This version of the form is not currently in use and is provided for reference only. Download this version of

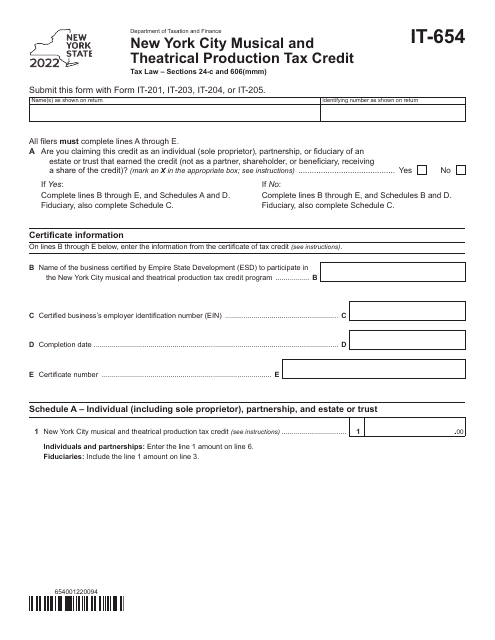

Form IT-654

for the current year.

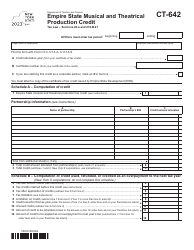

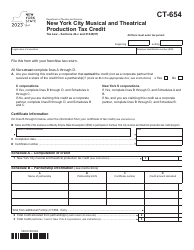

Form IT-654 New York City Musical and Theatrical Production Tax Credit - New York

What Is Form IT-654?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-654?

A: Form IT-654 is the New York City Musical and Theatrical Production Tax Credit form.

Q: What is the purpose of Form IT-654?

A: The purpose of Form IT-654 is to claim the New York City Musical and Theatrical Production Tax Credit.

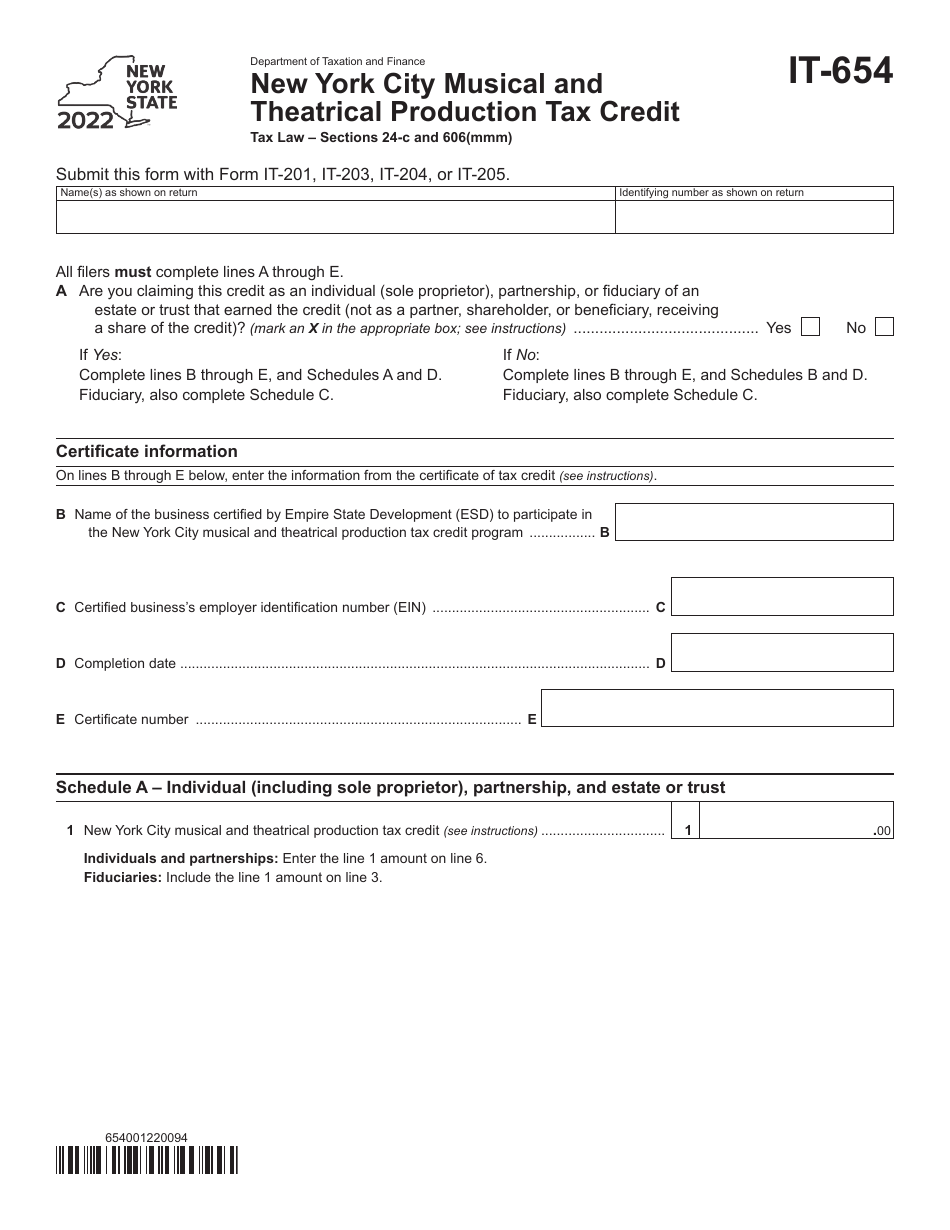

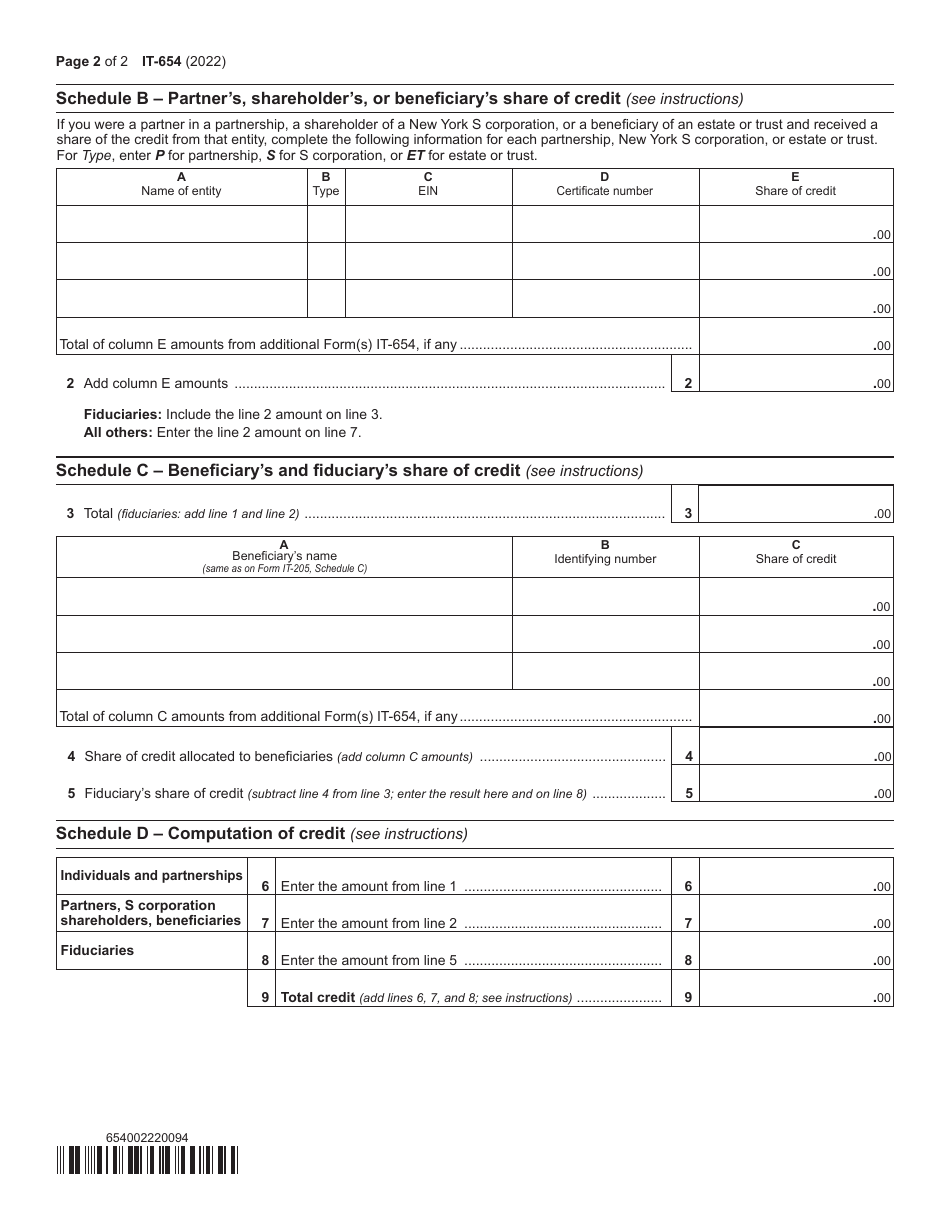

Q: Who is eligible to file Form IT-654?

A: Eligible taxpayers include qualified musical and theatrical production companies that meet the criteria set by the New York City Department of Finance.

Q: How do I file Form IT-654?

A: You can file Form IT-654 by using the New York State e-file system or by mailing a paper form to the New York State Department of Taxation and Finance.

Q: What information is required on Form IT-654?

A: Form IT-654 requires specific information about the musical or theatrical production, including production dates, qualified expenses, and the amount of the credit being claimed.

Q: What is the deadline for filing Form IT-654?

A: The deadline for filing Form IT-654 is generally the same as the deadline for filing your New York State tax return, which is usually April 15th.

Q: What is the New York City Musical and Theatrical Production Tax Credit?

A: The New York City Musical and Theatrical Production Tax Credit is a credit available to qualified musical and theatrical production companies that incur expenses in New York City.

Q: How much is the New York City Musical and Theatrical Production Tax Credit?

A: The amount of the credit can vary depending on the type of production and the expenses incurred, but it can be up to 25% of the qualified production costs.

Q: Are there any limitations or restrictions on the New York City Musical and Theatrical Production Tax Credit?

A: Yes, there are limitations and restrictions, including a cap on the total amount of credits that can be claimed in a single year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-654 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.