This version of the form is not currently in use and is provided for reference only. Download this version of

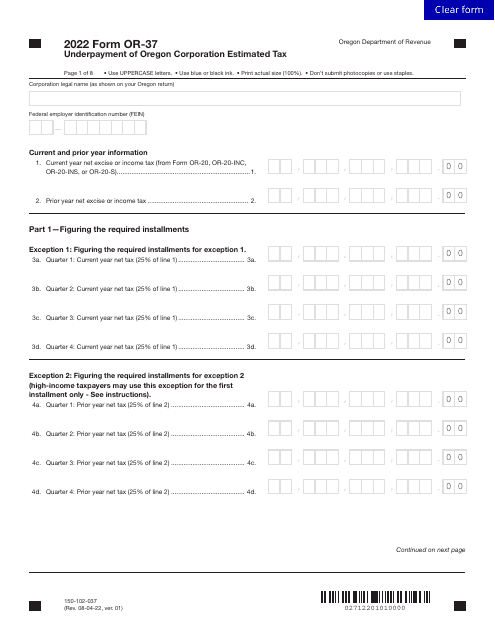

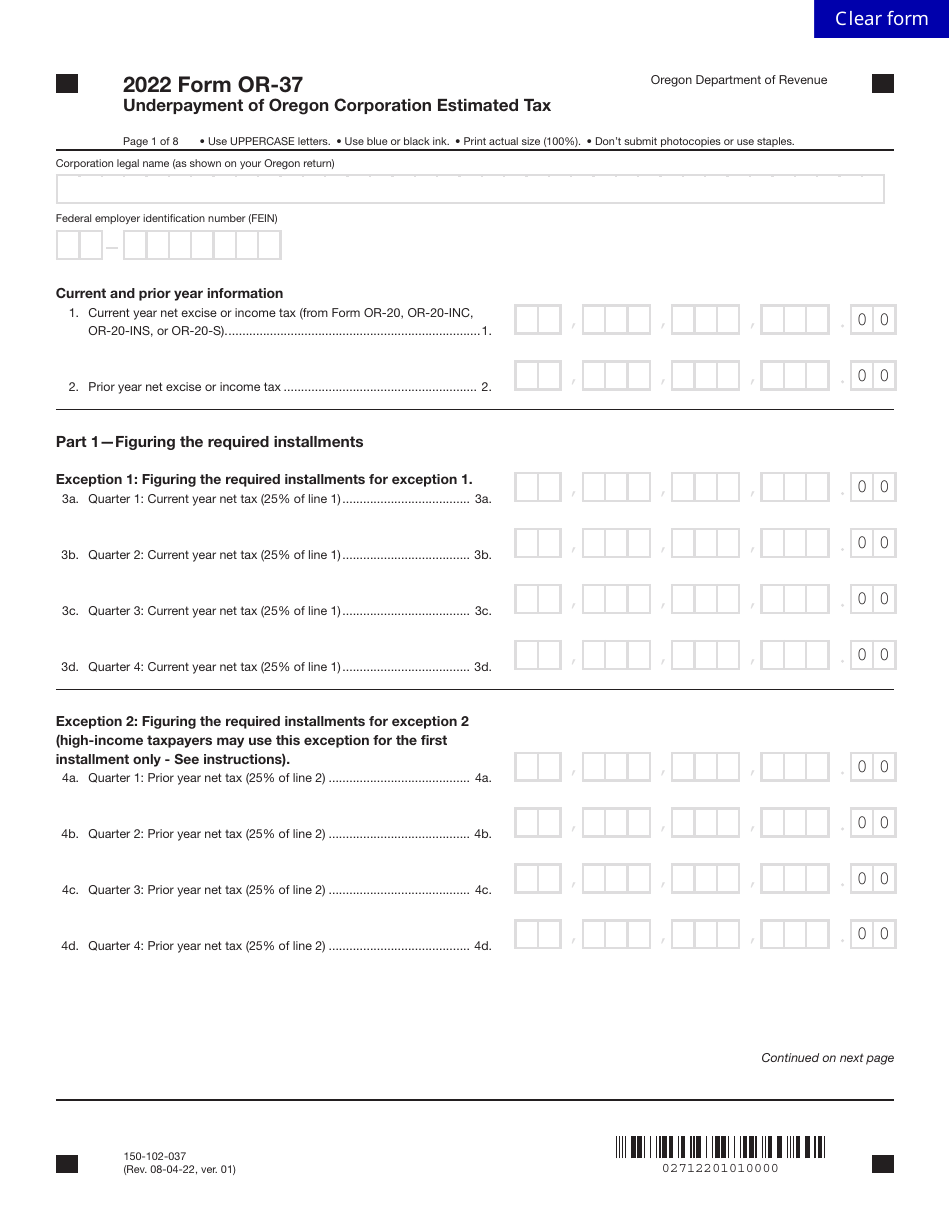

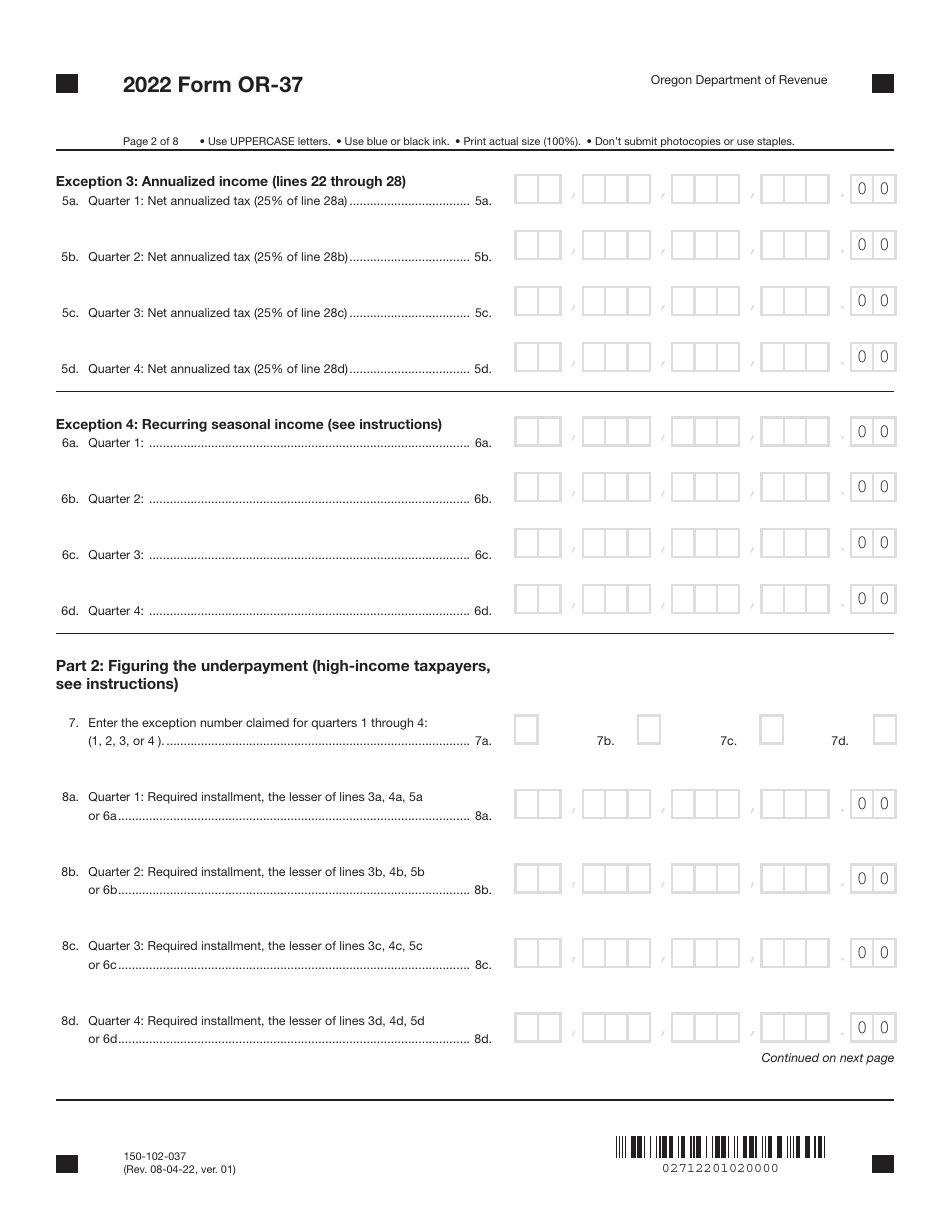

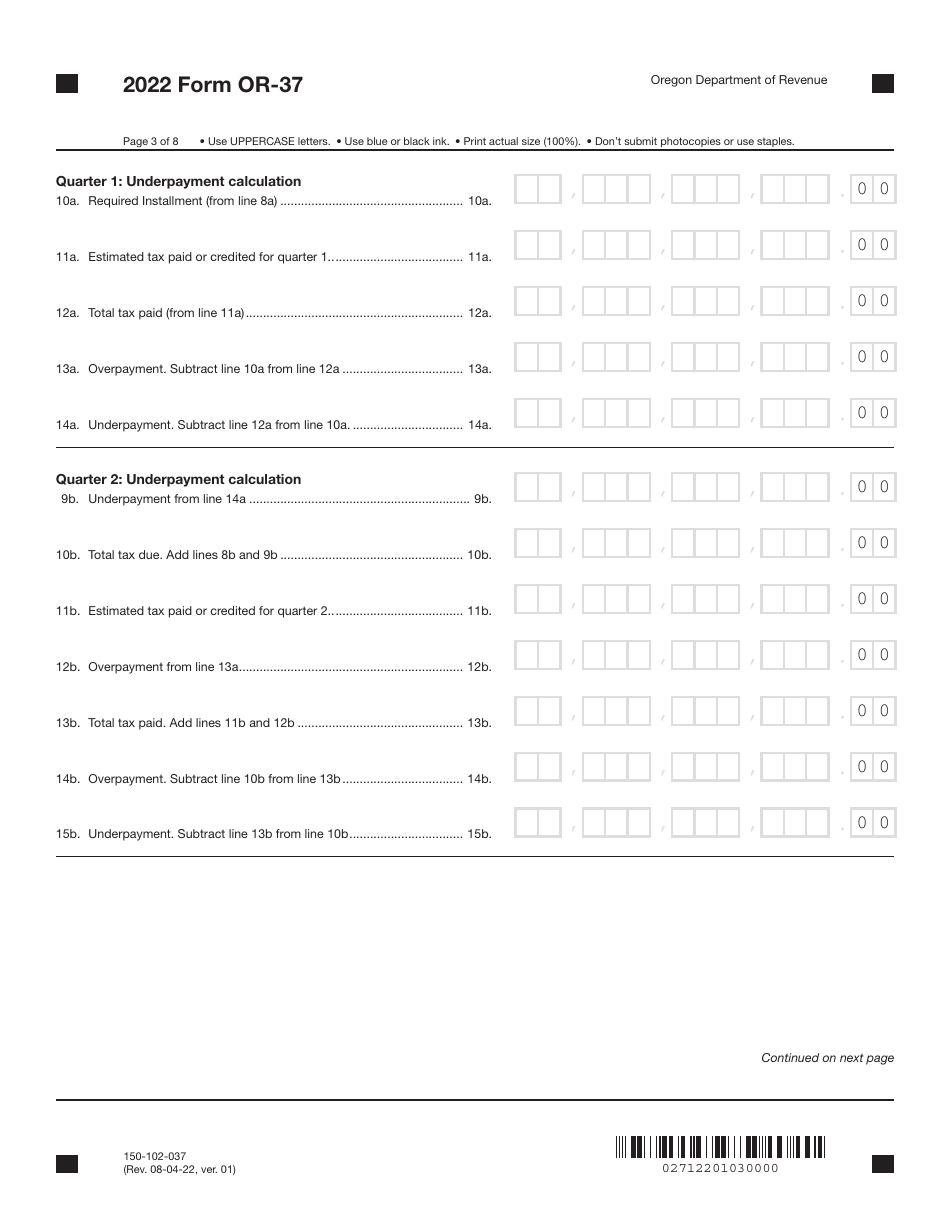

Form OR-37 (150-102-037)

for the current year.

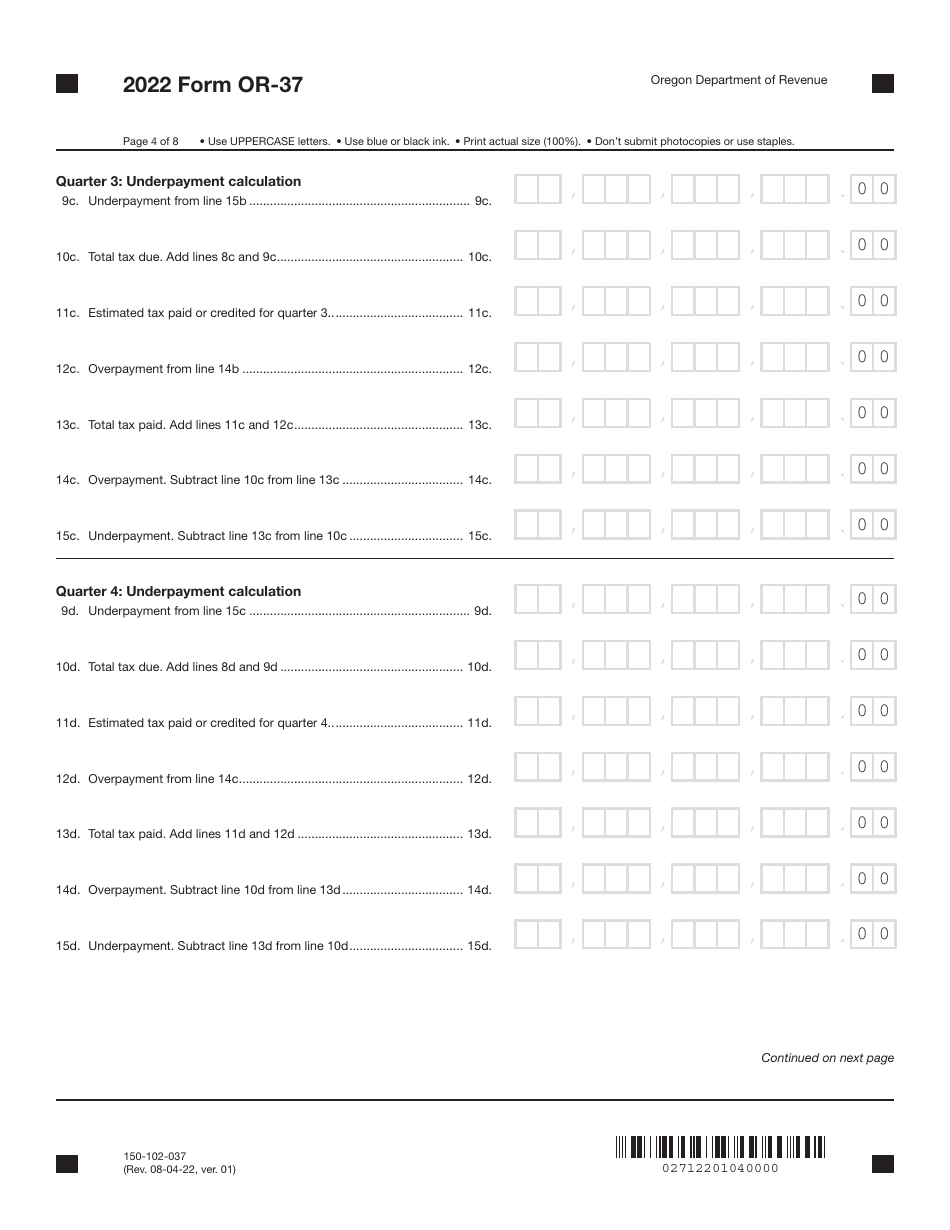

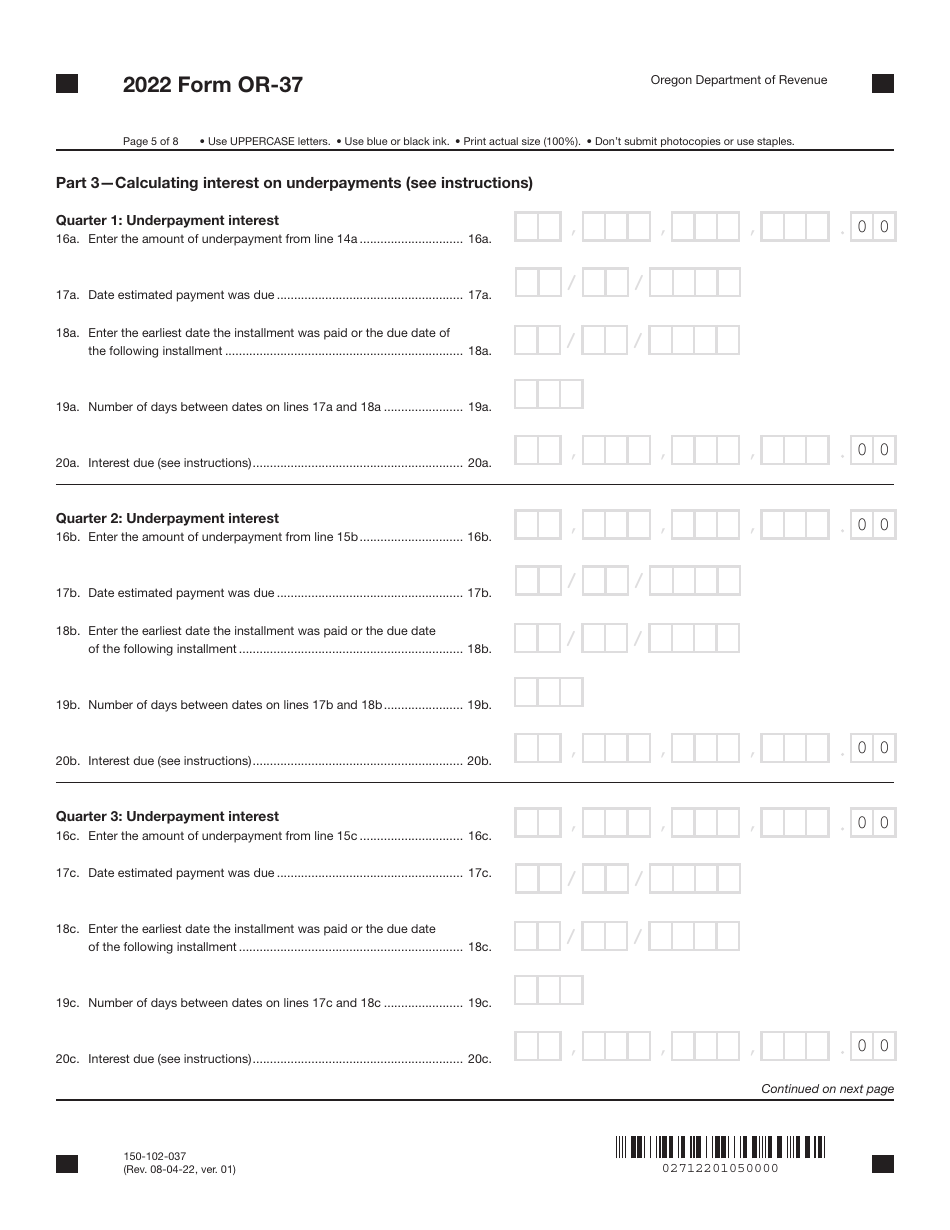

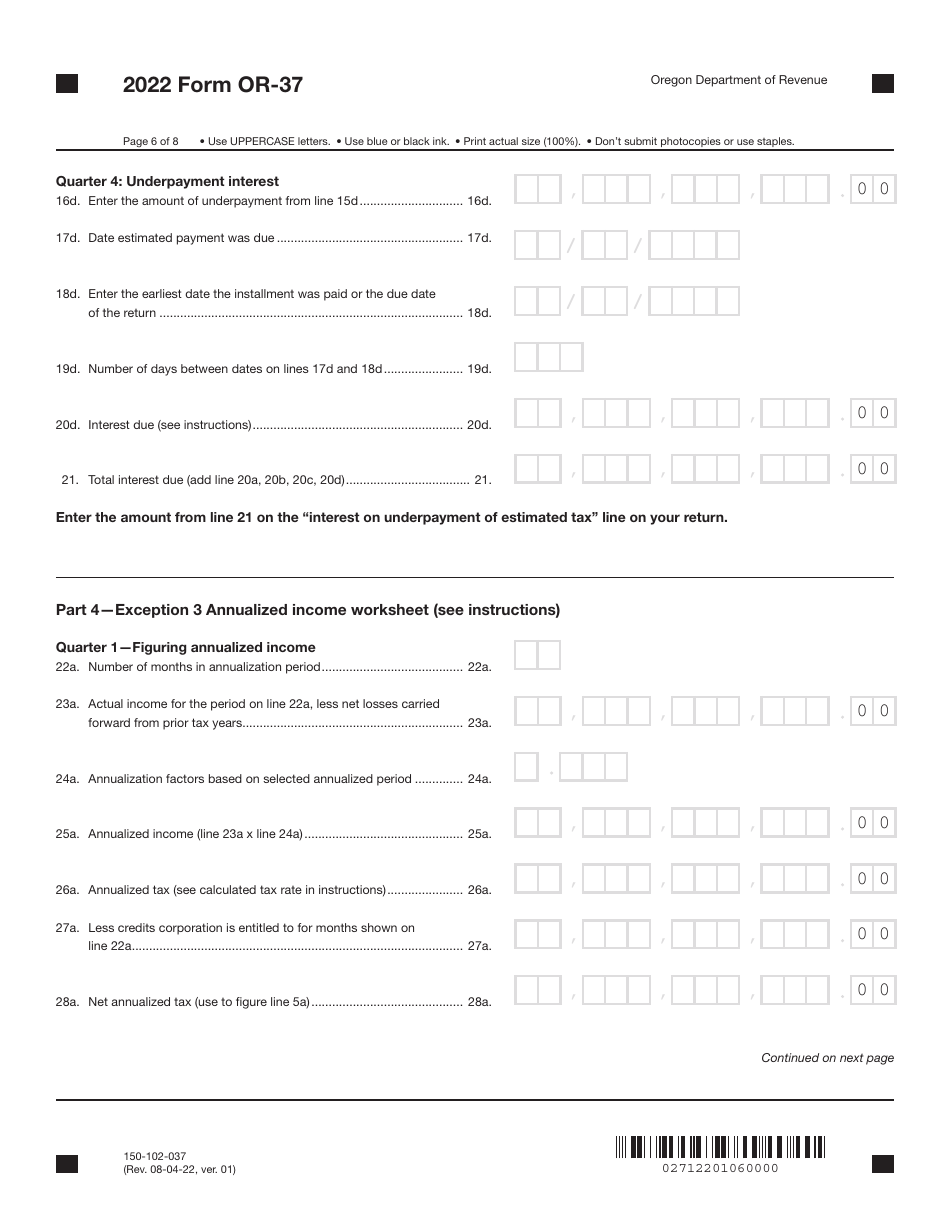

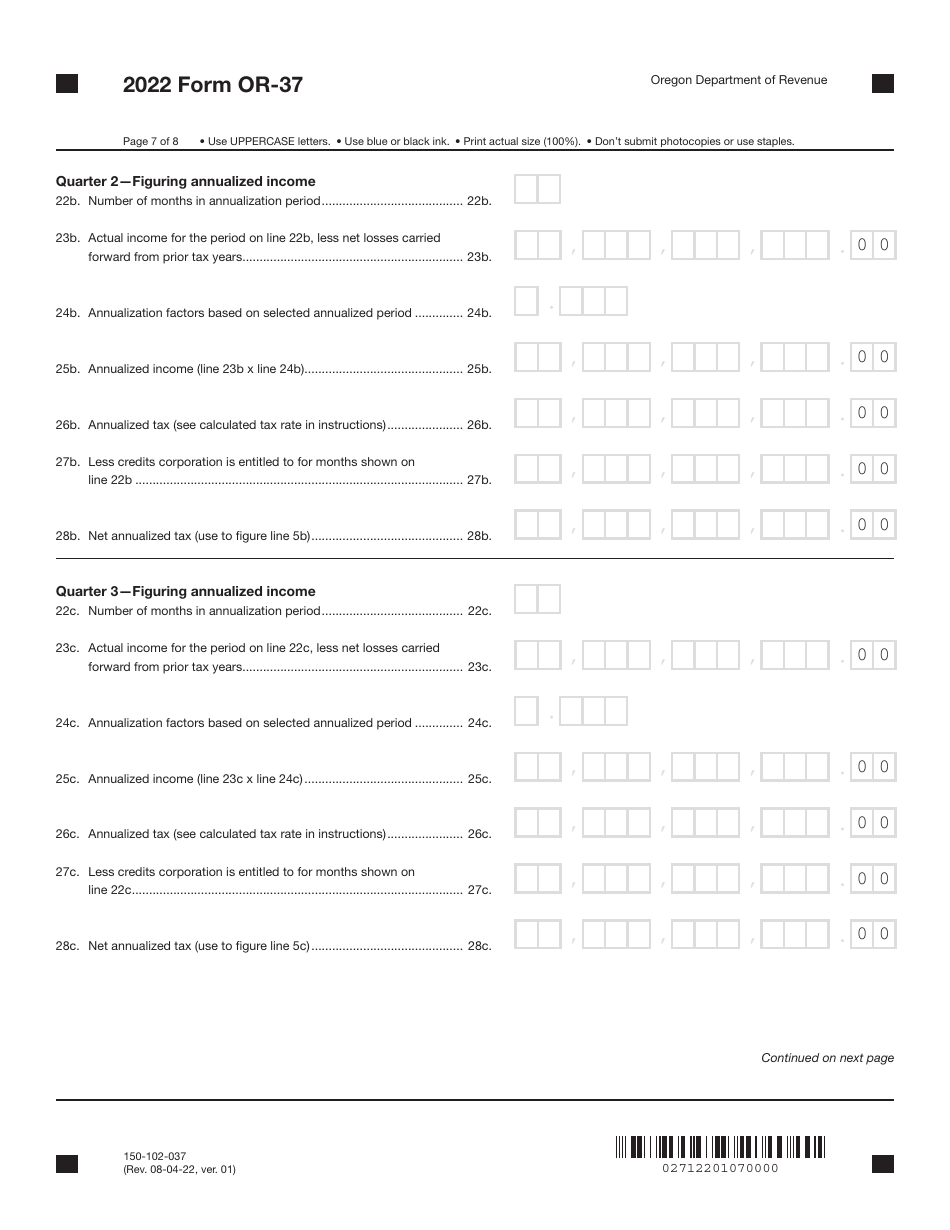

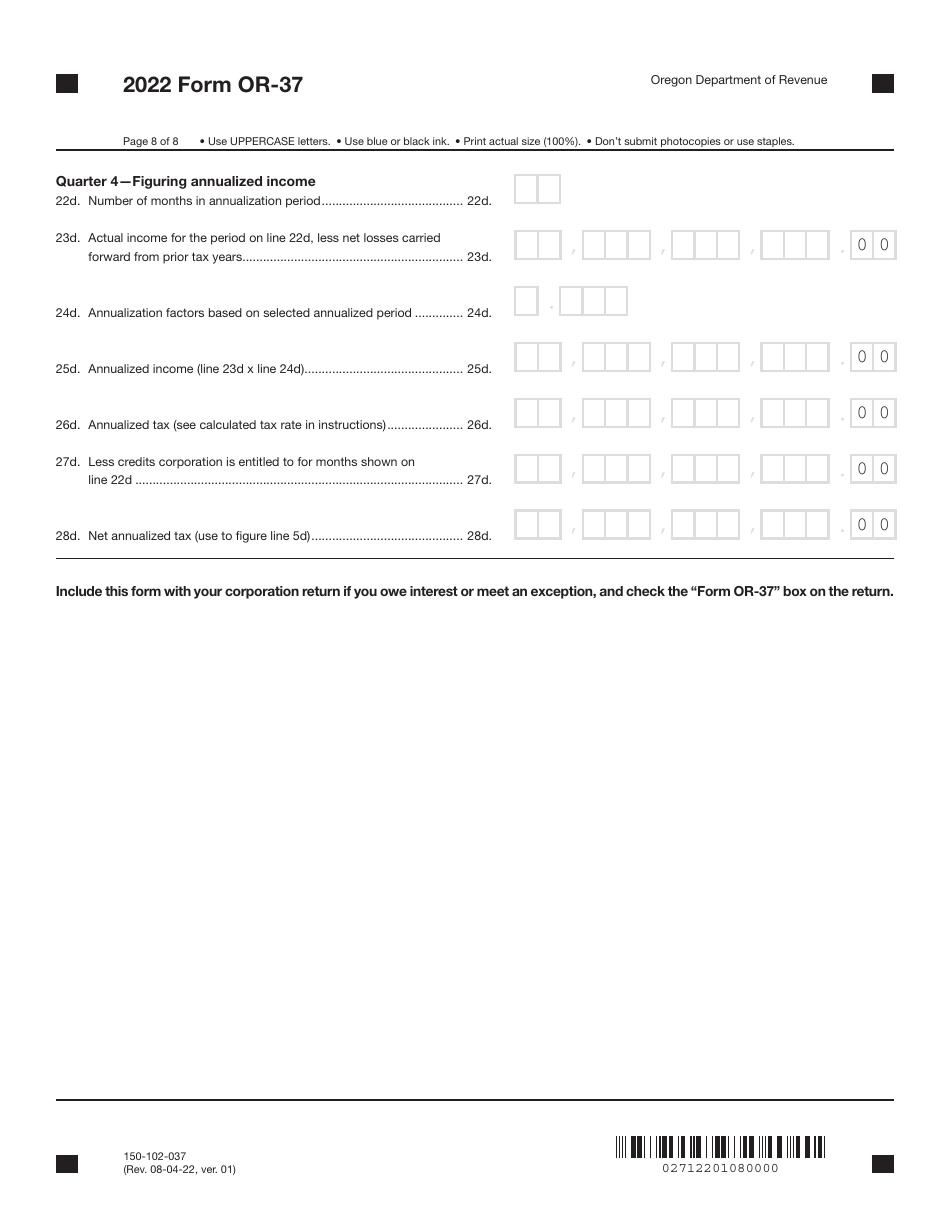

Form OR-37 (150-102-037) Underpayment of Oregon Corporation Estimated Tax - Oregon

What Is Form OR-37 (150-102-037)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-37?

A: Form OR-37 is a tax form for underpayment of Oregon Corporation Estimated Tax.

Q: What is the purpose of Form OR-37?

A: The purpose of Form OR-37 is to calculate and report any underpayment of estimated tax by an Oregon Corporation.

Q: Is Form OR-37 specific to Oregon corporations?

A: Yes, Form OR-37 is specific to Oregon corporations.

Q: Why do corporations need to file Form OR-37?

A: Corporations need to file Form OR-37 to ensure they have paid enough estimated tax throughout the year, as required by Oregon tax laws.

Q: Are there any penalties for underpayment of estimated tax?

A: Yes, there may be penalties for underpayment of estimated tax. Form OR-37 helps corporations calculate and report any underpayment to avoid or minimize penalties.

Form Details:

- Released on August 4, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-37 (150-102-037) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.