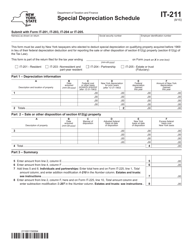

This version of the form is not currently in use and is provided for reference only. Download this version of

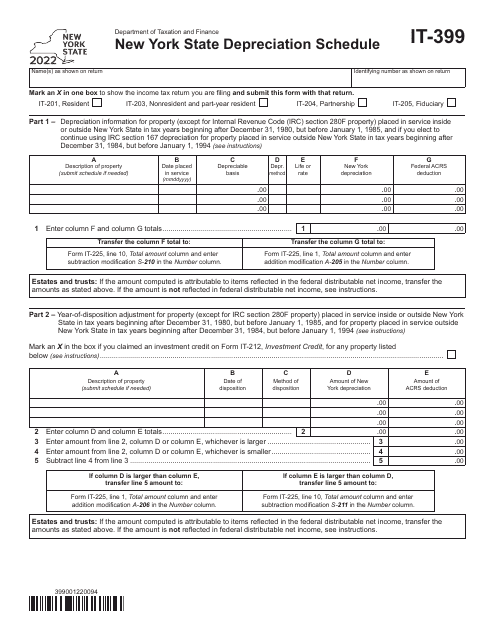

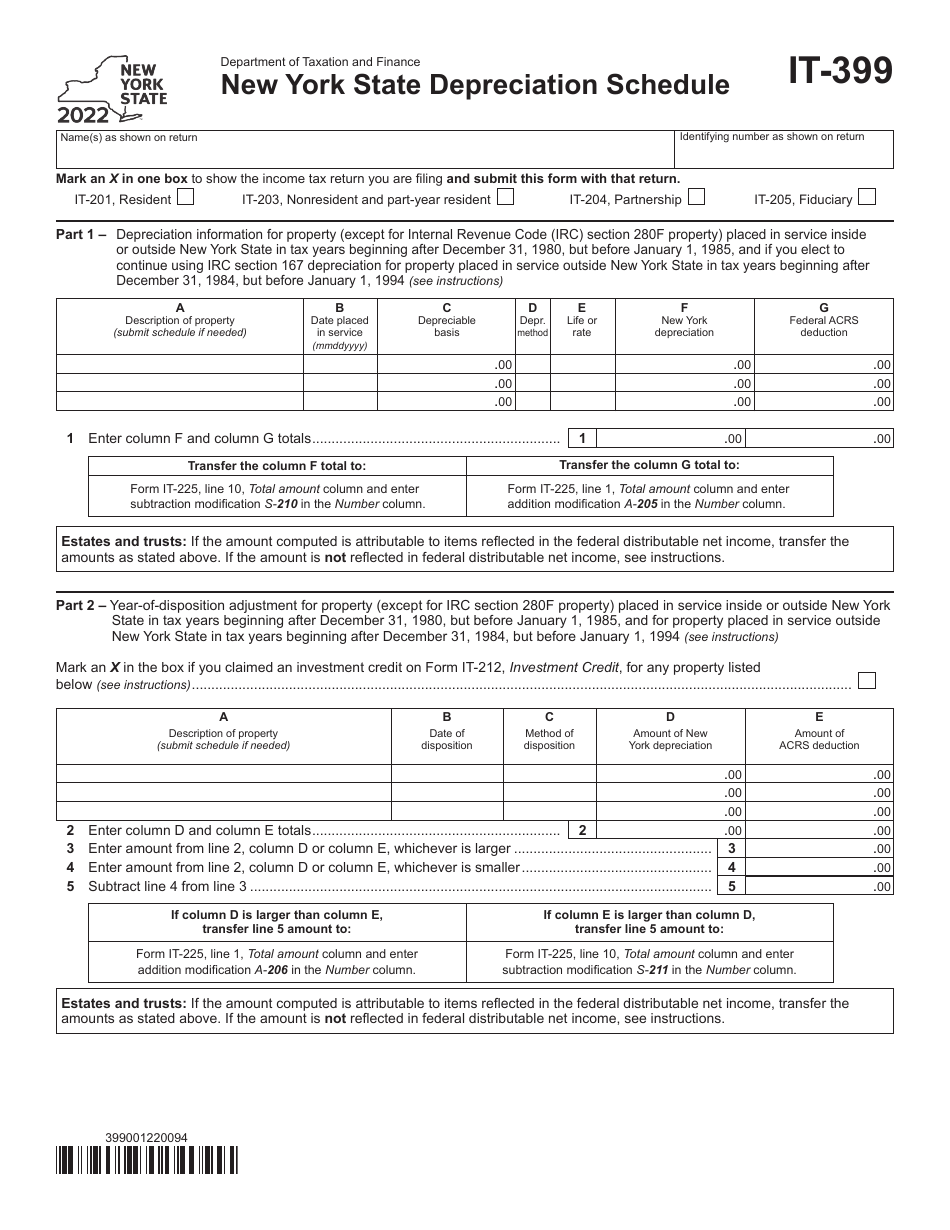

Form IT-399

for the current year.

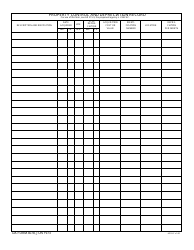

Form IT-399 New York State Depreciation Schedule - New York

What Is Form IT-399?

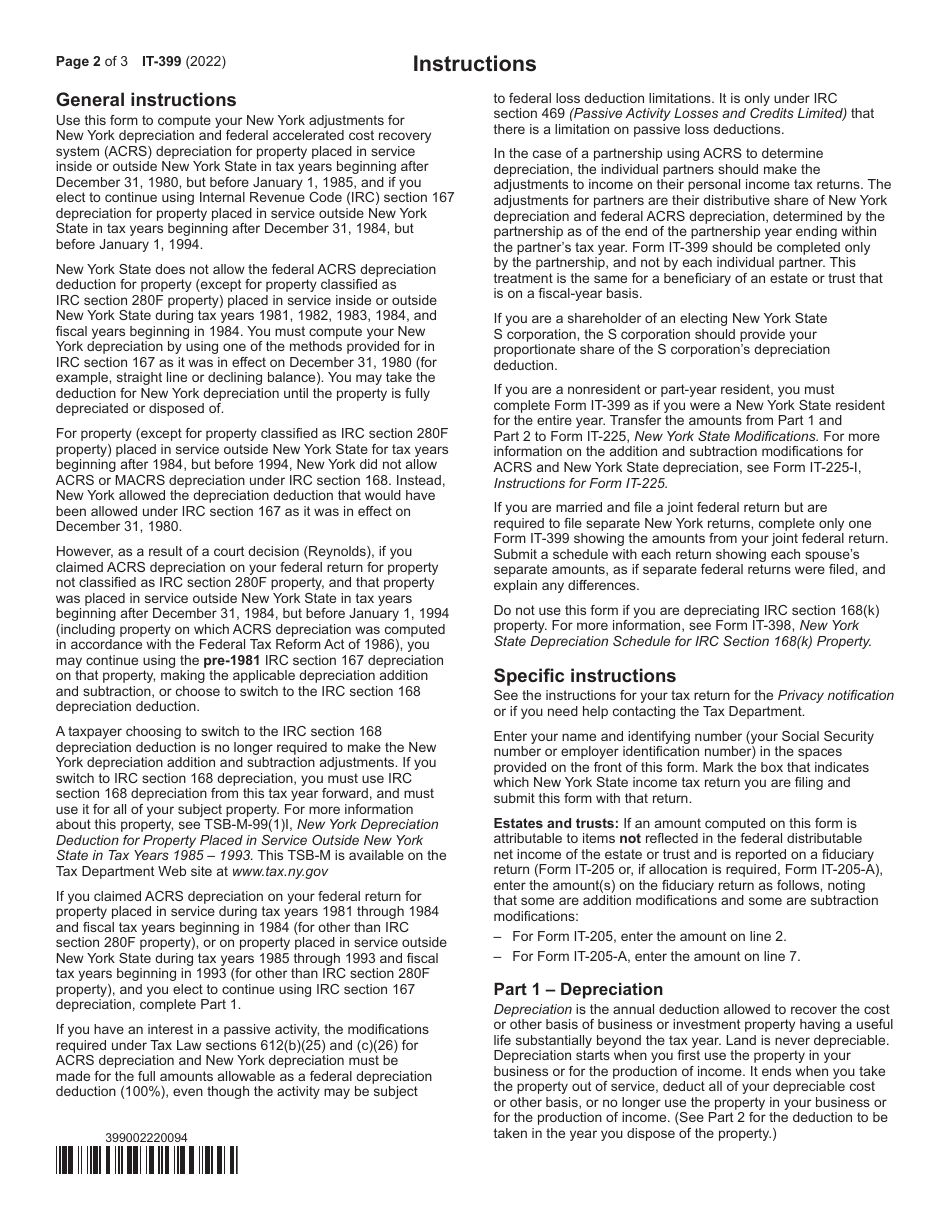

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-399?

A: Form IT-399 is the New York State Depreciation Schedule.

Q: What is the purpose of Form IT-399?

A: The purpose of Form IT-399 is to calculate and report depreciation for New York State tax purposes.

Q: Who is required to file Form IT-399?

A: Businesses and individuals in New York State who have depreciable assets are required to file Form IT-399.

Q: What information is required on Form IT-399?

A: Form IT-399 requires information about the depreciable assets owned by the taxpayer, including details such as the date of acquisition, cost, and depreciation method used.

Q: When is Form IT-399 due?

A: Form IT-399 is due on the same date as the taxpayer's New York State income tax return, which is generally April 15th.

Q: Are there any penalties for failing to file Form IT-399?

A: Yes, failure to file Form IT-399 or filing it late may result in penalties and interest.

Q: Can I claim depreciation on my federal tax return as well as on Form IT-399?

A: Yes, you can claim depreciation on both your federal tax return and on Form IT-399, but you may need to make certain adjustments to the figures.

Q: Is Form IT-399 only for businesses, or can individuals also file it?

A: Both businesses and individuals in New York State who have depreciable assets are required to file Form IT-399.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-399 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.