This version of the form is not currently in use and is provided for reference only. Download this version of

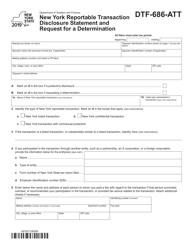

Instructions for Form DTF-686-ATT

for the current year.

Instructions for Form DTF-686-ATT New York Reportable Transaction Disclosure Statement and Request for a Determination - New York

This document contains official instructions for Form DTF-686-ATT , New York Request for a Determination - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form DTF-686-ATT?

A: Form DTF-686-ATT is a New York Reportable Transaction Disclosure Statement and Request for a Determination.

Q: What is the purpose of Form DTF-686-ATT?

A: The purpose of Form DTF-686-ATT is to disclose reportable transactions to the New York Department of Taxation and Finance and request a determination.

Q: Who needs to file Form DTF-686-ATT?

A: Taxpayers who have engaged in reportable transactions in New York need to file Form DTF-686-ATT.

Q: What are reportable transactions?

A: Reportable transactions are certain transactions that may have tax implications and need to be reported to the New York Department of Taxation and Finance.

Q: Are there any penalties for not filing Form DTF-686-ATT?

A: Yes, there are penalties for failure to file or filing an incomplete or inaccurate Form DTF-686-ATT.

Q: Is Form DTF-686-ATT required every year?

A: No, Form DTF-686-ATT is only required to be filed for the tax year in which the reportable transaction occurred.

Q: Can I file Form DTF-686-ATT electronically?

A: No, currently Form DTF-686-ATT can only be filed by mail.

Q: What documentation should be included with Form DTF-686-ATT?

A: Supporting documentation related to the reportable transaction should be included with Form DTF-686-ATT.

Q: How long does it take to receive a determination after filing Form DTF-686-ATT?

A: The processing time for a determination can vary, but it generally takes several weeks to receive a response after filing Form DTF-686-ATT.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.