This version of the form is not currently in use and is provided for reference only. Download this version of

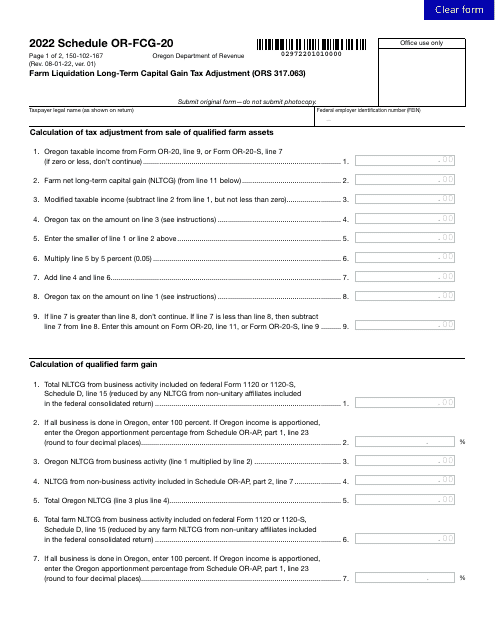

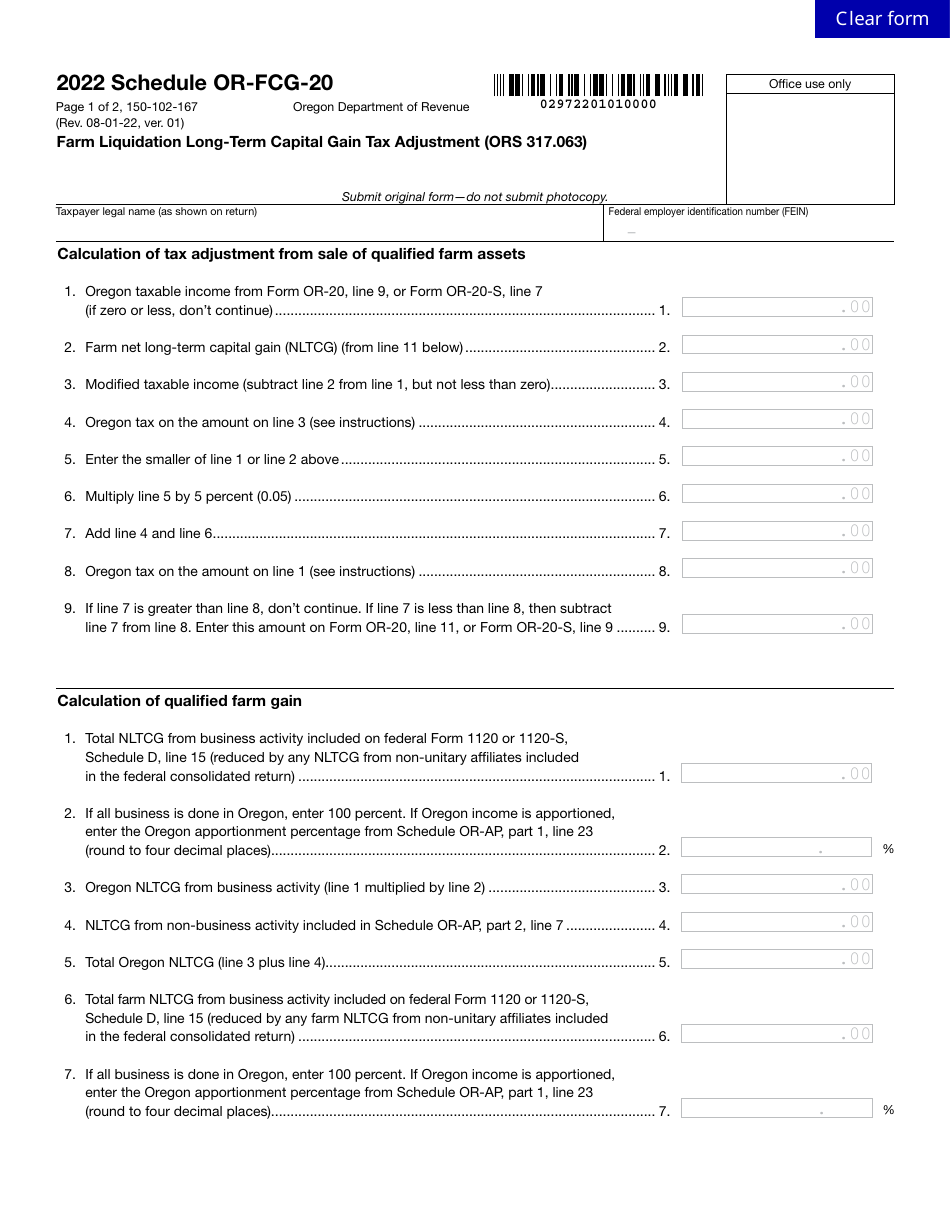

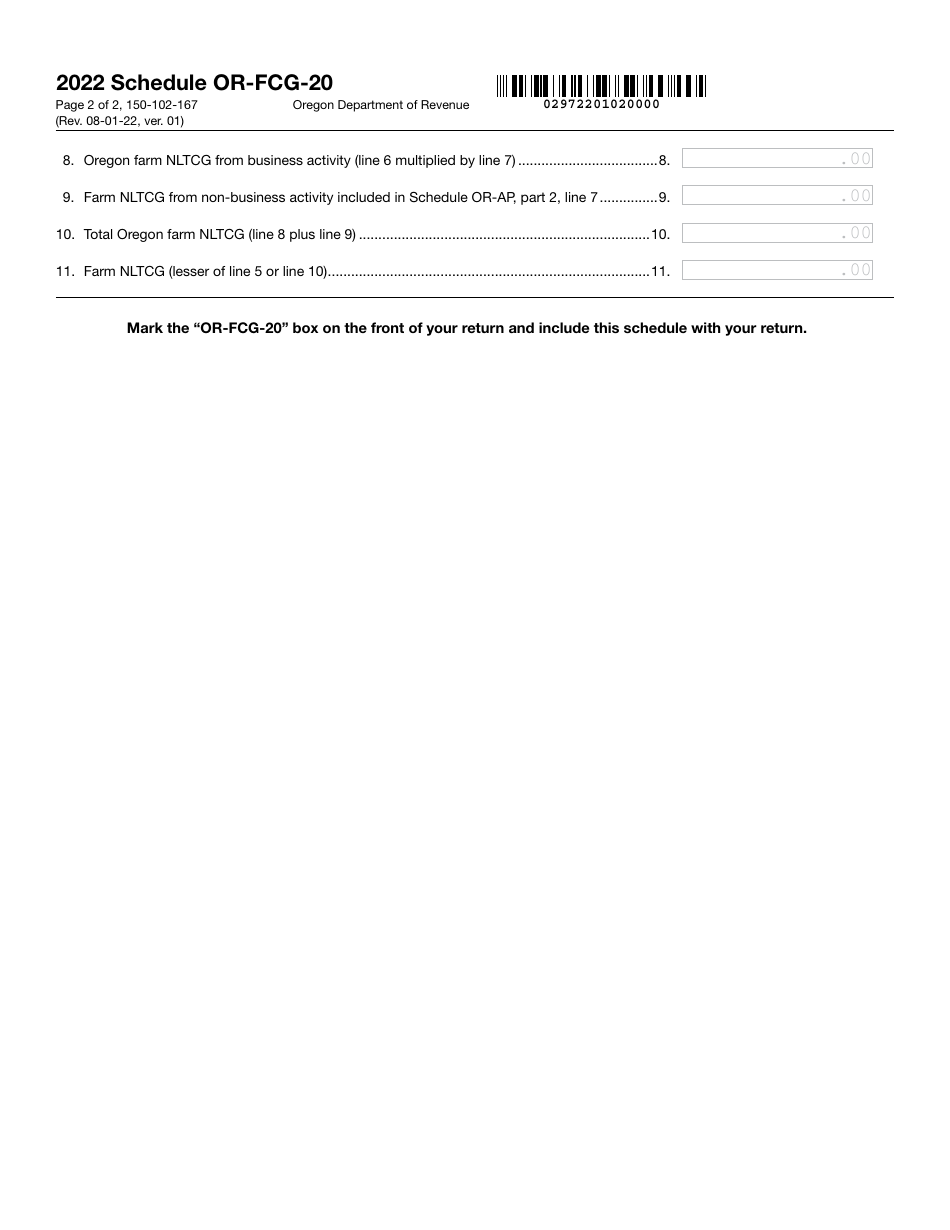

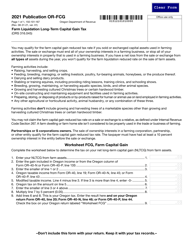

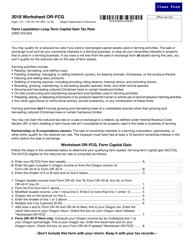

Form 150-102-167 Schedule OR-FCG-20

for the current year.

Form 150-102-167 Schedule OR-FCG-20 Farm Liquidation Long-Term Capital Gain Tax Adjustment (Ors 317.063) - Oregon

What Is Form 150-102-167 Schedule OR-FCG-20?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-102-167?

A: Form 150-102-167 is a tax form used in Oregon for reporting long-term capital gain tax adjustments related to farm liquidations.

Q: What is Schedule OR-FCG-20?

A: Schedule OR-FCG-20 is a specific schedule within Form 150-102-167 used for reporting farm liquidation long-term capital gain tax adjustments.

Q: What is a farm liquidation?

A: A farm liquidation refers to the process of selling or disposing of the assets and operations of a farm.

Q: What is a long-term capital gain tax adjustment?

A: A long-term capital gain tax adjustment refers to changes made to the calculation of long-term capital gains for tax purposes.

Q: Who needs to file Form 150-102-167?

A: Farmers in Oregon who are liquidating their farm assets and have long-term capital gains may need to file Form 150-102-167.

Q: What is the purpose of Form 150-102-167?

A: The purpose of Form 150-102-167 is to report and calculate the long-term capital gain tax adjustments related to farm liquidations in Oregon.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-167 Schedule OR-FCG-20 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.