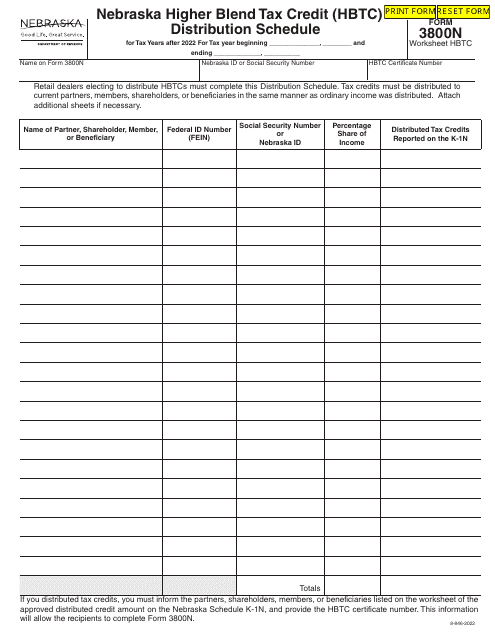

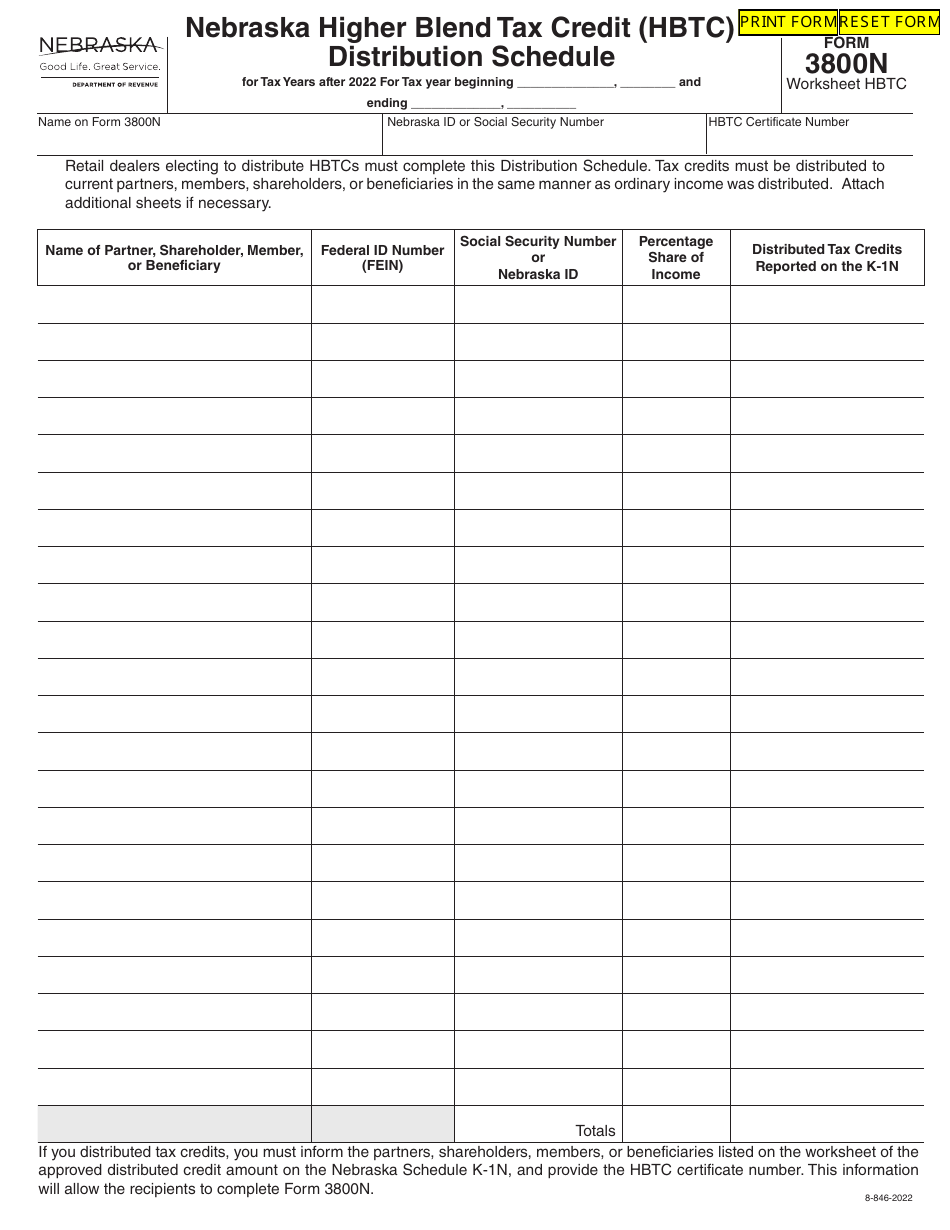

Form 3800N Worksheet HBTC Nebraska Higher Blend Tax Credit (Hbtc) - Distribution Schedule - Nebraska

What Is Form 3800N Worksheet HBTC?

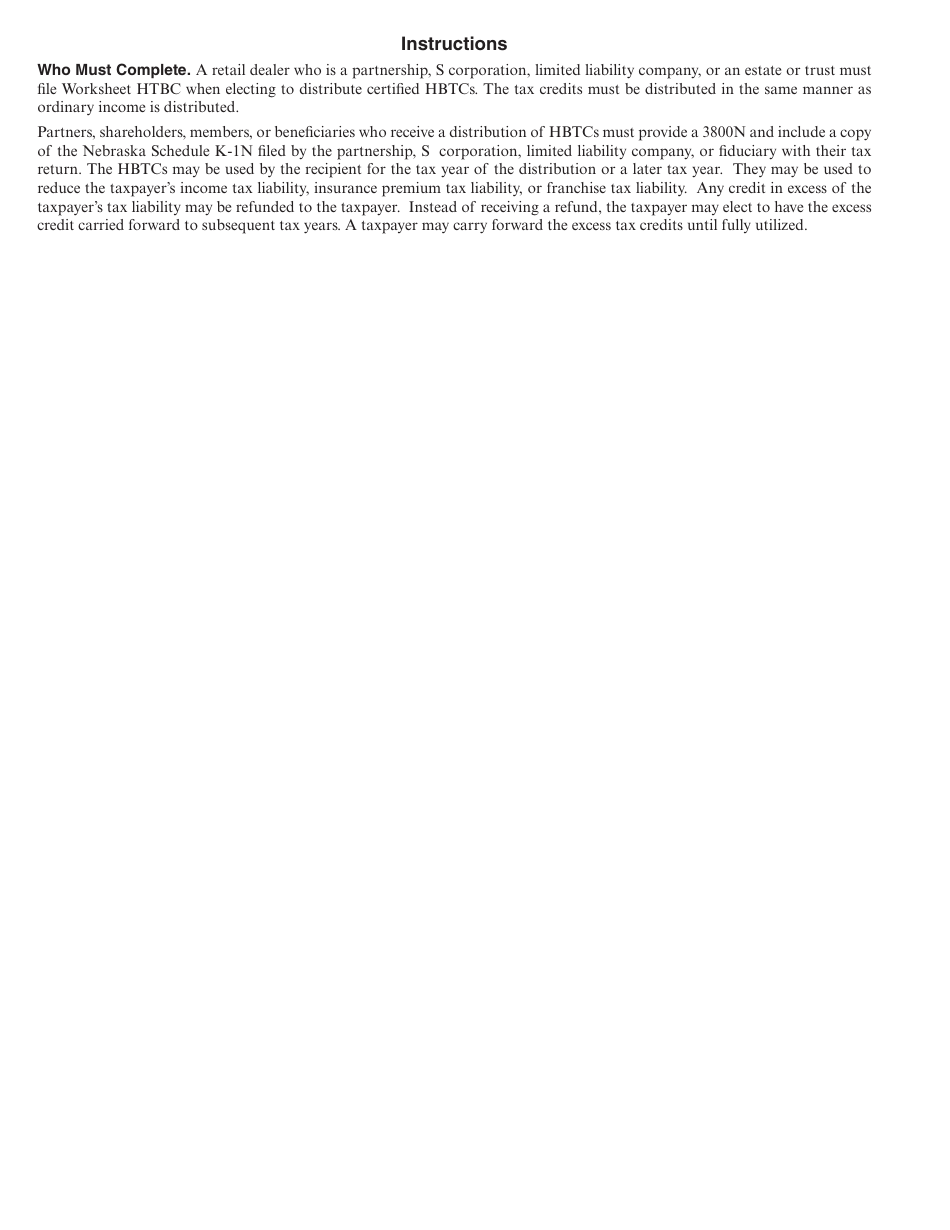

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 3800N, Nebraska Incentives Credit Computation for Tax Years After 2018. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3800N?

A: Form 3800N is a worksheet used for calculating the Nebraska Higher Blend Tax Credit (HBTC).

Q: What is the Nebraska Higher Blend Tax Credit (HBTC)?

A: The Nebraska Higher Blend Tax Credit (HBTC) is a credit given to retailers who sell gasoline blends with a higher percentage of ethanol.

Q: What is the purpose of the Distribution Schedule on Form 3800N?

A: The Distribution Schedule on Form 3800N is used to determine the allocation of the HBTC among multiple retailers.

Q: Who is eligible for the Nebraska Higher Blend Tax Credit (HBTC)?

A: Retailers who sell gasoline blends with at least 25% ethanol content are eligible for the Nebraska HBTC.

Q: What is the benefit of claiming the Nebraska Higher Blend Tax Credit (HBTC)?

A: By claiming the HBTC, retailers can receive a credit against their Nebraska state income tax for each gallon of higher blend fuel sold.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3800N Worksheet HBTC by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.