This version of the form is not currently in use and is provided for reference only. Download this version of

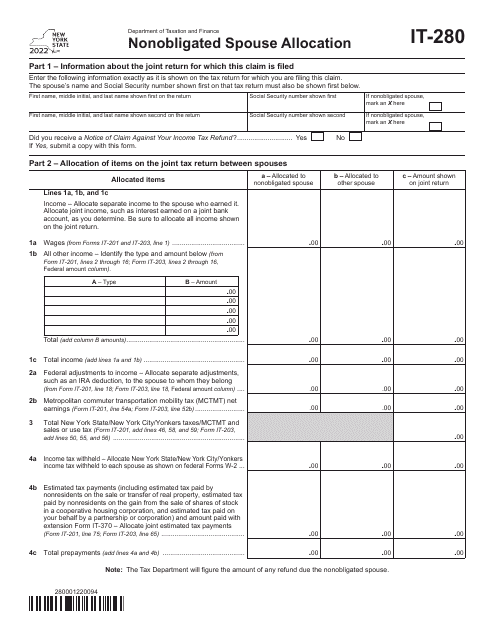

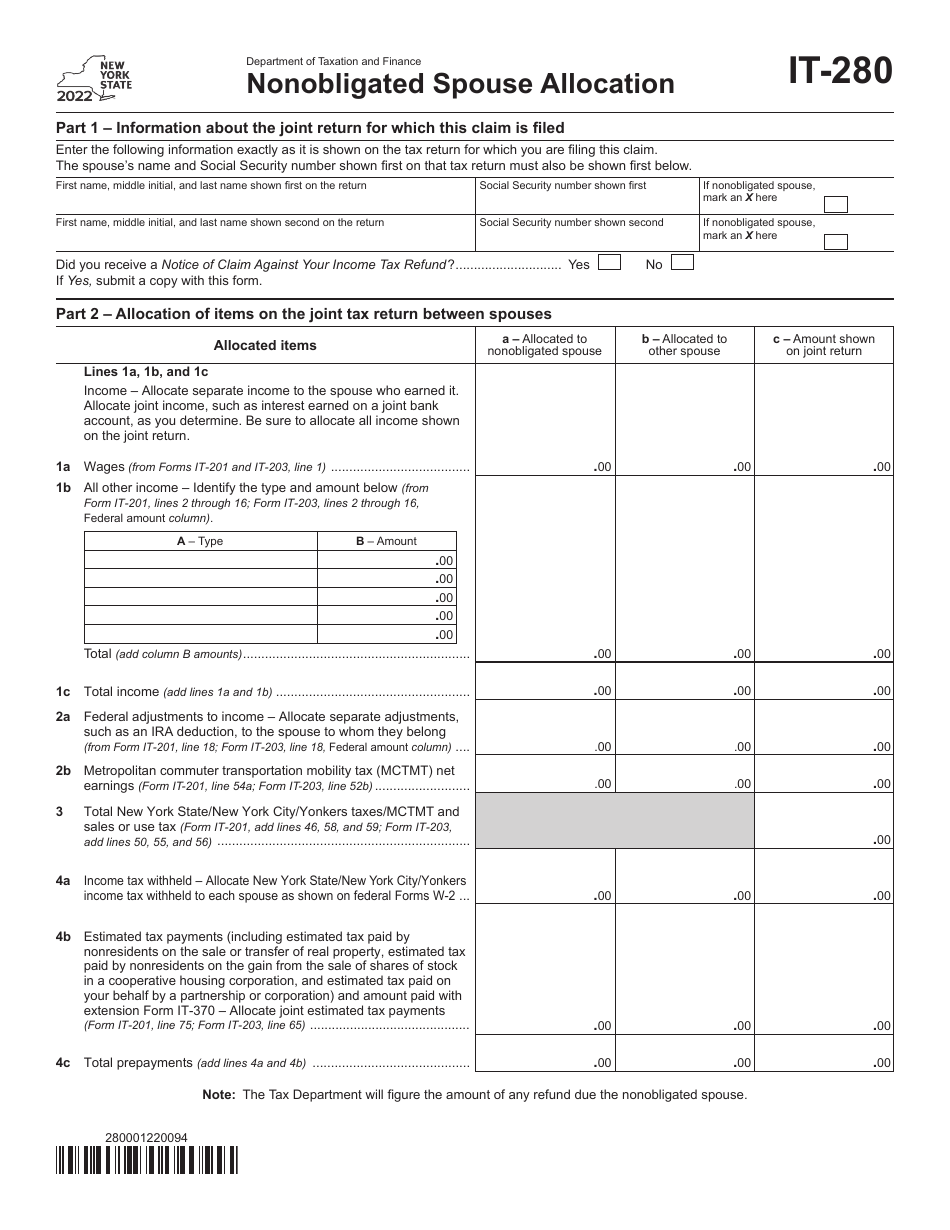

Form IT-280

for the current year.

Form IT-280 Nonobligated Spouse Allocation - New York

What Is Form IT-280?

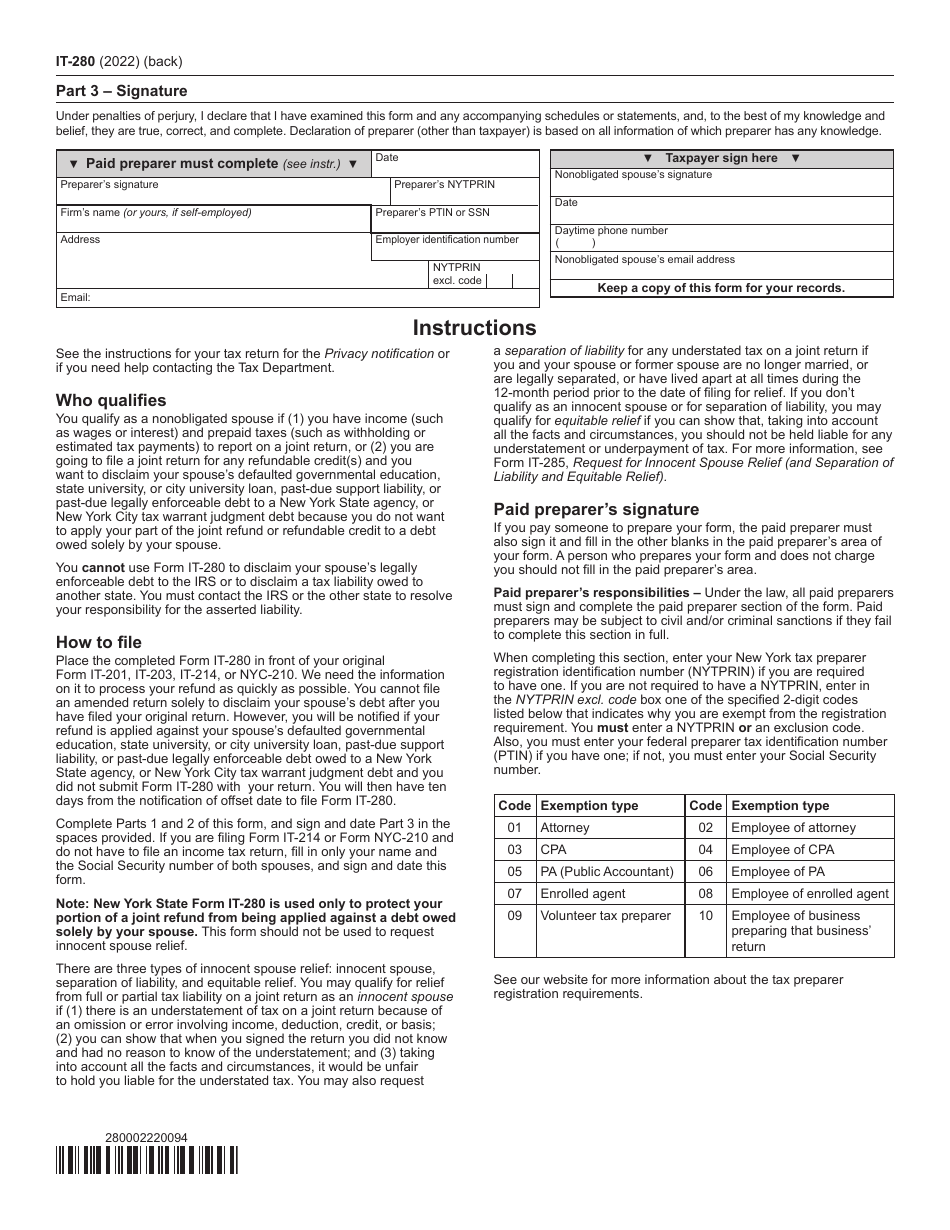

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-280?

A: Form IT-280 is the Nonobligated Spouse Allocation form for residents of New York.

Q: Who should use Form IT-280?

A: Form IT-280 should be used by married individuals who want to allocate income and deductions between spouses when filing their New York State income tax returns.

Q: What is a Nonobligated Spouse?

A: A Nonobligated Spouse is a spouse who is not legally responsible for paying any taxes owed.

Q: Why would someone use Form IT-280?

A: Someone would use Form IT-280 to allocate income and deductions in order to reduce their overall tax liability.

Q: When is Form IT-280 due?

A: Form IT-280 is typically due at the same time as your New York State income tax return, which is usually April 15th.

Q: Are there any restrictions on using Form IT-280?

A: Yes, there are certain income and filing status requirements that must be met in order to use Form IT-280. It is best to review the instructions provided with the form or consult a tax professional for guidance.

Q: Can I e-file Form IT-280?

A: Yes, it is possible to e-file Form IT-280 using approved tax preparation software or through a tax professional.

Q: What are the benefits of using Form IT-280?

A: Using Form IT-280 allows married individuals to allocate income and deductions in a way that can potentially reduce their overall tax liability.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-280 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.