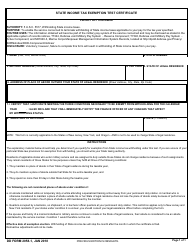

This version of the form is not currently in use and is provided for reference only. Download this version of

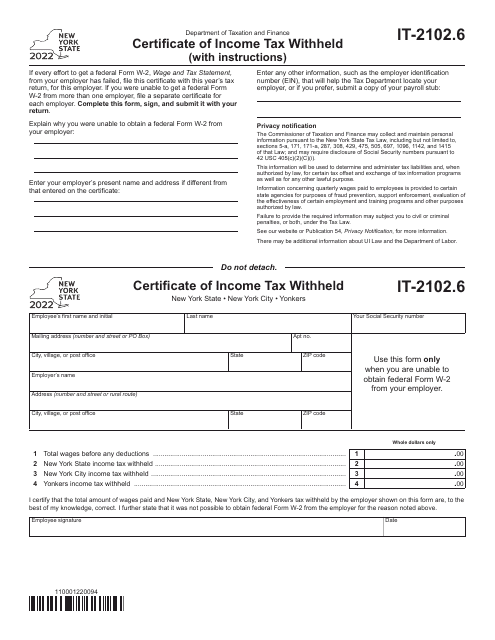

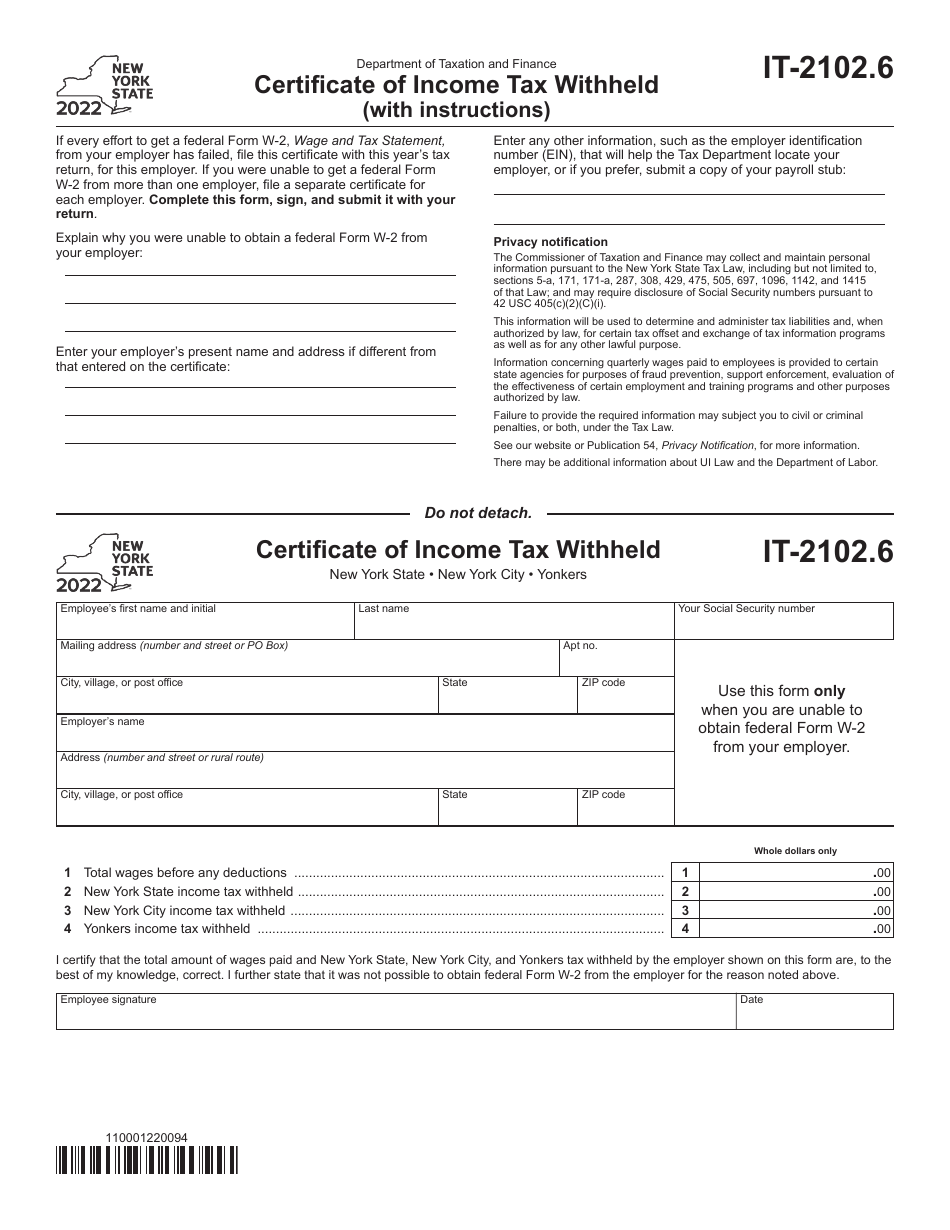

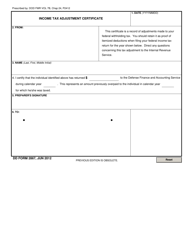

Form IT-2102.6

for the current year.

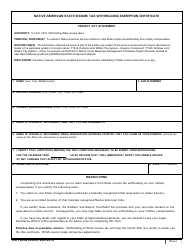

Form IT-2102.6 Certificate of Income Tax Withheld - New York

What Is Form IT-2102.6?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-2102.6?

A: Form IT-2102.6 is a Certificate of Income Tax Withheld for New York.

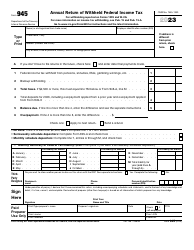

Q: Who needs to file Form IT-2102.6?

A: Form IT-2102.6 is for employees who have had income tax withheld in New York and want to claim a refund.

Q: What information do I need to fill out Form IT-2102.6?

A: You will need your personal information, employer information, and details about your income tax withheld.

Q: When is the deadline to file Form IT-2102.6?

A: The deadline to file Form IT-2102.6 is generally April 15th, or the same deadline as your income tax return.

Q: Can I e-file Form IT-2102.6?

A: No, Form IT-2102.6 cannot be e-filed and must be submitted by mail.

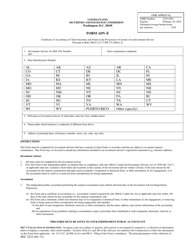

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2102.6 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.