This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-135

for the current year.

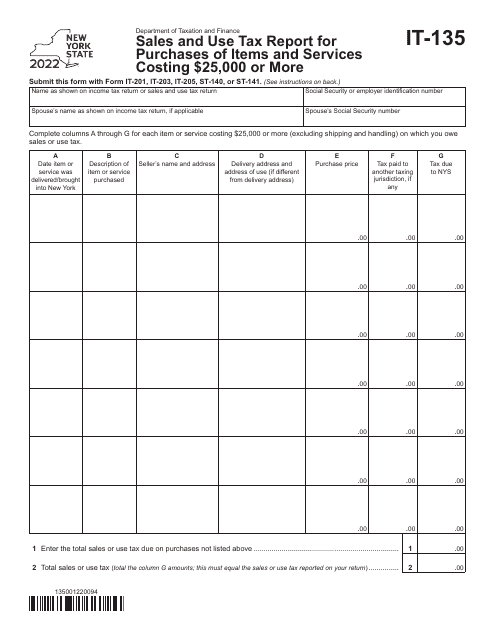

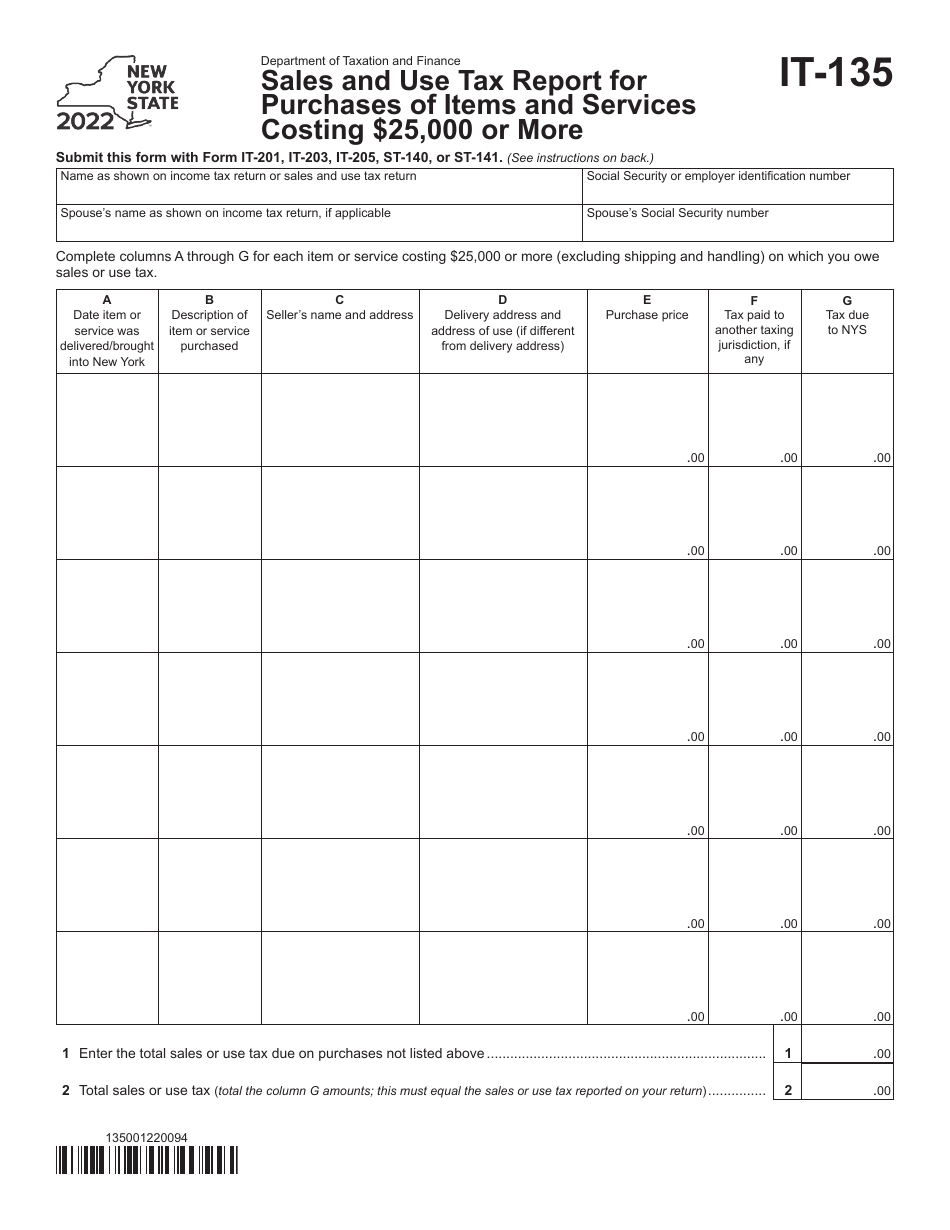

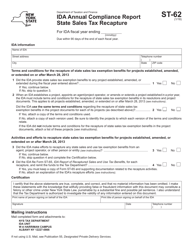

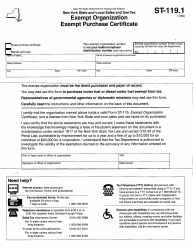

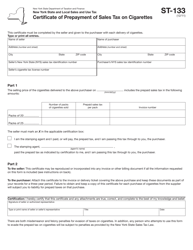

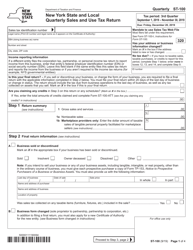

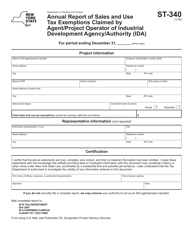

Form IT-135 Sales and Use Tax Report for Purchases of Items and Services Costing $25,000 or More - New York

What Is Form IT-135?

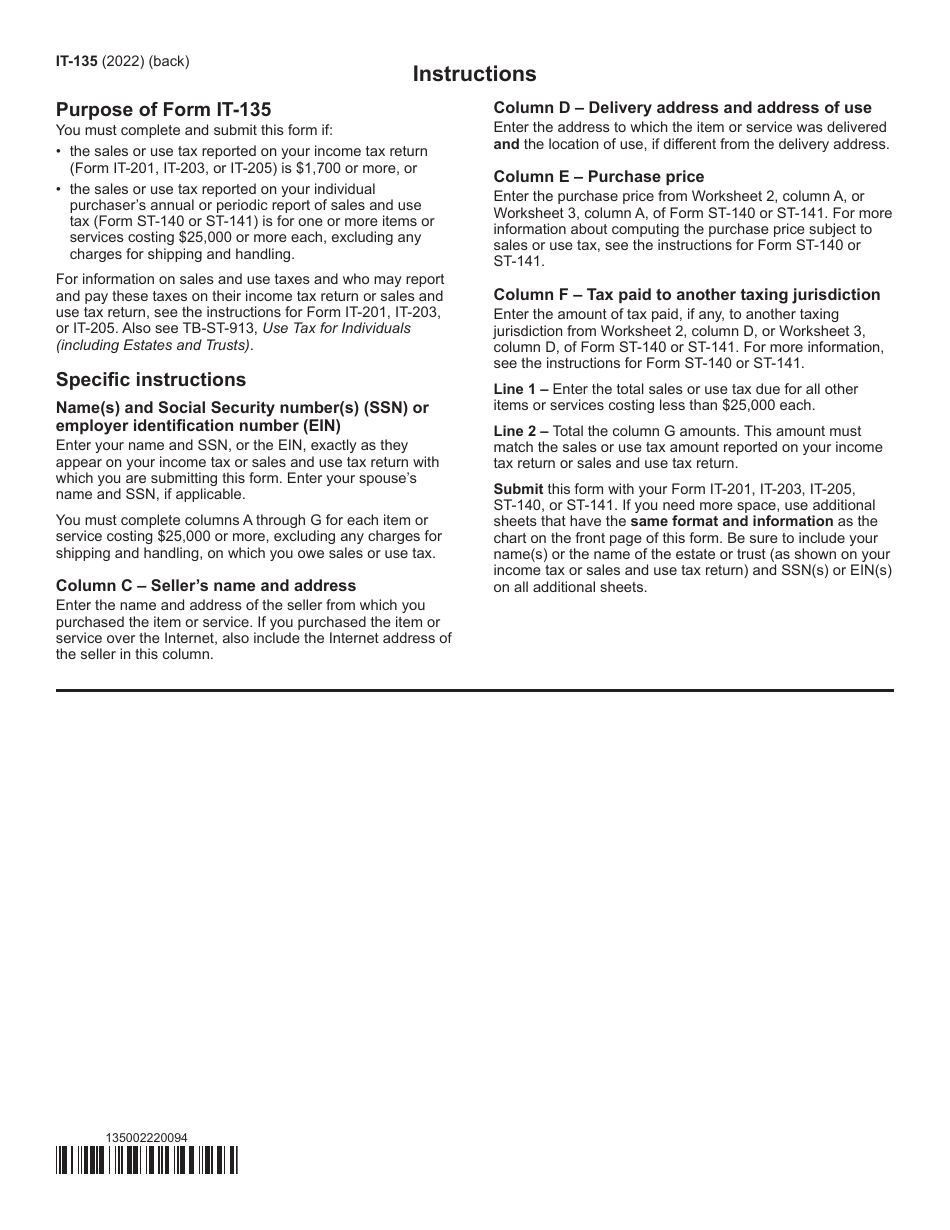

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-135?

A: Form IT-135 is the Sales and Use Tax Report for Purchases of Items and Services Costing $25,000 or More in New York.

Q: Who needs to file Form IT-135?

A: Any person or business in New York who made purchases of items and services costing $25,000 or more during the reporting period needs to file Form IT-135.

Q: What is the purpose of Form IT-135?

A: Form IT-135 is used to report and pay the sales and use tax due on purchases of items and services costing $25,000 or more.

Q: How often do I need to file Form IT-135?

A: Form IT-135 must be filed annually, on or before the 20th day of the month following the end of the reporting period.

Q: What information is required on Form IT-135?

A: The form requires information such as the taxpayer's identification number, reporting period, and details of the purchases made.

Q: Are there any penalties for not filing Form IT-135?

A: Yes, there may be penalties for failure to file or late filing of Form IT-135, including interest charges on the unpaid tax amount.

Q: Is there a filing fee for Form IT-135?

A: No, there is no filing fee for Form IT-135.

Q: What should I do if I have questions or need assistance with Form IT-135?

A: If you have questions or need assistance with Form IT-135, you should contact the New York State Department of Taxation and Finance for guidance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-135 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.