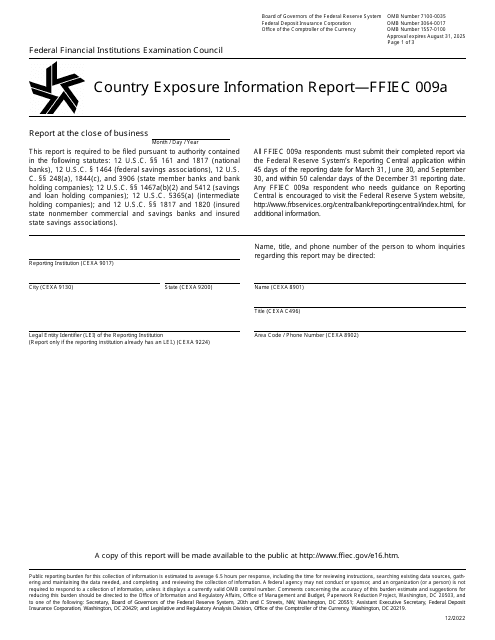

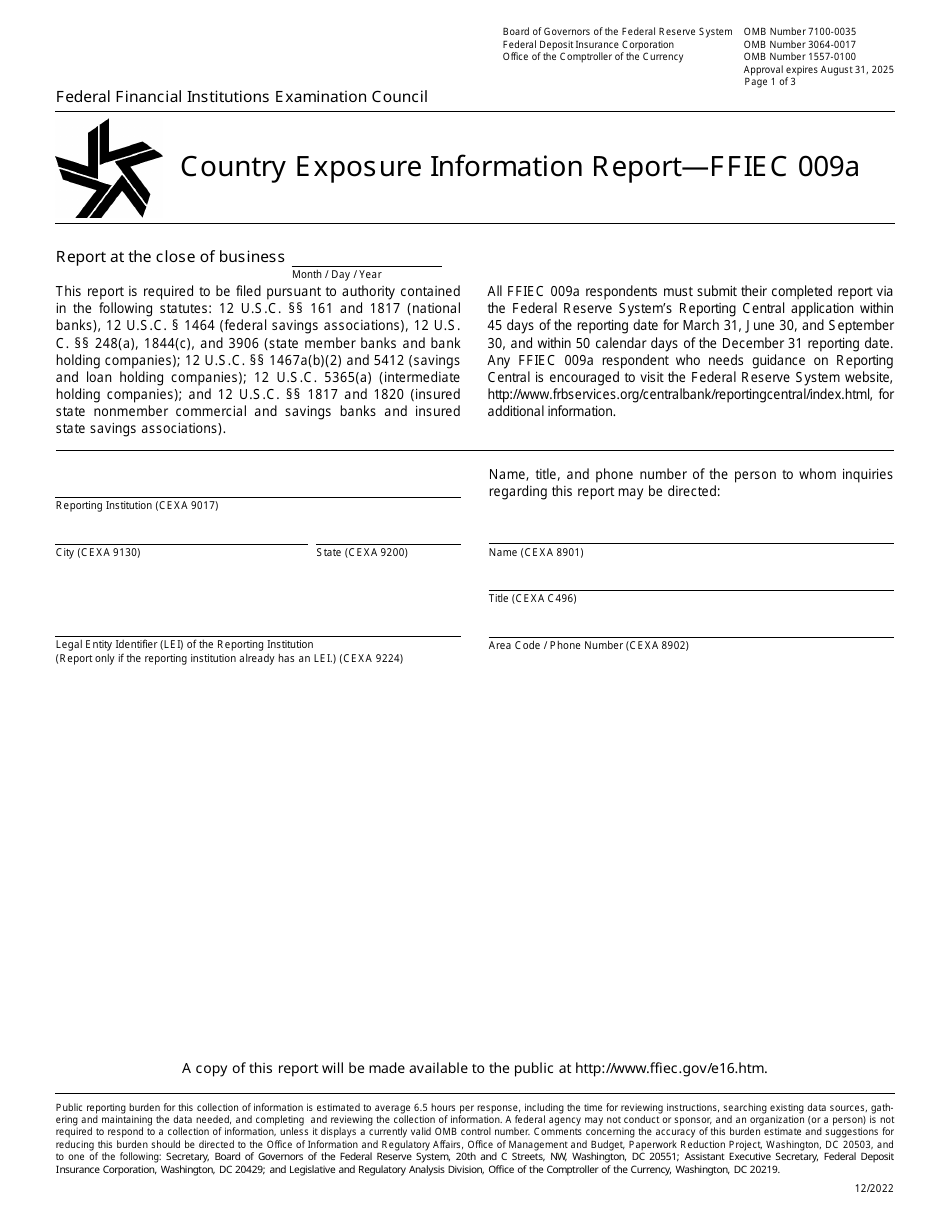

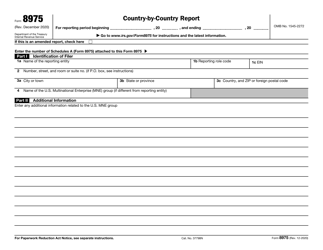

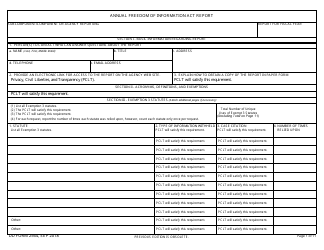

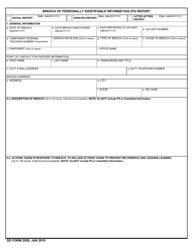

Form FFIEC009A Country Exposure Information Report

What Is Form FFIEC009A?

This is a legal form that was released by the Federal Financial Institutions Examination Council on December 1, 2022 and used country-wide. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the FFIEC009A Country Exposure Information Report?

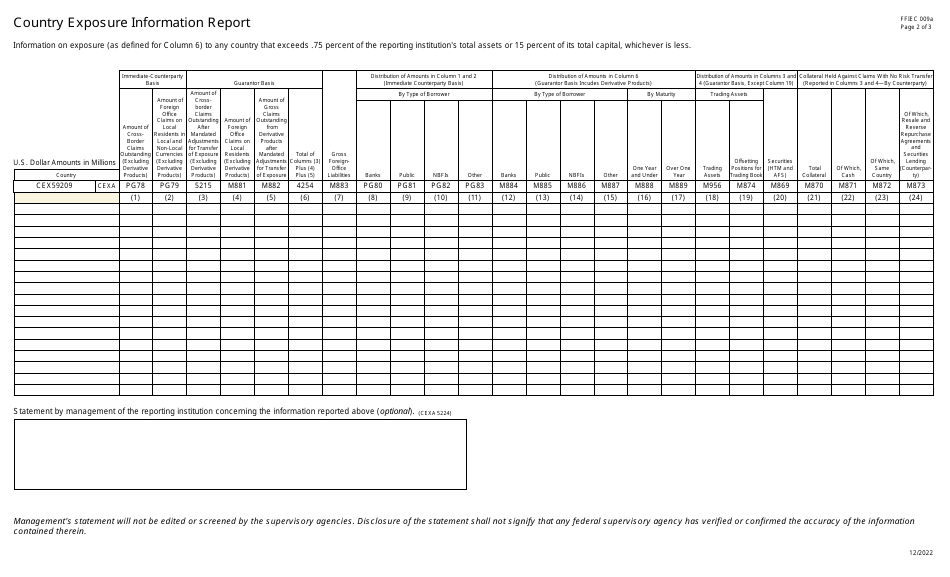

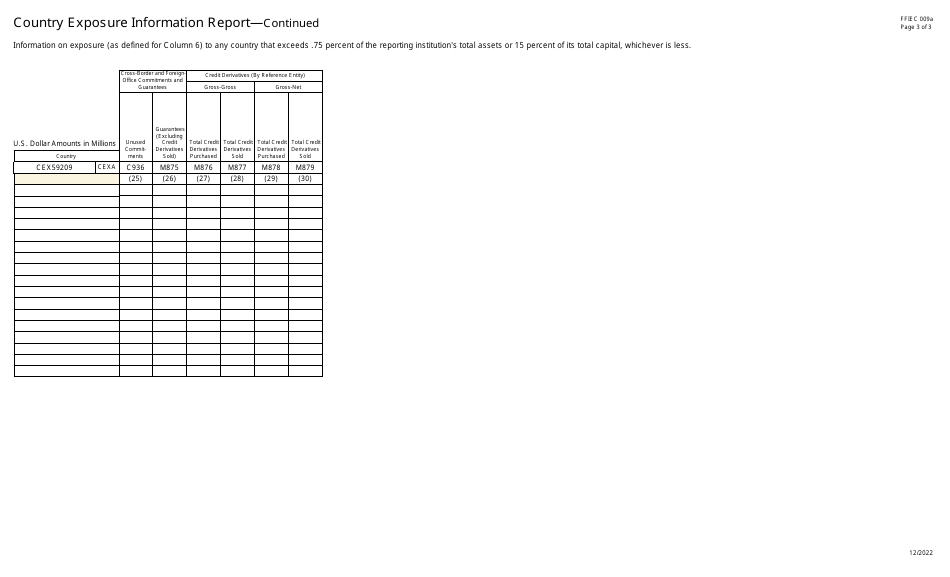

A: The FFIEC009A Country Exposure Information Report is a report that provides information on the exposure of U.S. banks to foreign countries.

Q: Who is required to file the FFIEC009A report?

A: U.S. banks that meet certain criteria are required to file the FFIEC009A report.

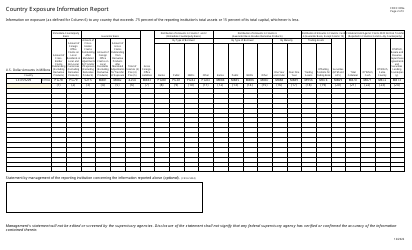

Q: What information does the FFIEC009A report include?

A: The FFIEC009A report includes information on a bank's exposure to individual countries, including loans, securities, and other assets and liabilities.

Q: Why is the FFIEC009A report important?

A: The FFIEC009A report is important because it helps regulators and the public assess the potential risks faced by U.S. banks due to their exposure to foreign countries.

Q: Are all U.S. banks required to file the FFIEC009A report?

A: No, only U.S. banks that meet certain criteria are required to file the FFIEC009A report.

Q: What are the criteria for a bank to be required to file the FFIEC009A report?

A: The criteria for a bank to be required to file the FFIEC009A report include factors such as the size of the bank's assets and its foreign exposure.

Q: How often is the FFIEC009A report filed?

A: The FFIEC009A report is filed quarterly.

Q: Are all foreign countries included in the FFIEC009A report?

A: No, the FFIEC009A report includes only certain countries that meet specific criteria.

Q: Who uses the information from the FFIEC009A report?

A: Regulators, analysts, and the general public may use the information from the FFIEC009A report to assess the health and risk profile of U.S. banks.

Form Details:

- Released on December 1, 2022;

- The latest available edition released by the Federal Financial Institutions Examination Council;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FFIEC009A by clicking the link below or browse more documents and templates provided by the Federal Financial Institutions Examination Council.