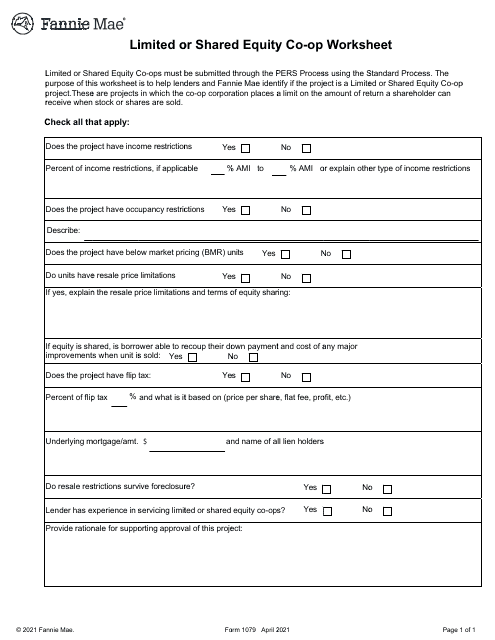

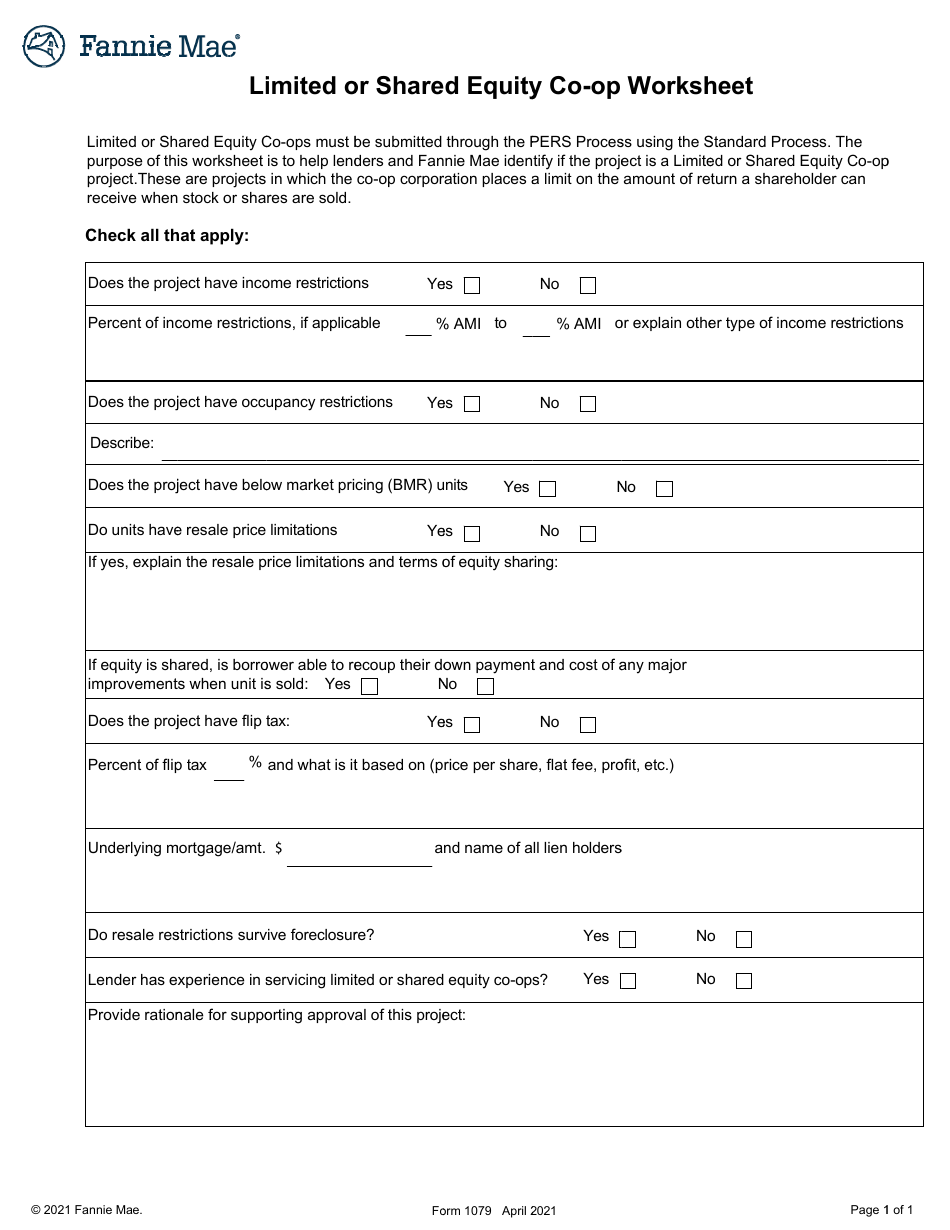

Form 1079 Limited or Shared Equity Co-op Worksheet

What Is Form 1079?

This is a legal form that was released by the Federal National Mortgage Association (Fannie Mae) on April 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1079?

A: Form 1079 is a Limited or Shared Equity Co-op Worksheet.

Q: What is a Limited or Shared Equity Co-op?

A: A Limited or Shared Equity Co-op is a cooperative housing arrangement where the resale value of the property is restricted.

Q: What is the purpose of Form 1079?

A: Form 1079 is used to determine the maximum allowable selling price of a Limited or Shared Equity Co-op unit.

Q: Who is responsible for completing Form 1079?

A: The cooperative housing organization or the property owner is responsible for completing Form 1079.

Q: Is Form 1079 required for all cooperative housing units?

A: No, Form 1079 is only required for Limited or Shared Equity Co-op units.

Q: What information is required on Form 1079?

A: Form 1079 requires information about the unit's purchase price, appraised value, and any resale restrictions.

Q: How does Form 1079 impact the sale of a Limited or Shared Equity Co-op unit?

A: Form 1079 helps determine the maximum selling price and ensures compliance with resale restrictions.

Q: Can Form 1079 be used for other types of cooperative housing?

A: No, Form 1079 is specifically designed for Limited or Shared Equity Co-op units.

Q: Are there any penalties for not filing Form 1079?

A: Failure to file Form 1079 may result in penalties or delays in the sale of a Limited or Shared Equity Co-op unit.

Form Details:

- Released on April 1, 2021;

- The latest available edition released by the Federal National Mortgage Association (Fannie Mae);

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1079 by clicking the link below or browse more documents and templates provided by the Federal National Mortgage Association (Fannie Mae).