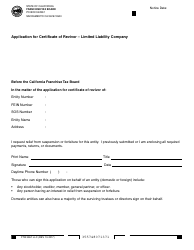

This version of the form is not currently in use and is provided for reference only. Download this version of

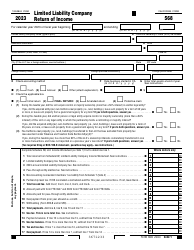

Form LLC-12

for the current year.

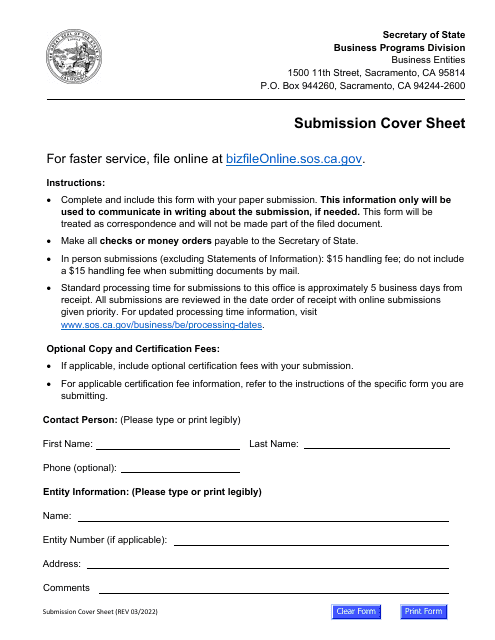

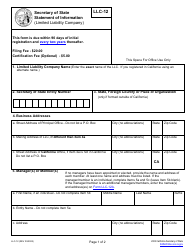

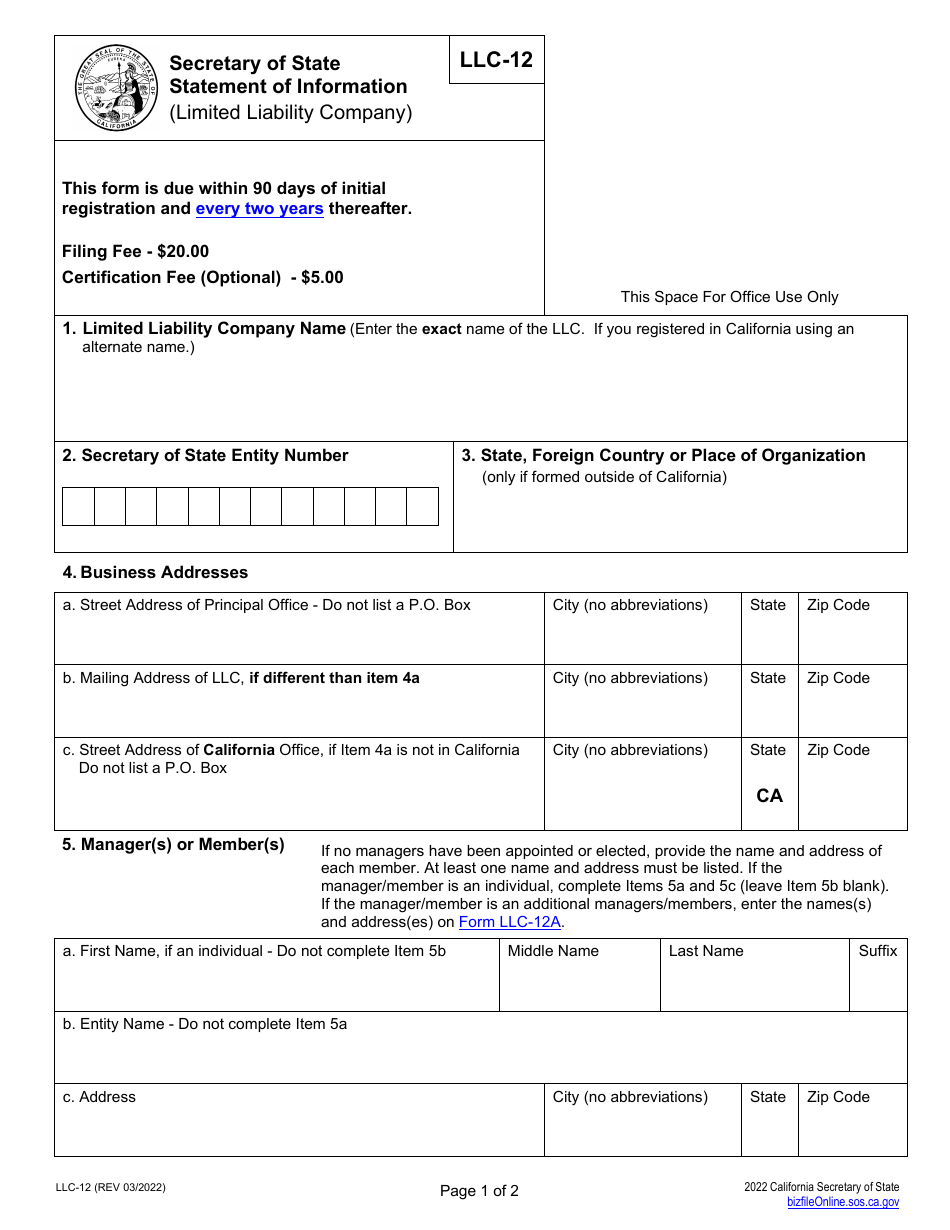

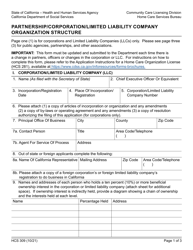

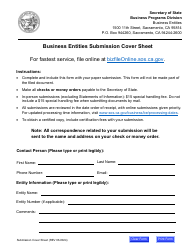

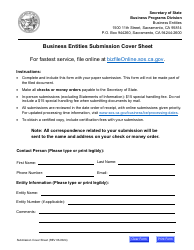

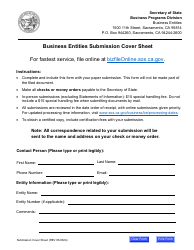

Form LLC-12 Statement of Information (Limited Liability Company) - California

What Is Form LLC-12?

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LLC-12?

A: Form LLC-12 is the Statement of Information for a Limited Liability Company (LLC) in California.

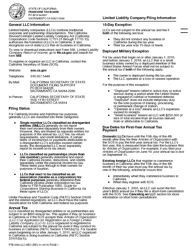

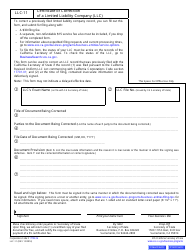

Q: Why do I need to file Form LLC-12?

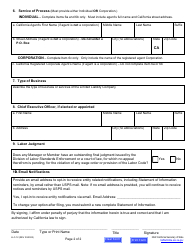

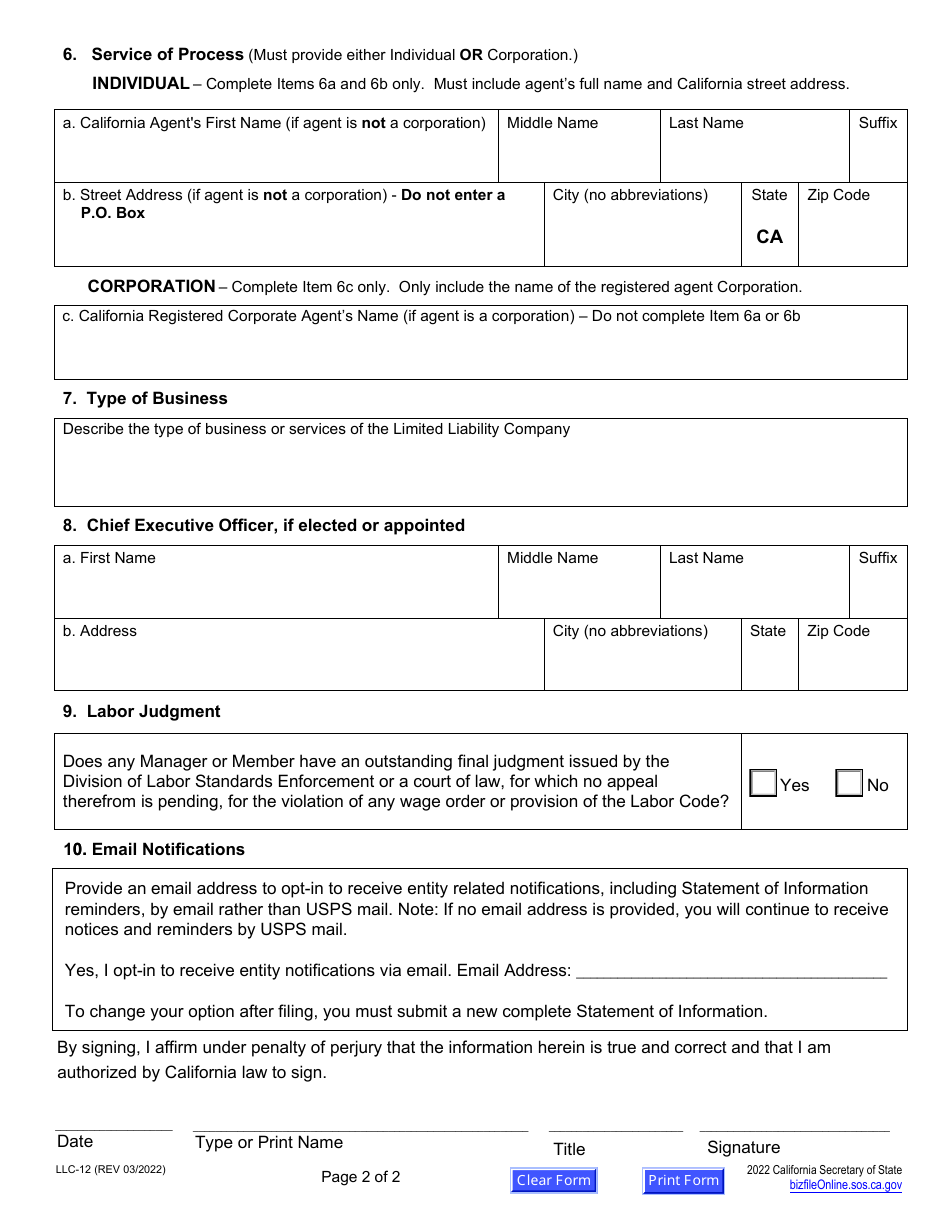

A: LLCs in California are required to file Form LLC-12 to provide updated information about the company, such as the name and address of the LLC's members and managers.

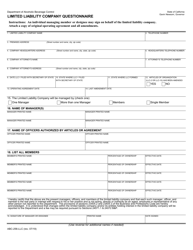

Q: What details are needed to complete Form LLC-12?

A: You will need to provide information such as the LLC's name, address, registered agent, and details about its members and managers.

Q: How much does it cost to file Form LLC-12?

A: The filing fee for Form LLC-12 in California is $20.

Q: When is the deadline to file Form LLC-12?

A: LLCs must file Form LLC-12 within 90 days of filing the Articles of Organization or within 90 days of a change in the information previously filed.

Q: What happens if I don't file Form LLC-12?

A: Failure to file Form LLC-12 can result in penalties, late fees, and your LLC being suspended or dissolved.

Q: Can I request an extension to file Form LLC-12?

A: No, there are no provisions for an extension to file Form LLC-12 in California.

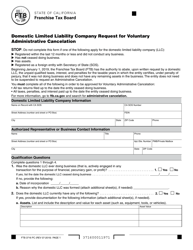

Form Details:

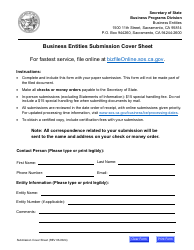

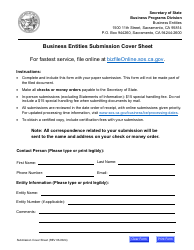

- Released on March 1, 2022;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LLC-12 by clicking the link below or browse more documents and templates provided by the California Secretary of State.