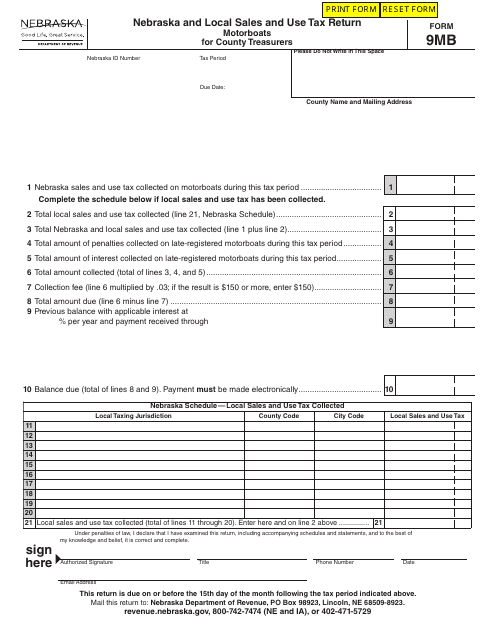

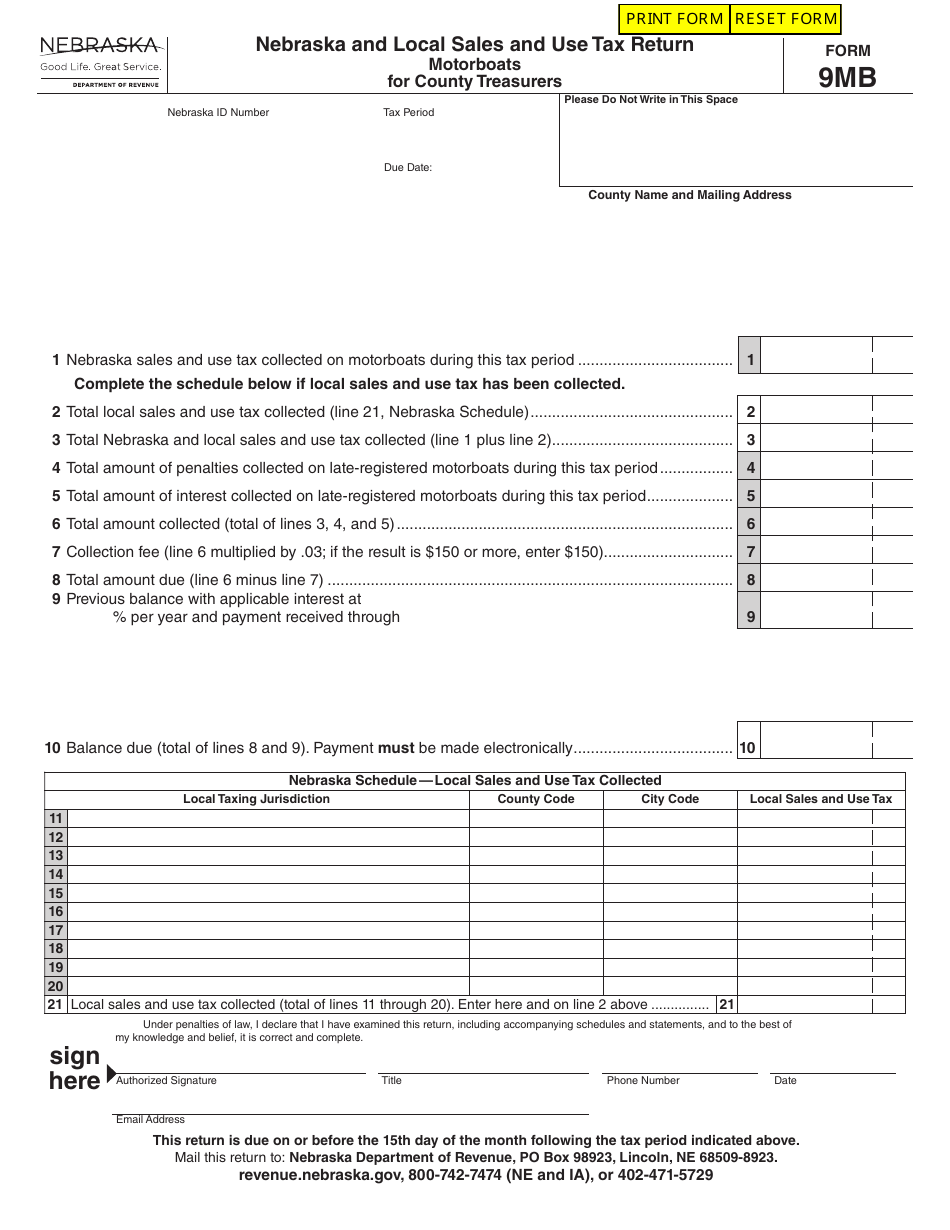

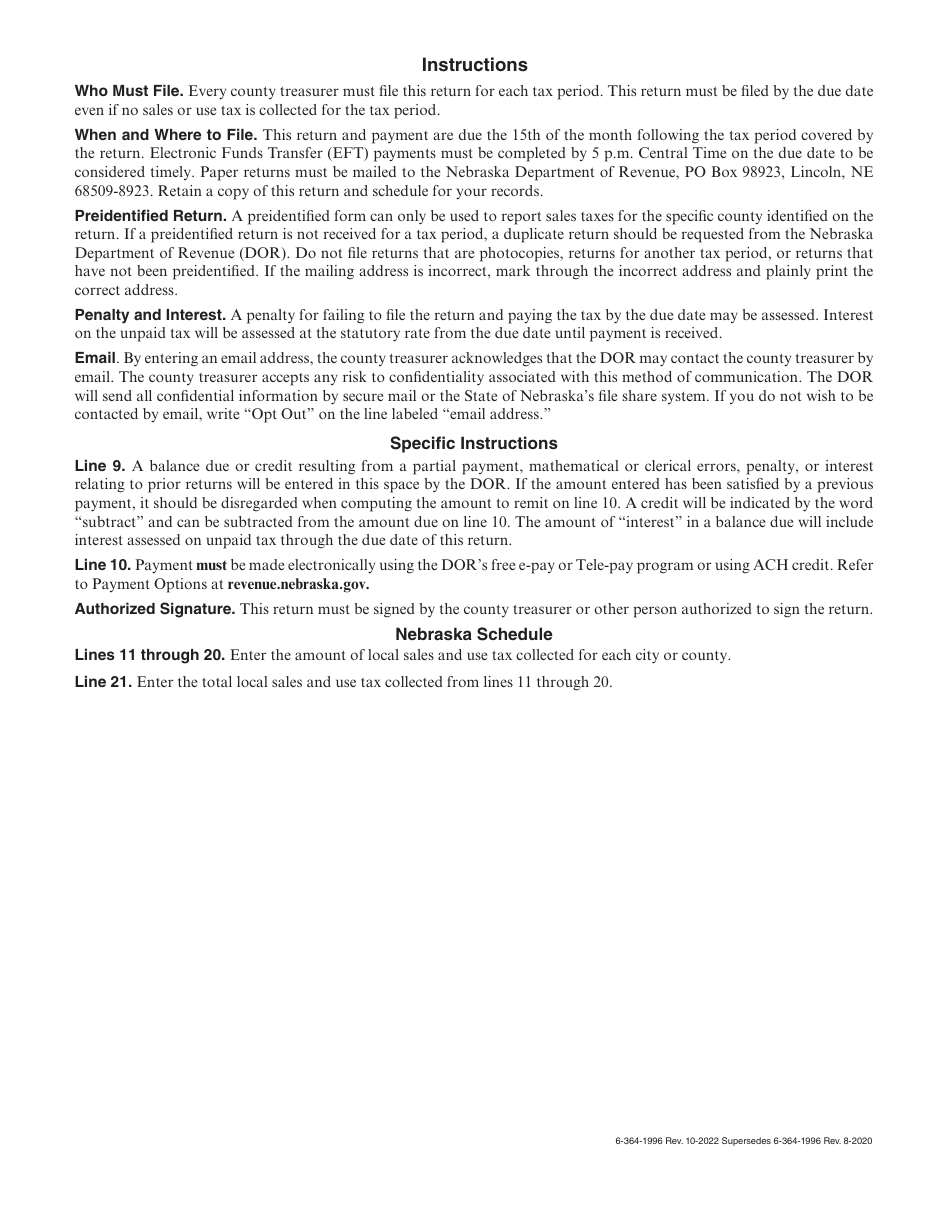

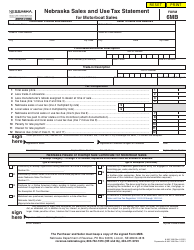

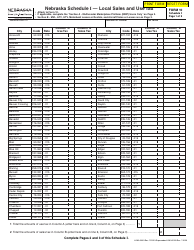

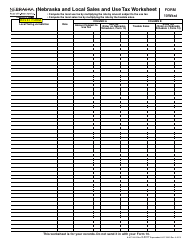

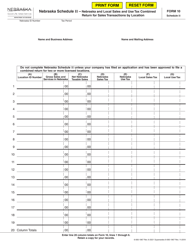

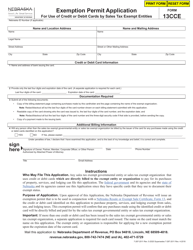

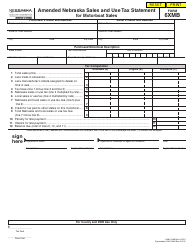

Form 9MB Nebraska and Local Sales and Use Tax Return Motorboats for County Treasurers (For 10 / 2022 and After) - Nebraska

What Is Form 9MB?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 9MB?

A: Form 9MB is the Nebraska and Local Sales and Use Tax Return Motorboats for County Treasurers.

Q: What is the purpose of Form 9MB?

A: Form 9MB is used to report sales and use tax related to motorboats.

Q: Who should file Form 9MB?

A: County Treasurers in Nebraska should file Form 9MB.

Q: When should Form 9MB be filed?

A: Form 9MB should be filed for the period of 10/2022 and after.

Q: What taxes are reported on Form 9MB?

A: Form 9MB is used to report Nebraska sales and use tax, as well as local sales and use taxes related to motorboats.

Q: Is Form 9MB required for all motorboat transactions?

A: Yes, Form 9MB is required for all motorboat transactions subject to sales and use tax.

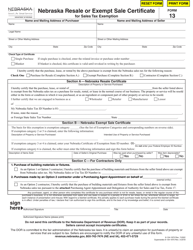

Q: Are there any exemptions for motorboats on Form 9MB?

A: Certain exemptions may apply for specific motorboat transactions. Please refer to the instructions for Form 9MB for more information.

Q: What happens if I fail to file Form 9MB?

A: Failure to file Form 9MB or pay the related taxes may result in penalties and interest being assessed.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 9MB by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.