This version of the form is not currently in use and is provided for reference only. Download this version of

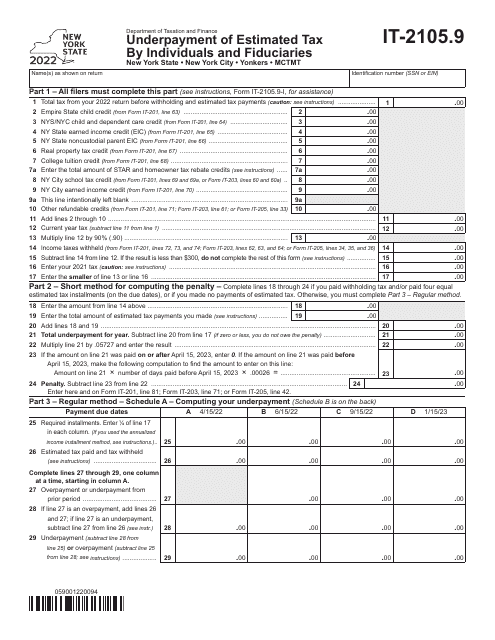

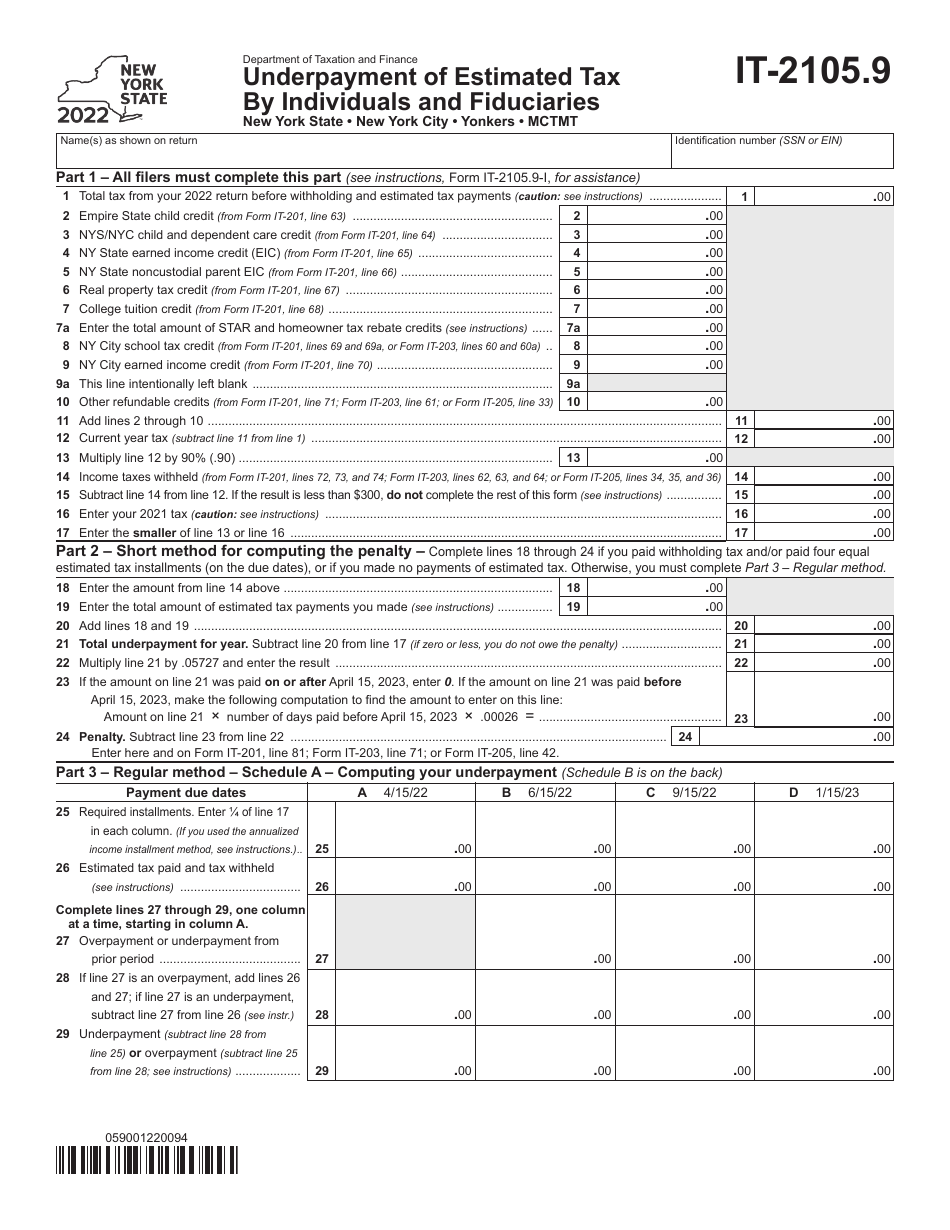

Form IT-2105.9

for the current year.

Form IT-2105.9 Underpayment of Estimated Tax by Individuals and Fiduciaries - New York

What Is Form IT-2105.9?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-2105.9?

A: Form IT-2105.9 is a form used to report and calculate underpayment of estimated tax for individuals and fiduciaries in New York.

Q: Who needs to file Form IT-2105.9?

A: Any individual or fiduciary who had an underpayment of estimated tax in New York must file Form IT-2105.9.

Q: What is considered underpayment of estimated tax?

A: Underpayment of estimated tax occurs when you did not pay enough in estimated tax payments throughout the year to cover your tax liability in New York.

Q: When is Form IT-2105.9 due?

A: Form IT-2105.9 is typically due on April 15th of the following year, the same day as your New York state income tax return.

Q: How do I calculate my underpayment of estimated tax?

A: You can calculate your underpayment of estimated tax by following the instructions provided on Form IT-2105.9. It involves comparing your estimated tax payments to your actual tax liability.

Q: What happens if I do not file Form IT-2105.9?

A: If you had an underpayment of estimated tax in New York and do not file Form IT-2105.9, you may be subject to penalties and interest on the unpaid amount.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2105.9 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.