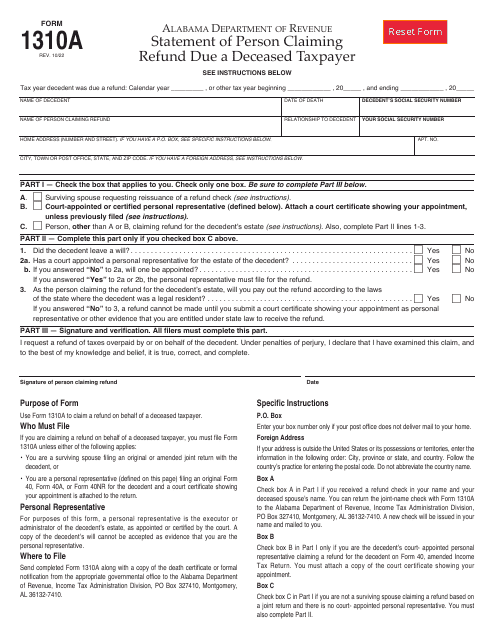

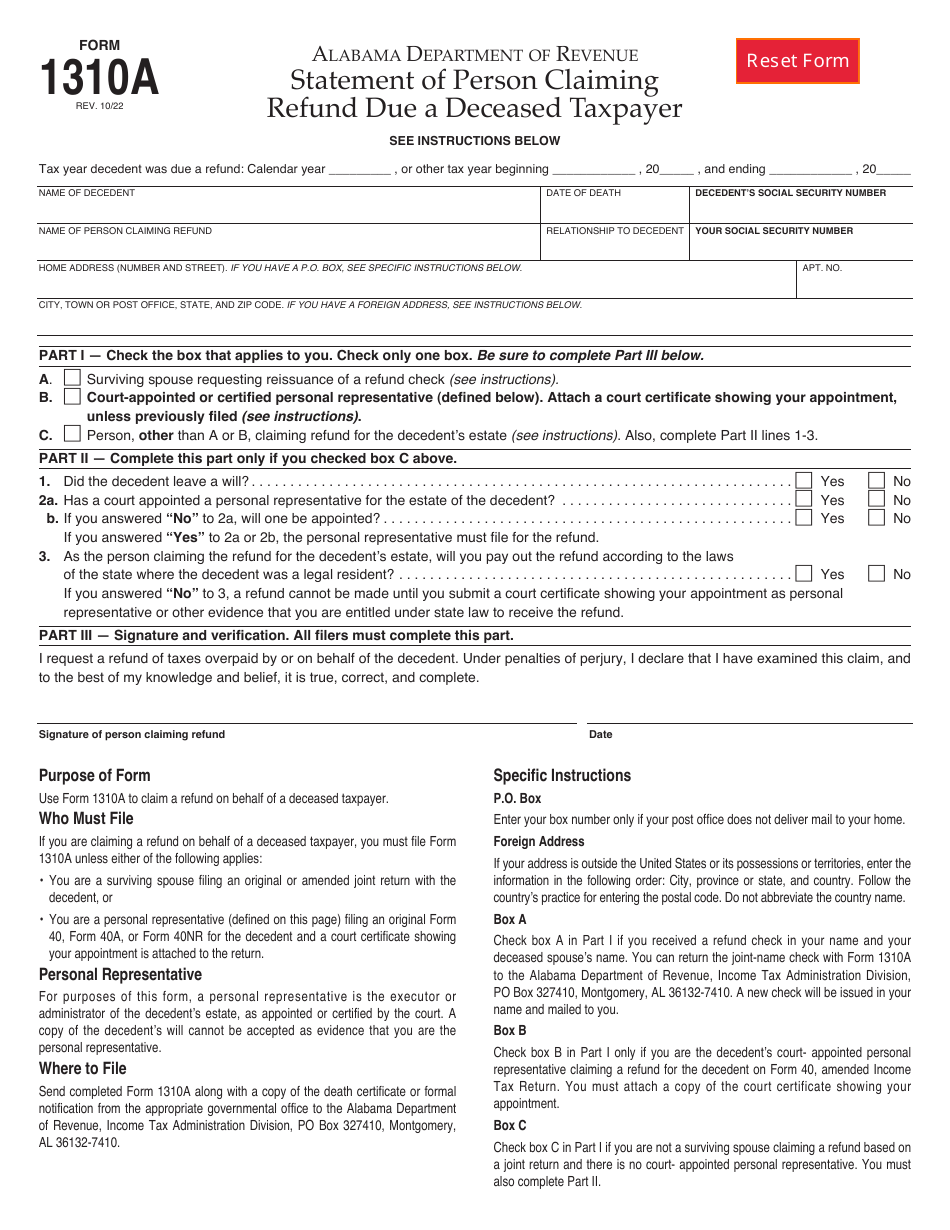

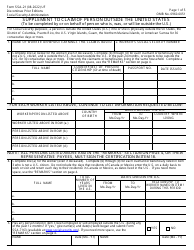

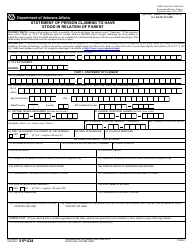

Form 1310A Statement of Person Claiming Refund Due a Deceased Taxpayer - Alabama

What Is Form 1310A?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1310A?

A: Form 1310A is the Statement of Person Claiming Refund Due a Deceased Taxpayer.

Q: Who should use Form 1310A?

A: Form 1310A should be used by individuals claiming a refund on behalf of a deceased taxpayer.

Q: What is the purpose of Form 1310A?

A: The purpose of Form 1310A is to provide the necessary information to claim a refund on behalf of a deceased taxpayer.

Q: Is Form 1310A specific to Alabama?

A: Yes, Form 1310A is specific to Alabama.

Q: Are there any special requirements for filing Form 1310A?

A: Yes, you must attach a copy of the taxpayer's death certificate and provide proof of your authority to claim the refund.

Q: Is there a deadline for filing Form 1310A?

A: Yes, Form 1310A must be filed within three years from the date of the taxpayer's death.

Q: Can I e-file Form 1310A?

A: No, Form 1310A must be filed by mail.

Q: Is there a fee to file Form 1310A?

A: No, there is no fee to file Form 1310A.

Q: Are there any other forms that need to be filed along with Form 1310A?

A: You may need to file additional forms, such as Form 40 or Form 40NR, depending on the individual circumstances of the deceased taxpayer.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1310A by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.