This version of the form is not currently in use and is provided for reference only. Download this version of

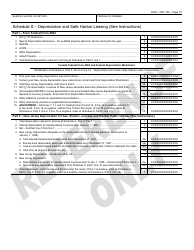

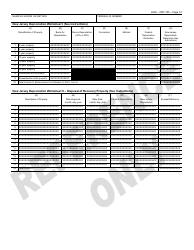

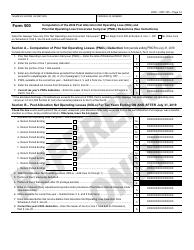

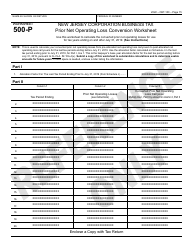

Form CBT-100

for the current year.

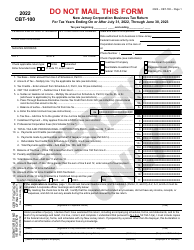

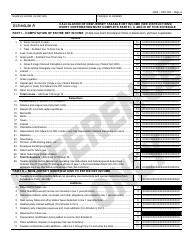

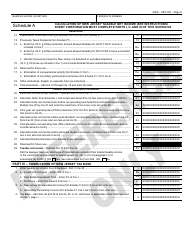

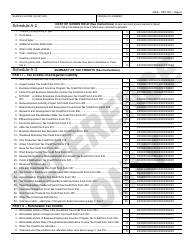

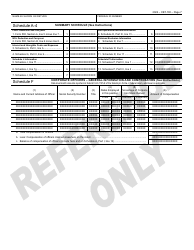

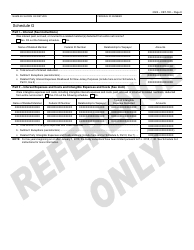

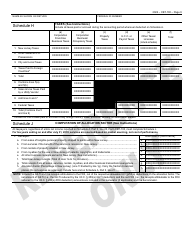

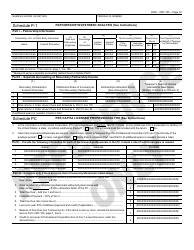

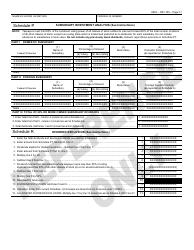

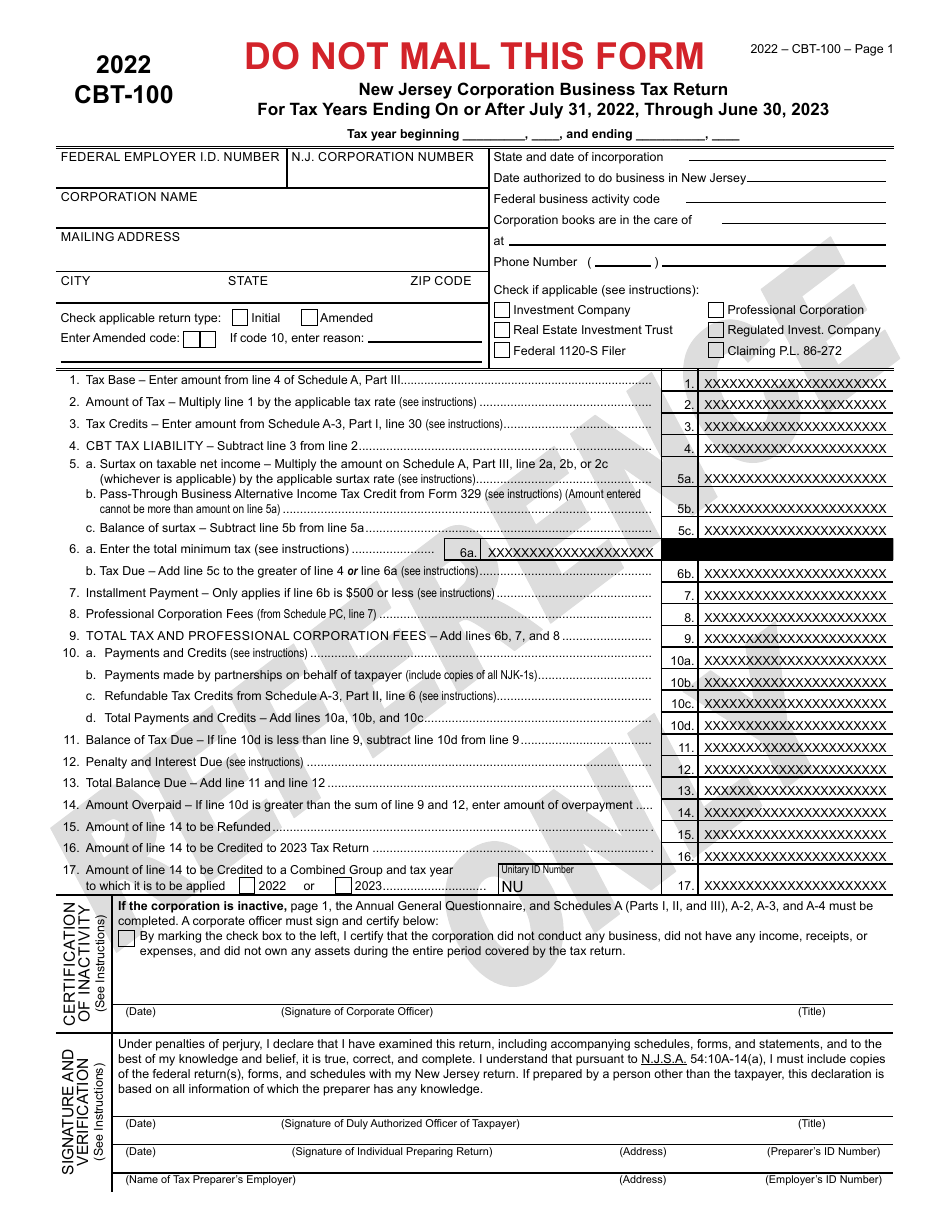

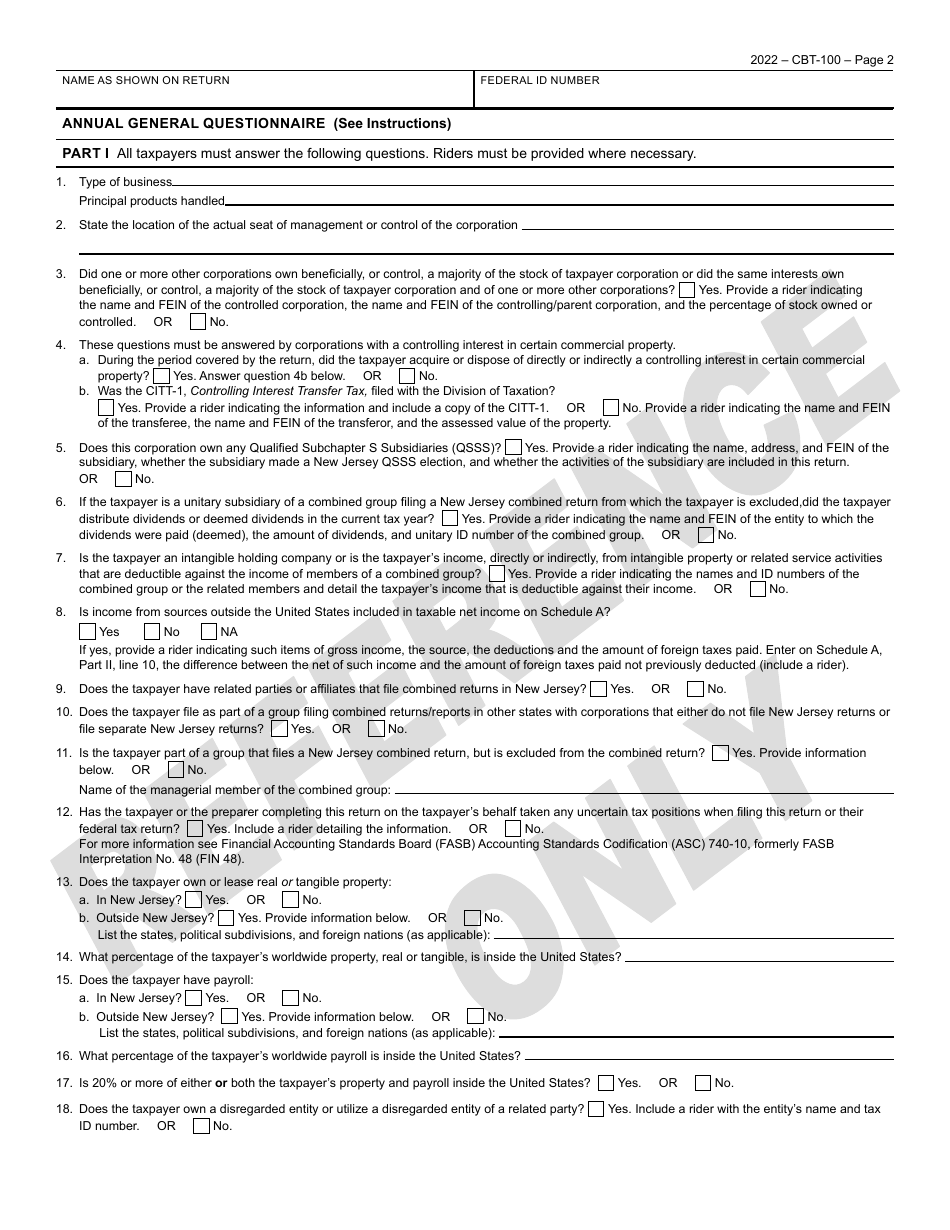

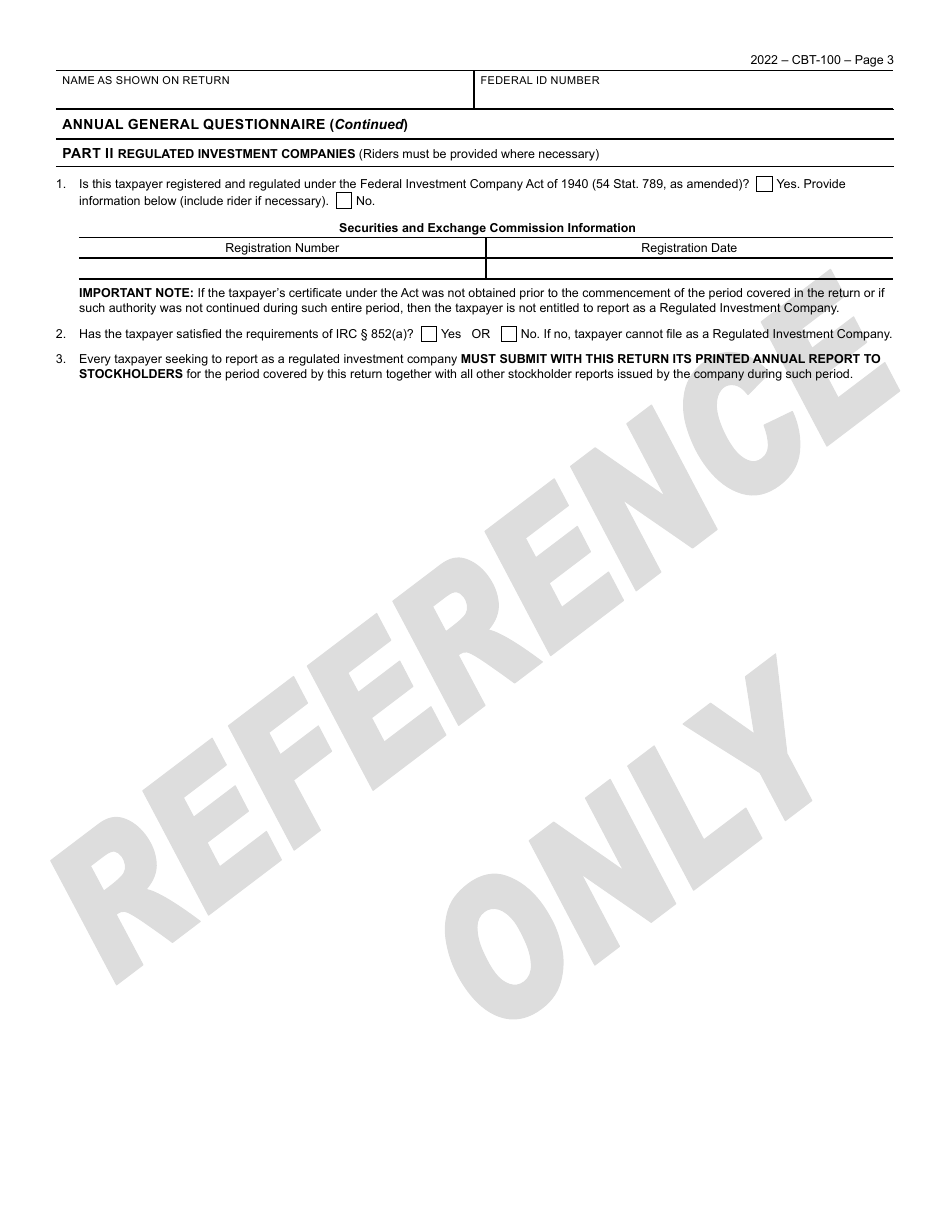

Form CBT-100 New Jersey Corporation Business Tax Return - New Jersey

What Is Form CBT-100?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

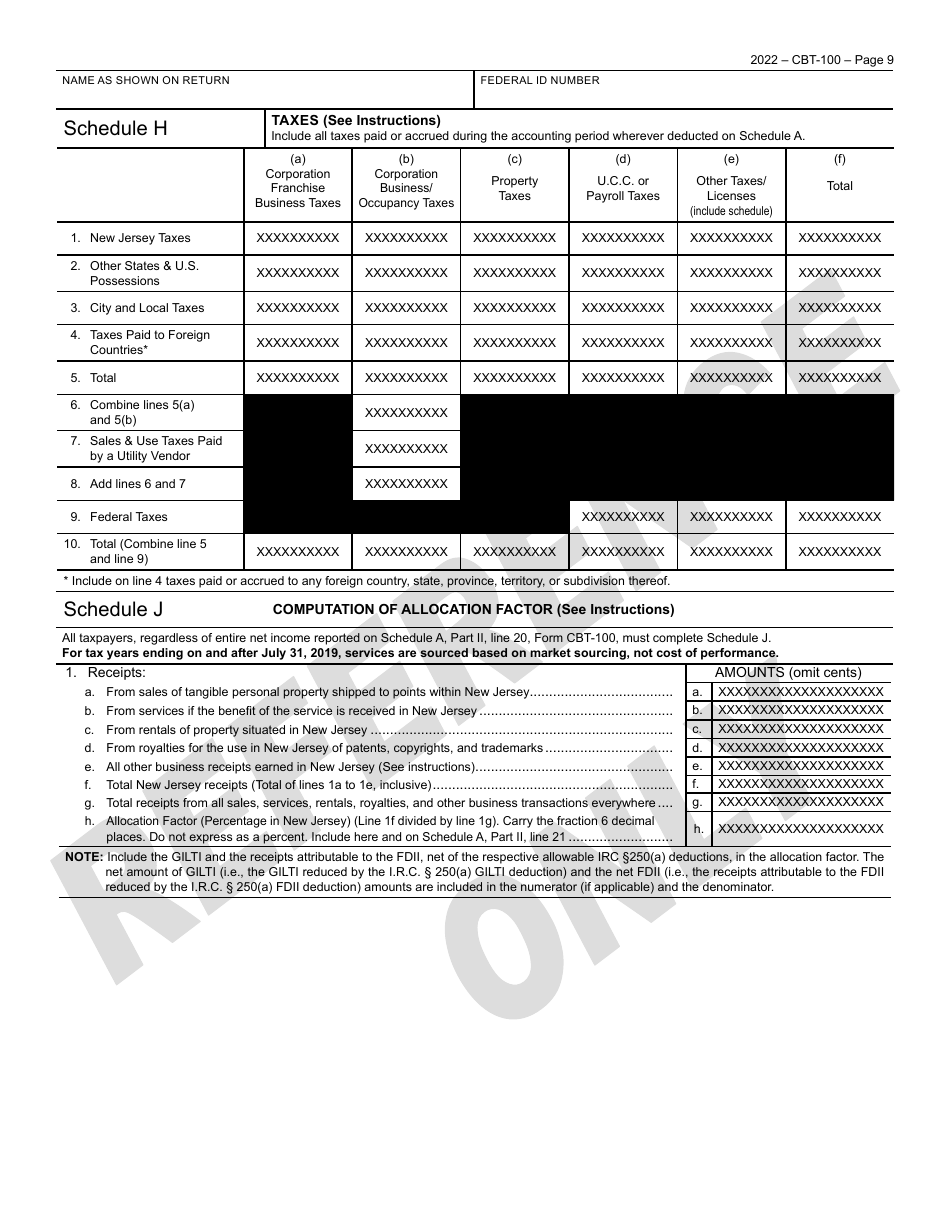

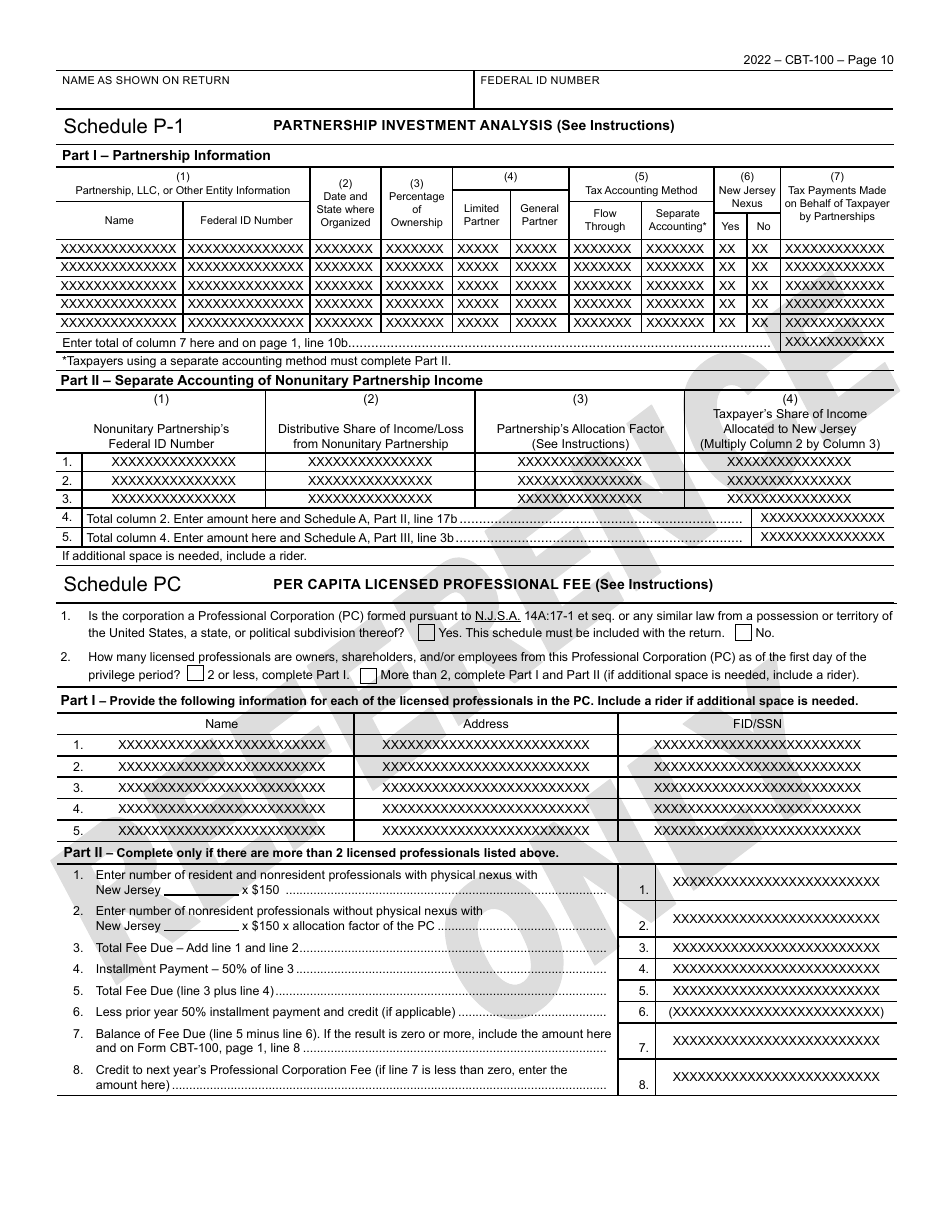

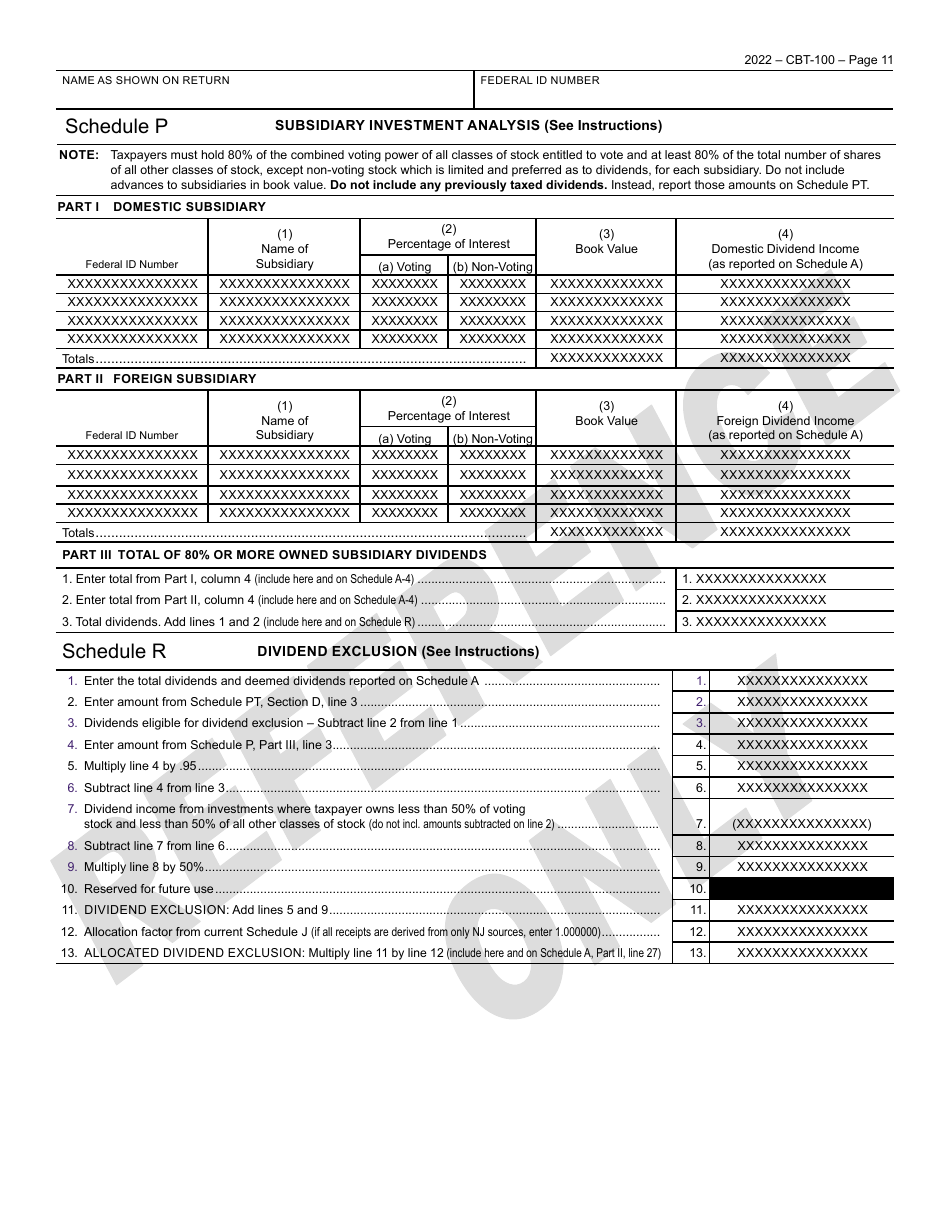

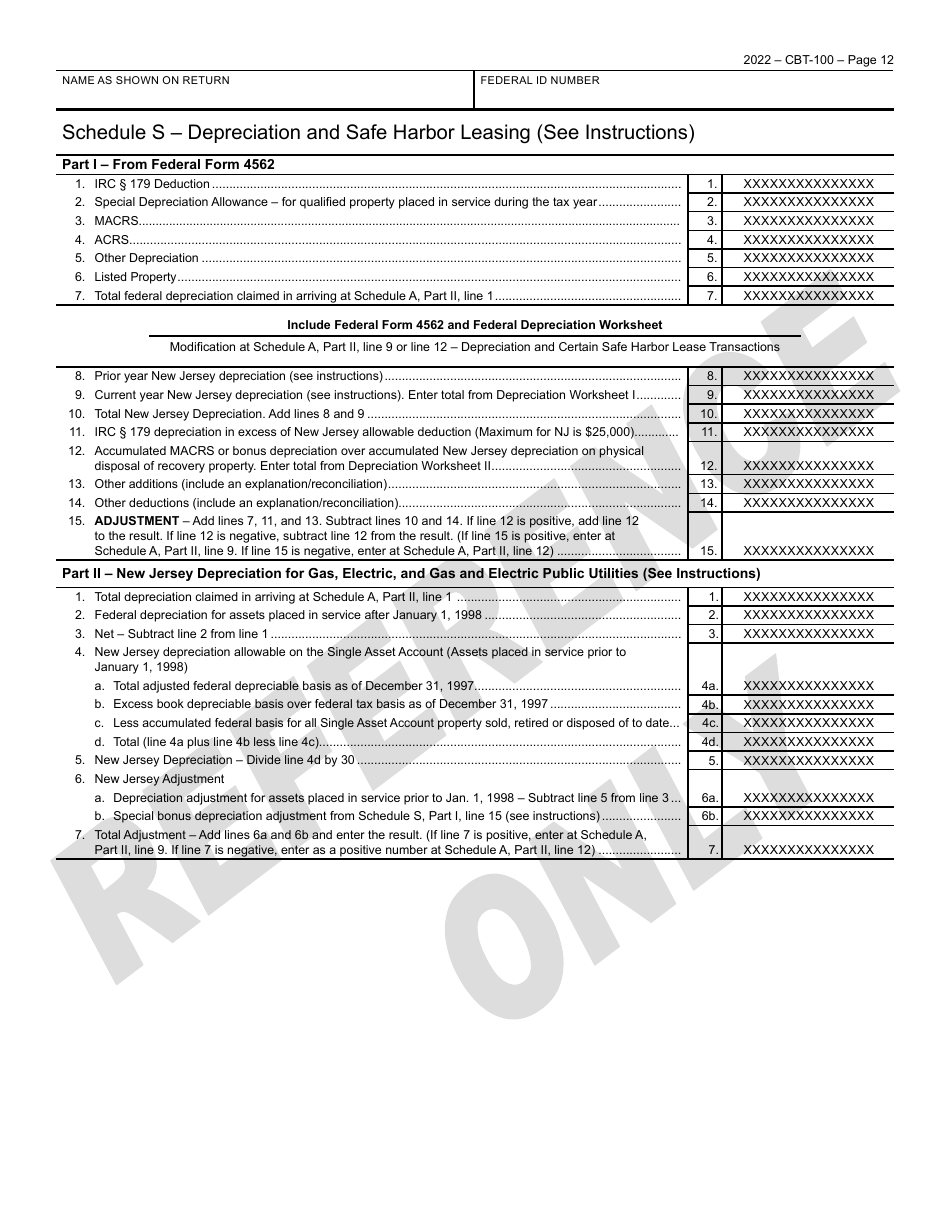

Q: What is CBT-100?

A: CBT-100 is a tax return form used by corporations in New Jersey to report their business tax liabilities.

Q: Who needs to file CBT-100?

A: Any corporation doing business in New Jersey is required to file CBT-100.

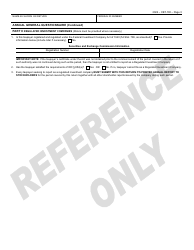

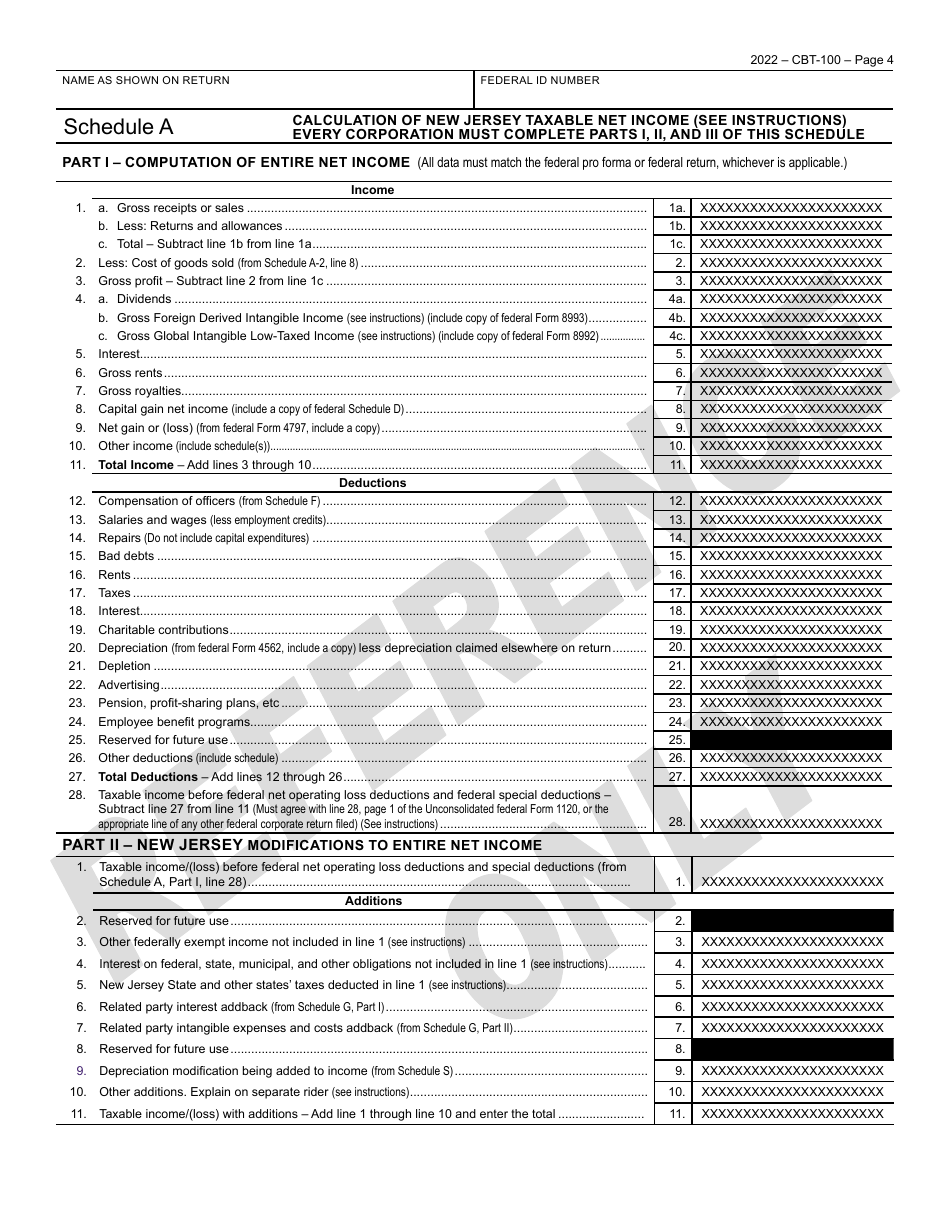

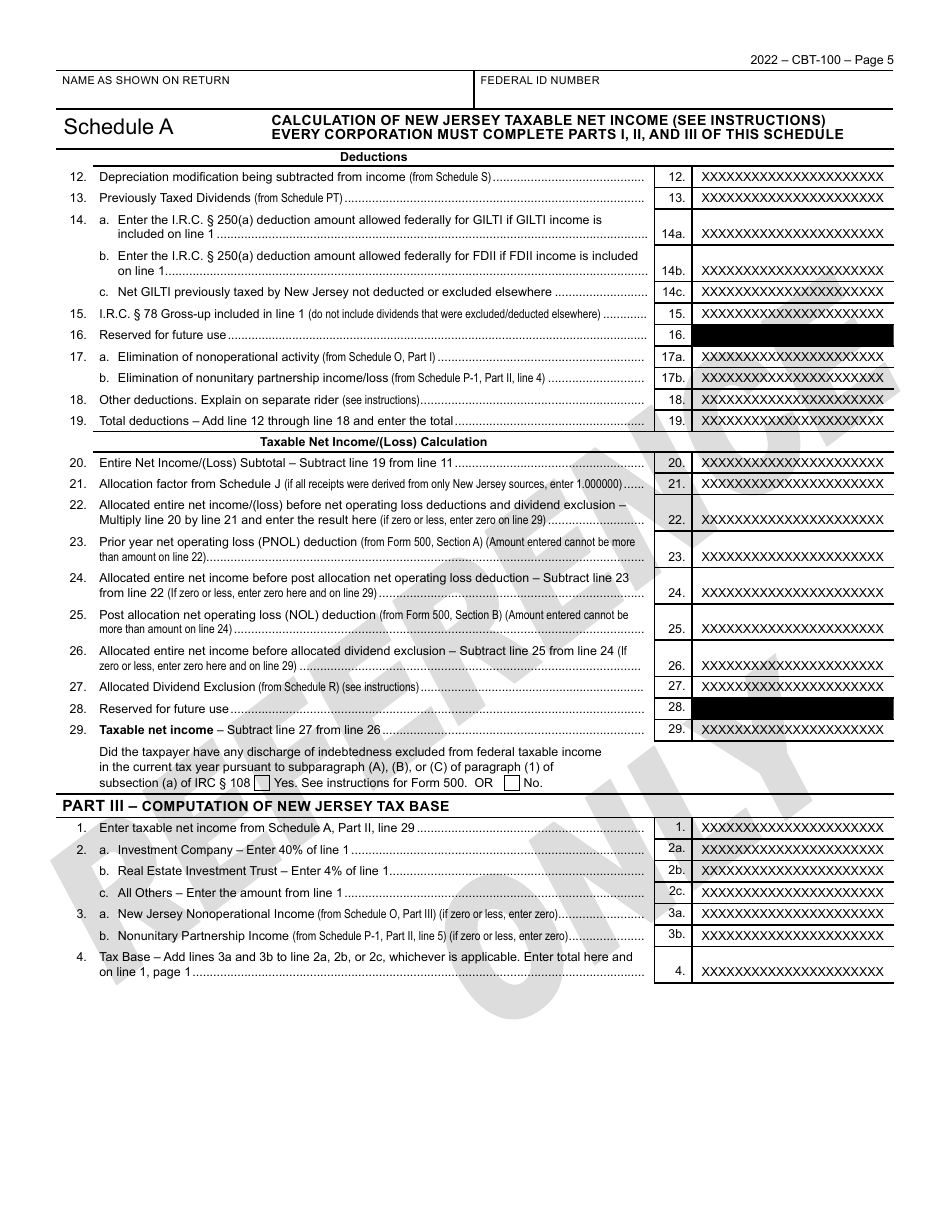

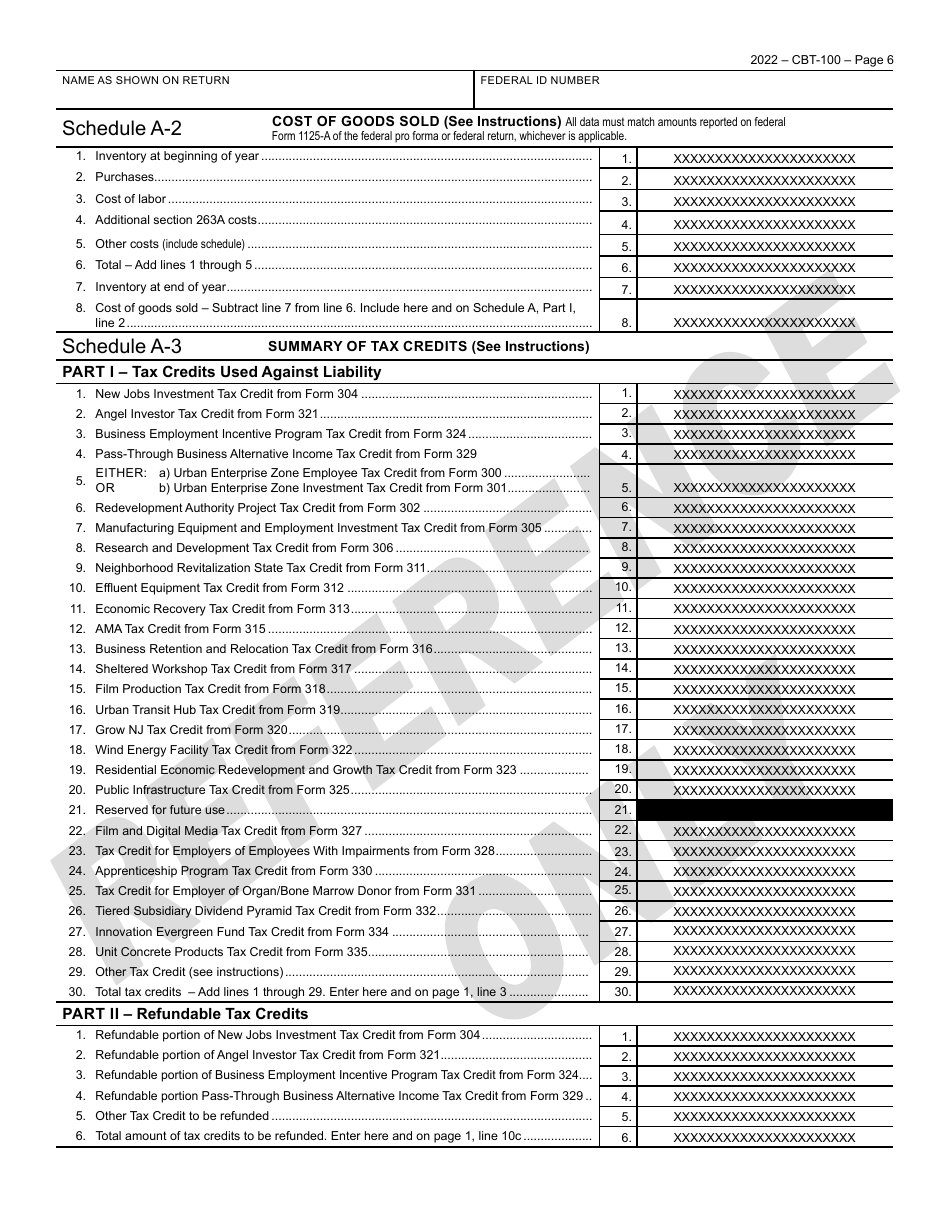

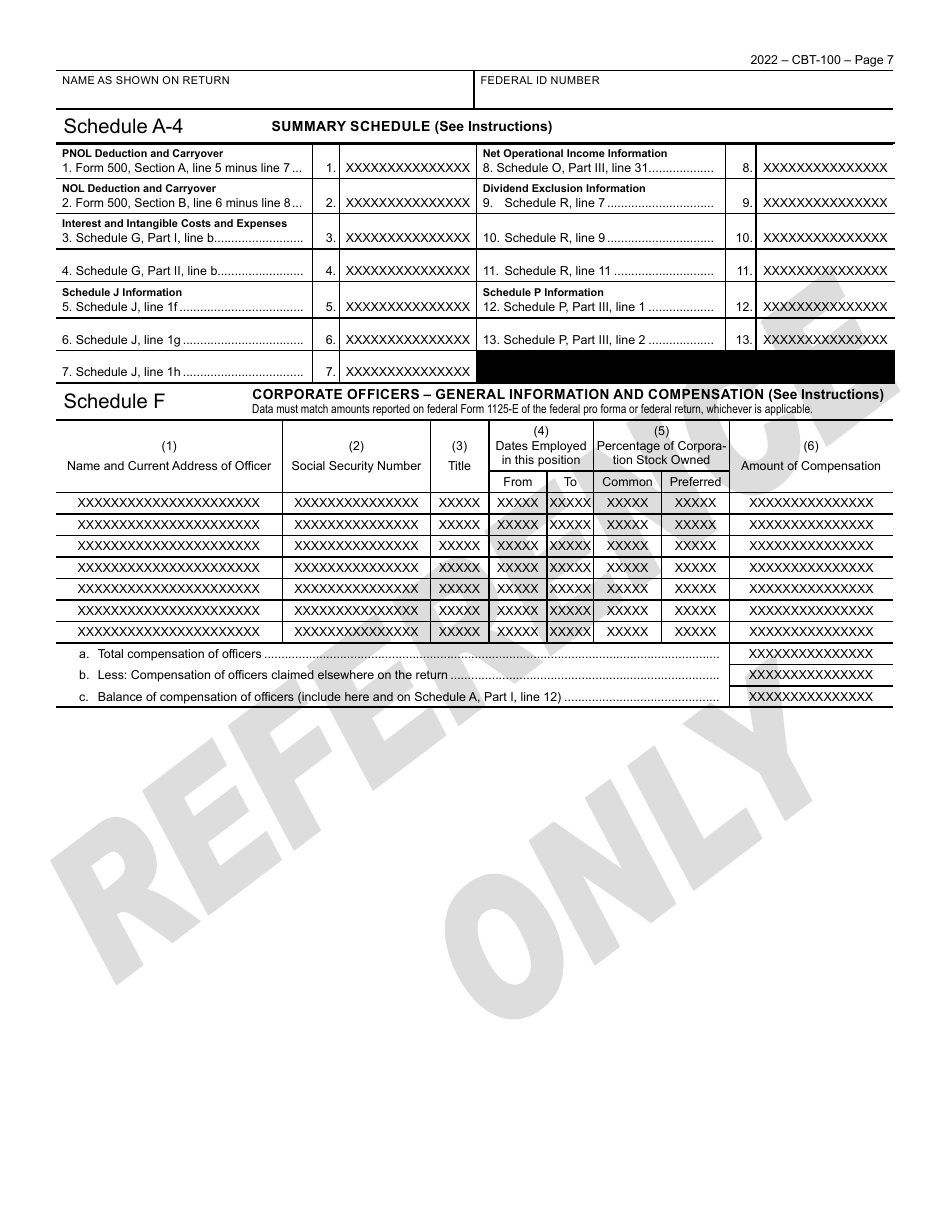

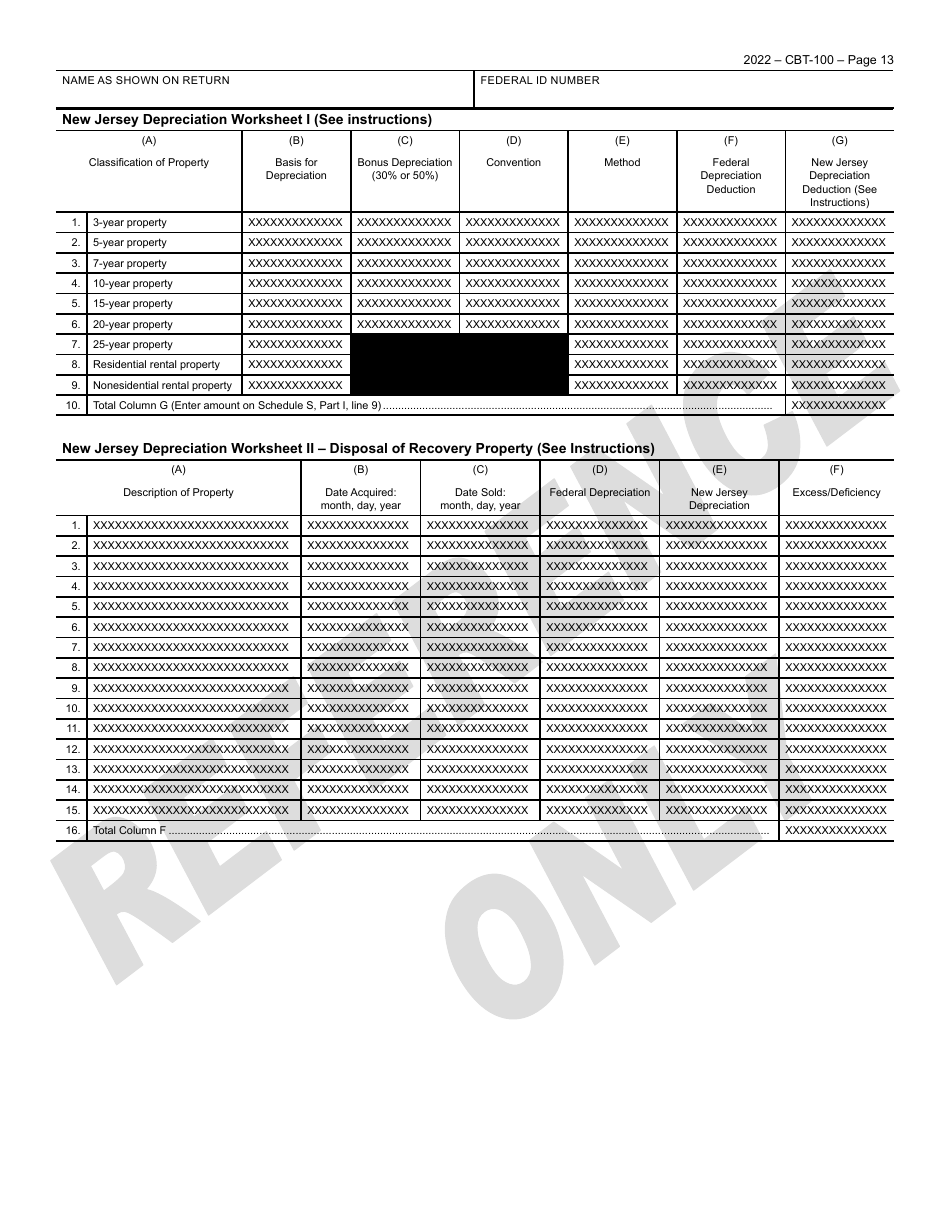

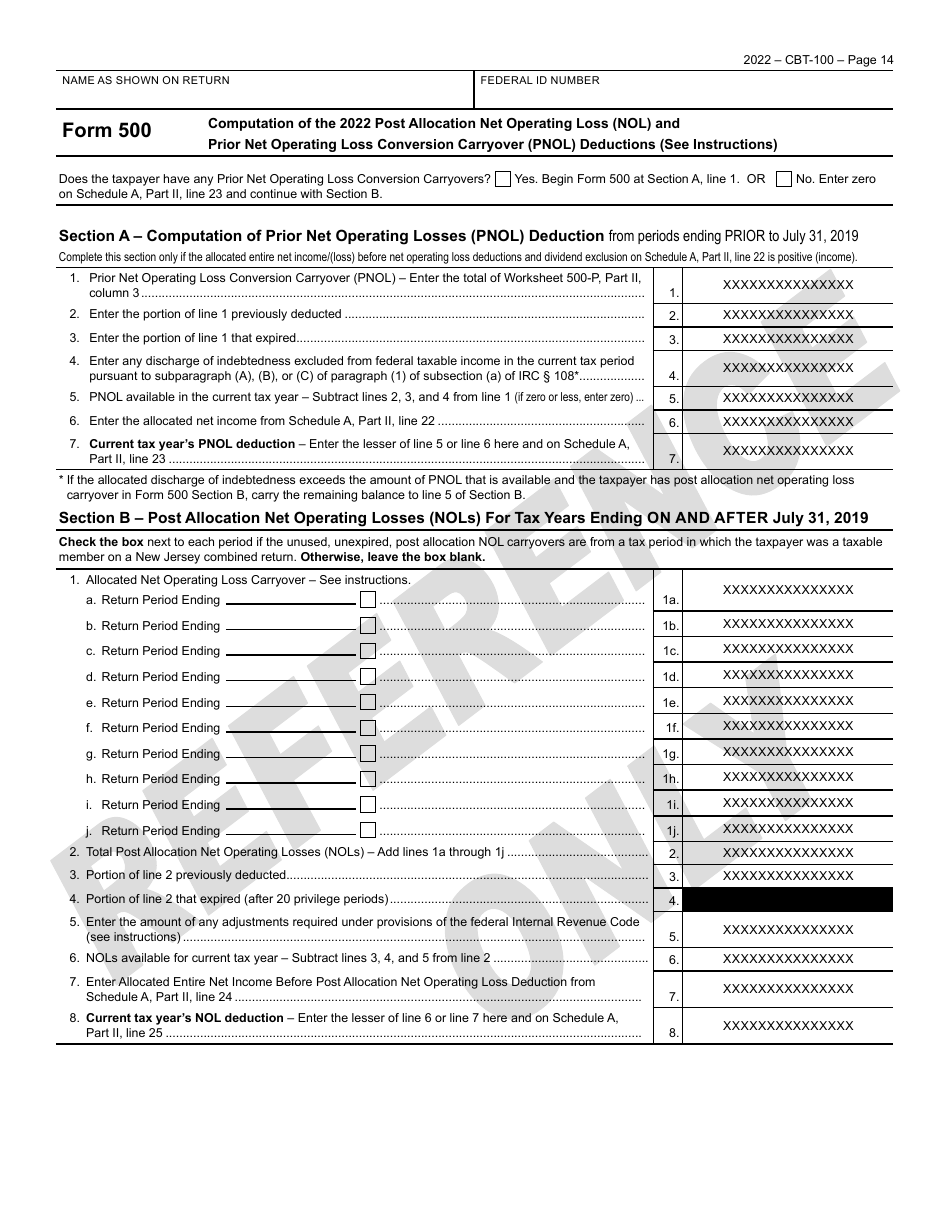

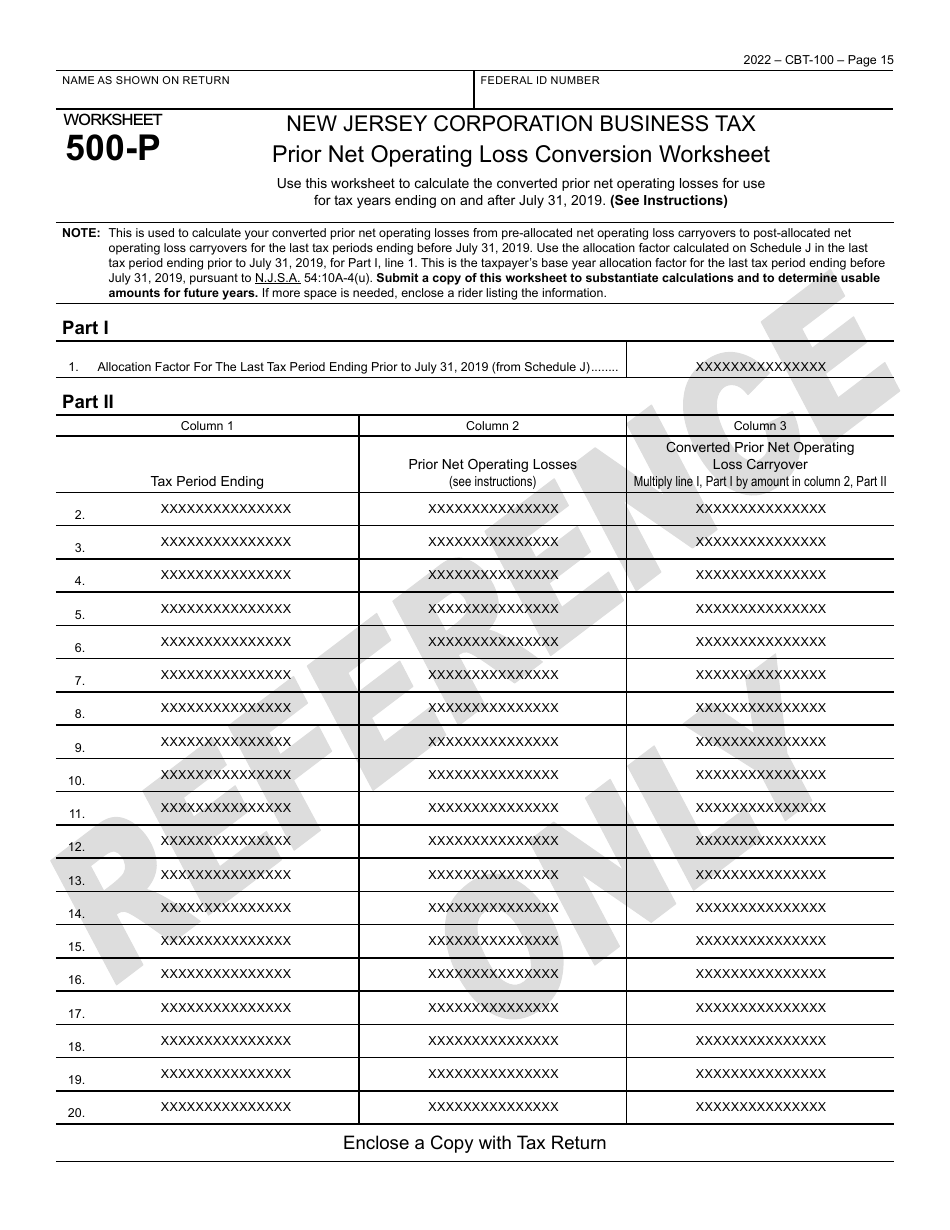

Q: What does the CBT-100 form include?

A: The CBT-100 form includes information about the corporation's income, deductions, credits, and tax liabilities.

Q: When is the CBT-100 due?

A: The due date for filing the CBT-100 form is generally on or before the 15th day of the fourth month following the close of the corporation's tax year.

Q: Are there any penalties for late filing of CBT-100?

A: Yes, there are penalties for late filing of CBT-100, ranging from monetary fines to loss of certain tax benefits.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CBT-100 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.