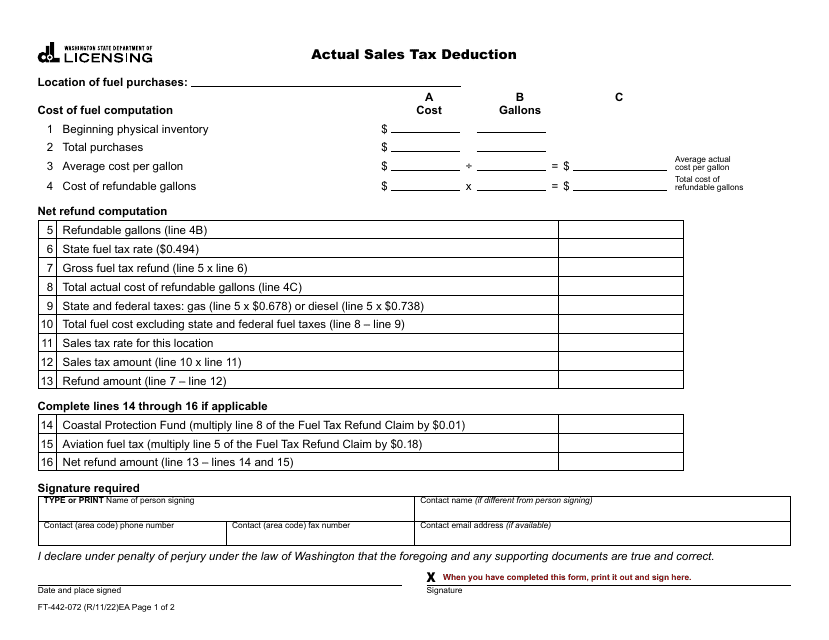

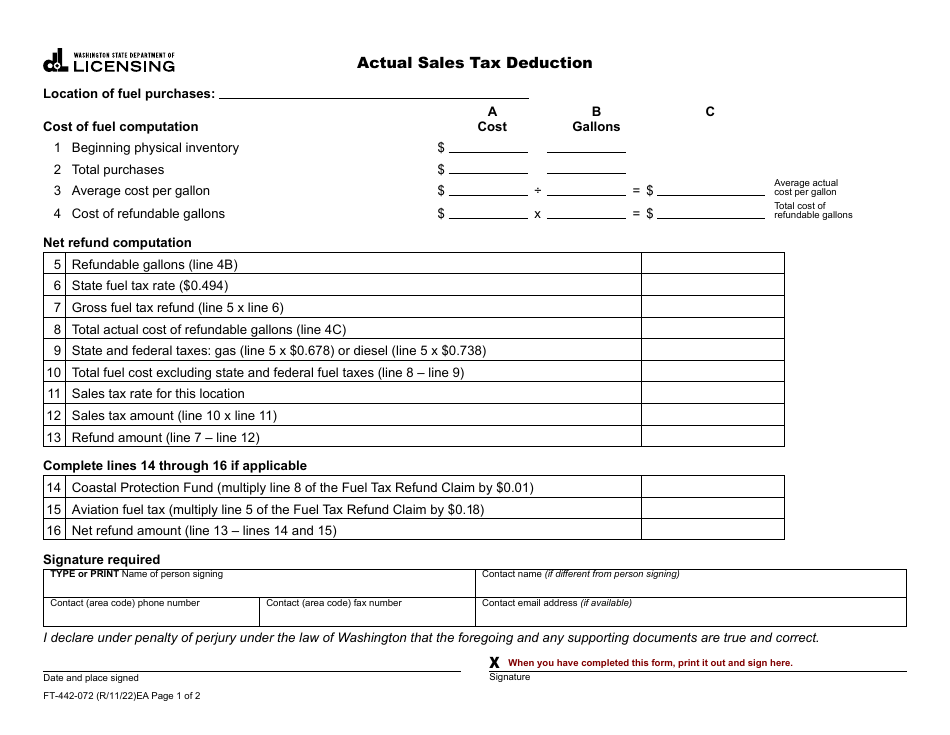

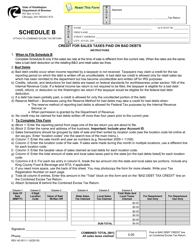

Form FT-442-072 Actual Sales Tax Deduction - Washington

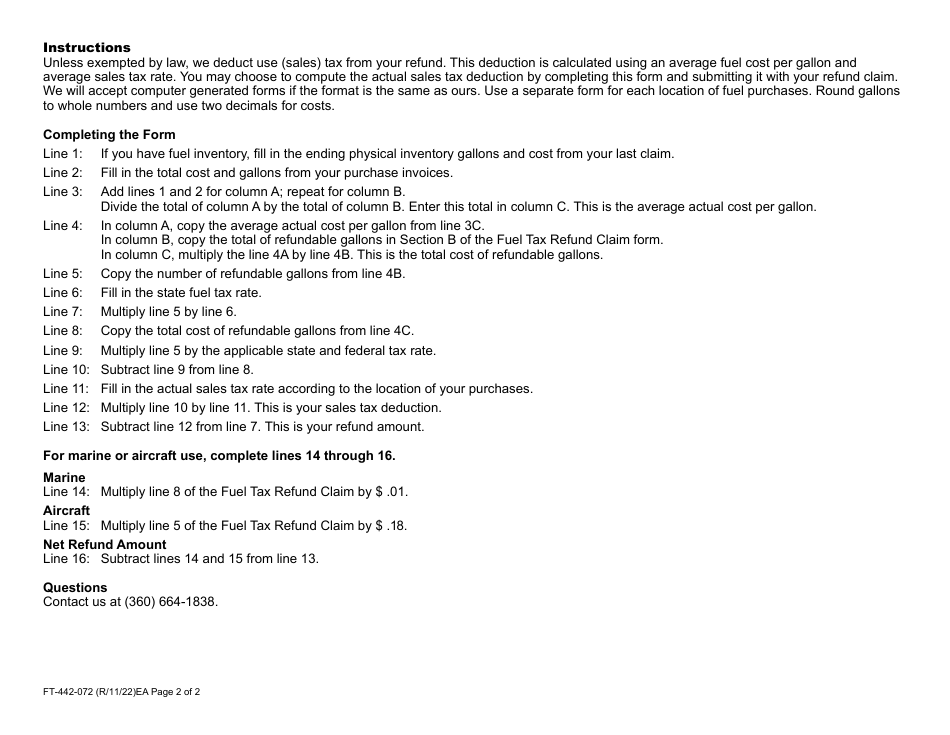

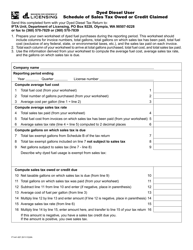

What Is Form FT-442-072?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

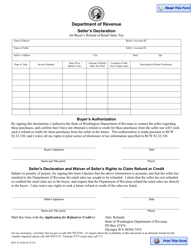

FAQ

Q: What is Form FT-442-072?

A: Form FT-442-072 is a tax form used in Washington for claiming actual sales tax deductions.

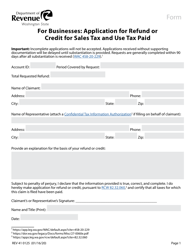

Q: What is the purpose of Form FT-442-072?

A: The purpose of Form FT-442-072 is to enable individuals to deduct their actual sales tax paid from their taxable income.

Q: Who can use Form FT-442-072?

A: Washington residents who itemize deductions on their federal tax return and paid sales tax on eligible purchases can use Form FT-442-072.

Q: What expenses can be deducted using Form FT-442-072?

A: Expenses such as major household items, vehicles, and other big-ticket purchases on which sales tax was paid can be deducted using Form FT-442-072.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Washington State Department of Licensing;

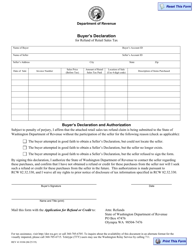

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-442-072 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.