This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-2104-SNY

for the current year.

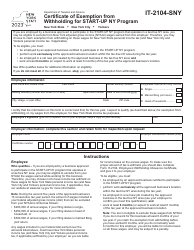

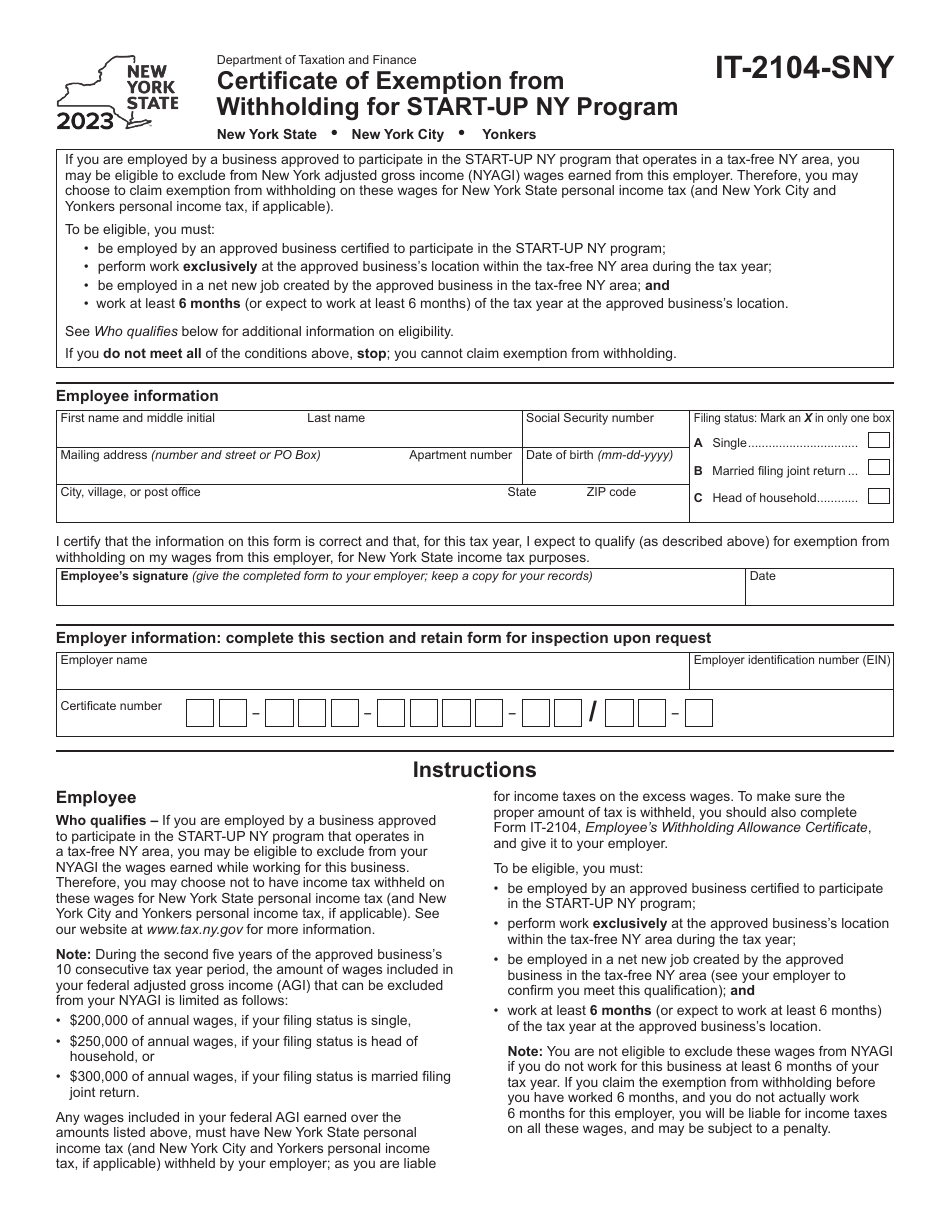

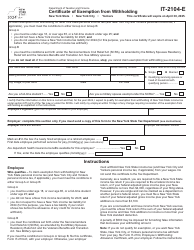

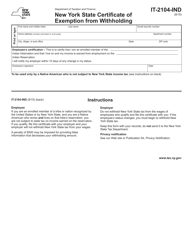

Form IT-2104-SNY Certificate of Exemption From Withholding for Start-Up Ny Program - New York

What Is Form IT-2104-SNY?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-2104-SNY?

A: Form IT-2104-SNY is a certificate of exemption from withholding for the Start-Up NY program in New York.

Q: Who needs to complete Form IT-2104-SNY?

A: Individuals who qualify for the Start-Up NY program and want to be exempt from withholding taxes.

Q: What is the Start-Up NY program?

A: The Start-Up NY program is a state initiative that allows qualifying businesses to operate tax-free for a period of time.

Q: What information is required on Form IT-2104-SNY?

A: Form IT-2104-SNY requires personal information, business information, and a certification statement.

Q: When should I submit Form IT-2104-SNY?

A: Form IT-2104-SNY should be submitted to your employer before the first paycheck is issued.

Q: How long does the exemption last?

A: The exemption lasts for the calendar year, but it must be renewed annually.

Q: Can I claim the exemption for multiple jobs?

A: Yes, but you must submit a separate Form IT-2104-SNY for each employer.

Q: Do I still need to file a tax return if I claim the exemption?

A: Yes, you are still required to file a tax return, but you may be eligible for a refund if you overpaid.

Q: What happens if I no longer qualify for the exemption?

A: If you no longer qualify for the exemption, you must submit a new Form IT-2104-SNY to your employer and start withholding taxes again.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2104-SNY by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.