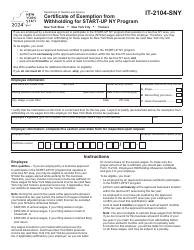

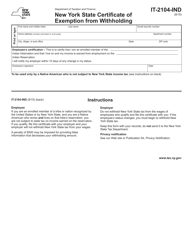

This version of the form is not currently in use and is provided for reference only. Download this version of

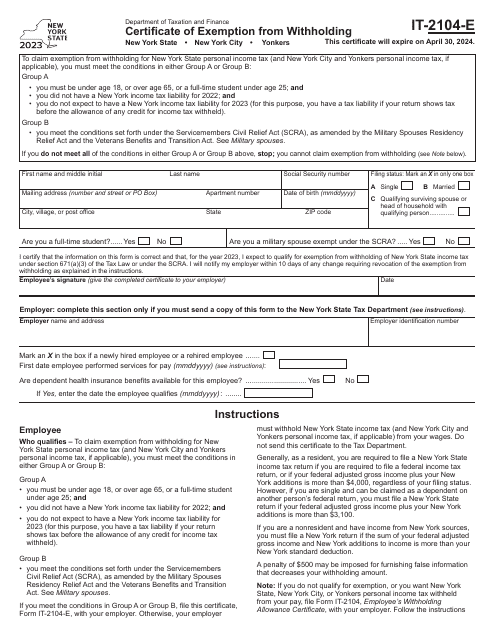

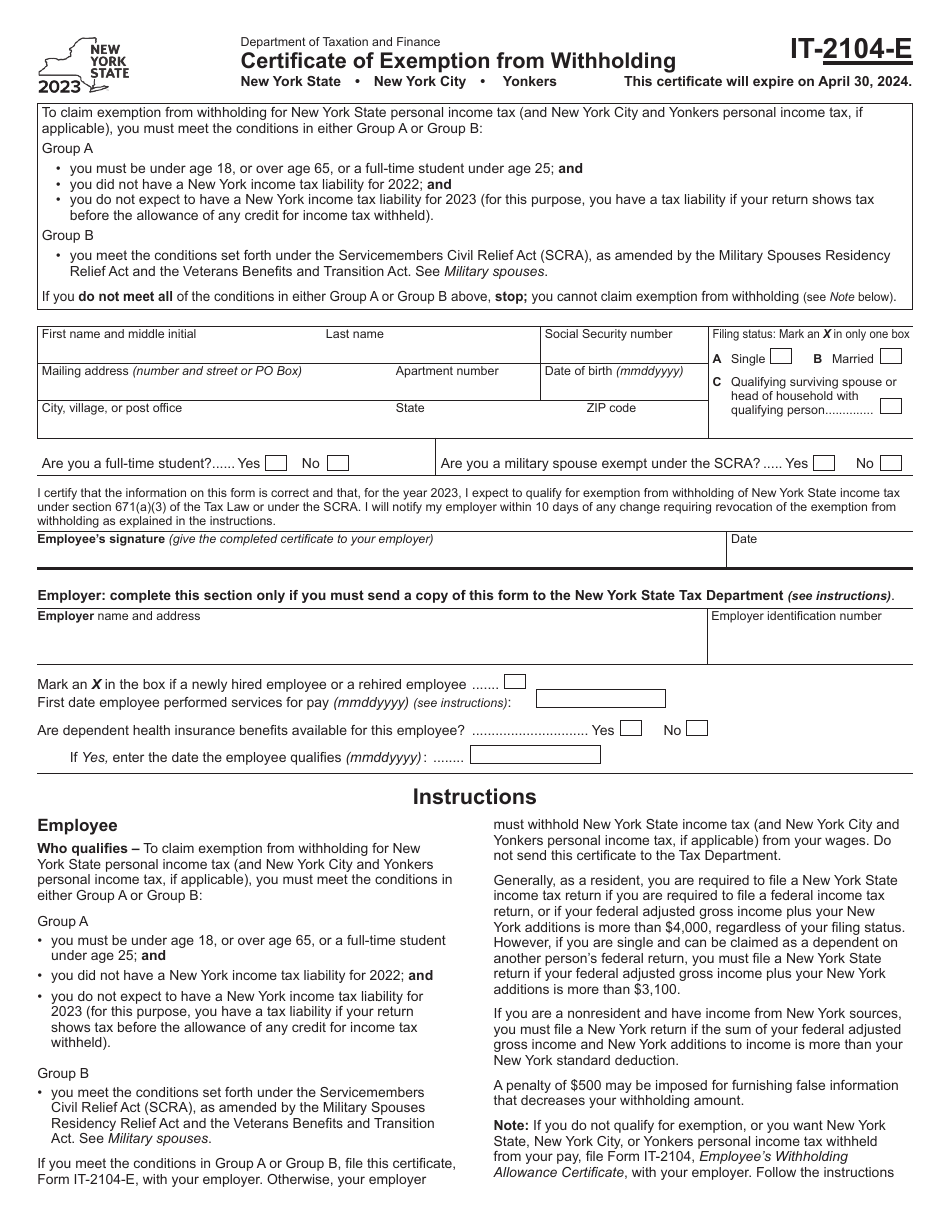

Form IT-2104-E

for the current year.

Form IT-2104-E Certificate of Exemption From Withholding - New York

What Is Form IT-2104-E?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-2104-E?

A: Form IT-2104-E is a Certificate of Exemption From Withholding in the state of New York.

Q: When do I need to fill out Form IT-2104-E?

A: You need to fill out Form IT-2104-E if you are claiming exemption from withholding on your New York State personal income tax.

Q: Who is eligible to claim exemption on Form IT-2104-E?

A: You are eligible to claim exemption on Form IT-2104-E if you meet certain criteria, such as being a full-year New York State resident with no New York State tax liability last year.

Q: How do I fill out Form IT-2104-E?

A: You need to provide your personal information, certify your eligibility for exemption, and sign the form.

Q: Do I need to submit Form IT-2104-E every year?

A: No, you do not need to submit Form IT-2104-E every year. However, you will need to submit a new form if your exemption status changes.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2104-E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.