This version of the form is not currently in use and is provided for reference only. Download this version of

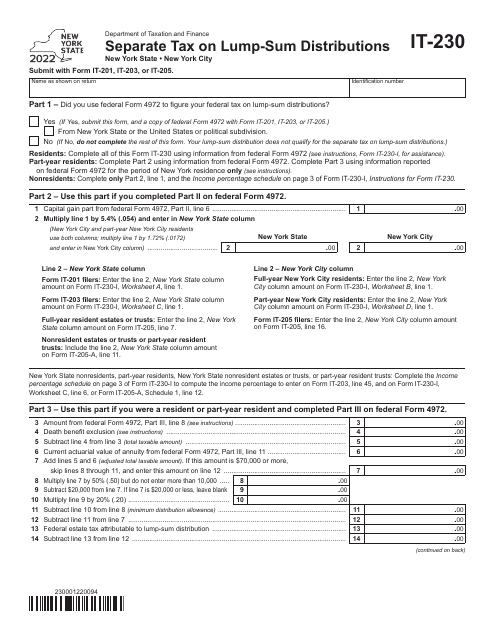

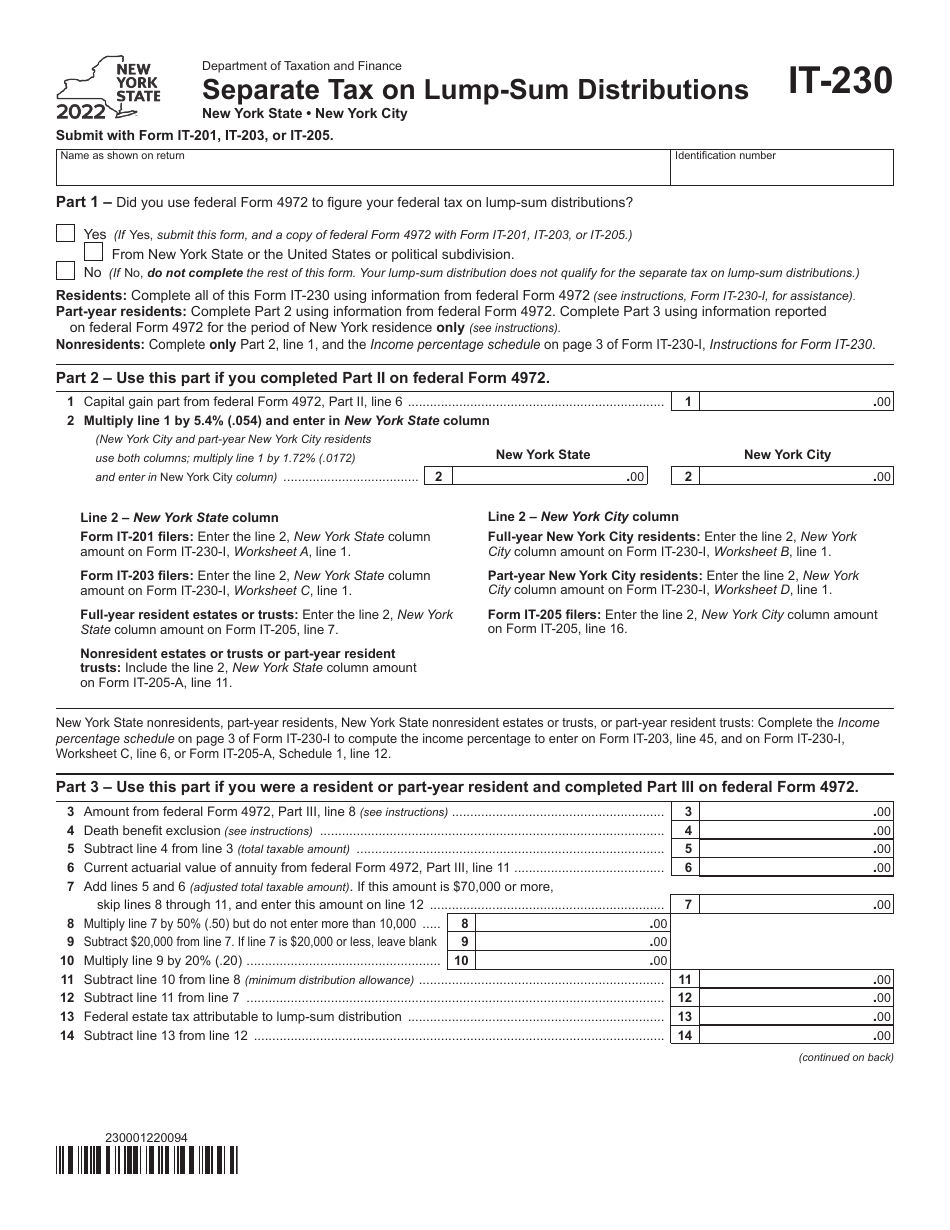

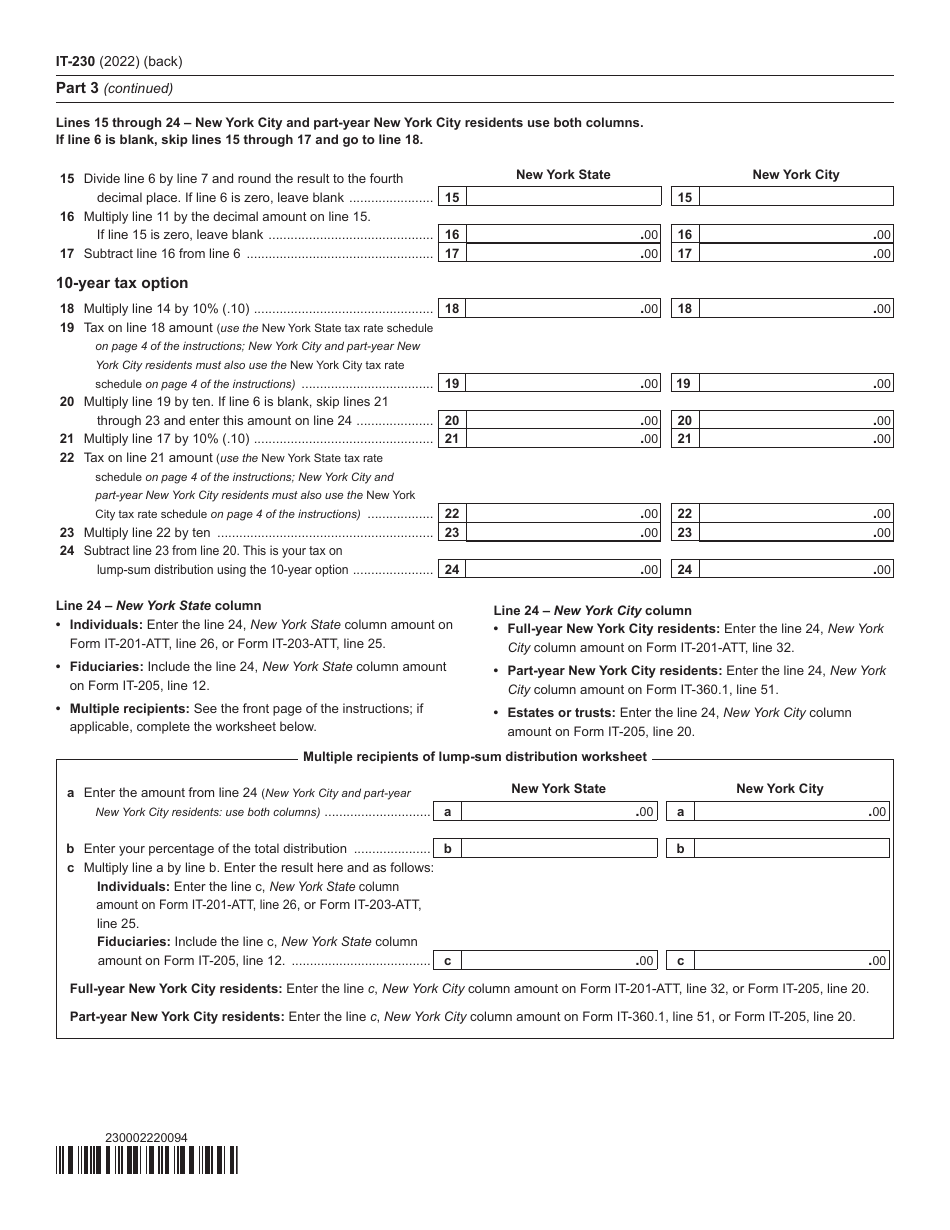

Form IT-230

for the current year.

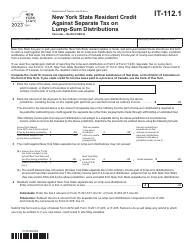

Form IT-230 Separate Tax on Lump-Sum Distributions - New York

What Is Form IT-230?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-230?

A: Form IT-230 is a separate tax form used in New York to report and pay taxes on lump-sum distributions.

Q: What are lump-sum distributions?

A: Lump-sum distributions are one-time payments of a large sum of money from a retirement account or pension plan.

Q: Who needs to file Form IT-230?

A: Individuals who receive a lump-sum distribution from a retirement account or pension plan in New York may need to file Form IT-230.

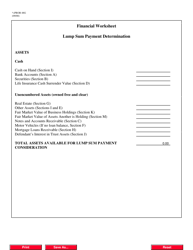

Q: What information is required on Form IT-230?

A: Form IT-230 requires you to provide information about the distribution, including the total amount, the tax year in which it was received, and any applicable exemptions.

Q: When is Form IT-230 due?

A: Form IT-230 is generally due by the same date as your New York state income tax return, which is usually April 15th.

Q: Is there a penalty for not filing Form IT-230?

A: Yes, there may be penalties for not filing Form IT-230, including interest charges and potential legal action.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-230 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.