This version of the form is not currently in use and is provided for reference only. Download this version of

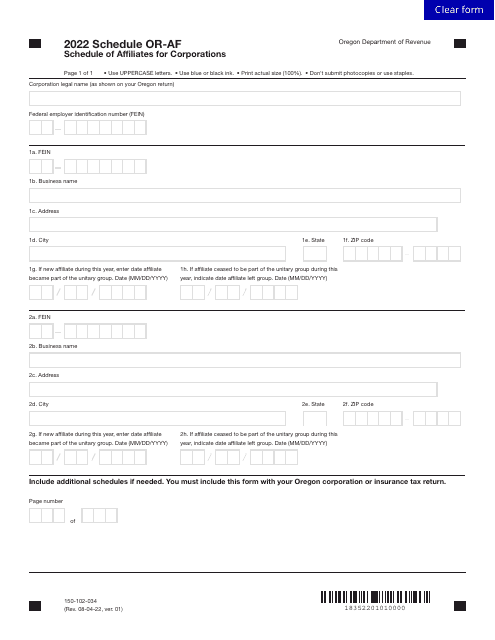

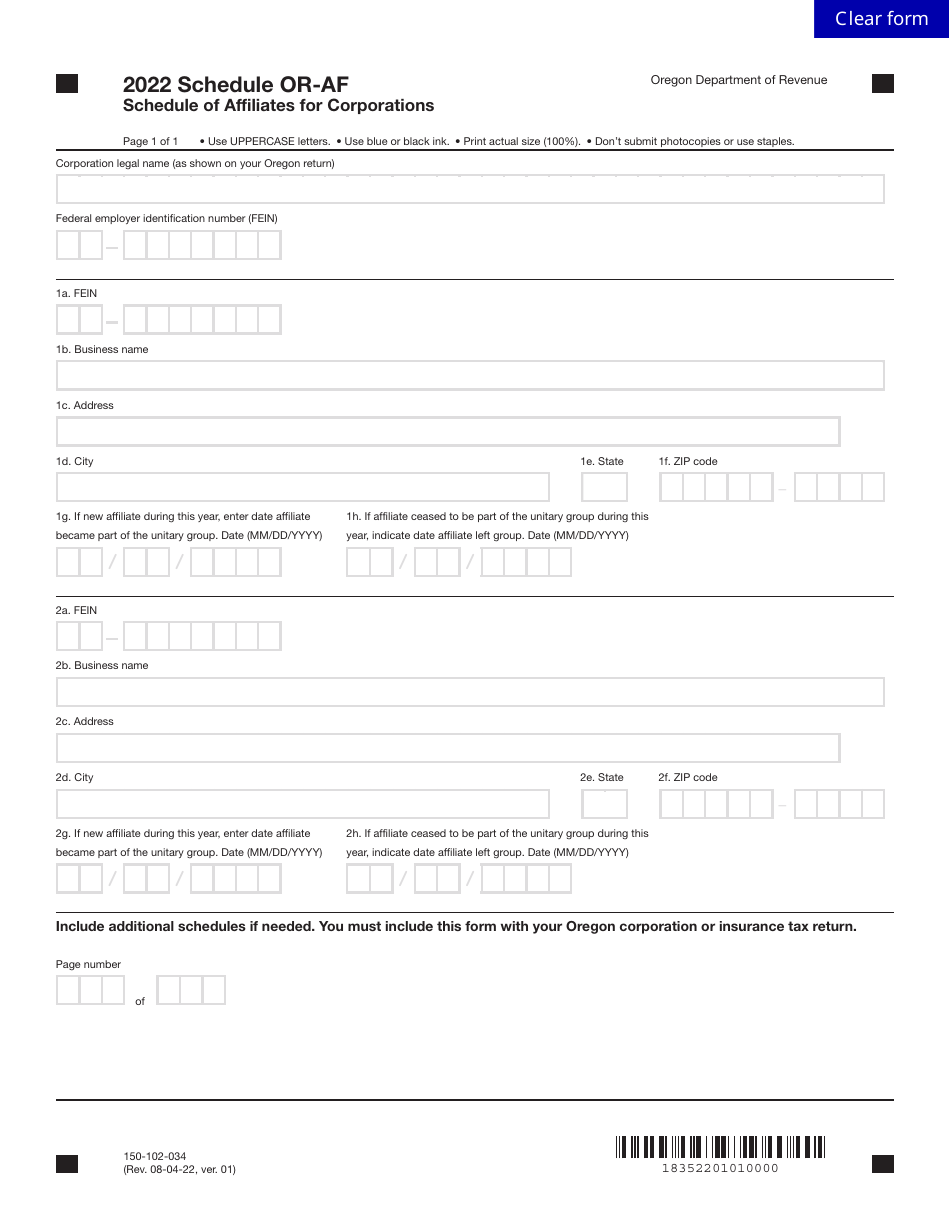

Form 150-102-034 Schedule OR-AF

for the current year.

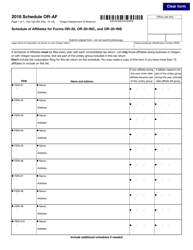

Form 150-102-034 Schedule OR-AF Schedule of Affiliates for Corporations - Oregon

What Is Form 150-102-034 Schedule OR-AF?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-102-034?

A: Form 150-102-034 is the Schedule OR-AF, which is used by corporations in Oregon to report their affiliates.

Q: What is the purpose of Schedule OR-AF?

A: The purpose of Schedule OR-AF is to provide information about the affiliated entities of a corporation in Oregon.

Q: Who needs to file Schedule OR-AF?

A: Corporations in Oregon need to file Schedule OR-AF if they have affiliates.

Q: What information is required on Schedule OR-AF?

A: Schedule OR-AF requires information about the affiliated entities, including their names, addresses, and relationship to the filing corporation.

Q: Is Schedule OR-AF separate from the corporate tax return?

A: Yes, Schedule OR-AF is a separate form that needs to be filed along with the corporate tax return in Oregon.

Form Details:

- Released on August 4, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-034 Schedule OR-AF by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.