This version of the form is not currently in use and is provided for reference only. Download this version of

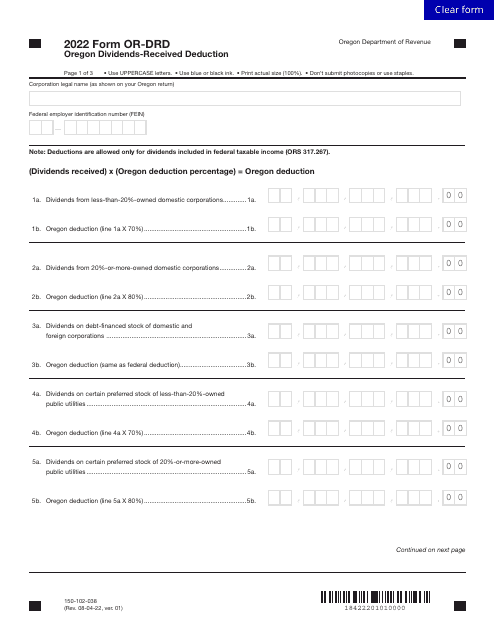

Form OR-DRD (150-102-038)

for the current year.

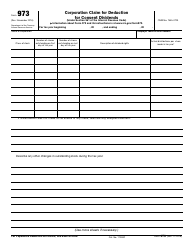

Form OR-DRD (150-102-038) Oregon Dividends-Received Deduction - Oregon

What Is Form OR-DRD (150-102-038)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-DRD?

A: Form OR-DRD is a tax form used in Oregon that allows taxpayers to claim a deduction for dividends received from certain corporations.

Q: What is the purpose of Form OR-DRD?

A: The purpose of Form OR-DRD is to calculate and claim the Oregon Dividends-Received Deduction, which reduces the amount of taxable income subject to Oregon income tax.

Q: Who is eligible to use Form OR-DRD?

A: Any resident or nonresident taxpayer who received qualifying dividends from eligible corporations can use Form OR-DRD to claim the deduction.

Q: What are qualifying dividends?

A: Qualifying dividends are distributions of earnings and profits from eligible corporations.

Q: What are eligible corporations?

A: Eligible corporations include certain domestic corporations, mutual savings banks, cooperative associations, and real estate investment trusts.

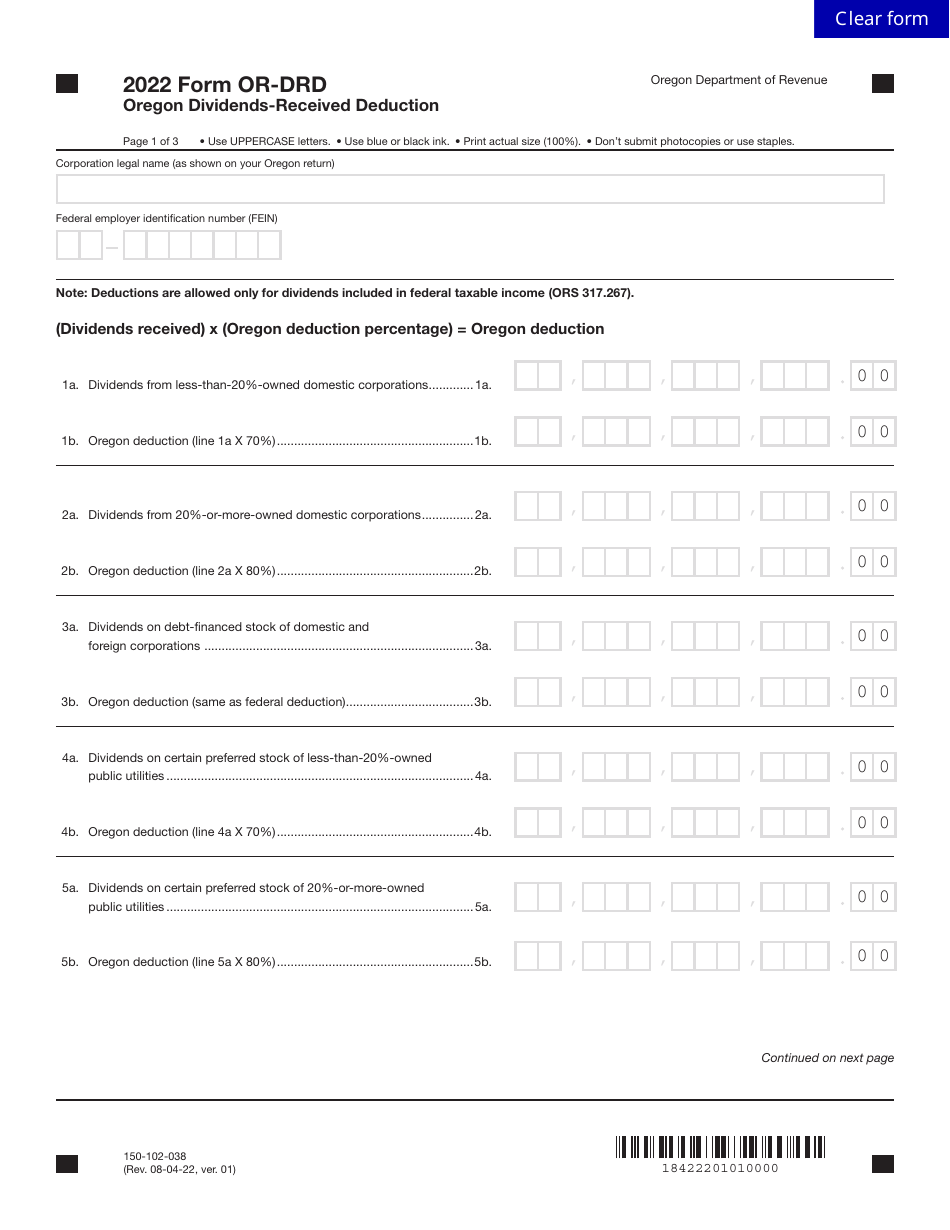

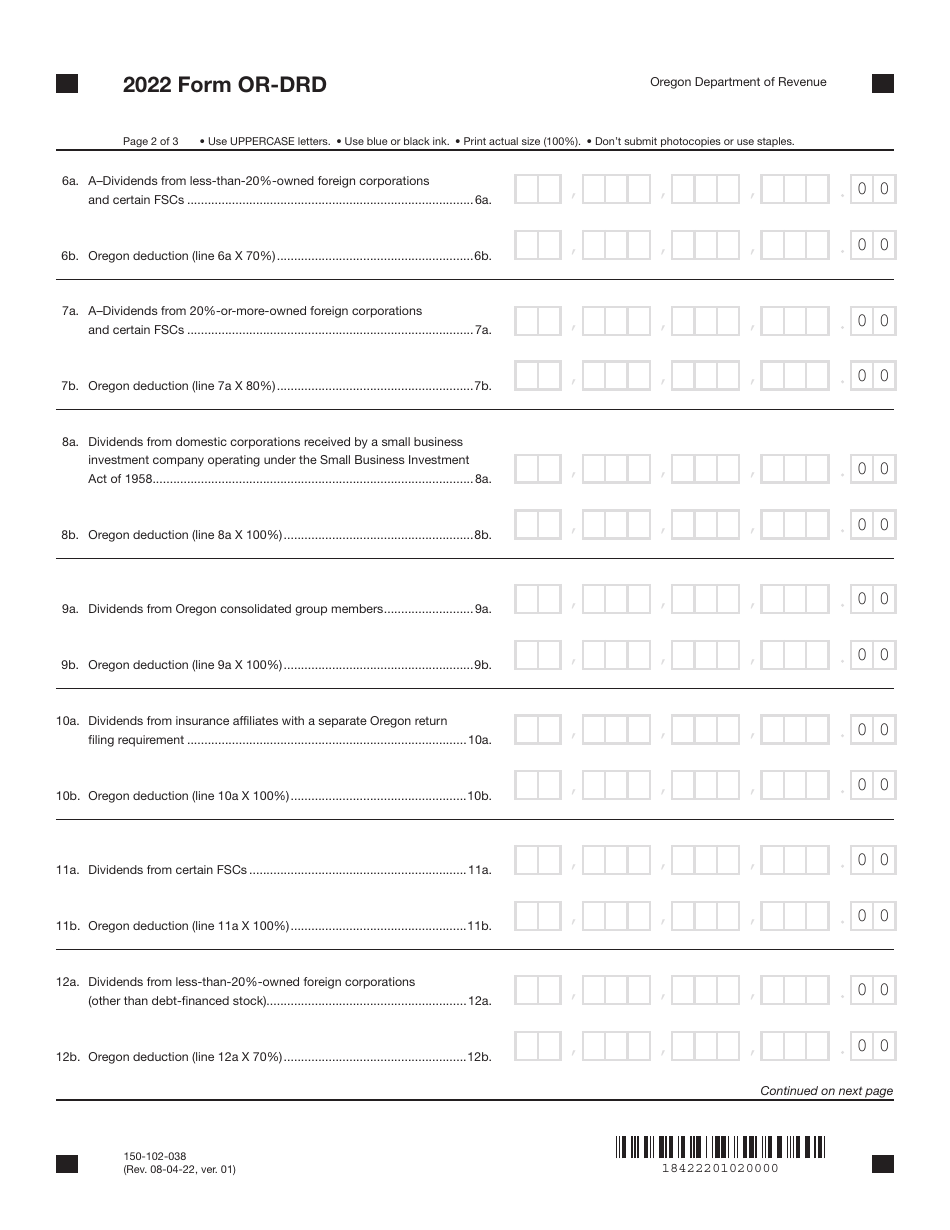

Q: How is the deduction amount calculated?

A: The deduction amount is calculated by multiplying the qualifying dividends by the percentage shown on the form.

Q: Are there any limitations to the deduction?

A: Yes, there are certain limitations and restrictions on the deduction. These are explained in the instructions accompanying the form.

Form Details:

- Released on August 4, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-DRD (150-102-038) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.