This version of the form is not currently in use and is provided for reference only. Download this version of

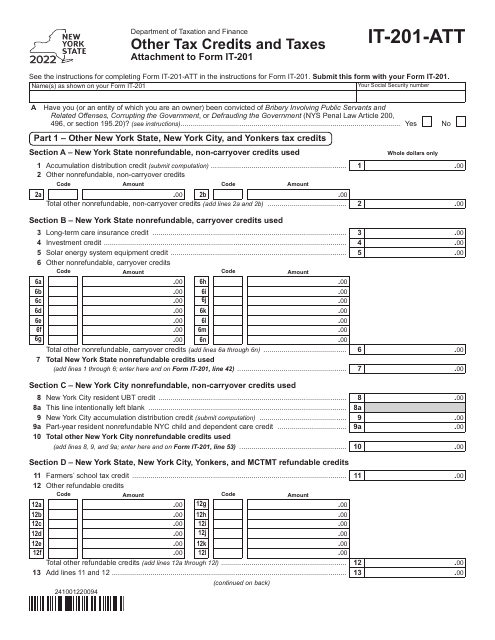

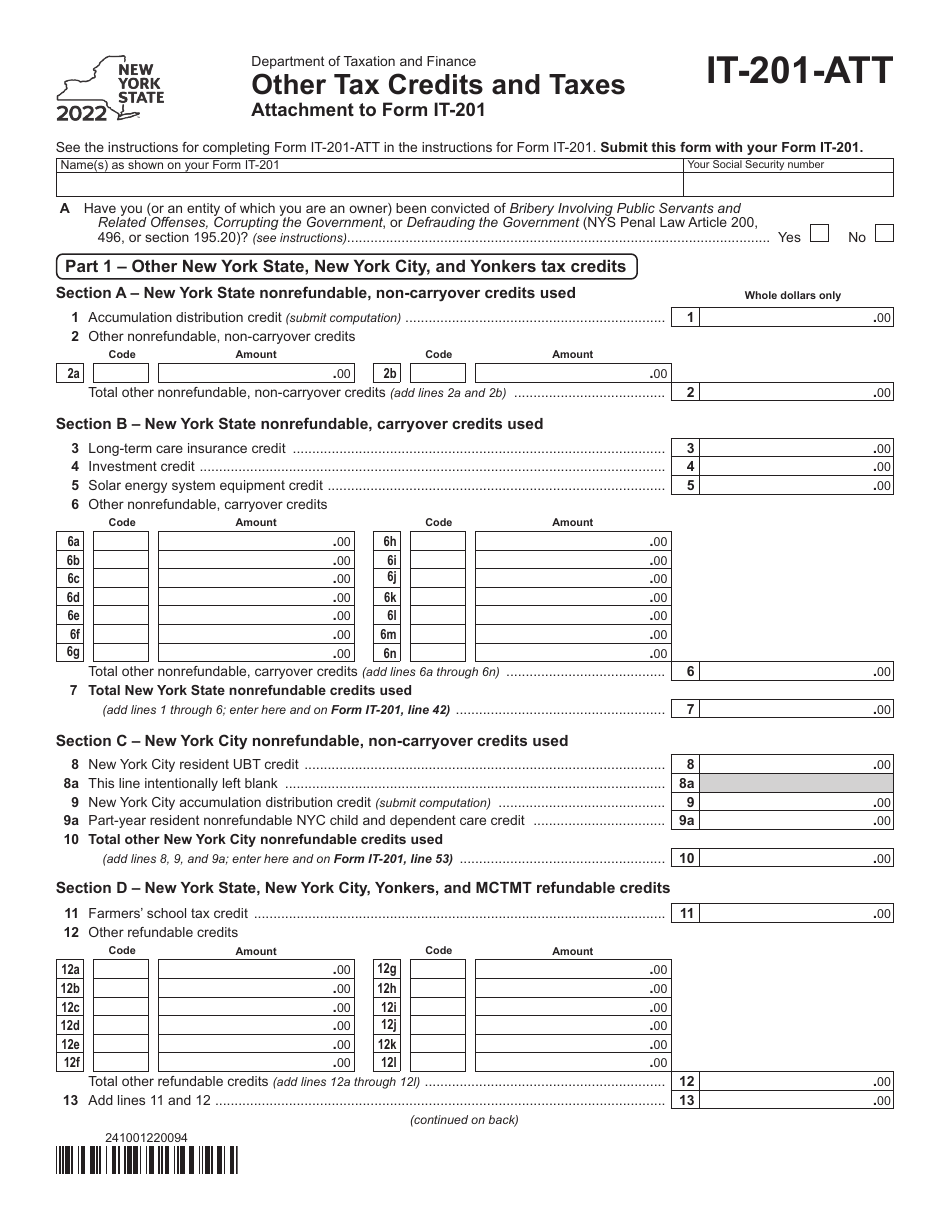

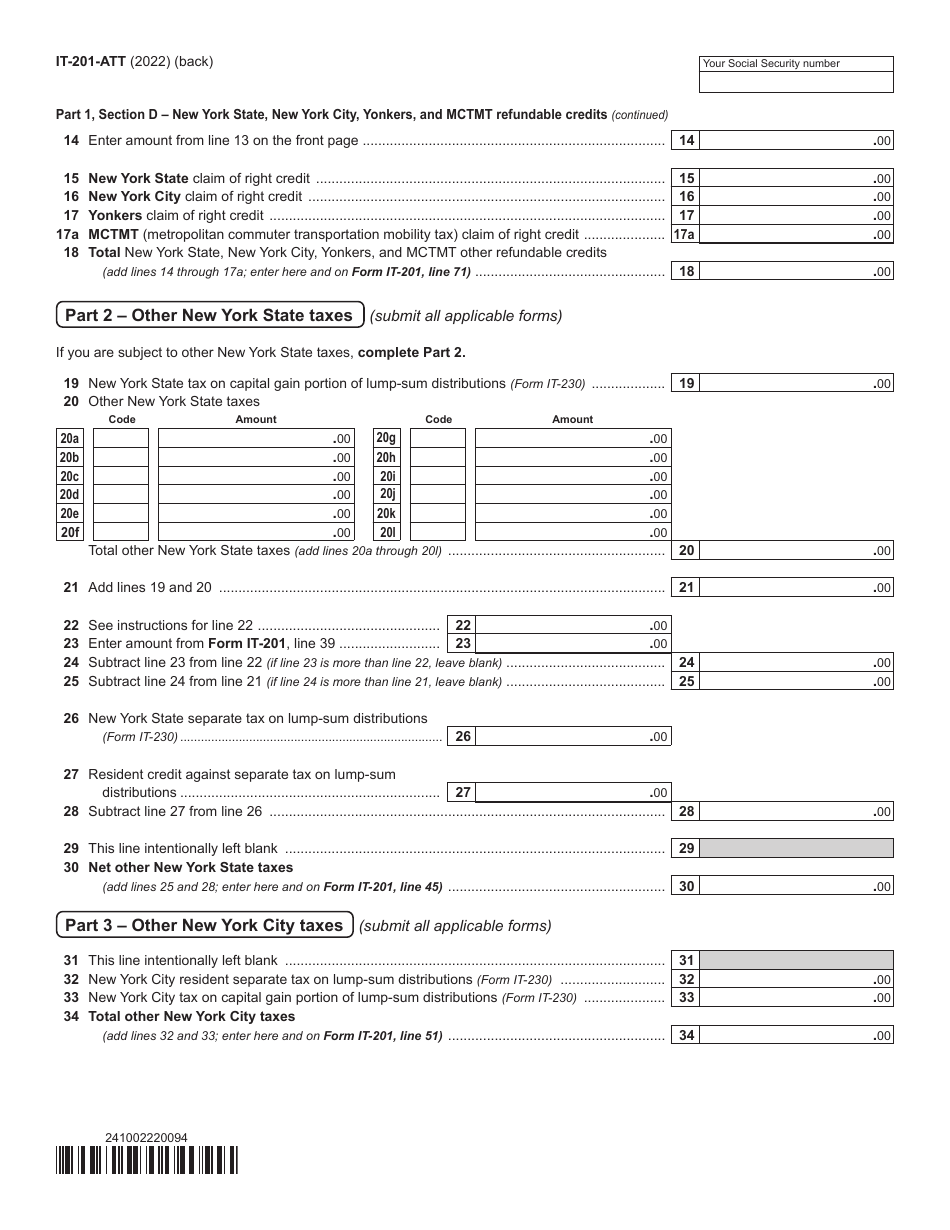

Form IT-201-ATT

for the current year.

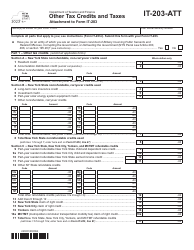

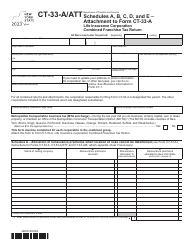

Form IT-201-ATT Other Tax Credits and Taxes - New York

What Is Form IT-201-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-201-ATT?

A: Form IT-201-ATT is a supplemental form used by residents of New York to claim additional tax credits and report certain taxes.

Q: What are tax credits?

A: Tax credits are deductions from your tax liability that directly reduce the amount of taxes you owe.

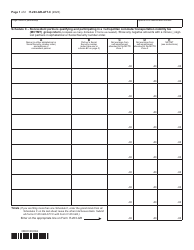

Q: What types of tax credits are available on Form IT-201-ATT?

A: Form IT-201-ATT includes tax credits such as child and dependent care credit, college tuition credit, and real property tax credit.

Q: What are the other taxes reported on Form IT-201-ATT?

A: Form IT-201-ATT is also used to report other taxes such as the MCTMT (Metropolitan Commuter Transportation Mobility Tax).

Q: Do I need to file Form IT-201-ATT if I don't have any additional tax credits or other taxes to report?

A: No, you only need to file Form IT-201-ATT if you have eligible tax credits to claim or specific taxes to report.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-201-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.