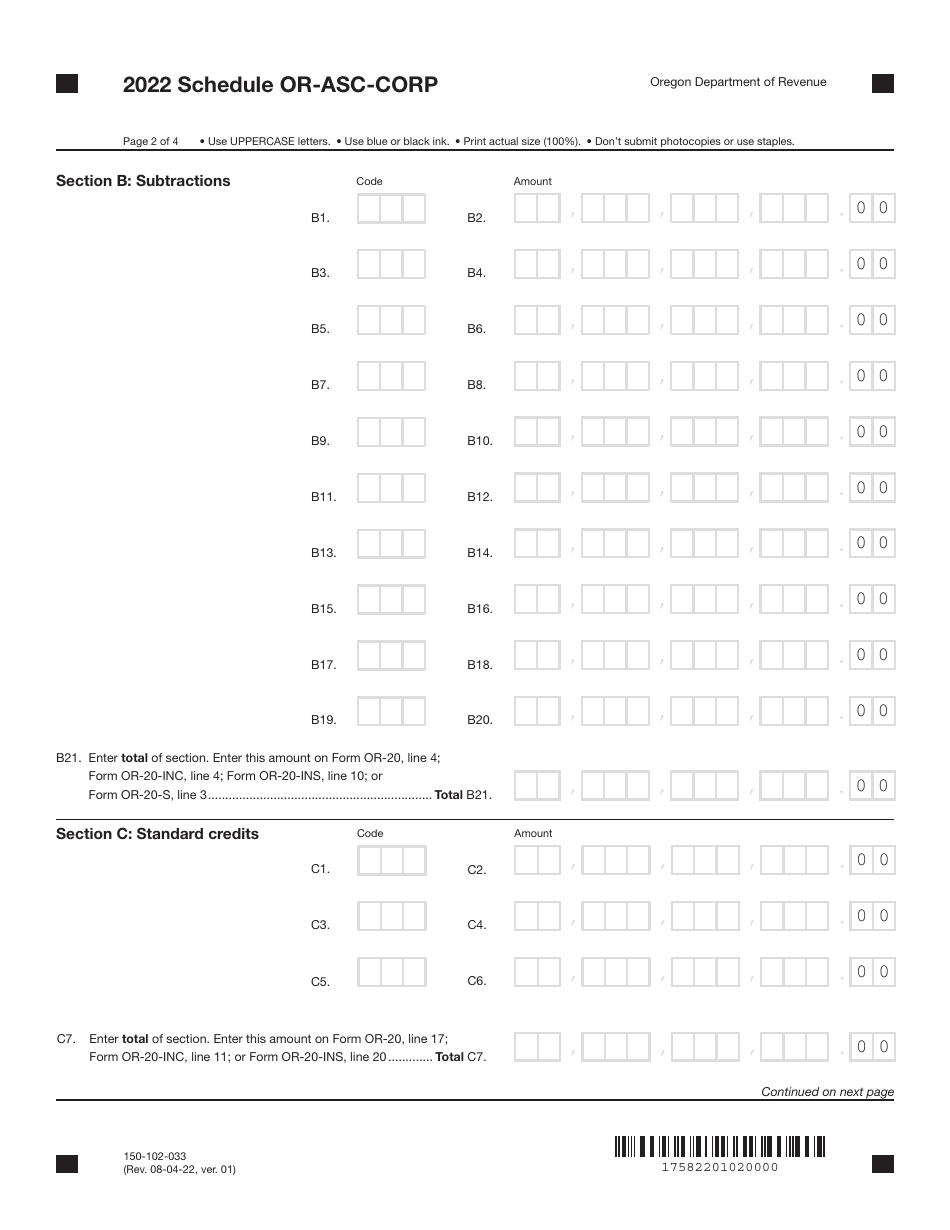

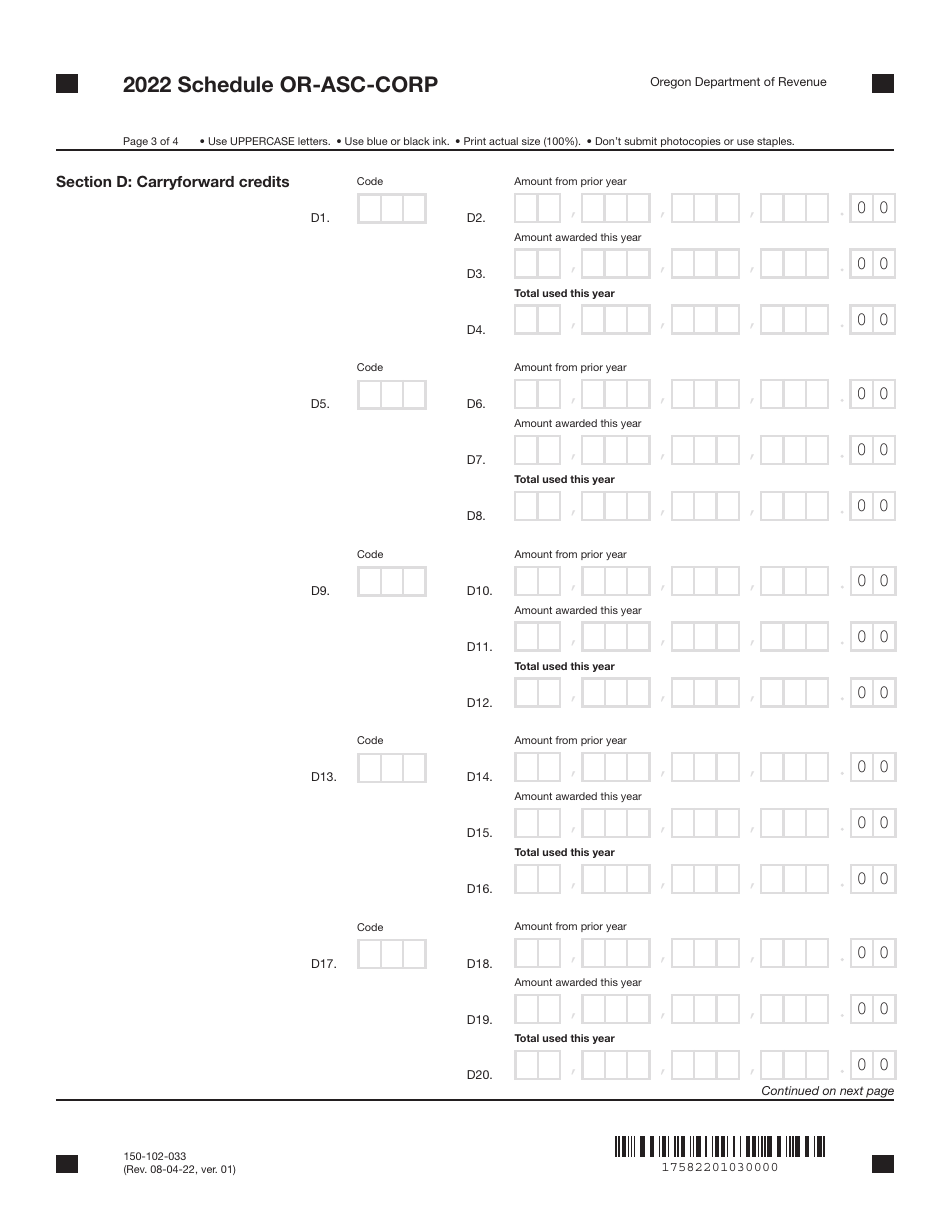

A: Form 150-102-033 is the Schedule OR-ASC-CORP, which is used by corporations in Oregon to report specific adjustments to their federal taxable income.

Q: Who is required to file Form 150-102-033?

A: Corporations in Oregon that have specific adjustments to their federal taxable income are required to file Form 150-102-033.

Q: What is the purpose of Form 150-102-033?

A: The purpose of Form 150-102-033 is to report the specific adjustments made to a corporation's federal taxable income for Oregon tax purposes.

Q: When is Form 150-102-033 due?

A: Form 150-102-033 is due on the same date as the corporation's Oregon Form OR-20 or OR-65.

Q: Are there any penalties for not filing Form 150-102-033?

A: Yes, there may be penalties for not filing Form 150-102-033 or for filing it late. It is important to file the form by the due date to avoid any penalties.

Form Details:

- Released on August 4, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-033 Schedule OR-ASC-CORP by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.