This version of the form is not currently in use and is provided for reference only. Download this version of

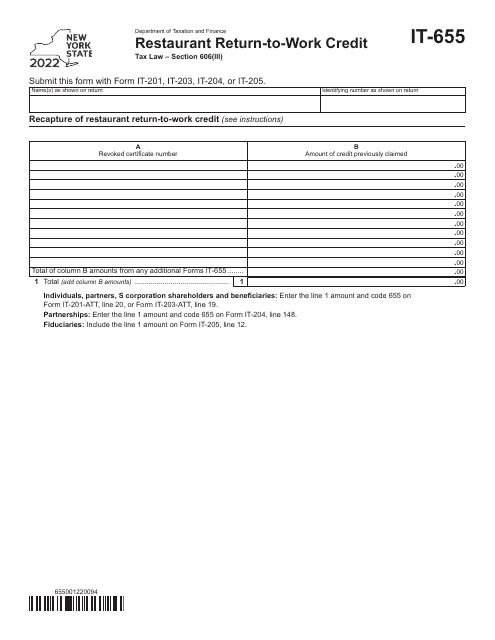

Form IT-655

for the current year.

Form IT-655 Restaurant Return-To-Work Credit - New York

What Is Form IT-655?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-655?

A: Form IT-655 is the Restaurant Return-To-Work Credit form for New York.

Q: Who is eligible to use Form IT-655?

A: Restaurant owners in New York are eligible to use Form IT-655.

Q: What is the purpose of Form IT-655?

A: The purpose of Form IT-655 is to claim the Restaurant Return-To-Work Credit in New York.

Q: What is the Restaurant Return-To-Work Credit?

A: The Restaurant Return-To-Work Credit is a tax credit designed to support restaurants in New York during the COVID-19 pandemic.

Q: How can restaurant owners claim the Restaurant Return-To-Work Credit?

A: Restaurant owners can claim the Restaurant Return-To-Work Credit by completing and submitting Form IT-655.

Q: When is the deadline to file Form IT-655?

A: The deadline to file Form IT-655 is specified by the New York State Department of Taxation and Finance.

Q: Are there any other requirements or documents needed to claim the Restaurant Return-To-Work Credit?

A: Additional documentation may be required, so it is advisable to refer to the instructions provided with Form IT-655 to ensure compliance.

Q: Can the Restaurant Return-To-Work Credit be claimed by individuals who are not restaurant owners?

A: No, the Restaurant Return-To-Work Credit is specifically for restaurant owners in New York.

Q: Is there a limit to the amount of credit that can be claimed using Form IT-655?

A: The maximum credit amount that can be claimed using Form IT-655 is determined by the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-655 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.